Coronavirus Has Limited Impact on Big Pharma and Big Biotech

Moats, valuations, and dividends look attractive in the market pullback.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

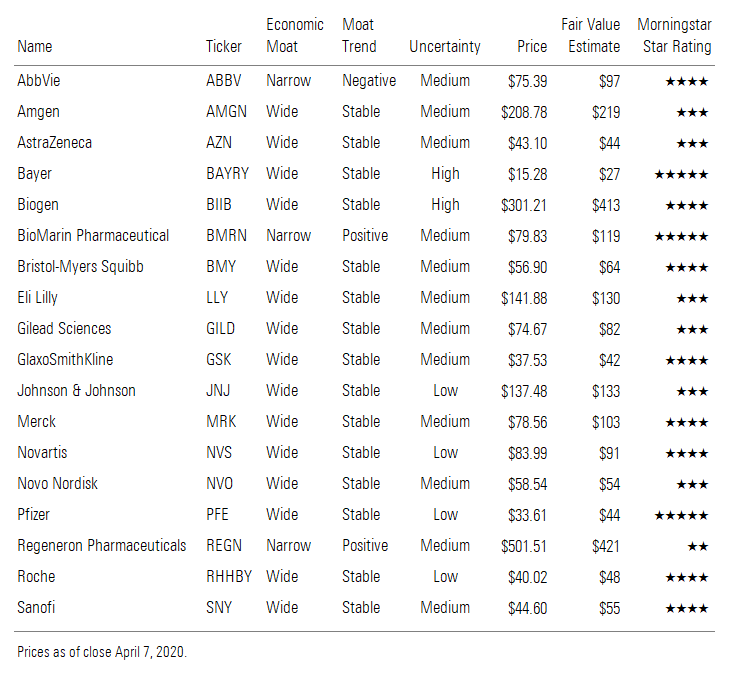

We have lowered our Big Pharma and Big Biotech fair value estimates by almost 2% in aggregate, much less than the stocks have declined as a result of disruptions caused by the coronavirus outbreak. The high need for drugs should support continued demand and supply. Also, we expect new treatments and vaccines to reduce the long-term impact of the virus. We don’t expect changes to our economic moat ratings, as innovation should continue with only minor disruptions. Successful coronavirus treatments by the pharmaceutical industry should also remind the world about the social importance of the group (a key environmental, social, and governance factor for the industry), shielding it from the potential pressures of any new drug-pricing policy reforms. Our top undervalued picks in the industry include Bayer, BioMarin, Biogen, Merck, and Pfizer.

We think the coronavirus pandemic will affect Big Pharma and Big Biotech companies in two major ways: (1) an economic slowdown, likely causing a 4.6% hit to 2020 global GDP (implying a 1.4% decline in 2020), and (2) a disruption in the use of drugs, vaccines, and consumer healthcare products. However, the highly inelastic demand for most drugs should largely offset any recessionary impact. We also expect overall headwinds to healthcare utilization to largely focus on new and elective drugs and products or less critical drugs and vaccines administered in a hospital or doctor’s office. The cash flows associated with these drugs and vaccines represent only a fraction of overall business. Further, we expect to return to a more normal business environment by 2021 and that any affected drugs will return fairly close to precoronavirus trajectories.

While the coronavirus pandemic has caused some disruption to the drug industry’s cash flows, we believe the market has overreacted regarding healthcare valuations. As of April 2, the Morningstar US Market Index was down close to 27% since Feb. 20, with the healthcare market down almost as much. While healthcare is showing some defensive characteristics, the only minor relative outperformance suggests potential upside for healthcare companies now as the healthcare pullback looks overdone from our perspective.

Beyond the capital appreciation in this industry, we expect drug companies to continue to support their dividends. With an average payout ratio of close to 50%, we believe the companies are secure in supporting dividend payments despite the disruption caused by the coronavirus. While we have lowered our earnings projections for 2020 based on the coronavirus disruptions, we expect dividend payout ratios to grow only 200 basis points in 2020, which should be manageable by the large companies. AstraZeneca’s payout ratio does trend toward a more challenging level at 75%, but we expect the company to continue to prioritize the dividend and sell assets in support, as it did when patent losses weighed on earnings in the last three years.

Coronavirus' Recession Impact Minor for Pharma and Biotech During the most recent global recession in 2009, the drug and biotech industries held up well, with limited impact to sales and profits. We expect the same defensive attributes of the industry in the likely recession ahead. With the need for prescription drugs relatively high irrespective of the economy, we expect patients will continue to demand fairly constant amounts of drugs. The elasticity of medication use ranges from negative 0.2 to negative 0.02, which is much lower than the price elasticity of negative 1.8 to negative 2.0 for typical food items like pasta and frozen meals, according to research firm IRI. Therefore, we expect little relationship between drug sales and the underlying economy.

Our economic outlook calls for a global decline in GDP of 1.4% in 2020, followed by a rebound in 2021, with a 0.9% headwind to long-run GDP from the coronavirus outbreak. The large drug and biotechnology companies weathered the 2009 recession without many impacts. With the 2009 global recession showing some similarities to our expectations for 2020, we don’t expect major changes to our valuations in the drug and biotech industry related to the economic pullback. However, in the United States, a larger portion of drug payments are connected to copays or cost sharing than in 2009, which could slightly increase drug-demand sensitivity to the overall economy.

New Treatments Significant to Pharma Goodwill but Not Valuations The pipeline of potential therapies to treat or prevent coronavirus infection is growing daily; as of March 31, the U.S. Food and Drug Administration counted 10 investigation drugs in trials, with 15 being considered for trial launches. While we have added Gilead's remdesivir to our model with a 70% probability of approval by midyear and a 40% probability of stockpiling for potential outbreaks over the next three years, this only slightly increased our fair value estimate after factoring in a slightly expensive acquisition of Forty Seven. We expect companies that can show strong data for efficacy, either with treatments or vaccines, will offer the medicines at low prices during this pandemic. However, there could be some intangible benefits to drug companies, as goodwill would build substantially if they can navigate a path out of this crisis, which we assume would mean that significant pressure on drug pricing in the future (in the form of inflation caps or international price benchmarks) would start to look overly punitive.

We see three major waves of potential coronavirus treatments. First, Gilead’s remdesivir and multiple approved drugs being repurposed for the coronavirus could all generate data in the second quarter, and we expect at least one effective option to emerge as more controlled studies read out.

Second, targeted antibodies are entering trials this summer and could be ready to help protect healthcare workers this fall and the broader public by the end of the year.

Finally, vaccines are already entering development. Moderna and CanSino started trials in March, and several other vaccines are poised to enter development over the next few months. Among potential large-cap pharma entrants, Johnson & Johnson has risen to the lead; it now expects to push a vaccine into development by September that could have a billion doses available by the end of the year. Moderna’s focus on mRNA is similar to approaches at peers like CureVac (entering trials in late April), BioNTech (partnered with Pfizer and entering trials in summer) and Translate Bio (partnered with Sanofi). We expect that these vaccines also have potential for hundreds of millions, if not a billion, doses, particularly BioNTech’s and CureVac’s self-amplifying technologies, with data in the second half of the year. Given significant funding from organizations like the Biomedical Advanced Research and Development Authority (part of Health and Human Services) and the Coalition for Epidemic Preparedness Innovations, as well as aggressive at-risk prioritization of manufacturing at these companies, we expect vaccine supply to be enough to cover much of the globe by early 2021, assuming at least two of the six or so leading programs see positive data. J&J said that emergency use of its vaccine would be provided on a not-for-profit basis, leading us to believe that pricing will probably be below $100 a person and well below this if it does provide a billion doses by early 2021.

Based on data produced so far, we think chloroquine-based treatments and remdesivir both look promising. Chloroquine and hydroxychloroquine are both now FDA-approved under an emergency use authorization, and the FDA is likely to act quickly to not only approve new trials and expanded-access programs but also to approve new drugs under the EUA. We’re also encouraged by early data on IL-6 antibodies like Roche’s Actemra and Sanofi/Regeneron’s Kevzara, but trials are just starting, and definitive data may not be available for another couple of months. Because patients require only one dose (compared with arthritis patients, who require chronic dosing every two weeks), we expect that supply of these drugs could be available today and ramped up by the second half of the year to serve patients who are at risk of becoming critically ill.

Top-Line Impact: Newly Launched Drugs Likely Take the Biggest Hit Pfizer was one of the first major drug companies to guide sales representatives to work from home, and we expect the entire industry to follow its lead. With sales representatives working from home, we expect the effectiveness of marketing products will fall. According to ZS Associates, in general, about 47%-48% of physicians are willing to take visits from pharmaceutical representatives but will only open 8%-10% of emails from drug companies. We expect recently approved drugs, and drugs with recently gained indications, will face the brunt of the potential pullback on marketing efforts. In some cases, we expect new drug launches will be slightly delayed, as is the case with Bristol's multiple sclerosis drug Zeposia. The drug was approved by the FDA on March 26, but Bristol is delaying its commercialization because of the coronavirus. We could also see delayed launches for Gilead's immunology drug filgotinib, BioMarin's hemophilia gene therapy valrox, and Roche's neurology drugs satralizumab and risdiplam (all are still expected to receive FDA approval this year).

Drugs deeper into their lifecycle, especially chronic drug treatments, should continue to drive steady sales, as less support is needed. Patients typically refill prescriptions without much need to visit a doctor over the next six months. New drugs and new indications could struggle to gain new patients during the coronavirus outbreak. Beyond less marketing push, we expect doctors will be heavily distracted and inundated with coronavirus patients. Also, we expect patients in need of less critical care drugs will be less likely to enter hospital settings in fear of getting the coronavirus. Therefore, new patient starts on drugs will probably slow as well, especially for less critical diseases. Drugs administered in the hospital could be especially hard hit as coronavirus patients take priority. However, most drugs delivered in hospitals focus on critical-care treatments like oncology, so these drugs should show some resilience.

No Major Impact on Branded Drug Supply Chain and Manufacturing Costs Drug manufacturing is not labor-intensive, and personnel should continue to be allowed to leave homes in the event of major global sheltering. In Italy, for example, where some of the most stringent stay-at-home requirements are in effect (outside of China), workers in drug manufacturing are allowed to continue to go to work. Overall, companies do not typically disclose drug supply chains as they are considered trade secrets, and regulatory agencies have largely agreed with them. While details around supply inventories are not disclosed, we estimate at least six months of supply for most drugs. Merck has announced that it carries 6-12 months of supply for most drugs, and we expect that most other large companies carry similar levels. Novo Nordisk has at least a 6-month supply of insulin, assuming manufacturing were to shut down, and BioMarin keeps about 18 months of inventory on hand for its rare-disease treatments.

While the sales growth of drug companies will likely slow with sales representatives staying home, we expect most variable sales costs to drop dramatically. Travel and entertainment expenses should fall along with the costs of presenting at medical conferences. Further, commissions should fall on new drug sales. Overall, while we expect some sales and marketing offsets, we project margins will be under pressure overall as companies aren’t likely to cut staff to maintain margins in the short term.

R&D Outlook: Delays in Patient Recruitment and New Study Starts Likely We expect some clinical development delays, but we don't expect major impacts to drug development overall. The FDA has allowed for more adaptive amendments and new techniques in clinical trials, such as remote data collection and checking on patients in alternative locations less affected by coronavirus patients. Additionally, Eli Lilly said that the majority of its late-stage clinical trials remain on track with the exception of mirikizumab for gastrointestinal indications. However, Lilly is pausing enrollment in most studies and delaying new clinical starts. We expect that pausing study enrollment and delaying new trials will be widespread across the industry but that the impact should be manageable as long as it is less than a year (our base case assumes the pandemic is a 2020 event). While there are likely more delays in earlier-stage studies, many key 2020 study readouts have data already in-house or relate to studies with completed enrollment, which should mean less disruptions for very late-stage pipeline drugs.

Company-Specific Valuation Impacts We lowered our AbbVie ABBV fair value estimate to $97 per share from $101 based on likely less ability to market new products as the coronavirus outbreak keeps sales representatives and doctors less connected. We have lowered the growth expectations for AbbVie's key new immunology drugs Skyrizi and Rinvoq (both launched in 2019) by $400 million (1% of total sales) in 2020. Also, we expect new indications for oncology drugs Imbruvica and Venclexta to gain less share in 2020, resulting in a collective $600 million (1% of total sales) less sales in 2020. Additionally, we have factored in declines from Allergan's esthetics business, with cosmetic Botox treatments likely to fall significantly (estimating 50% declines for the remainder of the year) because of coronavirus concerns delaying treatments. However, the remaining parts of AbbVie's business lines are largely focused on critical-care oncology treatments or chronic at-home treatments, which should not be materially disrupted by the coronavirus outbreak. We expect some margin deterioration, as overall sales declines will likely be mitigated by cost controls but not fully offset.

We lowered our Amgen AMGN fair value estimate to $219 per share from $221, as the company’s ability to market its newer products or see new patient growth for office-administered drugs is likely to be significantly reduced for 2020 as a result of the coronavirus pandemic. We have lowered our growth assumptions for cardiology drug Repatha, osteoporosis drugs Evenity and Prolia, and migraine drug Aimovig, which lowered our top line by $450 million (2% of total sales) in 2020. We assume less switching among immunology therapies, boosting our Enbrel estimates and lowering our Otezla estimates. We did not change our sales estimates for drugs facing biosimilar competition, as we assume minimal impact (potentially some treatment delays but also a slower switch to new biosimilars). We’ve lowered the selling, general, and administrative expenses we assumed beyond the first quarter, which was more than offset by the lower growth assumptions we put in place for key drugs. In the pipeline, we see less disruption at Amgen than at some other companies due to the timing of its key trials. For example, Amgen is not launching any new branded drugs this year, and the potentially pivotal phase 2 trial of AMG 510 in non-small-cell lung cancer, the phase 3 study of tezepelumab in asthma, and the phase 3 study of omecamtiv mecarbil in heart failure are all fully enrolled, so Amgen doesn’t expect a delay in results, and we think 2021 launches are still on track.

We reduced our AstraZeneca AZN fair value estimate to $44 per share from $46 based on disruptions caused by the coronavirus. We expect new indications for cardiovascular drug Brilinta and diabetes drug Farxiga will make much less progress with new patient starts, and we are reducing these drugs sales projections by $350 million (1% of total sales) in total in 2020. Also, we expect slower sales ramps for new cancer drugs Lynparza, Imfinzi, Tagrisso and Enhertu, knocking off just under $1 billion (4% of total sales) in projected 2020 sales in aggregate as doctors and patients delay treatments. The potential crowding of hospitals due to the coronavirus is likely to have a bigger impact on the hospital-administered drugs Imfinzi and Enhertu. While we expect the cancer drugs will still grow, we expect the pace of growth to decline relative to expectations before the coronavirus outbreak, as salespeople are less effective in marketing the new drugs by working from home and patients want to avoid hospitals and doctor’s offices for fear of contracting the coronavirus. Nevertheless, given the critical nature of the drugs, we still project growth. The loss of new sales from these high-margin cancer drugs will likely hit operating margins by more than 100 basis points in 2020. However, we do expect a fairly strong rebound in new drug sales in 2021 as pent-up demand resurfaces and the distractions of coronavirus fade.

We reduced our Bayer BAYRY/BAYN fair value estimate to $27/EUR 101 per share from $29/EUR 105 largely due to sales disruptions caused by the coronavirus. We expect sales of cardiovascular drug Xarelto to slow in 2020, reducing our annual estimate by EUR 600 million (1% of total sales), as doctors will likely see less atrial fibrillation patients and new indications in coronary artery disease and peripheral artery disease are less marketed by sales representative who need to work from home. These new indications need the sales effort to drive sales, as we believe doctors are less likely to embrace Xarelto for these indications without strong educational support and marketing from Bayer. Additionally, for ophthalmology drug Eylea, we are reducing our projections by EUR 300 million (1% of total sales), as we expect patients and doctors will delay treatments even longer. We don’t expect these sales reductions to have material impact on Bayer’s higher debt levels, as most of it is due in 2025 or later, significantly after when we expect the impact of the coronavirus to have dissipated.

We lowered our Biogen BIIB fair value estimate to $413 per share from $421 after accounting for coronavirus-related treatment delays for hospital-administered therapies (Spinraza) as well as delays to clinical trials for its novel neurology-focused pipeline. While several studies expected to read out in 2020 could still be on track (Parkinson’s, multiple sclerosis, and ophthalmology gene therapy among them), amyotrophic lateral sclerosis and stroke trials that were expected to have data in 2021 could be delayed by several months. Overall, this lowers our 2020 sales estimate by $400 million (3% of sales). However, with the FDA filing on aducanumab expected any day now, we don’t think a potential launch in late 2020 or early 2021 is at risk for a significant delay at this point. Also, most of Biogen’s MS therapies, like oral Tecfidera or injectable Avonex/Plegridy, are delivered to the home and should not see disruptions. We also think delays for neurology infusion center therapies could be less pronounced (Tysabri and Ocrevus are both infused).

We’re maintaining our BioMarin BMRN fair value estimate at $119 per share, as we don’t see significant impact to underlying revenue or the timing of drug launches. We have lowered our 2020 revenue by $170 million, or 8%, but this countered the significant cash flow increase in 2021 as new launches draw closer. Most of BioMarin’s products can be infused at home, and we don’t expect patients to delay these important rare-disease treatments. However, Palynziq is still early in its launch, and patients need to go to a dedicated PKU clinic for their first injection. In the pipeline, BioMarin has the data it needs for filing vosoritide in achondroplasia, and even the studies in younger patients that are ongoing are likely to continue, as parents administer the drug at home. BioMarin’s hemophilia gene therapy valrox (which should be approved in August) could see a delayed launch in early 2021, but we expect competitors like Sangamo/Pfizer and Roche (Spark) could see bigger delays, as they are still enrolling phase 3 studies, which could improve BioMarin’s early market share lead beginning in 2021. We expect delays for earlier-stage programs, but these are not yet explicitly included in our valuation model.

We are maintaining our $64 fair value estimate for Bristol-Myers Squibb BMY despite potential disruptions from the coronavirus. Most of Bristol’s drugs are entrenched cancer drugs that we don’t expect to meaningfully decline based on coronavirus challenges. While we expect sales of Eliquis to come in $500 million lower in 2020, the decline is not material enough to change our fair value, partly because the shared profit on the drug with Pfizer dilutes the sales reduction impact. Additionally, we don’t expect much impact to immuno-oncology drug Opdivo, as the coronavirus could actually help the drug maintain market share as physicians may embrace a competitive drug (Merck’s Keytruda) at a slower rate in Europe in the important first-line non-small-cell lung cancer indication. Also, while we do expect slightly lower sales for newly acquired Celgene drugs, the hit isn’t large enough to move our fair value estimate. The recent fall in Bristol’s stock price is probably due to increased concerns about Bristol’s elevated debt from the recent Celgene acquisition. We continue to believe that Bristol’s cash flows are very robust and that it will pay down debt to a pre-Celgene acquisition level over the next five years. Additionally, more than half of the debt is due after 2024, giving the company plenty of room to repay its loans.

We lowered our Gilead Sciences GILD fair value estimate to $82 per share from $85 as a result of headwinds from the coronavirus pandemic on current franchises. Gilead’s core HIV therapy, Biktarvy, has already had a tremendous launch, although we anticipate more patients staying on their current regimens because of coronavirus this year, so we’re slightly trimming our Biktarvy assumptions for 2020. While this is not a threat to long-term Biktarvy growth, slower patient transitions from pre-exposure prophylaxis with Truvada (going generic at the end of September) to newer branded drug Descovy in the U.S. could have a bigger long-term impact, and we’ve reduced our assumption for the percentage of patients who will make the transition before the fourth quarter to 25% from 50%. We’re assuming slower sales of Yescarta (hospitals avoiding in-patient therapy) and delayed timelines for development of Forty Seven’s magrolimab. Gilead’s efforts to accelerate the approval of filgotinib in arthritis (likely mid-2020 FDA approval) may have been wasted, as a launch in the second half could be challenging. Overall, we have lowered our 2020 revenue estimate by $1 billion (4% of total sales). That said, we previously added remdesivir to our valuation model, which creates one potential tailwind from the pandemic.

We are maintaining our GlaxoSmithKline GSK/GSK fair value estimate of GBX 1,795 for the local shares but reducing our fair value estimate for the ADRs to $42 based on changes in exchange rates since our last valuation update. While Glaxo is launching new drugs that will face some slight disruptions, the new drugs are not overly material to cash flows in the near term. We expect the company’s new respiratory drug Trelegy to face slightly slower growth but that respiratory drugs will face less disruptions, as patients will likely be more sensitive to respiratory problems given the potential lung problems caused by the coronavirus. Also, Glaxo’s new HIV drug Dovato wasn’t projected to hit material sales growth until 2021, which should remain largely on track. The company’s most material product that could be affected by the coronavirus is Shingrix (shingles vaccines) as patients avoid doctor’s offices and hospitals, but given the shortage in manufacturing for the vaccine, we don’t expect the demand disruptions by the coronavirus to have a material impact on sales. On the consumer side, we expect potential increases in well-being health to offset any demand disruptions caused by the coronavirus.

We reduced our Johnson & Johnson JNJ fair value estimate to $133 per share from $137 based on expected disruptions caused by the coronavirus pandemic. We expect reduced demand for elective surgeries and slower growth for new drug launches. In orthopedics, we forecast hip and knee replacements to fall close to 25% for the rest of the year as patients avoid hospitals and doctors are preoccupied with coronavirus concerns. The reduction to our orthopedic projections cuts close to 1% off J&J’s top line. Additionally, new drugs or drugs with recently approved indications should slow. We are reducing our projections for immunology drugs Stelara and Tremfya by $650 million (1% of sales) in 2020. We expect lower sales for cancer drugs Darzalex, Imbruvica, and Erleada as the coronavirus slows the sales ramps associated with new indications of the drugs, taking close to 1% off of total sales for the company. Lastly, we forecast immunology drug Remicade to fall faster as patients would like to avoid going to the hospital or doctor’s office for this less critical care drug. While we expect J&J to mitigate some of these top-line pressures, we expect margins to slightly deteriorate in 2020.

We lowered our Eli Lilly LLY fair value estimate to $130 per share from $135 based on coronavirus disruptions primarily related to the company’s new drugs. While we don’t expect major swings in Lilly’s diabetes franchise, we do expect a slower uptake of new patients for Trulicity and Jardiance, cutting close to 2% off growth for 2020. Also, we expect slow trajectories of growth for migraine drug Emgality, cancer drug Verzenio, and immunology drug Taltz, collectively taking an additional 2% off growth in 2020. Despite these drugs likely growing at a slower rate in 2020, Lilly holds a fairly defensive portfolio of drugs that are critically needed by patients and should not see too much disruption. Lilly announced in late March that it was not expecting any major changes to its financial guidance for 2020, but we expect some minor pressure to this guidance as the year progresses.

With most of Merck’s MRK products fairly entrenched in the medical system, we don’t expect a major change to our valuation and are maintaining our $103 fair value estimate. However, we do expect a slower ramp in Keytruda sales, especially in Europe, where the drug recently gained most of its reimbursement for the largest indication in first-line non-small-cell lung cancer. As a result, we reduced our 2020 Keytruda sales by close to $1 billion (2% of total sales), but we assume a faster rebound in 2021 following less impact from the coronavirus. Also, we expect modest pressures on new drug ramps for oncology drugs Lynparza and Lenvima, but both are shared profits with other companies, so the impact is partly reduced. As a result of fewer elective procedures, we expect less utilization of anesthesia reversal agent Bridion. Lastly, we expect human papillomavirus vaccine Gardasil will hold up well despite some likely crowding out by the coronavirus due to the vaccine’s heavy demand and Merck’s supply constraints for manufacturing the vaccine.

We decreased our Novartis NVS/NOVN fair value estimate to $91/CHF 90 per shares from $94/CHF 94 based on disruptions caused by coronavirus concerns. The drugs facing the largest adjustments in growth are immunology drug Cosentyx and cardiology drug Entresto, which we project will have a collective $500 million (1% of total sales) less in sales for 2020 as new patients and doctors are distracted by coronavirus concerns. Additionally, Novartis is launching a leading number of new drugs, including cancer drug Piqray, multiple sclerosis drug Mayzent, ophthalmology drug Beovu, and spinal muscular atrophy drug Zolgensma. However, these drugs are early in their launch, and we expect a fairly solid rebound in sales ramp for the drugs in 2021 following the likely slowing of coronavirus disruptions, which makes the slower sales ramps less damaging to the company’s valuation.

Overall, Novo Nordisk’s NVO/NOVO B business looks well protected from the impact of the pandemic, and we’re not making any changes to our fair value estimate of $54 per share (slight adjustment related to foreign exchange to DKK 368 from DKK 366). The biggest impact could be on Rybelsus, the oral GLP-1 therapy launching in diabetes. We assume a hit of DKK 1 billion in 2020 as a result (less than 1% of sales), as we had already assumed slow uptake as Novo gains access on formularies throughout the year. Novo still expects to file semaglutide in obesity either late this year or early 2021, as the trials here have largely already fully enrolled. That said, new trials could be delayed, including the company’s once-weekly insulin LAI287 and combination obesity drug programs. However, we have not explicitly modeled these earlier-stage programs.

We reduced our fair value estimate for Pfizer PFE to $44 per share from $46 based on likely coronavirus disruptions to the drug portfolio. We expect new drug launches for oncology drugs Xtandi, Mektovi, and Braftovi along with cardiovascular drug Vyndaqel to stagnate while patients and doctors are less inclined to try new treatments, resulting in $500 million (1% of total sales) less sales for these drugs collectively in 2021. We expect entrenched drugs Eliquis (for atrial fibrillation) and Ibrance (for breast cancer) to bring on fewer new patients as people avoid checking on ailments, cutting off close to $600 million (1% of total sales) in 2021. Additionally, we expect vaccine sales for Prevnar 13 to fall (especially for adult patients) as older patients try to avoid doctor’s offices and hospitals over concerns about contracting the coronavirus.

We raised our fair value estimate for Regeneron REGN to $421 per share from $389 after adding coronavirus targeted antibody programs to our valuation model. The Biomedical Advanced Research and Development Authority is working with Regeneron to develop antibodies that could be used in combination, and the drugs use Regeneron’s VelociSuite technology, similar to Ebola drug REGN-EB3. Regeneron hopes to be in human testing by early summer. The drugs could be used for prevention or treatment, and hundreds of thousands of prophylactic doses could be made by the end of summer. We assume a 60% probability of approval and roughly $2 billion in annual sales of the antibodies for a two-year period, as the antibodies could be used as prophylaxis for healthcare workers and some high-risk people. We’ve maintained our Kevzara sales estimates, as we think the arthritis drug could be effective but for a smaller group of critically ill coronavirus patients. We assume pricing will be low (less than $1,000) for both drugs, as Kevzara patients would likely require only one dose (versus 26 doses a year for arthritis patients), and Regeneron’s pricing history makes it unlikely to offer the targeted antibodies at a high price. We’ve lowered our estimates for cholesterol-lowering drug Praluent, immunology drug Dupixent, and ophthalmology drug Eylea, as we expect fewer new patient starts on Praluent and Dupixent and treatment delays with Eylea (from high-risk patients avoiding physician offices on some level throughout 2020).

We lowered our Roche RHHBY/ROG fair value estimate to $48/CHF 374 per share from $49/CHF 381, as we see mixed impact from the coronavirus. Roche is increasing production of Actemra, as demand is surging while the drug is used off-label and in clinical trials in COVID-19 patients (it is approved for use in arthritis and to treat cancer patients who develop a dangerous immune system reaction to immunotherapy). We’ve slightly raised our Actemra sales assumptions for 2020, as well as sales of Activase (another potential coronavirus treatment). We’re maintaining estimates for drugs that could see relative benefits to competitors due to coronavirus. Even though Roche is early in the launch of cancer drug Polivy, we’re not changing our estimates, as we believe sales could benefit as a more convenient alternative to CAR-T therapy (patients can avoid in-patient stays at hospitals). We also expect that the coronavirus gives Roche more time to anchor Ocrevus as the leading MS therapy (Novartis was hoping to launch later this year), and hemophilia drug Hemlibra could be appealing for parents of hemophiliacs (who can easily administer the product at home rather than going to a clinic for intravenous infusions). However, we have reduced 2020 sales for most of Roche’s cancer drugs and ophthalmology drug Lucentis, as older patients delay treatment to avoid exposure to the virus. We also expect the second-half launches of new neurology medicines satralizumab and risdiplam to be delayed into 2021. In diagnostics, Roche can supply millions of coronavirus tests per month and hopes to increase this number, which should counter some of the pressure on centralized and point-of-care diagnostics (reduced annual screening) and molecular diagnostics (reduced blood donations).

We lowered our Sanofi SNY/SAN fair value estimate to $55/EUR 100 per share from $57/EUR 103 based on disruptions caused by the coronavirus. We see the biggest impact to the sales ramp for immunology drug Dupixent. We are reducing our forecast by close to EUR 500 million (3% of total sales) in 2020 from the drug as we expect new patient starts to fall significantly as patients avoid starting new therapy as coronavirus concerns weigh on treatment decisions. Additionally, we expect slightly slower ramps for several of Sanofi’s other drugs, but the magnitude of the impact should be much less than Dupixent, which is right in the core part of its lifecycle, where cash flows are very meaningful and new patient starts are critical for growth. We expect Dupixent to regain its traction in 2021 following less disruption from the coronavirus as the target patient populations in atopic dermatitis and severe asthma are undertreated.

MORN DODFX VINIX VWILX TSVA EGO WU Brightstart429plan MRO VZ MOAT T NKE CMCSA GOOG

/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

/s3.amazonaws.com/arc-authors/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)