After Earnings, Is Arista Stock a Buy, a Sell, or Fairly Valued?

With strong results in line with expectations, here’s what we think of Arista’s stock.

Arista Networks ANET released its fourth-quarter earnings report on Feb. 12. Here’s Morningstar’s take on Arista’s earnings and stock.

Key Morningstar Metrics for Arista Networks

- Fair Value Estimate: $195.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What We Thought of Arista Networks’ Q4 Earnings

- Arista’s results were strong, and mostly in line with our predictions. The outlook for 2024 and the first quarter also met our expectations. The firm is seeing strong growth from greater spending out of high-speed cloud providers, including investment in artificial intelligence.

- The results affirm our long-term thesis that Arista will be a dominant force in high-speed switching and a key beneficiary of AI spending. We anticipate share gains across Arista’s end markets over the next five years. Still, even with our bullish forecast, we cannot justify Arista’s current valuation, as we think its stock has been caught up in overexuberant trading around its AI opportunity.

Arista Networks Stock Price

Fair Value Estimate for Arista Networks

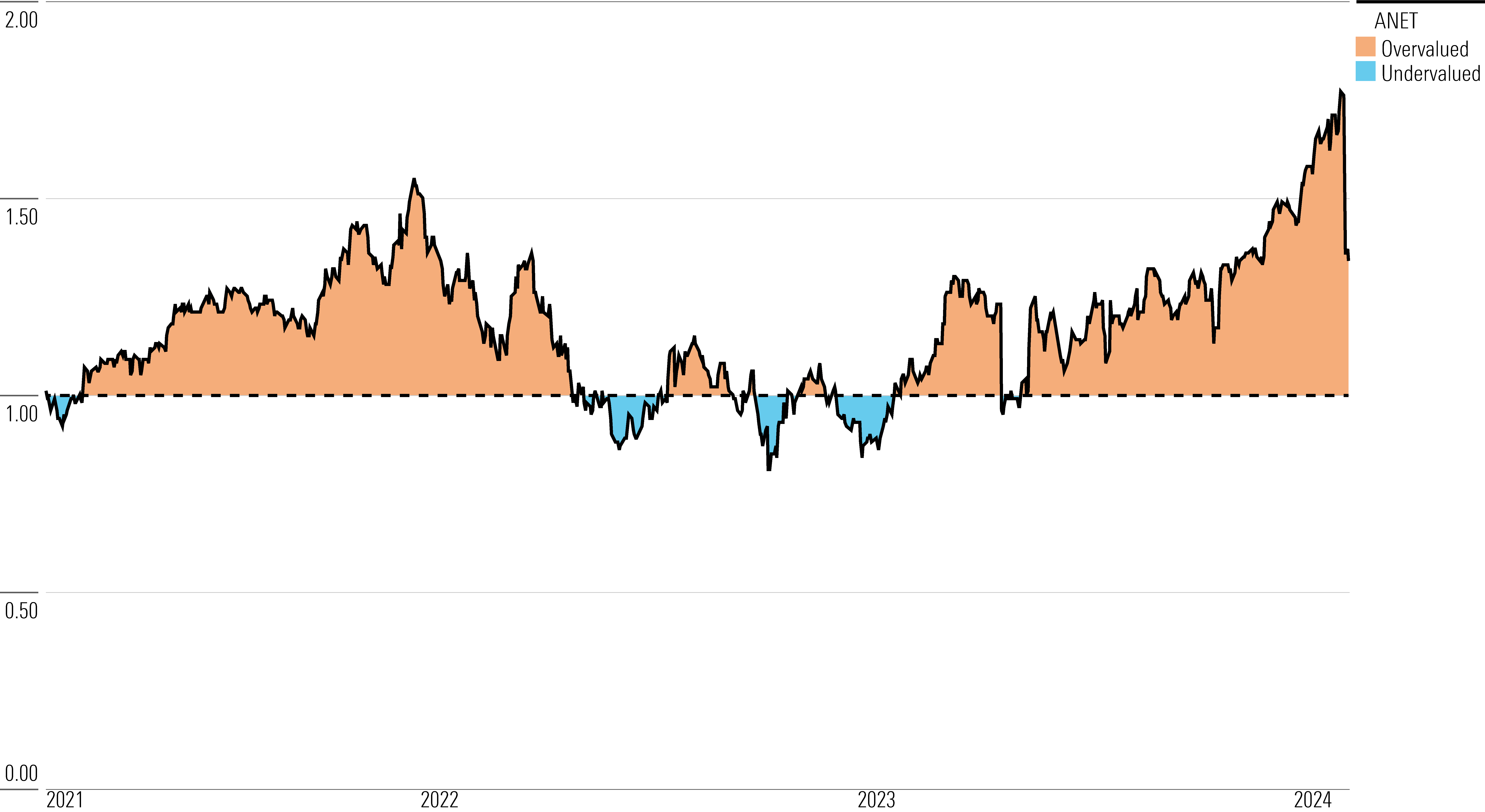

With its 2-star rating, we believe Arista’s stock is overvalued compared with our long-term fair value estimate.

We forecast 12% compound annual sales growth through 2028 for the firm. Sales into data centers are the biggest contributor, and we model a 16% compound annual growth rate for this business. We expect Arista’s data center sales to grow faster than the market, with continued market share gains. We expect significant share gains for Arista’s campus portfolio as well, with this revenue growing 25% annually through 2028 in our model and eclipsing management’s $750 million goal in 2025. We think heightened product development and go-to-market investment will be key to Arista’s penetration of these markets.

We forecast Arista’s non-GAAP gross margin to remain within its target range of 62%-64%. We model Arista’s non-GAAP operating margin to remain in the low 40% range through 2028, following great profitability in 2022 and 2023. We expect Arista to maintain high investment in research and development to maintain its intangible assets and fend off relentless competition from the larger Cisco Systems CSCO. We also expect higher go-to-market investment in the next five years as Arista aggressively fights for shares in the enterprise and campus markets. We see it as prudent that Arista plans to spend aggressively and even eat slightly into operating margins to pursue these vectors.

Read more about Arista Networks’ fair value estimate.

Arista Networks Historical Price/Fair Value Ratio

Economic Moat Rating

We assign Arista a wide moat based on intangible assets in high-speed networking and customer switching costs. We view Arista’s high-speed switches and software-led approach as significantly differentiated from other networking competitors and very difficult to replicate. We expect the firm’s strength in high-speed switching to generate economic profits over the next 20 years.

We believe Arista’s networking switches are best of breed, resulting from a software-led approach over its networking hardware. The firm’s specialty is high-speed switches (those with speeds of 100 gigabits or more) designed for data centers. These switches create a local network to then connect to a wider network and the internet. Data traffic continues to explode, increasing the need for Arista’s gear, in our view.

We believe Arista’s high-speed switches are the preferred option of both public cloud providers and enterprises building private clouds, and it occupies roughly one-third of the market for 100-gigabit ports and faster. It has gained this share steadily since its founding in 2004 and has dethroned networking colossus Cisco at high speeds. We believe Arista’s share gains are the result of fundamentally better performance at higher speeds and a software-led approach that outsources semiconductor development to merchant silicon from the likes of Broadcom AVGO and Marvell Technology MRVL.

Read more about Arista Networks’ economic moat.

Risk and Uncertainty

We assign Arista a High Uncertainty Rating. Its sales are concentrated in the cloud networking market, which can exhibit cyclicality and lumpy customer spending patterns. This lumpiness can be exacerbated by Arista’s concentration in customers like Microsoft MSFT and Meta Platforms META. Softer spending patterns from these customers can cause top-line performance to suffer, as seen in 2019 and 2020 when Meta skipped an upgrade cycle.

Arista is working to expand its presence in the larger enterprise market, both in on-premises data centers and campus environments. The firm’s market share in on-premises data centers trails its presence in high-speed cloud setups, and it has historically not been a participant in campus. We think its efforts to penetrate these markets create uncertainty. Arista breached the cloud market with cutting-edge high-speed performance, but it may struggle to match the comprehensive portfolio of Cisco—inclusive of cybersecurity and collaboration software—for smaller customers and campus environments. If the company can’t make inroads, its performance could suffer.

On the environmental, social, and governance front, we foresee little risk for Arista. We believe its biggest risk is a data or security breach via its equipment, which could create permanent reputational harm, but we think such risk is low.

Read more about Arista Networks’ risk and uncertainty.

ANET Bulls Say

- Arista has gained a top market position in high-speed switching, and it continues to gain shares.

- Arista holds best-in-class profit margins and earns robust profits, reflecting its strong value proposition and wide moat.

- Arista earns heady free cash flow, which it can use for organic investment and shareholder returns.

ANET Bears Say

- Arista has a weaker position in areas of networking outside high-speed switching, and it may struggle to expand into adjacent markets.

- We see heightened investment and competition from Cisco in Arista’s core high-speed market, which may make growth and market share gains more difficult.

- Arista’s acquisition history is small and new, and it could risk destroying shareholder value with ill-advised deals.

This article was compiled by Frank Lee.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ca129aad-9614-4bf0-993b-3df5f6bfa41e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca129aad-9614-4bf0-993b-3df5f6bfa41e.jpg)