Software Stocks Are Cheap, but Is It a Safe Time to Buy?

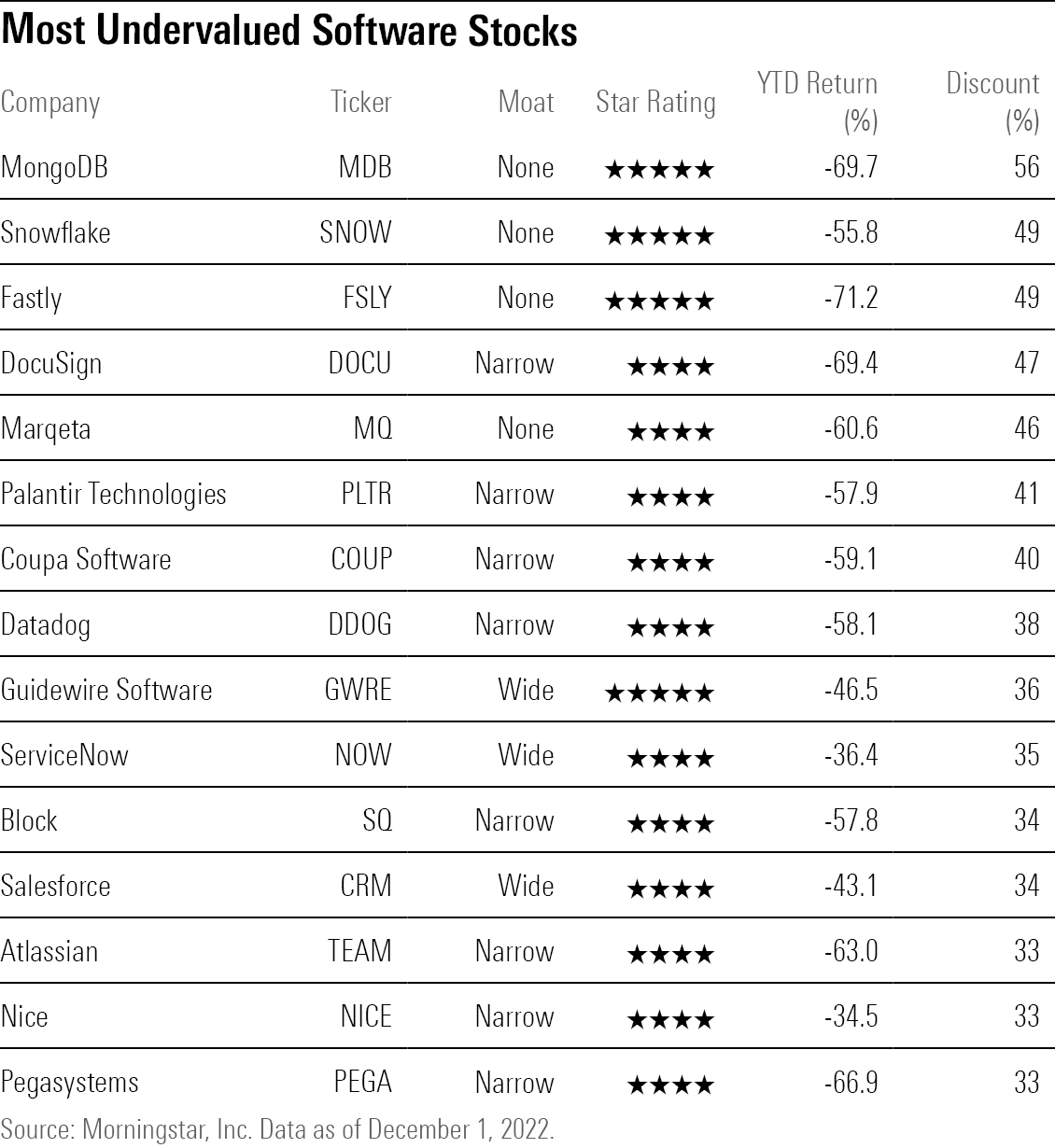

Stocks like MongoDB, Snowflake, and ServiceNow are at big discounts, but a murky revenue outlook clouds the picture.

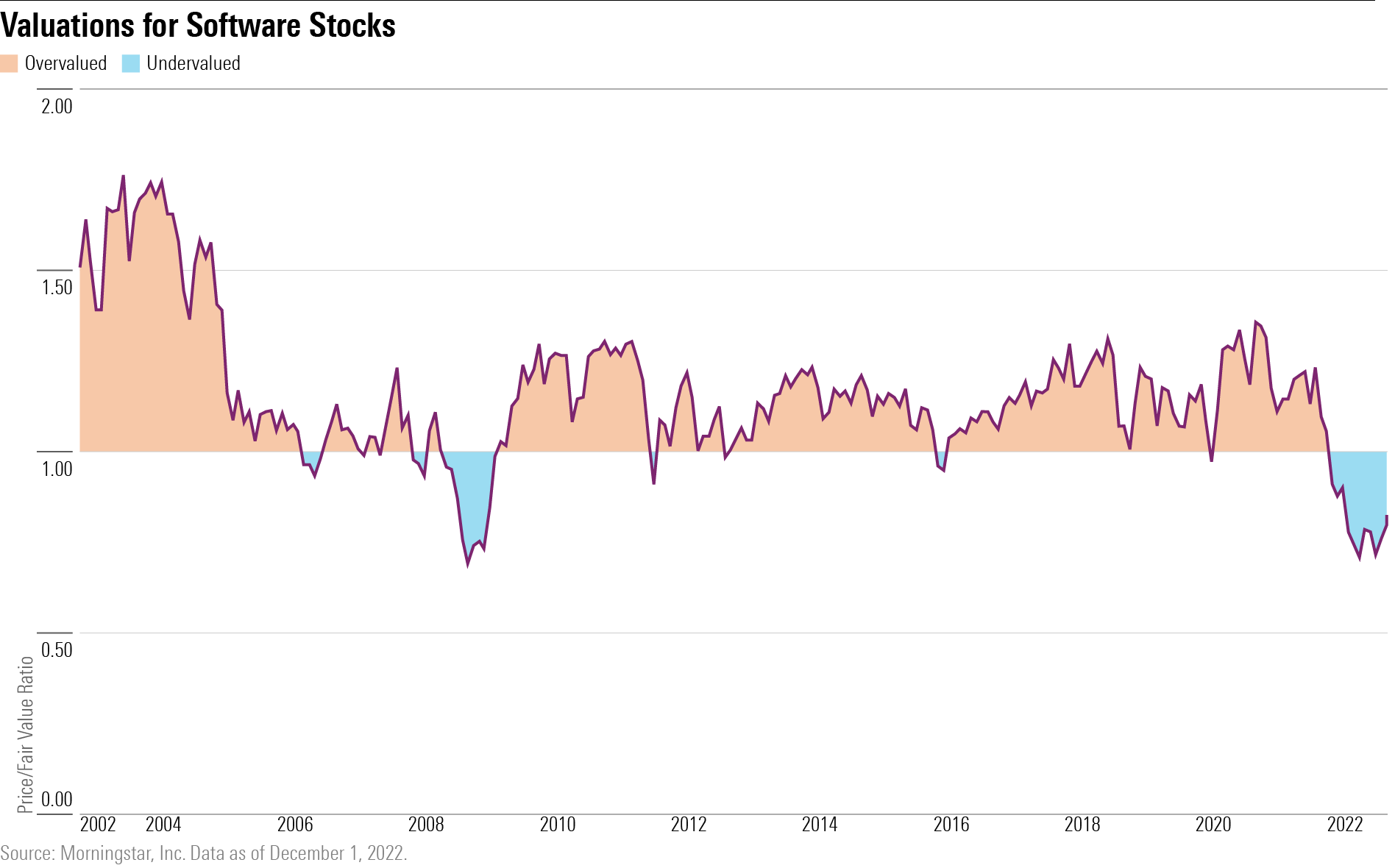

In a bad year for technology stocks overall it has been especially brutal for software stocks. While that’s left software names at some of their cheapest valuations since 2008, the outlook remains murky enough that investors may want to tread carefully.

Software stocks covered by Morningstar stock analysts trade at an average discount of about 18%. That’s the most attractive level since the global financial crisis in 2008, and among the lowest valuations in the last 20 years.

For example, document-oriented database provider MongoDB (MDB) is trading at a nearly 70% discount to its Morningstar fair value estimate, data lake and warehousing company Snowflake (SNOW) is at a roughly 56% discount, and business software provider ServiceNow (NOW) is considered undervalued by about 36%.

But even if the stocks are looking attractive for longer-term investors, it could be a bumpy ride in coming quarters.

The worry is that with a recession seemingly on its way, the software sales cycle is “elongating.” That means customers are delaying purchases, trying to make current products last as long as possible, and putting off upgrades to the latest iteration of products and services. This dynamic could continue to hurt software company results in 2023, with the industry potentially not seeing a business recovery until 2024.

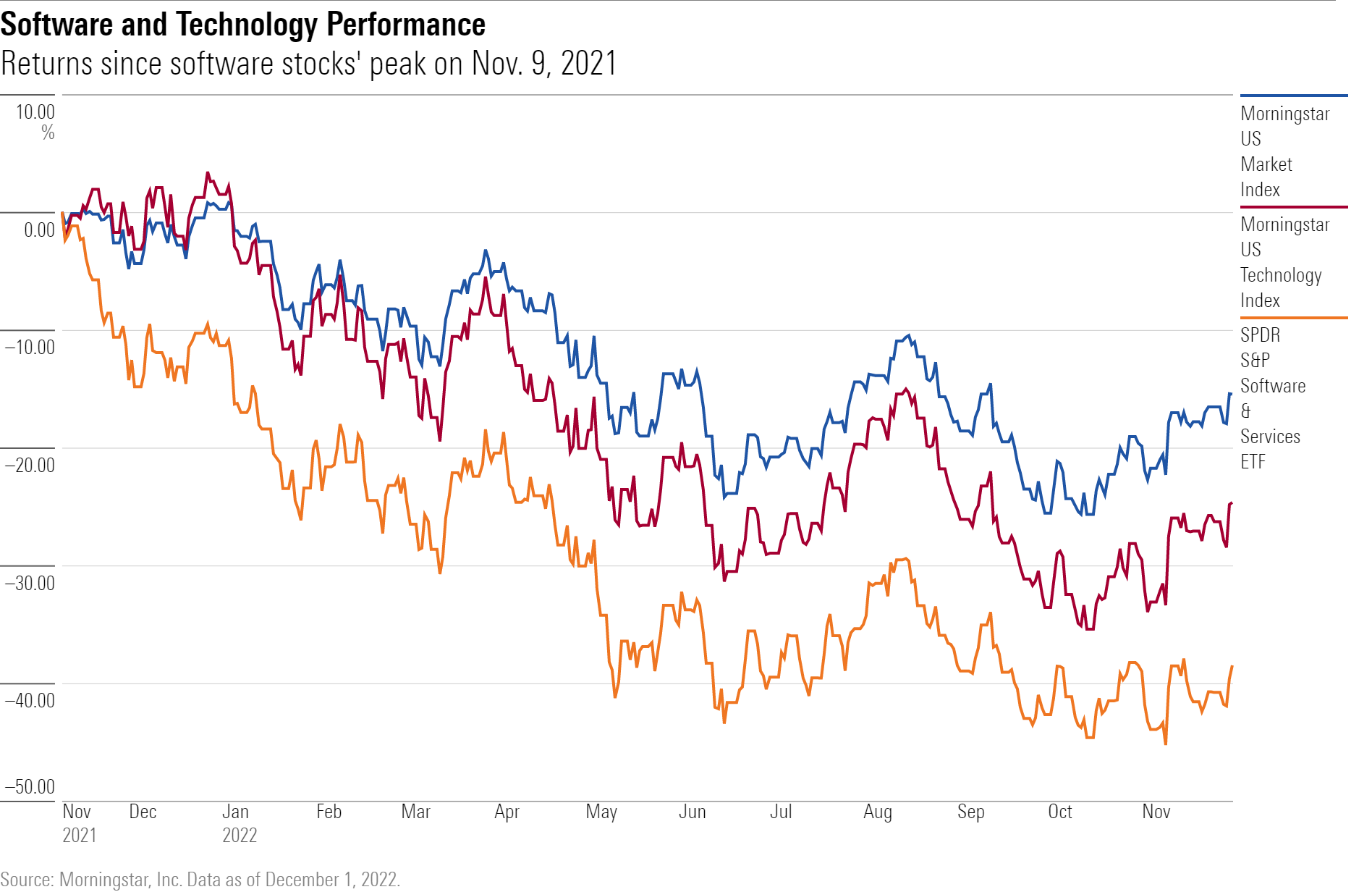

Software stocks have been crushed in recent months. As of Dec. 1, the SPDR S&P Software and Services ETF (XSW) is down 38.5% from its all-time high on Nov. 9, 2021. The ETF is off 30.6% so far this year.

That’s worse than tech stocks in general, with the Morningstar US Technology Index down 25.8% since the start of 2022, and much worse than the broader market, with the Morningstar US Market Index down 15.7%.

Among the major software stocks on Morningstar’s coverage list that have taken the biggest hits this year:

- Okta (OKTA) is down 69.9%

- DocuSign (DOCU) is down 68.3%

- Pegasystems (PEGA) fell 66.5%

- Atlassian (TEAM) dropped 63.3%

Fueling this carnage in software stocks are worries about the impact of a recession on revenue. Software stocks are often seen as more vulnerable to economic swings than many other kinds of technology companies. Making matters worse is that software stocks had started the year at lofty valuations, putting them more at risk for outsize declines.

These factors overwhelmed the supportive, secular trend for software companies of businesses transitioning to the cloud. The shift to the cloud was thought to act as a demand anchor for software firms, as those looking to adopt cloud computing were expected to view spending on software products and services as increasingly essential to daily operations. This would, in turn, provide software companies with “sticky revenue,” sales that would remain robust even amid an economic downturn.

That anchor effect turned out to be much more nuanced than expected, as quarterly results soon showed.

What Happened to Software Stocks?

The majority of software stocks’ collapse occurred between November 2021 and March 2022, even before major signs of weakness in companies’ financial results were reported.

“I don’t think a lot of people were worried about demand destruction [from a recession] at that point,” says Malik Ahmed Khan, a Morningstar equity analyst. Instead, the selloff was driven by rising interest rates, elevating firms’ cost of capital which, as with other growth stocks, diminishes the value of longer-term earnings.

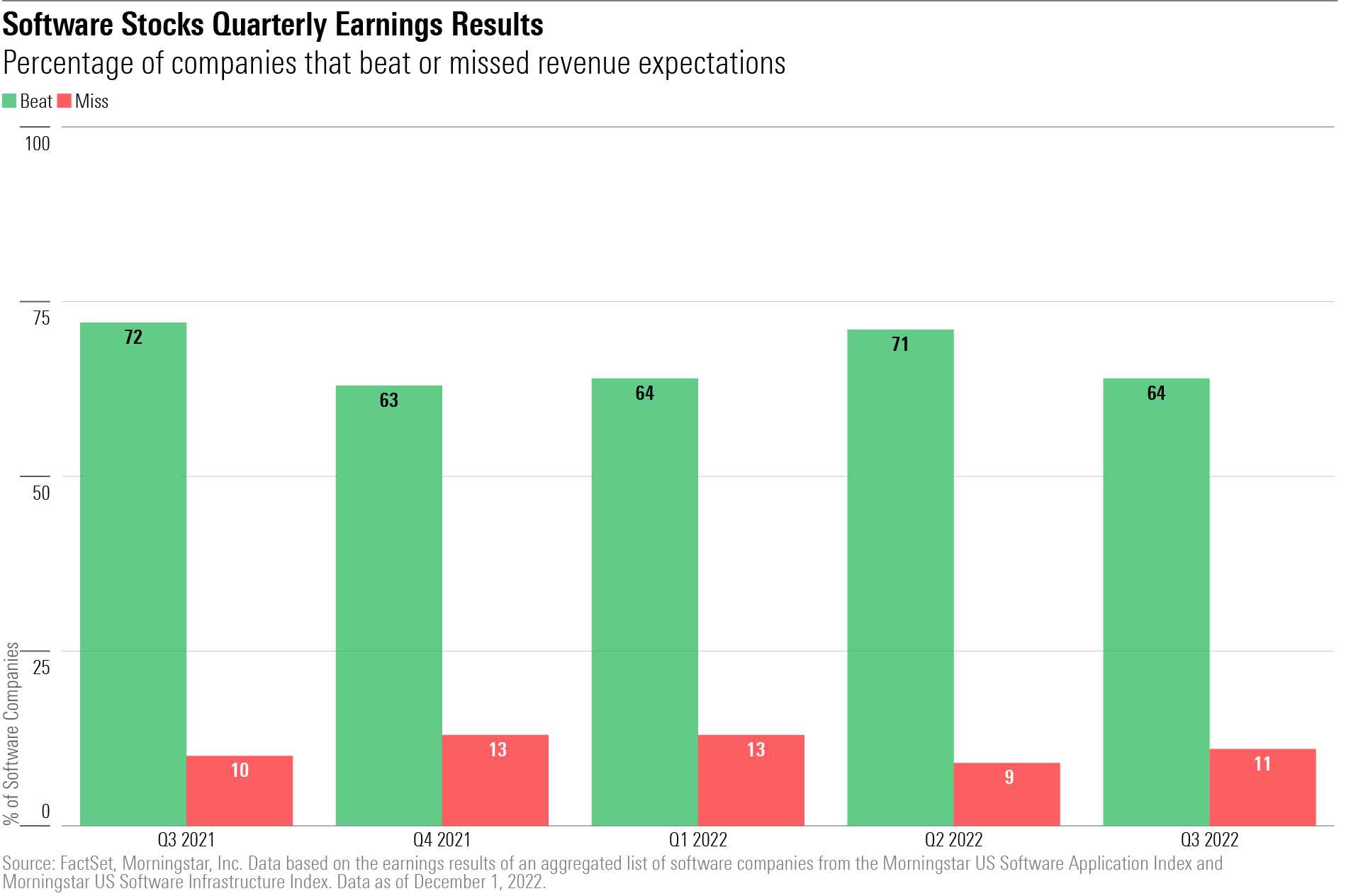

In fact, earnings results from software companies held up in the third quarter. Among the software companies that make up the Morningstar US Software Application and Morningstar US Software Infrastructure indexes, roughly 64% of software companies reported results that beat consensus earnings estimates from FactSet by 5% or more.

Although that’s a slight decline from the 72% a year ago, it’s consistent with the fourth quarter of 2021, where 63% of companies, and the first quarter of 2022, where 64%, beat estimates.

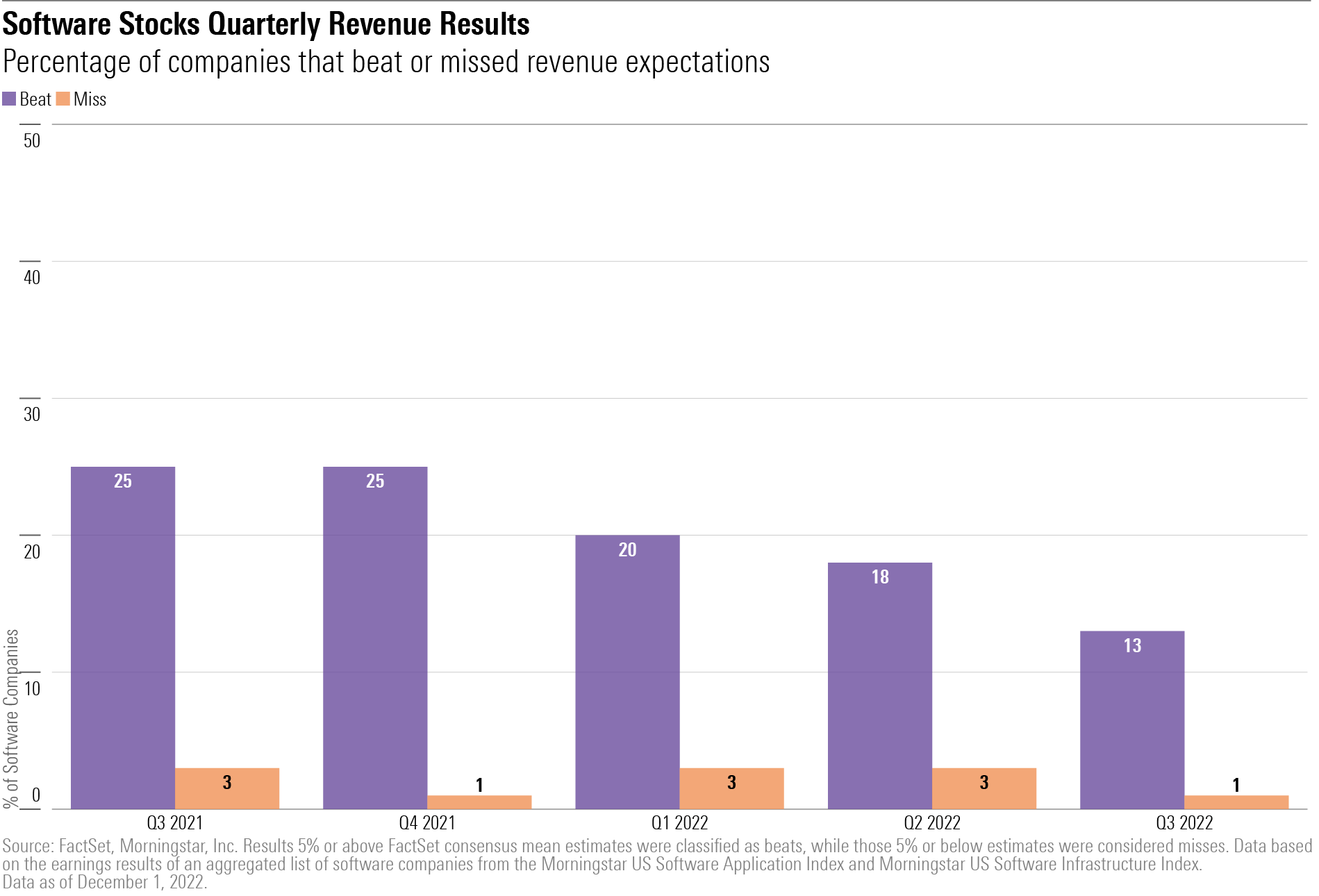

In addition, revenue was also still looking healthy. Among software stocks, 25% of companies beat revenue estimates in the fourth quarter of 2021, and 20% in the first quarter of 2022.

But in the background, as early as the second quarter of 2022, fears and concerns over software growth began to show up in company comments and earnings results.

“The first narrative change was foreign exchange [rates],” says Khan. “The U.S. dollar has strengthened a lot and that had an impact on earnings,” says Khan. Among the software companies hardest hit by the strong dollar was Microsoft (MSFT).

Companies also began to report “elongating” sales cycles, says Khan. As fiscal health became a top priority among their clients, software companies’ customers started growing more conservative with their spending, either cutting down on nonessential products and services, or extending their timeline for new purchases.

By the third quarter of 2022, there were significantly fewer revenue beats. Only 13% of companies beat estimates by 5% or more as of Dec. 1, compared with 25% a year ago.

Despite the trend of businesses’ transitioning their operations to the cloud serving as a tailwind for the industry, second- and third-quarter results showed that not all software companies’ services were sticky, says Morningstar’s Khan.

Among the companies showing signs of slowing revenue in the third quarter were search engine solution provider Elastic (ESTC), which reported longer sales cycles as “clients continued to optimize their spending amid a tricky macroeconomic environment,” says Khan.

The same was found at digital customer service platform Five9 (FIVN), which saw slow license growth from existing customers, according to Dan Romanoff, Morningstar senior equity analyst. In addition, Atlassian, which produces products for software developers, saw fewer customers convert free subscriptions into paid subscriptions, says Romanoff. All three software stocks fell 10% or more between Oct. 1 and Dec. 1.

There were, however, a few software firms with more stable revenue, especially among cybersecurity stocks, Khan says. For example, Palo Alto Networks (PANW) had 2023 fiscal first-quarter revenue growth of 25% year over year. Fortinet (FTNT) saw a 33% increase in revenue in its third-quarter results.

Widespread Fair Value Estimate Cuts

As 2022 has progressed, the more difficult business environment led Morningstar analysts to cut their fair value estimates for many software companies. On average, software stocks have seen fair value estimates reduced by 16% since the start of the year, compared with a 2% increase for all U.S.-listed stocks covered by Morningstar analysts.

Among the stocks with the largest fair value estimate reductions were cybersecurity firm Okta, whose fair value estimate was cut to $71 from $280 at the start of the year. Driving the majority of that reduction was the firm’s acquisition of Auth0, which Khan views as “value-destructive.” Other major fair value estimate reductions included Pegasystems, which was reduced to $55 from $157, and DocuSign, which was slashed to $88 from $244.

Are Software Stocks Undervalued?

Yet, despite the cut in software stocks’ fair value estimates, Morningstar analysts think the market has swung too far as prices have fallen. Among the 66 U.S.-listed software stocks on Morningstar’s coverage list, 41 are now considered undervalued. Of those, nine of them are undervalued enough to have a Morningstar Rating of 5 stars. At the beginning of the year, there were 13 undervalued software stocks, and only one with a rating of 5 stars.

Software stock valuations have reached a level not seen since 2008, according to Morningstar analysts. For only the second time in the last 20 years, software stocks are now trading at an average discount of 18%, and that is even more attractive than the broader technology sector, which trades at a 14% discount. Meanwhile, Morningstar analysts see the U.S. market at a 10% discount.

That contrasts with the start of the year, when software stocks were viewed as 5% overvalued and technology 9% overvalued. The market was 6% overvalued.

What Is the Outlook for Software Stocks?

Still, risks remain in the near to medium term. Khan notes that software companies have been telling stock analysts that they expect a weak end to 2022. Beyond this year, “in 2023 they expect weakness in demand, as well,” he says.

Some firms have been laying off workers to help boost their bottom lines. But Khan sees that as a potential risk for companies in the medium term. “You need people to develop products, and people to sell those products,” he says. “Once you start letting people go, that can save some near-term costs, but in the medium term that would impact the top line.” In a sense, Khan already sees this occurring with Okta, attributing its “labor-related attrition and salesforce integration challenges” as one reason why he views the Auth0 integration as value-destructive.

He also notes that this is new territory for many software firms. With many companies having been founded after the 2008 financial crisis, this is their first round of major layoffs.

Still, Khan sees software stocks positioning themselves for a comeback. “I’m expecting 2023 is going to be weak, and then there’s going to be a rebound in 2024 as things normalize,” he says.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)