After Earnings, Is Applied Materials Stock a Buy, a Sell, or Fairly Valued?

With top-end sales and overachieving earnings, here’s what we think of Applied Materials’ stock.

Applied Materials AMAT released its fiscal first-quarter earnings report on Feb. 15, after the close of trading. Here’s Morningstar’s take on Applied Materials’ earnings and stock.

Key Morningstar Metrics for Applied Materials

- Fair Value Estimate: $152.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What We Thought of Applied Material’s Q1 Earnings

Applied Materials reported sales at the top end of guidance, as well as earnings above what we expected. The outlook for the fiscal second quarter met our model and was positive. The firm is enjoying strong profitability and sales out of Chinese chipmakers, which we expect to moderate in the back half of the fiscal year.

The results align with our long-term thesis for the company to continue taking share as a large and well-positioned chip equipment provider. Shares rose after the release thanks to better commentary about China demand staying strong into the fiscal second quarter. Still, we see its shares as out of reach, and we believe its valuation implies overly rosy expectations for Applied’s long-term fundamentals.

We believe Applied and other providers of wafer fabrication equipment, or WFE, are overpriced, with shares shooting up on a rebounding chip market. We bake strong recovering chip demand into our forecast, but we believe shares have exceeded fundamentals.

Applied Materials Stock Price

Fair Value Estimate for Applied Materials

With its 2-star rating, we believe Applied Materials’ stock is overvalued compared with our long-term fair value estimate of $152 per share, which implies a fiscal 2024 adjusted price/earnings multiple of 18 times and a fiscal 2024 enterprise value/sales multiple of 5 times. The biggest drivers to our valuation are the cyclical growth of WFE spending and Applied’s ability to increase market share.

We forecast 6% compound annual sales growth for Applied through fiscal 2028, inclusive of cyclicality. In fiscal 2024 we project growth in the low single digits as the semiconductor market remains soft. Memory chipmakers have slashed equipment spending as they work to raise profitability and cash generation, and logic chipmakers have also seen softer demand. We expect growth in Applied’s services business to pad revenue and help it avoid a top-line decline in these years.

We project strong growth for Applied in a cyclical rebound in fiscal 2025-26, and then midcycle growth in the mid-single digits thereafter. We expect midcycle growth to be driven by more advanced chip designs at chipmakers that rely on Applied’s equipment to manufacture gate-all-around transistors, chiplets, and high-bandwidth memory interfaces, among other technologies. Applied’s system sales are its most cyclical business, while its services business is quite stable, which helps offset some cyclicality on the top line. Finally, the display segment is dealing with a market downturn, but its relatively small size lessens its impact on Applied’s overall results.

We project Applied to raise its non-GAAP gross margin from 47% in fiscal 2023 to nearly 49% in fiscal 2028, primarily due to a higher mix of services revenue and partly from higher volumes. We project its operating margin to rise in line with its gross margin as the firm continues its high R&D spending. We estimate a 31% non-GAAP operating margin in fiscal 2028, up from 29% in fiscal 2023.

Read more about Applied Materials’ fair value estimate.

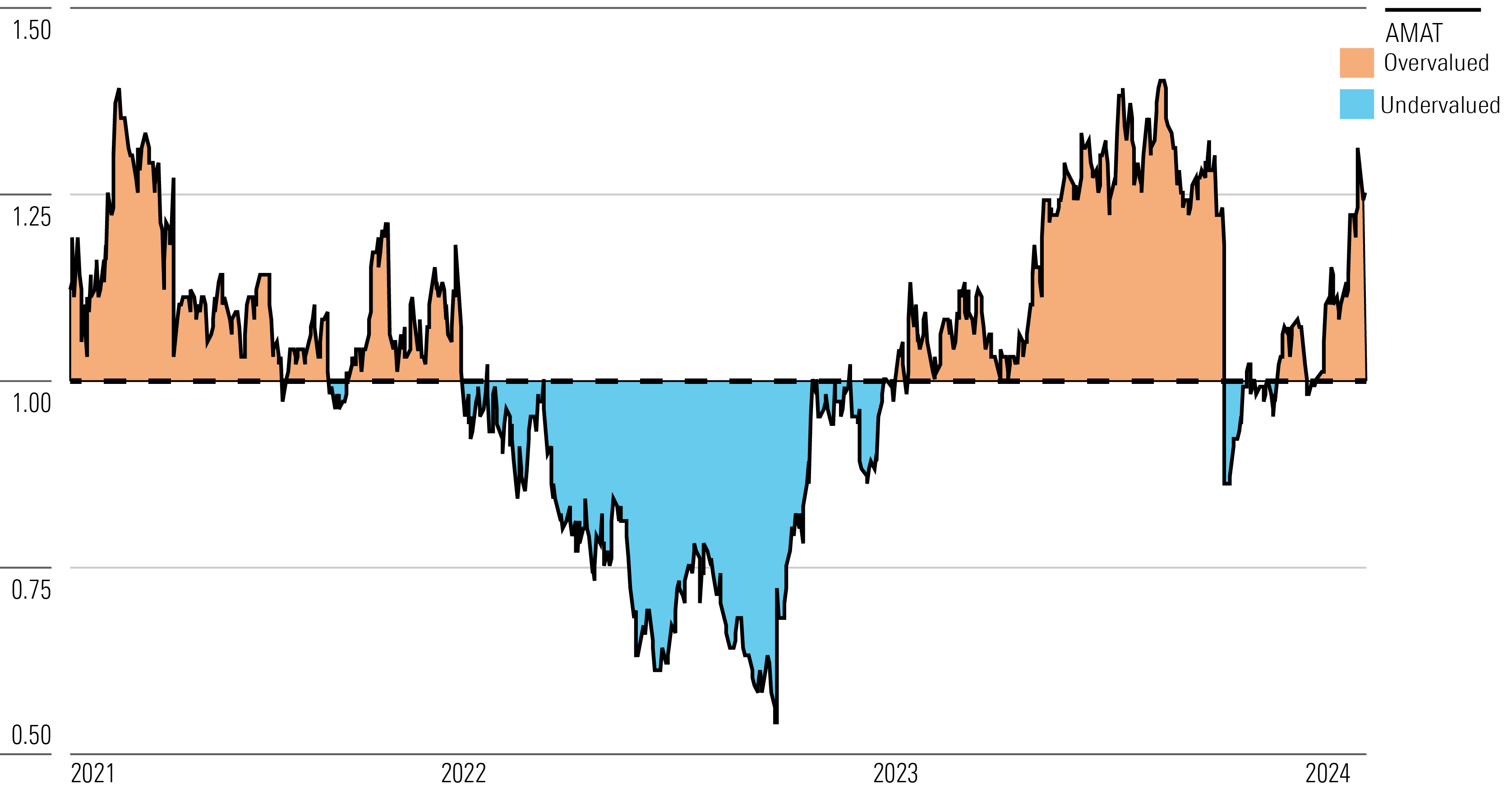

Applied Materials Historical Price/Fair Value Ratio

Economic Moat Rating

We assign Applied Materials a wide moat based on its intangible assets and switching costs.

Applied’s proficiency in WFE comes from top-notch design expertise, in our view, and we think the firm’s embedded services business and long-term customer roadmaps are sticky. We also believe the sheer amount of investment required to remain at the forefront of leading chip development (particularly across so many subsections of the market) creates an immense barrier to entry for all but the largest and best-capitalized chip equipment manufacturers. We expect Applied to earn returns on invested capital well above its cost of capital for the next 20 years.

We think Applied holds the most comprehensive portfolio of equipment for semiconductor manufacturing in the world. Its product lines run the gamut of chip manufacturing, can serve logic and memory chipmakers alike with cutting-edge equipment, and have offerings in nearly every category spanning the spectrum of cost and capability. While many WFE peers occupy one or two corners of the market, Applied meaningfully plays in them all. The only exception is lithography, where ASML Holding ASML has a vise grip.

Read more about Applied Materials’ economic moat.

Risk and Uncertainty

We assign a High Uncertainty Rating to Applied Materials. The firm is prone to the cyclicality of the semiconductor industry, with times of oversupply and lower capital expenditures followed by times of strong demand and more manufacturing buildouts. Applied’s results can fluctuate with semiconductor end demand, but we retain our belief that it can grow over the long term.

Applied also faces risks from geopolitical uncertainty, primarily between the US and China. The US government has levied export restrictions on advanced semiconductor manufacturing equipment, which limits Applied’s ability to ship to Chinese chipmakers. This impact has already been digested, and we believe Applied is largely able to compensate through demand elsewhere in the world. Still, there is a risk that restrictions ramp up further and become a headwind to sales.

Read more about Applied Materials’ risk and uncertainty.

AMAT Bulls Say

- Applied Materials is the largest WFE provider in the world, with the broadest portfolio and the largest R&D budget of its peers.

- We expect Applied to benefit from drivers of chip complexity, like gate-all-around transistors and advanced packaging.

- Applied has strong profit margins and cash flow, and it sends most of that cash flow back to shareholders.

AMAT Bears Say

- We consider Applied Materials to be a generalist in WFE. The firm competes with more specialized competitors like Lam Research LRCX and KLA KLAC, which could outcompete it in their respective markets.

- Applied faces cyclicality in the semiconductor market, which can lead to years that see lower sales and margin compression.

- Applied faces risk from geopolitical tensions between the US and China that may further inhibit its ability to ship to Chinese chipmakers.

This article was compiled by Freeman Brou.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ca129aad-9614-4bf0-993b-3df5f6bfa41e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca129aad-9614-4bf0-993b-3df5f6bfa41e.jpg)