Consumer Cyclicals: Discretionary Spending Uncertainty Drives Attractive Valuations

Though consumers have been cautious, overall spending has been resilient despite the challenging backdrop.

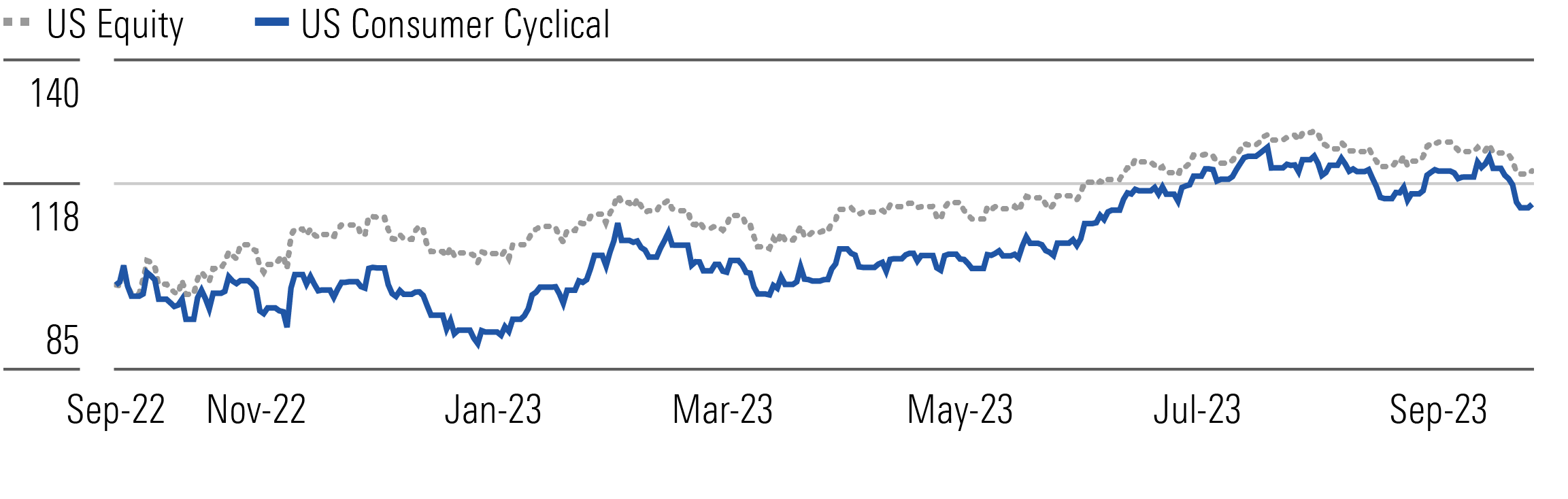

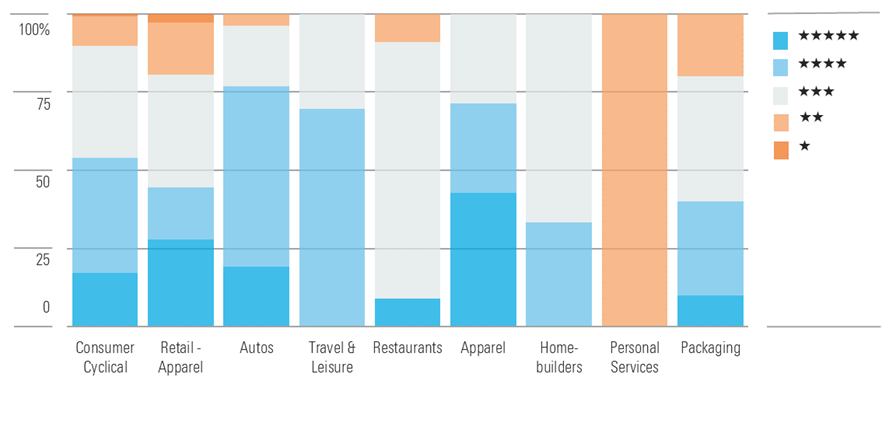

The Morningstar U.S. Consumer Cyclical Index declined 4.2% in the third quarter, a touch below the broader market’s 2.3% decline. In our view, compelling investment opportunities remain, as the median consumer cyclical stock trades at a 17% discount to our fair value estimate, with 54% of our coverage trading in 4- or 5-star territory. Apparel continues to stand out, trading at a 46% discount to our intrinsic valuations.

Investors Remain Reluctant to Embrace Consumer Cyclical Shares In Q3

Though consumers have been cautious, overall spending has remained relatively resilient despite the challenging backdrop of elevated interest rates and inflation’s drag on personal savings. While persistent macroeconomic pressures could stretch consumers further, we believe this risk is already reflected in share prices, and that such steep discounts to our fair value estimates are unwarranted.

Bargain Hunters Have a Chance to Swallow Up Apparel and Travel Stocks

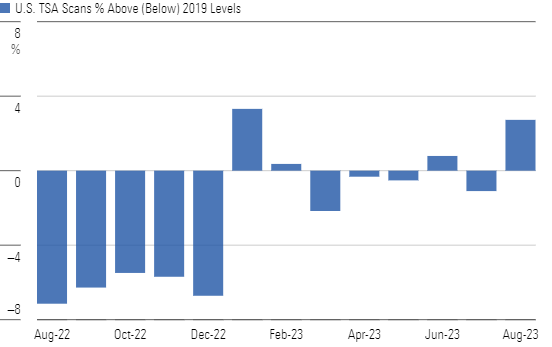

Though conditions may prompt consumers to alter their spending habits, we believe there is still pent-up demand for travel. Since January 2023, the number of monthly TSA passenger scans averaged 0.38% ahead of comparable 2019 levels, tracking near all-time highs despite mounting inflation. We contend that tailwinds related to hybrid work models and the deep-seated desire to travel should enable trends to persist, offering further growth. We believe that in lieu of ditching travel plans, consumers could increasingly shun restaurants to preserve cash, eating more at home.

Passenger Counts Tracking Close to 2019 Figures Despite Inflation

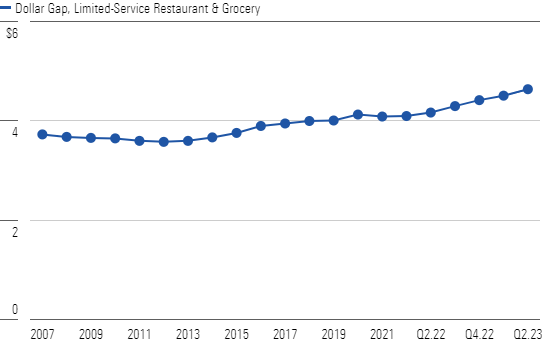

Even as the absolute difference in price between the grocery and restaurant channels remained relatively flat during the COVID-19 pandemic, this changed beginning in the second quarter of 2023, when the total dollar gap between limited-service restaurants and grocery stores increased 11% from $4.17 a year ago to $4.64. In our view, stepped-up promotions in the grocery aisle (now that supply and demand imbalances have generally been rectified) stand to pressure restaurant sales and traffic trends, along with greater financial stress on consumers. That said, we don’t believe restaurants will sit still. Instead, we believe operators will bolster innovation in their core offerings and experience to maintain traffic and entice consumers.

Stepped-Up Grocery Promotions Make Restaurant’s Premium Appear Lofty

Top Consumer Cyclical Sector Picks

Hanesbrands

- Fair Value Estimate: $19.70

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

We believe Hanesbrands HBI, trading at a deep 79% discount to our fair value estimate, offers a good investment opportunity. We surmise the market has been overly focused on short-term challenges, including the impact of inflation, high interest rates, and softer consumer demand, but has underestimated the company’s potential for free cash flow generation, progress in clearing excess inventory, and improving mix shift. We anticipate that lower input costs and Hanesbrands’ strategy to boost Champion and North American innerwear, streamline its portfolio, and engage consumers will improve its profitability.

VF

- Fair Value Estimate: $60.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

VF’s VF shares are attractive, trading at a 71% discount to our fair value estimate. We believe investors are fixated on the firm’s challenges, including a slowdown in Vans sales, elevated inventories, and a recent dividend cut, but are overlooking its potential for sales growth and margin improvement in the medium term. VF has exposure to the attractive active and outdoor categories, and North Face achieved 17% constant-currency sales growth in fiscal 2023. While it may take some time for Vans and Supreme to return to sales growth, we believe VF is taking the proper steps and improving its supply chain efficiency.

Nordstrom

- Fair Value Estimate: $40.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

Nordstrom’s JWN shares trade at around a 65% discount to our fair value estimate. While recent results have been bumpy, we still see the firm as a top operator in the U.S. apparel market, boasting a loyal customer base drawn to its differentiated products and strong customer service. We believe the company is making progress with its efforts to manage its inventory and improve its supply chain while juicing its sales of premium brands and the profitability of its digital sales. We surmise that investors discount Nordstrom’s potential for over 200 basis points of operating margin improvement over the next two years.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)