After Earnings, Is Broadcom Stock a Buy, a Sell, or Fairly Valued?

With added vigor to its momentum in AI, here’s what we think of Broadcom stock.

Broadcom AVGO released its first-quarter earnings report on March 7. Over the past year, the stock has more than doubled. Here’s Morningstar’s take on Broadcom’s earnings and outlook.

Key Morningstar Metrics for Broadcom

- Fair Value Estimate: $1,090.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

What We Thought of Broadcom’s Q1 Earnings

- Broadcom’s results were mostly in line with expectations, reaffirming its full-year guidance for sales. Broadcom meaningfully raised its expectations for fiscal 2024 revenue from artificial intelligence, offset by other end markets weakening this year.

- These results add a lot of vigor to Broadcom’s overall AI momentum. The segment is now guided to be 20% of total sales in fiscal 2024, or 35% of chip sales. We see AI becoming one of the firm’s primary drivers over the next five years. There was also great strength in VMware, which adds software and diversification to Broadcom’s business. Still, despite our bullish view on Broadcom’s AI opportunity, we think it has been overhyped in the stock price, and we see shares as overvalued.

- To justify Broadcom’s current valuation, we believe one must assume 50% compound annual growth for AI sales through fiscal 2028, reaching $50 billion. Our forecast assumes $30 billion in AI sales in fiscal 2028.

Broadcom Stock Price

Fair Value Estimate for Broadcom

With its 2-star rating, we believe Broadcom’s stock is overvalued compared with our long-term fair value estimate of $1,090.00.

In our view, Broadcom’s primary valuation drivers are its networking business and its ability to extract growth and operating leverage from VMware. We also anticipate continued inorganic growth over the long term. We model 18% revenue growth for Broadcom, including the inorganic contribution from VMware, through fiscal 2028. We see high artificial intelligence sales driving supernormal growth in the next five years, but for longer-term durable growth to settle in the high-single digits on an organic basis.

We believe Broadcom will continue to exert operating leverage and grow operating expenses below sales growth. After a jump in operating expenses following the VMware deal, we anticipate Broadcom will focus on trimming excess expenses and streamlining sales and marketing spending. We expect the combined entity to spend more on sales and marketing than pre-VMware Broadcom but less than standalone VMware, as Broadcom focuses its sales and marketing on core customers. Along with higher gross margins incorporating VMware, we project non-GAAP operating margins returning to the low 60% range in fiscal 2028.

Read more about Broadcom’s fair value estimate.

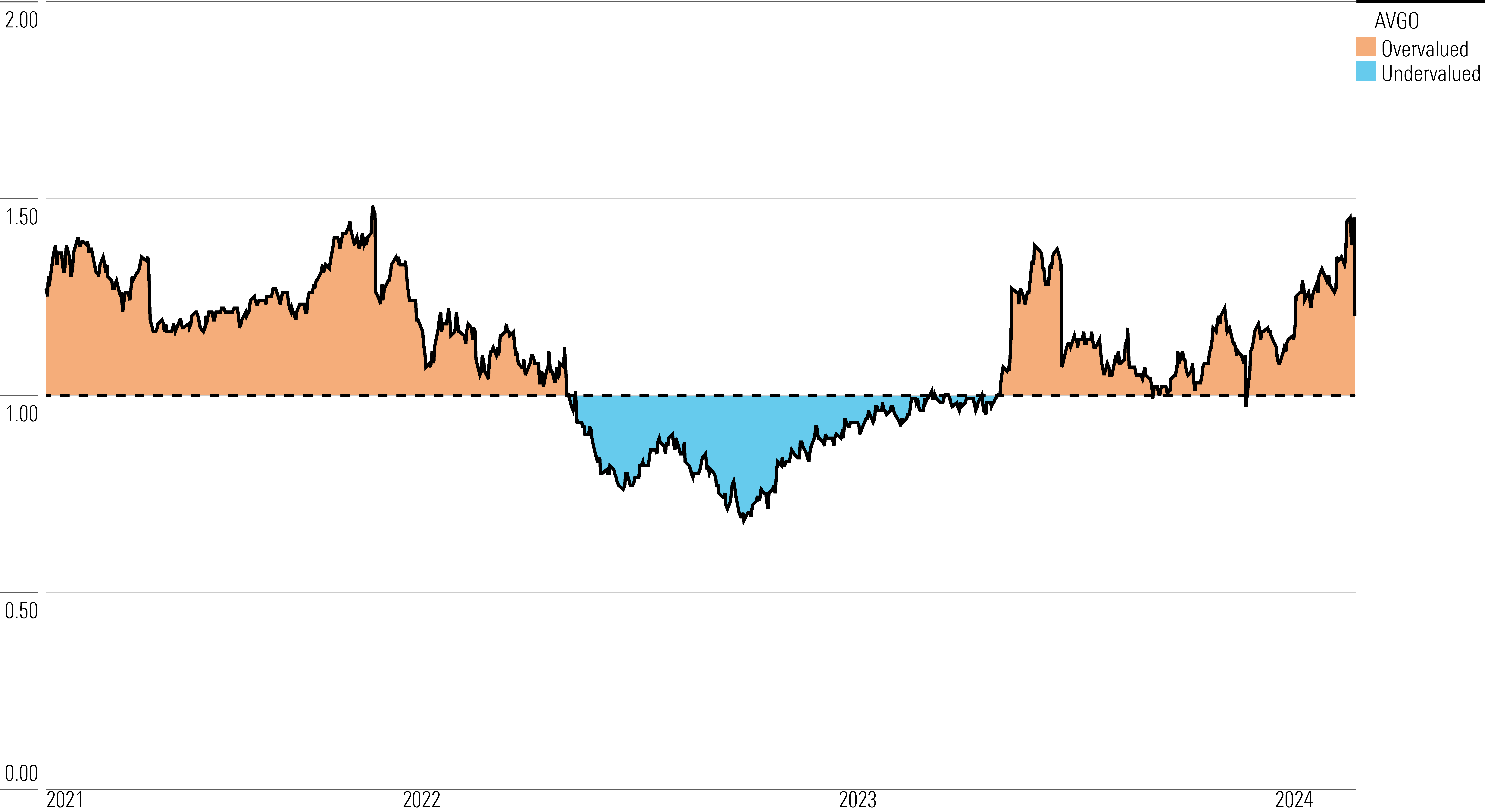

Broadcom Historical Price/Fair Value Ratio

Economic Moat Rating

We believe Broadcom has a wide moat, stemming from intangible assets in chip design and switching costs for its software products. The firm’s strength in both chips and software lets it earn terrific accounting and economic profits, and we believe its competitive positioning will likely allow it to do so for the next 20 years. Most of the company’s business is in semiconductors, with broad end-market exposure across enterprise networking, wireless chips for smartphones, broadband access, and storage applications. We see the two largest exposures here, networking and wireless chips, benefiting from the firm’s expertise in chip design.

Read more about Broadcom’s economic moat.

Risk and Uncertainty

We assign a Medium Uncertainty Rating to Broadcom. As a chipmaker, it is vulnerable to market supply and demand cycles. Though it has been able to offset cyclicality in recent years with its software exposure and networking strength as a buoy, future cycles may not look similar. It also highly relies on Taiwan Semiconductor Manufacturing TSM for its chips, and any supply constraints could hamper its ability to ship to customers. Nonetheless, we believe Broadcom is a preferred customer of Taiwan Semiconductor and would receive high priority in such a scenario, both for its scale and lengthy relationship.

Read more about Broadcom’s risk and uncertainty.

AVGO Bulls Say

- Broadcom is a poster child for operating efficiency. It earns excellent operating margins and generates enormous cash flow. It is particularly strong at acquiring companies and trimming excess expenses.

- Broadcom’s networking and wireless chip businesses boast best-of-breed technologies, along with marquee customer relationships with Apple AAPL, Alphabet GOOGL, Cisco Systems CSCO, Arista Networks ANET, and others.

- We believe Broadcom will significantly benefit from rising AI spending, which we expect to spur significant growth for its networking semiconductor sales.

AVGO Bears Say

- Broadcom has sizable exposure to non-moaty businesses, like its broadband and storage chips.

- Broadcom’s software portfolio holds many legacy and mature businesses, like virtualization and mainframes, which we think will exhibit lower growth.

- Broadcom relies heavily on acquisitions to expand its portfolio, yet tends to focus more on expense cutting rather than seeking strategic synergies for its deals.

This article was compiled by Frank Lee.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ca129aad-9614-4bf0-993b-3df5f6bfa41e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca129aad-9614-4bf0-993b-3df5f6bfa41e.jpg)