July CPI Report Cements Improved Inflation Picture

Shelter costs keep inflation north of Fed’s target, but rate hikes seen off the table.

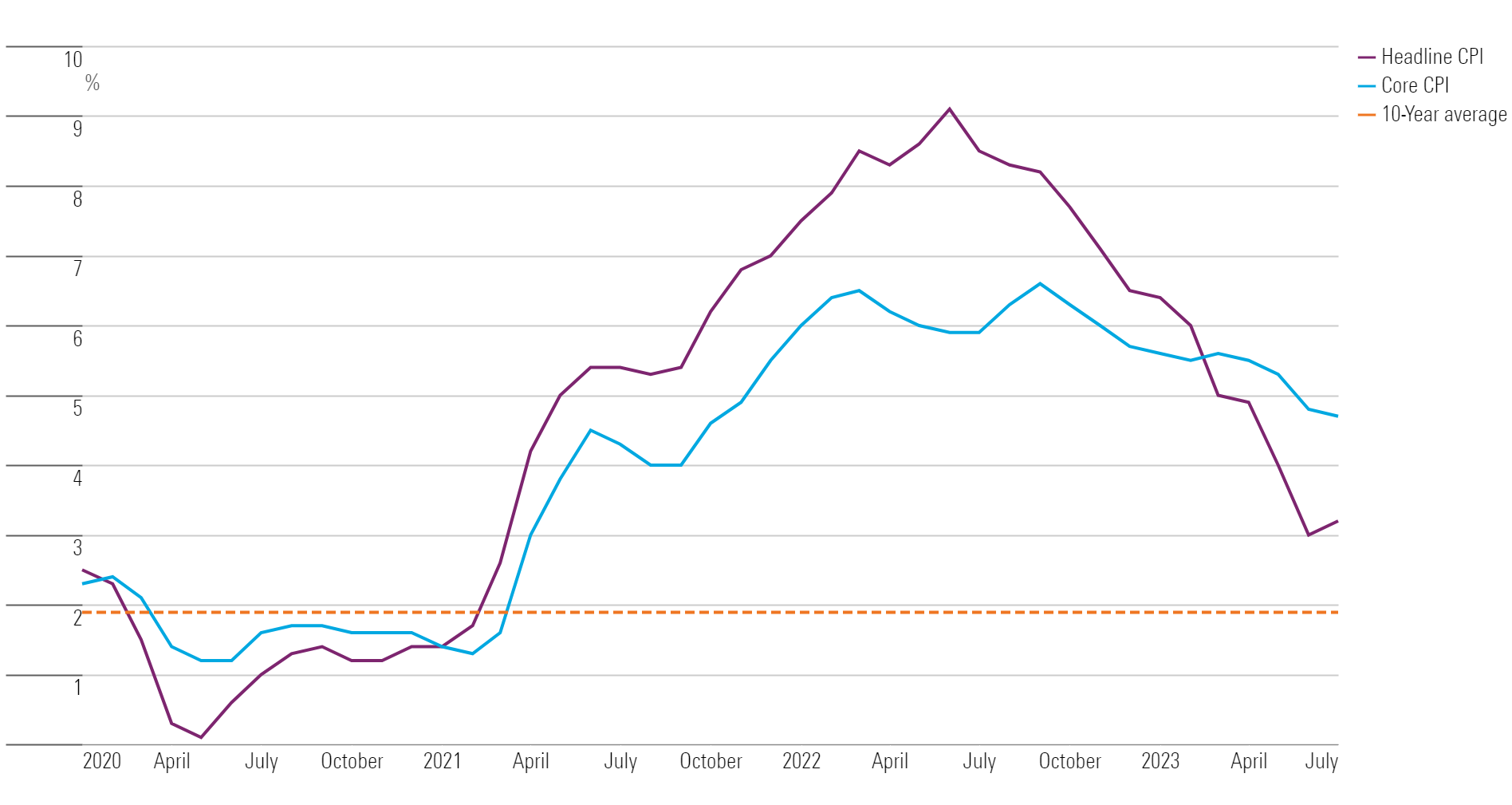

The July Consumer Price Index report provided more good news on inflation, reaffirming the effect of easing upward pressures on prices this year.

The exception to this rosier picture is the cost of housing, which remains elevated. But economists say the overall situation should continue to improve, helping bring inflation down closer to the Federal Reserve’s target. Against this backdrop, it is widely believed that the Fed will keep rates steady (albeit at a high level) for the rest of 2023.

The Bureau of Labor Statistics reported that the CPI rose 3.2% in July from year-ago levels—a slight increase from June’s 3.0%, but well below last summer’s peak of 9.1%. Core CPI, which excludes volatile food and energy costs, rose 4.7% over the last 12 months after rising 4.8% in June. This latest reading came in line with economist forecasts.

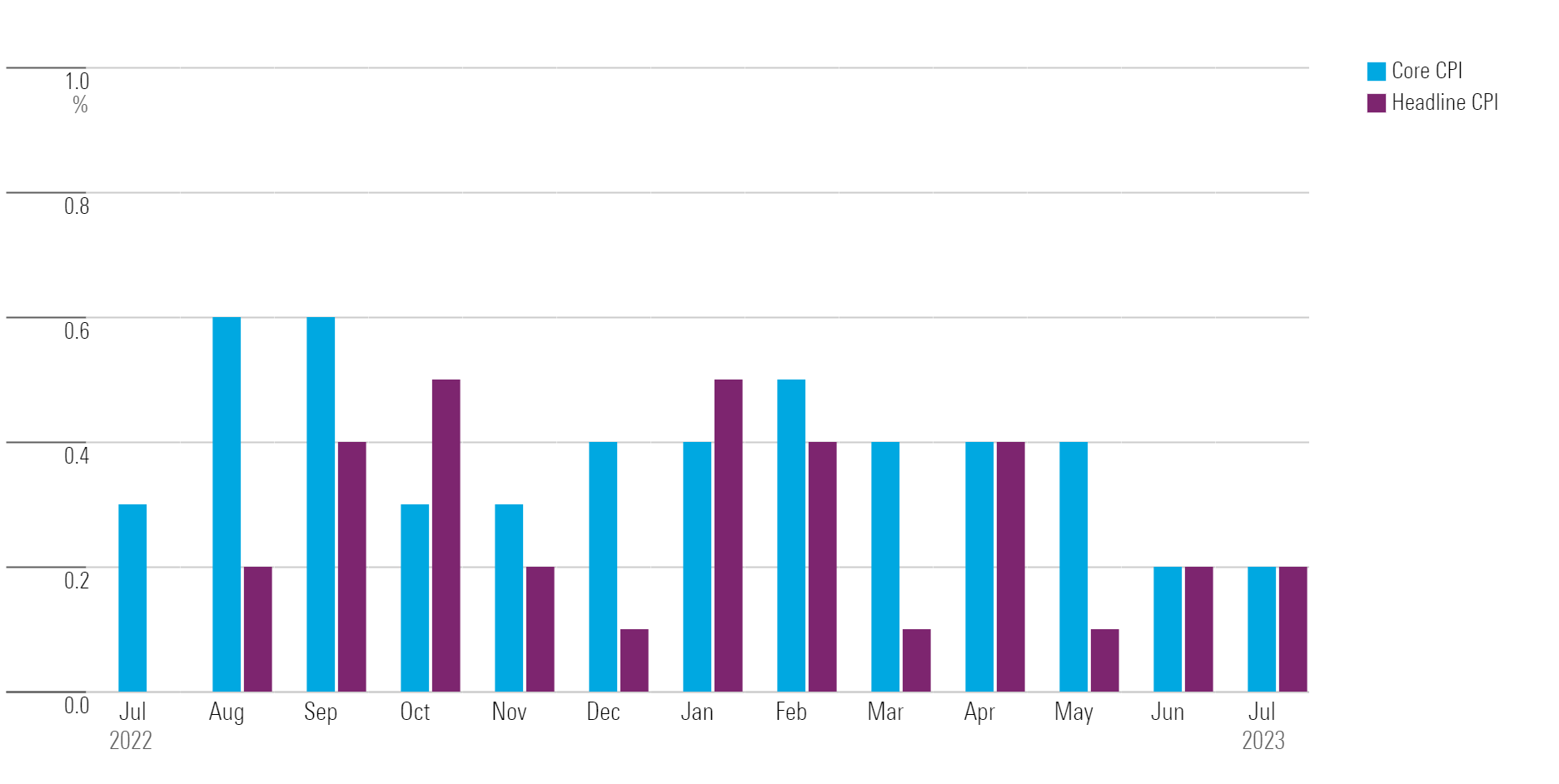

The CPI rose 0.2% in July from month-ago levels, as it did in June. Core CPI also rose 0.2%, matching both the June increase and economist forecasts. This was the second consecutive month during which both headline and core inflation posted increases of only 0.2%

CPI vs. Core CPI

Fed policymakers are next meeting on September 19 and 20. Before then, investors will see an additional CPI report, as well as an August update on job growth in the U.S.

In the bond market, nearly all investors expect the Fed to hold the federal-funds rate at its current levels. From there, markets are still pricing in a chance of one more rate hike, but with a probability of only about 25%. Morningstar’s chief U.S. economist, Preston Caldwell, sees inflation coming down enough for the Fed to start cutting rates significantly next year.

July CPI Report Key Stats

- CPI rose 0.2% for the month, as it did in June.

- Core CPI rose 0.2% after rising by the same amount in June.

- CPI rose 3.2% year over year after rising 3.0% in June.

- Core CPI rose 4.7% year over year after rising 4.8% in June.

Within the report, shelter was by far the largest contributor to the monthly rise in prices, accounting for over 90% of the total increase. Still, for the first three months of the year, shelter posted an average monthly increase of 0.7%; that figure has been less than 0.5% for the past three months. Motor vehicle insurance prices also made an outsized contribution.

Food prices rose 0.2% in July after increasing 0.1% in June. Food-at-home prices rose 0.3% over the month, while food-away-from-home (restaurant) prices rose 0.2%. Energy prices rose 0.1%.

Consumer Price Index

Shelter Prices Are Keeping Inflation Elevated

In July, shelter prices rose 0.4% after increasing by the same amount in June. Vehicle prices fell, as the index for used cars and trucks declined by 1.3% and the new vehicles index fell by 0.1%.

Energy prices were mixed over the month, up 0.1% overall after rising 0.6% the prior month. Utility (piped) gas service prices gained 2.0%, fuel oil prices rose 3.0%, gasoline prices rose 0.2%, and electricity prices declined 0.7%.

Change in Selected CPI Components

Markets See No Fed Rate Hike In September

Currently, 90.5% of participants in the bond market expect the Fed to maintain its target range of 5.25%-5.50% for the federal-funds effective rate at its September meeting, according to the CME FedWatch Tool as of 9 a.m. Eastern time.

These expectations have strengthened from a month ago, when 72.4% of respondents expected the September target rate range to stay at 5.25%-5.50%. Additionally, 22.3% predicted the rate reaching a higher range of 5.50%-5.75%.

Expectations for July 2023 Federal Reserve Meeting

Will the Fed Pause Rate Hikes Beyond September?

Looking ahead to the end of the year, participants are split on whether the Fed will hold interest rates steady. The majority (67.2%) currently predict the Fed will keep the rate at current levels through year-end, while 22.4% expect it to raise them by an additional quarter-point to a target of 5.50%-5.75%. Just 8.8% expect the Fed to pivot to lowering rates to 5.00%-5.25% in that time frame.

Expectations for December 2023 Federal Reserve Meeting

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XF7WENSYN5BFBFLPPFH7BJYUHE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)