7 Market Trends From Q3 2023

Which stocks look undervalued after a volatile quarter.

Equity markets cooled in the third quarter of 2023 after a strong start to the year. The mega-cap growth stocks that fueled the first-half rally receded as investors absorbed the impacts of a higher-for-longer interest-rate scenario. Even following a 3.3% drop for the quarter, the S&P 500 still closed September up more than 13% this year.

What fixed-income investors gained in yield they lost in price during the third quarter. Income-conscious investors were pleased by their increased payouts but less pleased with a 3.2% price decline across U.S. investment-grade bonds. High-yield bonds were largely spared by this contraction, though, breaking even on the quarter and preserving their 6% gain on the year.

Commodities were one of the few bright spots this quarter, which was marred by losses across most major asset classes. The Bloomberg Commodity Index was up nearly 5%, driven by rising oil prices following production cuts by OPEC+ producers.

The United States was not the only market caught in the crosshairs. Just like at home, foreign investors mulled the possibility of higher rates for longer to combat stubbornly high inflation. Most major international markets fell in the third quarter despite posting strong returns to begin the year. Developed-market stocks were hit particularly hard. The MSCI EAFE Index fell more than 4% in the quarter.

Every quarter, Morningstar’s research team reviews the most recent U.S. market trends and evaluates the performance of individual asset classes. We then share our findings in the Morningstar Markets Observer, a publication that draws on careful research and market insights. (Morningstar Direct and Office clients can download the report here.)

Here are some of the findings from our latest quarterly market review.

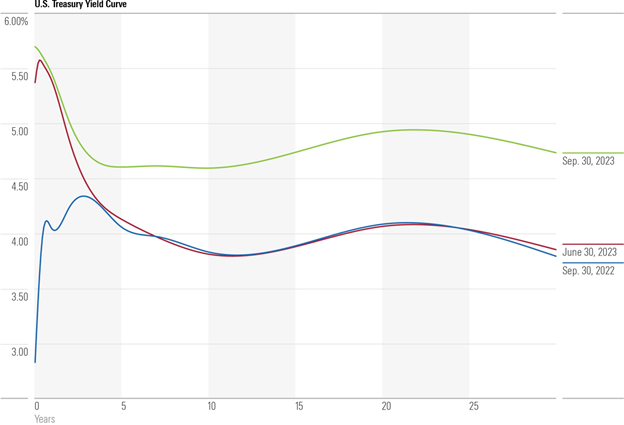

Treasury Yield Curve Bucks the Historical Norm

The Treasury curve bear steepened over the quarter as long rates moved higher, while short rates remained anchored. This is unusual: Historically, as the Fed moves closer to the end of a rate-hiking cycle, both short and long rates move down, with short rates falling faster (a bull steepening). However, continued inflation volatility, a resilient domestic economy, and pressure from increased Treasury issuance challenged conventional wisdom.

U.S. Yield Curve Ends the Third Quarter With Less Inversion

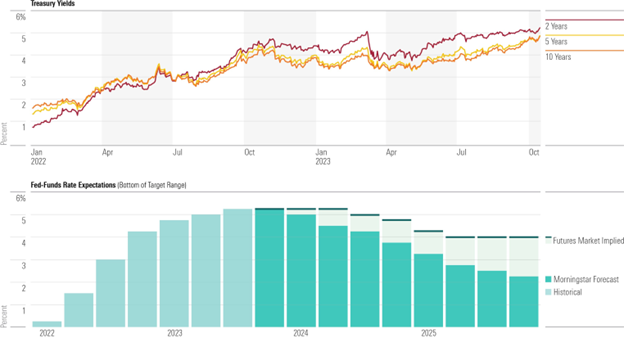

Interest Rates May Dip Below 3% by 2025

Our forecasts for the path of the federal-funds rate are well below market expectations, growing into a nearly 2-percentage-point gap by the end of 2025. Our optimism about inflation coming down is a key reason that we expect interest rates to fall faster than the market. Also, we disagree with the emerging view that the neutral rate of interest has jumped compared with its prepandemic level.

We Project U.S. Interest Rates to Fall Lower Than the Market Expects

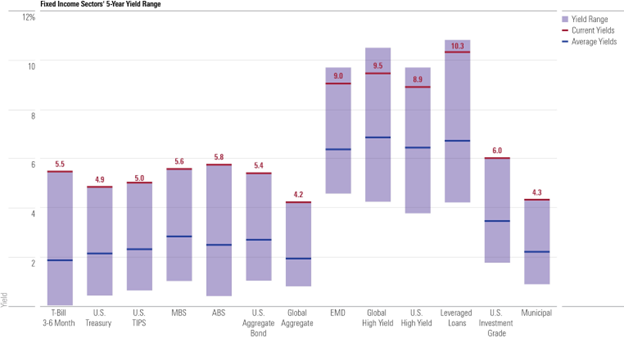

Credit Risk Not Needed To Earn An Attractive Yield

Yields continued to climb as the Federal Reserve reinforced higher-for-longer messaging in order to tame inflation. Bond prices have been crushed since early 2022, but higher yields may present attractive opportunities, especially in less-risky, higher-quality bonds like Treasuries or agency mortgage-backed bonds. This backdrop allows investors to pare back credit risk while improving income potential, a luxury they have not had in a long time.

Yields Across Fixed Income Climb Higher

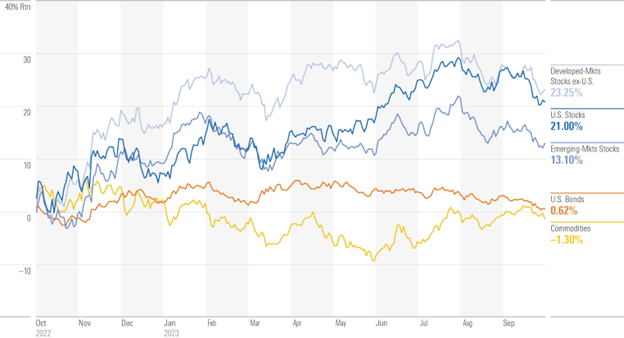

Developed-Markets Stocks Remain on Top

Developed-markets stocks remain 12-month winners, even with third quarter losses, as equities rebounded from October 2022 lows. Emerging-markets equities have rallied, though Chinese stock market weakness dragged on the index. Commodities stormed back in the third quarter as oil rebounded but did not offset a 9.4% drop from October 2022 to June 2023. U.S. bonds have recovered from lows but still struggle in a higher-interest-rate environment.

Trailing 12-Month Performance of Major Asset Classes

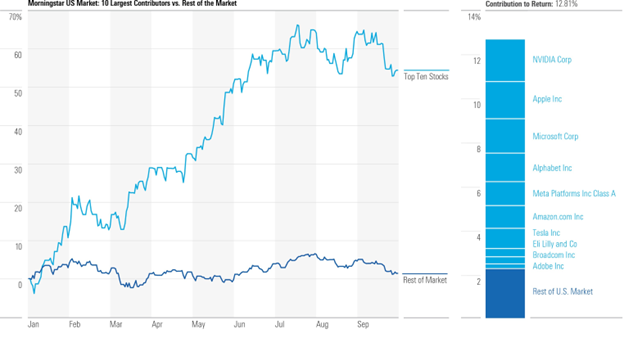

10 Stocks Drive 82% of the Market’s Return

Much of the U.S. market’s year-to-date gains through the third quarter of 2023 came from a handful of companies. Of the Morningstar US Market Index’s 12.8% return through Sept. 30, 10.5% was sourced from the 10 companies listed below. Put another way, a market-cap-weighted portfolio with only these 10 stocks would have returned 55% through the third quarter. A portfolio consisting of the market outside the top 10 contributors would have returned just 1.4%.

Mega-Cap Growth Stocks Dominate U.S. Market Returns

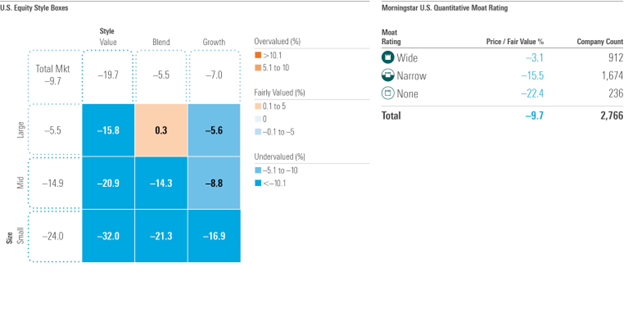

Value Stocks Remain Significantly Undervalued

Stocks sold off across the board during the third quarter, with value equities losing slightly less. Still, value stocks continue to be significantly undervalued, as many large-blend stocks like Apple AAPL remained near all-time highs, while large-growth stocks like Meta Platforms META, Nvidia NVDA, and Tesla TSLA enjoyed rebounds off their lows. Wide-moat stocks traded closer to fair value than narrow- or no-moat stocks as investors opted for quality.

Morningstar Price/Fair Value, U.S. Equity Style Box

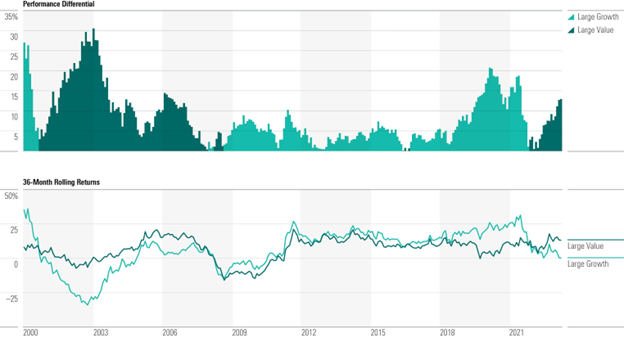

Value Stocks Finally Gain the Upper Hand

The performance of growth and value has historically been cyclical. Growth enjoyed a 10-plus year-long lead over value in the era of ultralow rates following the global financial crisis. Comparing the three-year rolling return for each index, value’s resurgence suggests a new cycle is underway.

Value Versus Growth: Value Makes a Comeback

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5db00d6b-9c2f-4da7-8f94-da4290cf3b4a.jpg)