After Earnings, Is Apple’s Stock a Buy, a Sell, or Fairly Valued?

With improved revenue drive from iPhone Sales, here’s what we think of Apple’s stock.

Apple AAPL released its fiscal first-quarter earnings report on Feb. 1. Here’s Morningstar’s take on Apple’s earnings and stock.

Key Morningstar Metrics for Apple

- Fair Value Estimate: $160.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

What We Thought of Apple’s Fiscal Q1 Earnings

Apple’s results showed better iPhone revenue in the December quarter than we expected, as well as better profitability. iPhone revenue was driven by the launch of the iPhone 15 lineup, and the improved profitability stems from a higher mix of services and higher-end products like the iPhone Pro models. However, revenue guidance for the March quarter fell below our expectations.

In the short term, we see demand headwinds for Apple relating to elongating personal device replacement cycles and more aggressive domestic alternatives in China. In the long term, we maintain our view that Apple can drive growth from its unique combination of hardware, software, and services, which also elicits steep customer switching costs and underpins our wide moat rating.

We believe guidance for weaker iPhone revenue in the March quarter portends weaker iPhone revenue for fiscal 2024 (ending in September). In our view, Apple’s current share price reflects overly rosy expectations for iPhone sales over the next five years, and our more modest forecast leads us to see the stock as overvalued.

Apple Stock Price

Fair Value Estimate for Apple

With its 2-star rating, we believe Apple’s stock is overvalued compared with our long-term fair value estimate of $160 per share. Our valuation implies a fiscal 2024 adjusted price/earnings multiple of 25 times, a fiscal 2024 enterprise value/sales multiple of 7 times, and a fiscal 2024 free cash flow yield of 4%.

We project 6% compound annual revenue growth for Apple through fiscal 2028. The iPhone will be the greatest contributor to revenue over our forecast, and we project 3% growth for iPhone revenue over the next five years. We expect this to be driven primarily by unit sales growth, with modest pricing increases. We think pricing increases will be driven primarily by higher features and a mix shift toward the more premium Pro models.

Services are Apple’s next biggest revenue contributor over our forecast, and we predict 8% revenue growth in this segment. Services are driven in large part by revenue from Google, thanks to its status as the default search engine on the Safari browser, as well as Apple’s cut of App Store sales. We expect solid growth in Google revenue, but we see a more mixed outlook for App Store results. There we forecast growth in overall app revenue but progressively lower cuts going toward Apple as the result of regulatory pressures. Elsewhere, we see roughly high-single-digit growth across revenue from Apple Music, Apple TV+, Apple Pay, AppleCare, and Apple’s other services.

We see the highest growth opportunity in Apple’s wearables revenue, to the tune of 18% through fiscal 2028, primarily driven by our expectations for the ramp of the new Vision Pro headset. We project a rapid ramp for Vision Pro, approaching 10 million unit sales and $30 billion in revenue in fiscal 2028. We see high-single-digit growth for Apple Watch and AirPods sales, with both products continuing to gain share.

Read more about Apple’s fair value estimate.

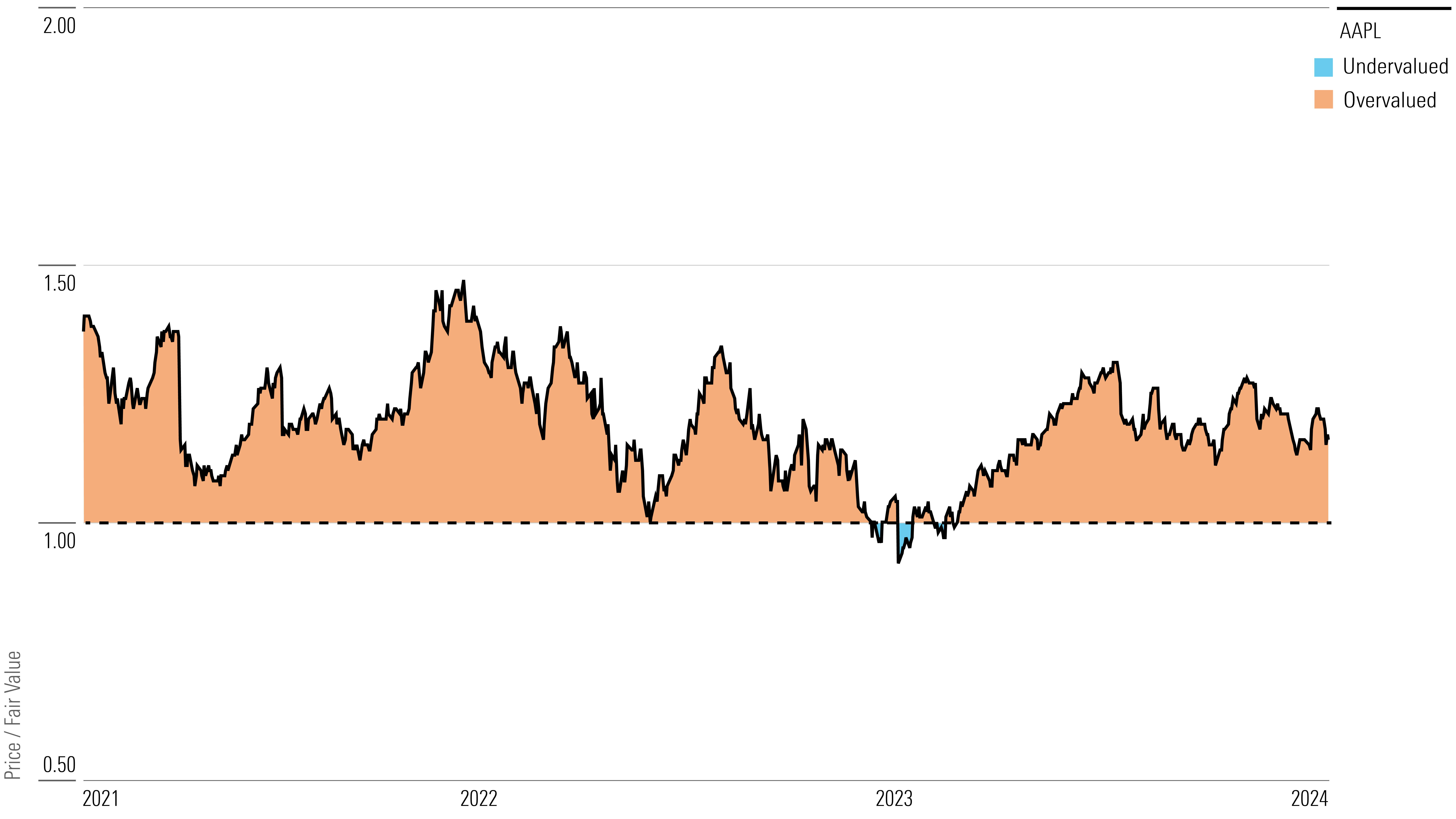

Apple Historical Price/Fair Value Ratio

Economic Moat Rating

We assign Apple a wide moat, stemming from customer switching costs, intangible assets, and a network effect. In our view, Apple’s iOS ecosystem extends far-reaching, sticky tendrils into customers’ wallets, entrenching them with its software capabilities and integration across disparate devices like the iPhone, Mac, iPad, Apple Watch, and more.

We also see immense design prowess at Apple, most impressively from its deep integration of hardware, software, and semiconductors to create best-of-breed products. Finally, we see a virtuous cycle between Apple’s affluent customer base and its vast ecosystem of developer partners. These moat sources elicit great profitability and returns on invested capital. In our view, Apple can likely leverage these moat sources into continued economic profits over the next 20 years.

To us, Apple’s most important moat source arises from the switching costs for its ecosystem of software, driven by iOS on the iPhone. The firm enjoys terrific customer retention and satisfaction, even despite pricing its products at a significant premium to its competition. First, Apple offers software capabilities that are only available to iPhone users—iMessage messaging, FaceTime calling, AirDrop sharing, the Apple Pay digital wallet, and location sharing are among the most used. Apple’s products become even more entrenched when a customer adopts two or more. Users who combine the iPhone with a Mac, an iPad, and/or a Watch are offered more features, which in turn creates a higher switching cost.

In our view, Apple’s ability to widen its portfolio of user devices helps augment its existing switching costs. The Apple Watch and AirPods are good recent examples of new products that we see raising the stickiness of customers. A Watch user can answer calls, read and respond to messages, and keep track of notifications, but must have an iPhone to use these capabilities. AirPods connect with marked ease to Apple devices but have to be manually repaired if joined to a non-Apple device. As customers use more point devices, we believe they are less likely to leave Apple’s ecosystem. We view Apple’s nascent push into augmented and virtual reality as the next step in this strategy. The firm’s Vision Pro headset offers yet another auxiliary form factor that relies on the iPhone as the focal computing point.

Read more about Apple’s moat rating.

Risk and Uncertainty

We assign Apple a Medium Uncertainty Rating. We think the firm’s greatest risk is its reliance on consumer spending, for which there is great competition and cyclicality. Apple is at constant risk of disruption, just as the iPhone disrupted BlackBerry in the budding smartphone market. The iPhone could be unseated by a new device or “super app.” We believe the firm defends against this risk by introducing new form factors (like a watch and an augmented reality headset) and selling an ecosystem of software and services on top of hardware.

We also see geopolitical risk arising from Apple’s supply chain. It is heavily dependent on Foxconn and Taiwan Semiconductor Manufacturing TSM for its assembly and chip production, respectively. The majority of iPhones are produced at a factory in China by Foxconn, and the majority of Apple chips are produced in Taiwan by TSMC. If there were a souring of relations between the United States and China, or if China threatened Taiwan, the firm could see a severe hit to its supply. Additionally, the Chinese government has recommended that government officials not conduct business on iPhones, which presents a current and potential future risk to sales in China.

We see a low level of environmental, social, and governance risk for Apple. The firm has committed to full carbon neutrality by 2030, and we believe it will achieve this goal. The potential future loss of talented human capital could be another risk on this front.

Read more about Apple’s risk and uncertainty.

AAPL Bulls Say

- Apple offers an expansive ecosystem of tightly integrated hardware, software, and services, which locks in customers and generates strong profitability.

- We like Apple’s move to in-house chip development, which we think has accelerated its product development and increased its differentiation.

- Apple has a stellar balance sheet and sends great amounts of cash flow back to shareholders.

AAPL Bears Say

- Apple is prone to consumer spending and preferences, which creates cyclicality and opens the firm to disruption.

- Apple’s supply chain is highly concentrated in China and Taiwan, which leaves the firm vulnerable to geopolitical risk. Attempts to diversify into other regions may pressure profitability or efficiency.

- Regulators have a keen eye on Apple, and recent regulations have chipped away at parts of its sticky ecosystem.

This article was compiled by Quinn Rennell.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ca129aad-9614-4bf0-993b-3df5f6bfa41e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca129aad-9614-4bf0-993b-3df5f6bfa41e.jpg)