2 Consumer Stocks That Could Echo Mattel’s Barbie Movie Success

Undervalued companies with economic moats, solid execution, and potential for digital brand extension.

Following the high-heeled footprints of the Barbie movie craze, Mattel’s MAT stock is riding high, up more than 30% since hitting a low in mid-March 2023. The company is now planning further innovative marketing investments behind its Barbie brand, alongside many more movies for other properties in its portfolio.

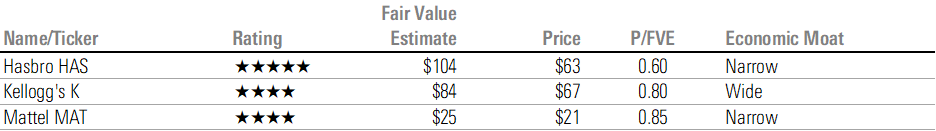

But how can investors tap into this? For one, despite the strong recent performance, Mattel’s stock still looks attractive, with a 4-star (or undervalued) rating. Outside of this stock, there are also a couple of other similarly attractive companies with brand-powered moats that arguably have the potential to tap into consumers’ nostalgia through well-executed media extensions.

Undervalued Consumer Companies With Brand Extension Capacity

Finding Firms With a Brand-Driven Economic Moat Is Only the First Step

A starting point to finding companies that could benefit from brand extension is to look for economic moats based on intangible assets—one of five moat sources assigned by Morningstar equity analysts.

Of course, not all will be targets for potential extension into digital media. For one, moats based on intangible assets can also include patents, retailer relationships, and other nonbrand competitive advantages. And second, not every brand can reasonably be expected to support a film or TV franchise; the world probably doesn’t need a Bath & Body Works BBWI movie, to pick on one example.

Only a handful of names likely fit the bill, based on an (admittedly rough) estimate as to a brand’s nostalgia factor, relative prestige, and proven track record of innovation. Some are obvious, like media leaders Paramount Global PARA or Warner Bros. Discovery WBD. But there are potentially more-interesting companies in the consumer space, including major brand owners like McDonald’s MCD and Coca-Cola KO, on top of the names highlighted elsewhere in this article.

Beyond Brands, Execution Is Critical in Bridging the Digital Divide

Mattel has proved successful in tapping into its brand intangible assets to bring its traditionally physical toys into the digital age, particularly since CEO Ynon Kreiz joined in 2018. But proper execution is also important.

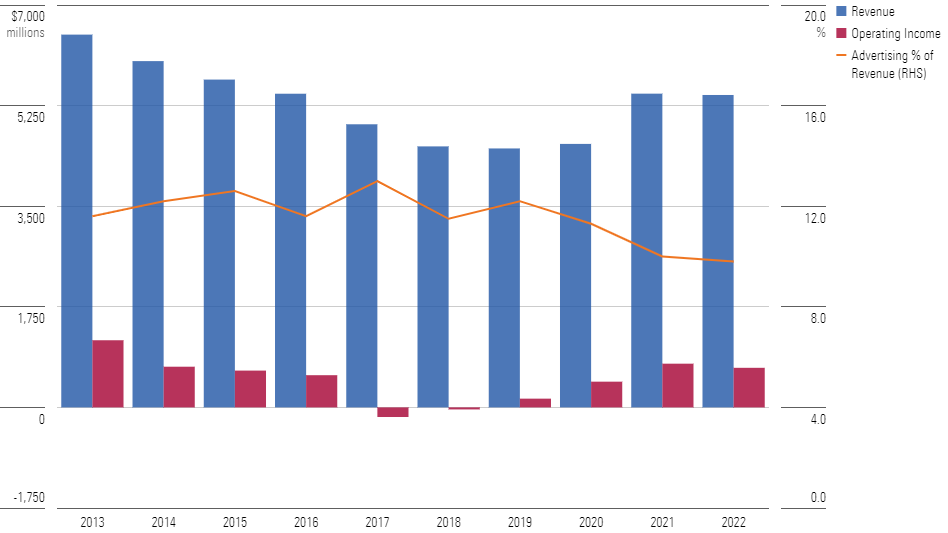

Illustrating this, Mattel’s road has been bumpy. Revenue fell 30% from 2013 through 2019, and operating earnings slipped into the red. It wasn’t simply a matter of spending more on marketing; advertising outlays remained relatively constant as a percentage of sales over the period. It was only by successfully executing on turnaround plans—originally announced in 2016—that the firm saw lasting improvement.

Despite Continued Advertising Spending, Mattel's Financials Only Improved After 2016-17 Turnaround Plans

Nintendo’s The Super Mario Bros. Movie, currently the top-grossing film of 2023, also illustrates the effectiveness of solid execution. While the film isn’t exactly a critical darling, with 59% on review aggregator Rotten Tomatoes, it’s a massive improvement on the company’s last effort, 1993′s Super Mario Bros., an infamous box-office flop with an unenviable 29% rating.

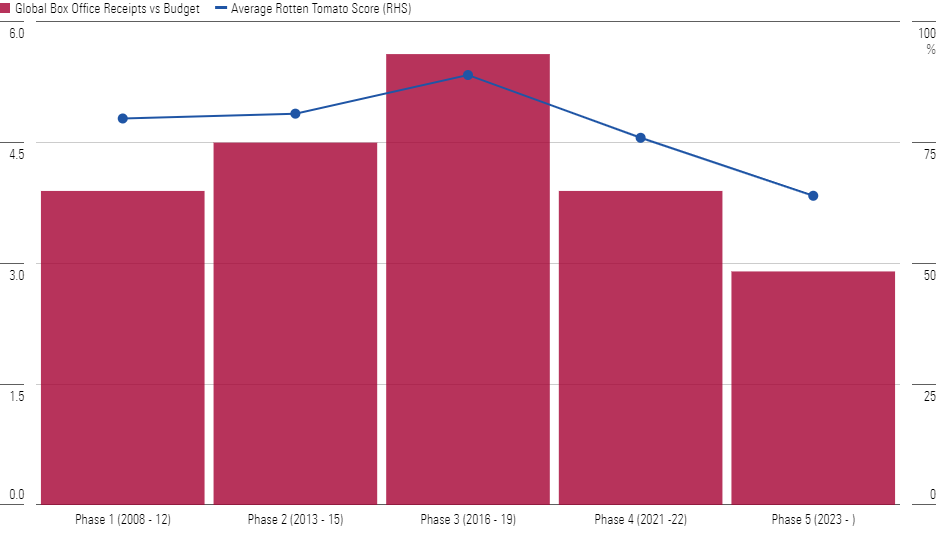

Compare this with Disney’s DIS Marvel Cinematic Universe. Following the massive success of 2008′s Iron Man—which kicked off the company’s “Phase One” of comic-book films—the brand has arguably been stretched too thin. Phases Four and Five have seen critical misfires, and while each movie has still comfortably recouped its enormous budget, the multiples have waned. Alongside other high-profile flops from its animation studios and ongoing political tensions, Disney’s stock has fallen more than 50% since its all-time high in early 2021 and is essentially flat versus 2014.

MCU Global Box Office Totals have Covered Budget Less as Critics' Reviews Have Worsened

Valuation Remains Paramount, Too

To wrap, identifying companies that not only enjoy solid brand-intangible assets but also meet a threshold for reasonable execution capabilities is key to finding potential investments that could enjoy expanded media extension. But—as always—valuation is a critical overlay as well. With that in mind, I’d highlight two companies:

Hasbro HAS

This narrow-moat stock was arguably early to the media-extension theme with its resurgent Transformers movie franchise launching in 2007, alongside a growing (and highly profitable) digital gaming business led by Magic: The Gathering and Dungeons & Dragons. Its strong film-industry connections allow the firm to capture media partnerships with relative ease, as it is an obvious choice for any partner to pair with given its wide audience reach and ability to aggressively spend on marketing. This is illustrated by an upcoming suite of movies that includes G.I. Joe, Power Rangers, and—in the vein of The Lego Movie franchise—Play-Doh and Monopoly.

Hasbro has seen revenue in its traditional toy segment languish in recent years, but it is now undergoing its own brand refinement under CEO Chris Cocks, who started less than 18 months ago. And the stock trades at a deep discount to our fair value estimate, offering a solid margin of safety.

Kellogg K

The wide-moat food manufacturer is already a strong partner in the digital realm, with frequent movie tie-ins (like Avatar: The Way of Water and Jurassic World, recently) gracing its well-known cereal and snack boxes. The company also sports a deep roster of brands that arguably meet the nostalgia blueprint outlined by the Barbie movie. This includes a recent Eggo Waffle tie-in with Stranger Things and a planned Netflix NFLX original movie titled Unfrosted, directed by Jerry Seinfeld. While nothing is announced, it stands to reason that a Tony the Tiger movie wouldn’t be outside the realm of possibility.

Outside of cereal, Morningstar’s equity analysts have long held that the market has failed to appreciate the strides that the firm has made to diversify into on-trend snacking and faster-growing emerging markets, rendering the shares undervalued. While the company is planning to split its cereal brands from snack foods in a spinoff before the end of the year, a sum-of-the-parts valuation suggests there’s a margin of safety in this stock, too.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)