The Worst-Performing Stocks of Q3 2023

Farfetch, Chewy, and utilities are among the quarter’s biggest losing stocks.

During the third quarter, share prices slumped across the stock market as bond yields jumped. And no stock sector was hit harder than utilities.

The title of worst-performing stock during the third quarter among the U.S.-listed companies covered by Morningstar analysts goes to Farfetch FTCH, which fell 65.4% on weak second-quarter earnings. The internet retailer was also broadly caught up in concerns about luxury goods sales amid the weakness in China’s economy and rising interest rates in the United States.

It was a similar story for online pet-care retailer Chewy CHWY, whose stock fell 53.7% after the company forecast softer demand and lower prices.

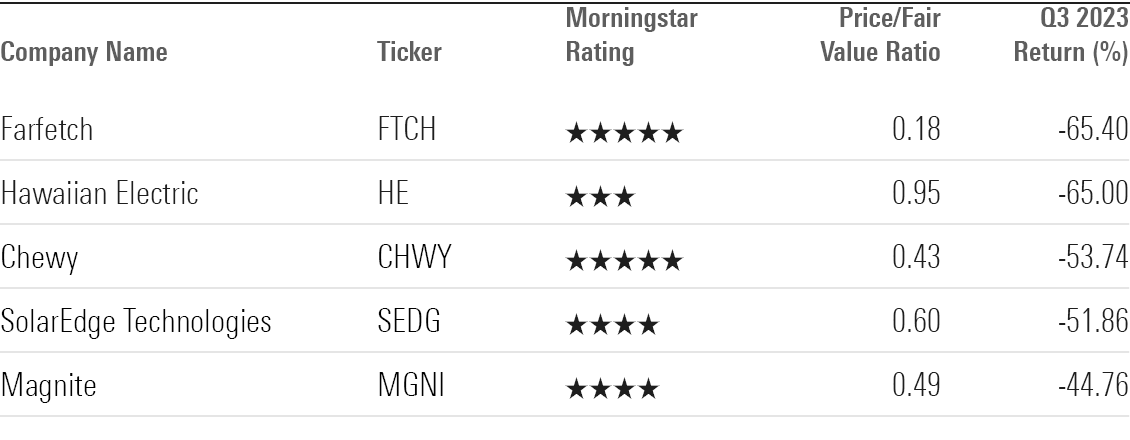

Here are the third quarter’s worst-performing stocks among Morningstar’s U.S. coverage.

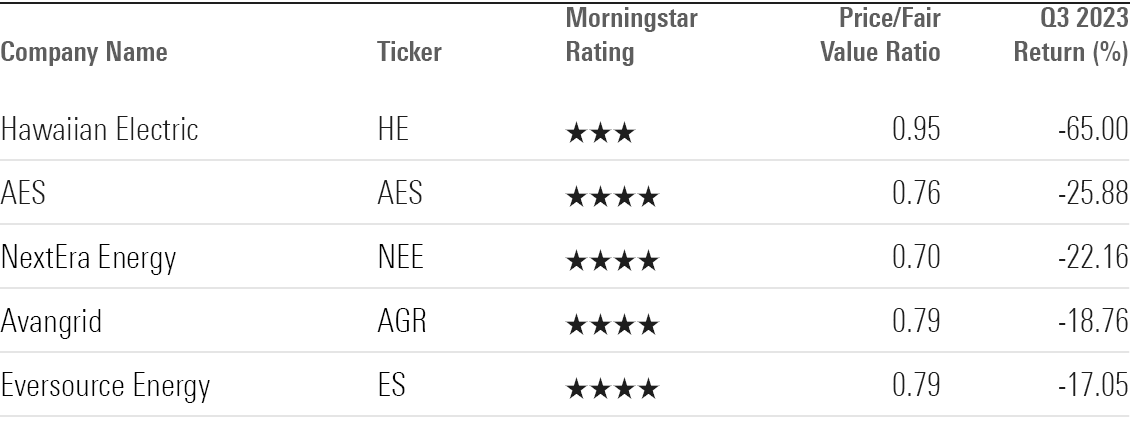

Overall, utilities posted the worst returns of any sector during the third quarter, with the Morningstar US Utilities Index losing 9.3%. “The increasing probability of higher-for-longer interest rates has finally caught up to utilities,” explains Morningstar energy and utilities strategist Travis Miller. He notes that utilities’ dividend yields are less attractive compared with current Treasury bond yields and that financing costs likely will climb.

The worst-performing utility stock, Hawaiian Electric, wasn’t hit by rising rates. Instead, the company was damaged by worries about its liabilities concerning the wildfires that killed over 100 people on Maui in August. Morningstar equity strategist Andrew Bischoff warned that “investors could experience material capital loss given the wide range of potential outcomes, which remain very uncertain and could change as the situation develops.”

Here’s a look at the third quarter’s worst-performing stocks, along with their key Morningstar metrics and selected commentary from our analysts. All data is as of Sept. 30.

Q3′s Worst-Performing Stocks

Worst-Performing Stocks

Farfetch

- Fair Value Estimate: $11.40

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

“U.S. weakness doesn’t come as a surprise, given our prior expectations for a significant weakening of luxury demand in the country after very strong post-pandemic growth. Most luxury names under our coverage reported declines in revenue in the North American markets during the quarter. Declines in China come as more of a surprise, given the easier comparison base (last year was affected by lockdowns). However, we suspect luxury brick-and-mortar stores were the main beneficiaries of the recovery and that some demand may have been redirected toward travel channels. We still see shares as undervalued at current levels, but continue to prefer Zalando ZLNDY in the apparel online space on a bigger scale and in a more sound financial position.”

—Jelena Sokolova, senior equity analyst

Hawaiian Electric

- Fair Value Estimate: $13.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

“Shareholders will need to be comfortable with a wide range of outcomes due to potentially significant liabilities from recent wildfires in Maui. The largest fire, in Lahaina, killed more than 100 people and destroyed 2,200 structures, with an estimated cost of $5.5 billion, according to a damage report released in mid-August by the Pacific Disaster Center and the Federal Emergency Management Agency. Plaintiffs will need to show that the utility was negligent or could have reasonably prevented a loss.”

—Andrew Bischof, strategist

Chewy

- Fair Value Estimate: $42.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

“The pet care industry remains challenging, with sluggish new pet household formation, increasing price sensitivity, and an uptick in industry promotional activity pinching results. Nevertheless, we take a sanguine view of Chewy’s prospects, with the firm’s large auto-ship user base and plenty of nascent initiatives paving the way toward long-term excess returns. While we anticipate sluggish user growth in 2023 and 2024 amid a challenging macroeconomic environment in the firm’s home U.S. market (trimming our net active buyer growth forecast to 3.5% in 2024 from 7.5%), we see further margin upside from the firm’s ads business than initially contemplated after positive management commentary regarding the initial pilot.”

—Sean Dunlop, equity analyst

SolarEdge Technologies

- Fair Value Estimate: $216.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

“While weakness in U.S. rooftop solar demand has weighed on shares across the industry, many (ourselves included) expected SolarEdge to be more resistant, given greater end-market diversification. However, this proved to not be the case following disappointing guidance for the third quarter, with revenue expected to fall 8% sequentially, well below PitchBook consensus. The weaker-than-expected guidance is exacerbated by channel destocking at European distributors, which saw elevated inventories (particularly for batteries) across the firm’s two main geographies, Europe and the U.S. The company expects Europe to correct by year-end, while U.S. excess inventories will likely last into 2024, given subdued demand.”

—Brett Castelli, equity analyst

Magnite

- Fair Value Estimate: $15.50

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

“While we were impressed by Magnite’s second-quarter results, which confirmed our assumption that a recovery in digital advertising is underway, we were surprised that the firm sees some weakness in CTV for the remainder of the year. Some CTVs are choosing platforms with lower take rates or prices, which is hurting Magnite in the short term. The demand-side platform providers could also experience some pricing pressure or demand for lower take rates in the future. We think as the economic uncertainty lessens, the more recently transitioned CTV ad sales to programmatic publishers will go to the market leaders, such as Magnite and PubMatic PUBM. Their services have higher take rates but are also more scalable, which allows them to provide better inventory and campaign management, including frequency capping and overall yield optimization.”

—Ali Mogharabi, senior equity analyst

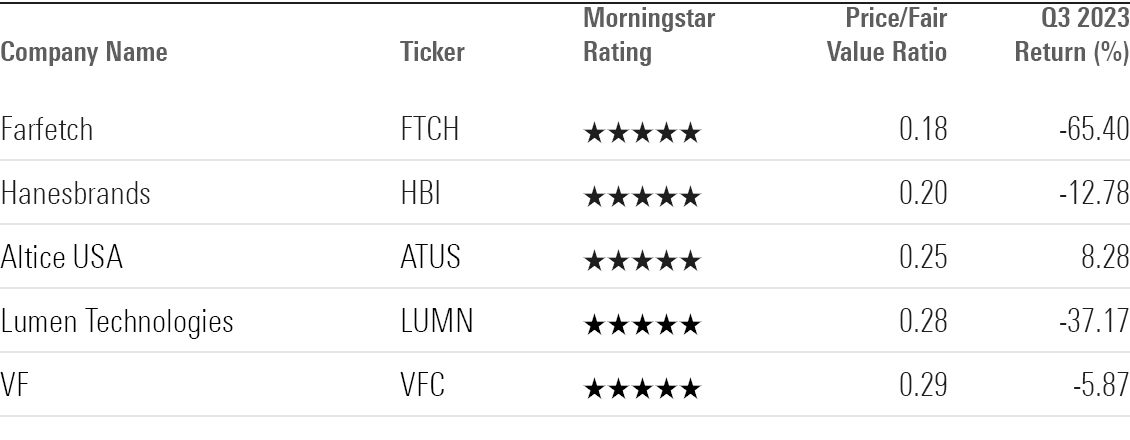

Most Undervalued Worst-Performing Stocks

Most-Undervalued Worst Performers

Hanesbrands HBI

- Fair Value Estimate: $19.70

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

“Hanesbrands’ second-quarter results were in line with our expectations, but guidance pointed to disappointing profit recovery in the second half of the year due to slow sales of Champion and tough market conditions in Australia. We view the weakness in Australia as temporary and macroeconomy-related, given that Hanesbrands’ products maintain their market leadership. However, the firm clearly needs a better plan for Champion, which has been underperforming similar activewear brands. To their credit, management outlined aggressive actions to rebuild Champion under the Full Potential plan, including new merchandise, supply chain improvements, and sales through pop-up stores.”

—David Swartz, senior equity analyst

Altice USA ATUS

- Fair Value Estimate: $13.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

“Altice USA’s second quarter provided glimmers of hope, but the firm remains far from healthy. While shares remain deeply undervalued relative to our fair value estimate, our uncertainty rating reflects the firm’s large debt load. Altice will likely need several quarters to stabilize its customer base before it can begin growing revenue again. An unexpected increase in competitive intensity before it reaches that point could be difficult to overcome.”

—Michael Hodel, director

Lumen Technology LUMN

- Fair Value Estimate: $5.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

“Lumen’s second-quarter earnings were poor, as expected, and are tracking full-year guidance. Management continues to sound an optimistic tone about the firm’s transition to more modern services, but sales declines are continuing at the same pace as the past few years. Despite its struggles, Lumen is undervalued relative to our fair value estimate, which is underpinned by a forecast that doesn’t assume a drastic improvement. That said, we don’t expect the stock can move much higher until the business improves and quells investors’ fears, which we don’t expect in the next few quarters. We believe Lumen will be able to pay off all debt maturing over the next three years, but if its financial performance doesn’t improve by the time it reaches its large debt maturity in 2027, we question its ability to maintain adequate liquidity.”

—Matthew Dolgin, equity analyst

VF VFC

- Fair Value Estimate: $60.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

“VF has built a portfolio of solid brands in multiple apparel categories. We view the three brands that account for about 80% of its sales (Vans, Timberland, and the North Face) as supporting its narrow moat based on a brand intangible asset. Despite economic concerns, we believe VF will grow faster than most competitors in the long run and maintain its competitive edge. Led by the North Face, VF’s results in fiscal 2024′s first quarter were close to our forecast, despite a steep 12% drop in its wholesale sales (53% of its total). The firm blamed the decline on cautious ordering amid an uncertain economy, merchandising issues with Vans, and low demand for workwear. While wholesale orders are not expected to bounce back in the short term, VF did hold its fiscal 2024 earnings per share guidance range of $2.05-$2.25. We view VF as very undervalued, given its potential for sales growth and margin improvement.”

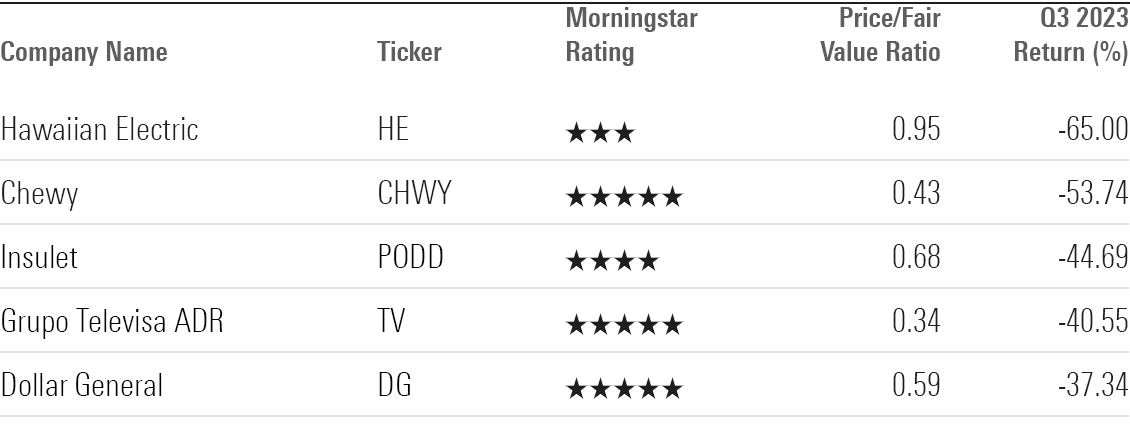

Worst-Performing Moat Stocks

Worst-Performing Moat Stocks

Insulet PODD

- Fair Value Estimate: $234.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

“We recognize that the second half of 2023 will offer more challenging comparisons as Insulet approaches the anniversary of the launch of Omnipod 5. Nonetheless, we still expect double-digit growth can be maintained into 2024, especially as the pump makes inroads outside the U.S. and into the type 2 diabetes population. We think the user-friendliness of Omnipod 5 makes it highly attractive to first-time pump users. Management indicated that 20% of new patient starts in the quarter were type 2 patients.”

—Debbie S. Wang, senior equity analyst

Grupo Televisa TV

- Fair Value Estimate: $9.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

“Televisa reported disappointing second-quarter results, posting a net decline in cable broadband customers and a sharp contraction in cable profitability. Management highlighted the appointment of telecom veteran Francisco Valim to head the cable business. Valim, who has served as CEO of several firms in Brazil, hasn’t yet officially joined Televisa, but he addressed investors briefly, mentioning an ongoing structural review that will serve as the basis for improving cash flow.”

Dollar General DG

- Fair Value Estimate: $179.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

“For the second straight quarter, Dollar General posted lackluster earnings, cut its guidance, and was punished by the market for its shortcomings. The firm’s core customers remain under pressure, acutely sensitive to sticky inflation in non-discretionary expenses, and they pulled back on purchases in the more cyclical seasonal (negative 1%), home goods (negative 7.7%), and apparel (7%) categories in response. While we expect to lower our intrinsic valuation by a mid-single-digit percentage, we continue to view issues as ephemeral rather than structural, and see significant long-term opportunity.”

—Sean Dunlop, equity analyst

Worst-Performing Utilities Stocks

Worst-Performing Utilities Stocks

AES AES

- Fair Value Estimate: $20.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

“CEO Andres Gluski has narrowed AES’ geographic and business focus by selling businesses in markets where the company did not have a strong platform or competitive advantage. We think his strategy has been in the best interest of shareholders. The company now has operations in fewer countries, a stronger balance sheet, and a rapidly growing renewable energy business. Management expects earnings to grow 7%-9% annually through 2025. We expect AES to achieve this. Growth should be supported by continued development of the company’s renewable energy backlog and growth at the company’s regulated utilities.”

—Andrew Bischof, strategist

NextEra Energy NEE

- Fair Value Estimate: $82.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

“We think NextEra Energy management, which also manages NEP, finds itself in an unusual position of having to regain investor confidence after management turnover earlier this year and revising growth expectations at NEP. We think the market’s readthrough of NEP’s guidance cut to NextEra is unwarranted. We don’t think NEP is vital to NextEra’s ability to finance its capital investment plan. NEP represented a small portion of the equity that we estimate NextEra will need to finance its renewable energy growth plan. We think NextEra’s strong balance sheet can support its capital investment plan. Though it’s not without its risks, the company now trades at a wide margin of safety to our fair value estimate.”

Avangrid AGR

- Fair Value Estimate: $38.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

“Avangrid is majority-owned by European utility Iberdrola. Investors must be comfortable with regulated operations across the Northeast and the outlook for the U.S. onshore and offshore renewable energy growth. Avangrid’s regulated utility segment, Networks, operates eight regulated electric and natural gas utilities across New York, Maine, Connecticut, and Massachusetts. We consider the utilities’ regulatory jurisdictions as mostly constructive. Most of its subsidiaries’ rates are tied to multiyear agreements or formula rates and decoupled from usage. However, Avangrid has struggled to earn its allowed returns.”

Eversource Energy ES

- Fair Value Estimate: $74.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

“Eversource has grown into one of the largest utilities in the U.S. Northeast after its 2012 merger with NStar, 2017 acquisition of Aquarion, and 2020 acquisition of Columbia Gas. This can make it a prime target for politicians and customers who pay high energy prices in the region. The region’s clean energy goals create ample opportunities for the company over the next decade to integrate renewable energy, energy efficiency, and electric vehicles. However, some regulators in the region have been stingy due to high customer rates, limiting the upside for shareholders.”

—Travis Miller, strategist

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)