Is Nvidia Stock a Buy, a Sell, or Fairly Valued After Earnings?

With the AI boom and a massive rally, here’s what we think of Nvidia stock.

Nvidia NVDA reported earnings on Nov. 21, and so far this year, its stock is up 227%. Here is Morningstar’s take on Nvidia’s results and the outlook for its stock.

Key Morningstar Metrics for Nvidia

- Fair Value Estimate: $480.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Very High

What We Thought of Nvidia’s Earnings

Nvidia’s earnings exceeded every estimate set by its own guidance, our prior expectations, and the FactSet consensus. This might normally result in a massive rally in a stock’s price, but Nvidia’s beats weren’t as eye-popping as the massive outperformance it achieved in the prior two quarters. As expected, revenue growth was quite strong, since companies are racing to invest in artificial intelligence and buying all the Nvidia GPUs they can get their hands on. Profitability was even more stellar than expected, as the company appears to be retaining massive pricing power on this revenue.

Nvidia’s forecast was also ahead of expectations, although the firm did concede that it will see a significant decline in revenue from China due to U.S. export restrictions. Nvidia will seemingly have no trouble making up for this lost revenue by shipping even more GPUs to customers in the rest of the world, but it’s possible that such demand will be satisfied a bit quicker than previously expected.

Nonetheless, Nvidia is firing on all cylinders, unlike any other technology company we can recall. It is in a nearly perfect position in AI semiconductors. Even as others catch up and customers undoubtedly diversify with other vendors over time, we think the firm will remain the market leader for years to come.

Bullish investors saw some great data points. Most obviously, there was Nvidia’s financial outperformance on the top and bottom lines in the third quarter, as well as a fourth-quarter forecast that was ahead of expectations. The company touted its strong performance in AI inference (when the model processes queries) semis—it’s the unquestioned leader in AI training GPUs, but it has been questioned whether it would also dominate here. Nvidia’s prospects seem promising here. We’re also encouraged that its networking business, led by the InfiniBand technology needed in AI, is running at a $10 billion annual run rate, up significantly versus a few quarters ago.

A bearish investor may have also seen some things they were looking for. Nvidia conceded that it will lose a good chunk of revenue in China. Also, AI revenue has certainly been lumpy, as the firm has earned more than 10% of revenue with a new customer in the third quarter and a different customer in the second quarter (which, notably, was not a 10% customer in the third quarter). If a bearish investor believes all the AI spending is an up-front purge and won’t be followed by a longer-lived revenue stream, these results might back them up. We don’t foresee an AI chip bubble any time soon, but we can’t rule out the potential that some of these large cloud vendors will take a breather on GPU purchases at some point.

After such a terrific quarter, we’re modestly more confident that Nvidia will reach our long-term target of $100 billion of data center, or DC, revenue in fiscal 2028. However, there are many moving pieces, such as the lumpy buying patterns of large customers and risks around U.S. sanctions on China. Thus, we reiterate our Very High Uncertainty Rating, even as we maintain our $480 fair value estimate

Nvidia Stock Price

Fair Value Estimate for Nvidia Stock

With its 3-star rating, we believe Nvidia’s stock is fairly valued compared with our long-term fair value estimate.

Our fair value estimate is $480 per share, which implies an equity value of over $1.1 trillion. Our fair value estimate implies a fiscal 2024 price/adjusted earnings multiple of 45 times and a fiscal 2025 forward price/adjusted earnings multiple of 31 times.

We anticipate a massive expansion in the AI processor market in the decade ahead, and we see room for tremendous revenue growth both at Nvidia and at competing solutions, whether they be external chipmakers (like Advanced Micro Devices AMD or Intel INTC) or in-house solutions developed by hyperscalers (such as chips from Alphabet GOOGL or Amazon AMZN).

Nvidia’s DC business has already achieved exponential growth, rising from $3 billion in fiscal 2020 to $15 billion in fiscal 2023. The firm should see an even higher inflection point in fiscal 2024, as we expect DC revenue to more than double to $41 billion. We don’t view this spike as coming from frontloaded orders or a buildup of excess capacity, as we model 46% growth in fiscal 2025 DC revenue to over $60 billion. We model growth of 23%, 20%, and 13% in the following three years, driving DC revenue to $100 billion in fiscal 2028, compared with AMD’s estimate for the AI accelerator total addressable market to be $150 billion by calendar 2027. We think this prediction is reasonable, given the massive investments and interest in AI. We doubt that any enterprise wants to be left behind; nor does any cloud computing provider want to be shorthanded in providing AI GPUs to its customers.

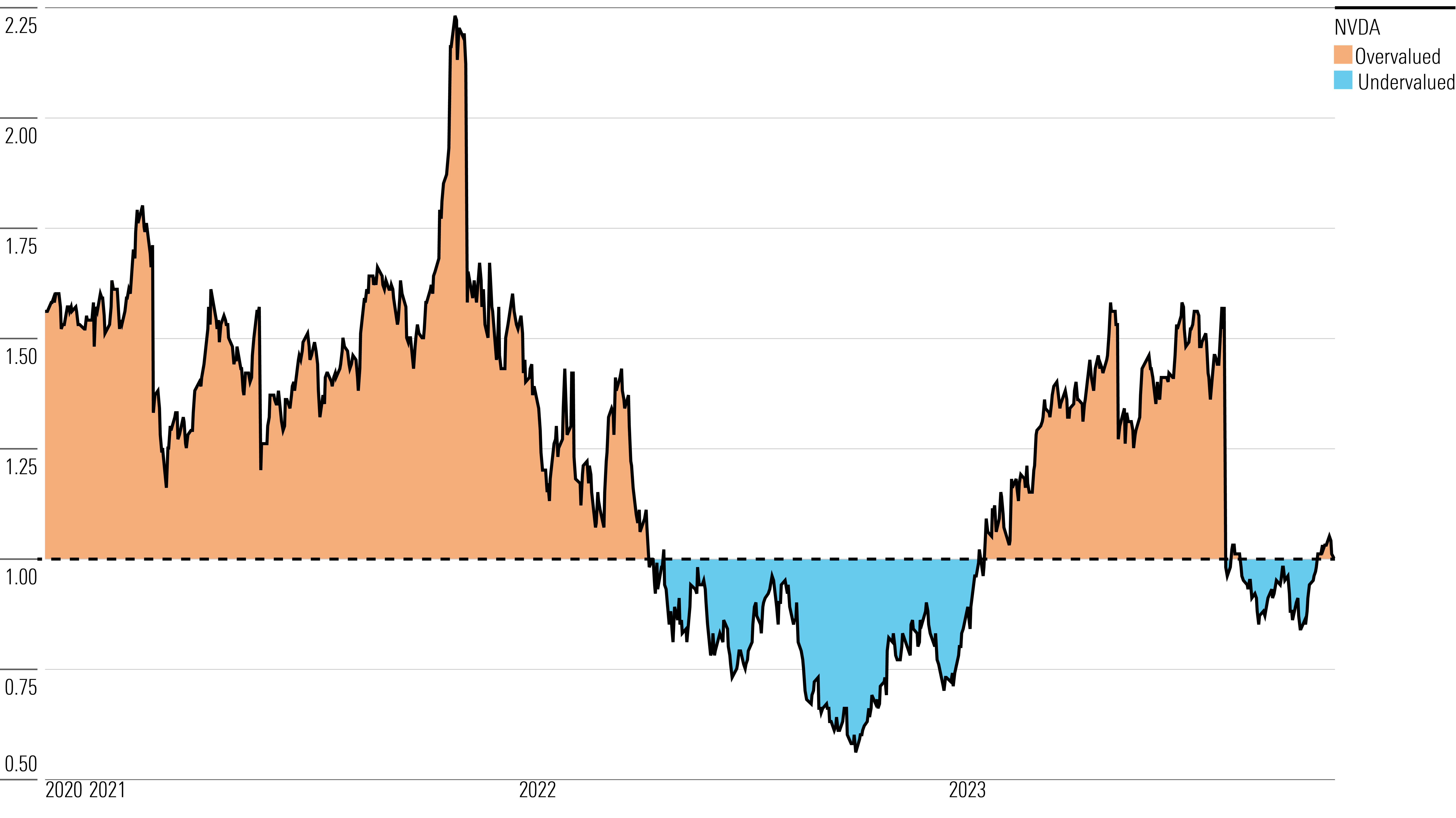

Nvidia Historical Price/Fair Value Ratio

Read more about Nvidia’s fair value estimate.

Economic Moat Rating

We assign Nvidia a wide economic moat, thanks to intangible assets around its graphics processing units and, increasingly, switching costs around its proprietary software, such as its Cuda platform for AI tools, which enables developers to use its GPUs to build AI models.

Nvidia was an early leader and designer of GPUs, which were originally developed to offload graphics processing tasks on PCs and gaming consoles. The company has emerged as the clear market share leader in discrete GPUs (over 80% share, per Mercury Research). We attribute this leadership to intangible assets associated with GPU design, as well as the associated software, frameworks, and tools developers need to work with these GPUs. We don’t foresee any emerging companies becoming a third relevant player in the market alongside Nvidia and AMD. Even Intel, the chip industry behemoth, has struggled for many years with trying to build a high-end GPU that would be adopted by gaming enthusiasts, and its next effort at a discrete GPU is slated to launch in 2025.

In our view, the nature of parallel processing in GPUs is at the heart of Nvidia’s dominance in its various end markets. PC graphics were the initial key application, facilitating more robust and immersive gaming over the past couple of decades. Cryptocurrency mining also involves many mathematical calculations that can run in parallel. And over the past decade, parallel processing has been found to more efficiently run the matrix multiplication algorithms needed to power AI models.

GPUs are best suited to make the many billions of calculations needed for large language models to predict the next word in a query (GPT-3 was trained on 175 billion parameters, for example). More importantly, Nvidia made shrewd moves to expand Cuda, creating and hosting a variety of libraries, compilers, frameworks, and development tools allowing AI professionals to build their models. Cuda is proprietary to Nvidia and only runs on its GPUs, and we believe this hardware-plus-software integration has created high customer switching costs in AI, contributing to the firm’s wide moat.

Read more about Nvidia’s moat rating.

Risk and Uncertainty

We assign Nvidia a Very High Uncertainty Rating. For better or worse, its stock price will be driven by its prospects for DC and AI GPUs. We see a host of tech leaders vying for its leading AI position. We think it is inevitable that leading hyperscale vendors, such as Amazon’s AWS, Microsoft MSFT, Alphabet, and Meta Platforms META, will seek to reduce their reliance on Nvidia and diversify their semiconductor and software supplier base, including through developing in-house solutions.

Our uncertainty rating is based on the uncertainty around this market. Nvidia dominates AI today, and the sky is the limit for the company’s profitability if it can maintain this lead over the next decade. However, any semblance of the successful development of alternatives could meaningfully limit the company’s upside.

Read more about Nvidia’s risk and uncertainty.

NVDA Bulls Say

- Nvidia’s GPUs offer industry-leading parallel processing, which was historically needed in PC gaming but has since expanded into crypto mining, AI, and perhaps future applications.

- Nvidia’s DC GPUs and Cuda software platform have established it as the dominant vendor for AI model training, a use case that should rise exponentially in the years ahead.

- The firm has a first-mover advantage in the autonomous driving market that could lead to the widespread adoption of its Drive PX platform.

NVDA Bears Say

- Nvidia is currently a leading AI chip vendor, but other powerful chipmakers and tech titans are focused on in-house chip development.

- Although Cuda is a leader in AI training software and tools, other cloud vendors would likely prefer to see greater competition in this space, and they may shift to alternative open-source tools if they arise.

- Nvidia’s gaming GPU business has often seen boom-or-bust cycles based on PC demand and, more recently, cryptocurrency mining.

This article was compiled by Tom Lauricella.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)