Market Brief: Will the December CPI Report Help Further Tame Inflation Fears?

Jobs data reassures investors; declining natural gas prices hits energy stocks.

With the December jobs report providing some reassuring news for investors, attention now turns to the December Consumer Price Index report due out Thursday.

The last CPI report brought good news on inflation for the second month in a row as consumer goods prices slid into deflation during November. But the early hints haven’t been enough to convince the Federal Reserve to alter its fight against inflation, and services prices showed continued upward pressure. Will this Thursday’s report be any different?

Many economists expect the week’s inflation report to bring good news, with predictions centering on an unchanged reading on the CPI.

“I’m expecting to see some incremental progress in inflation slowdowns in December,” on a year-over-year basis, says Bill Adams, chief economist at Comerica Bank. “But it would take a really big downside surprise for the Fed to reconsider their plans to raise interest rates further in 2023.”

Going into the CPI report, markets have scaled back their expectations for the Fed’s next move. According to the CME FedWatch Tool, the bond futures market now expects the Fed to raise the federal-funds rate by just 0.25 percentage points in February. A month ago, expectations centered on another half-point increase. A quarter-point hike in February would be its smallest rate increase since the Fed first kicked off its rate hikes in March 2022. However, a bad reading on the CPI could easily swing expectations back to a more aggressive rate hike.

December CPI Report Forecast

- CPI to be unchanged for the month versus 0.1% in November, according to FactSet.

- Core CPI (excluding food and energy) up 0.3% for the month versus 0.2% in November.

- CPI, year over year, to rise 6.5% versus 7.1% in November.

- Core CPI, year over year, to rise 5.8% versus 6.0% in November.

While Adams expects the CPI report to show improvement on a year-over-year basis, he anticipates a bounceback in the month-to-month reading. He forecasts an above-consensus headline CPI increase of 0.3% in December, and for core CPI to rise 0.4%.

Looking ahead, “inflation will likely stay above the Fed’s target throughout this year,” Adams says. Though energy prices have moderated and shelter prices are poised to slow down next, he says, the labor market is still too tight, keeping services inflation high. “A lot of momentum has built up in the growth of services prices over the last year.”

Here are three key data points that Adams will be watching in the December CPI report:

Divergence in Goods vs. Services Inflation

Adams is minding the gap in the price growth of goods versus services. “In 2022, there weren’t enough workers in the U.S. to produce all the goods and services that American consumers wanted to buy—and that drove inflation.” In the second half of the year, he says, spending slowed dramatically on the goods side amid higher interest rates, a housing correction, and slowdowns in inventory. “This has opened up slack that should help bring inflation lower.”

Nonshelter Services

The inflation problem won’t disappear until services prices (excluding shelter, which tends to be a lagging indicator) slow down, according to Adams. He points to the categories of food away from home (restaurants) and medical services as key areas of interest. “These kinds of services prices are going to be an important measure of whether a cooling economy is reducing price pressures for those stickier areas that tend to change less frequently.”

Small Businesses and Individual Proprietors

Though small-business services—such as music lessons and veterinary services—reflect a sliver of the overall consumer price basket, Adams sees the area as a key indicator of the underlying inflation trend. “These kinds of service prices reflect small-business owners passing on their own cost of doing business to their customers. That type of inflation accelerated into the fall of last year.”

Events scheduled for the coming week include:

- Tuesday: Bed Bath & Beyond BBBY reports earnings.

- Thursday: The CPI report for December. Taiwan Semiconductor Manufacturing TSM reports earnings.

- Friday: JPMorgan Chase JPM, Bank of America BAC, Citigroup C, Wells Fargo WFC, First Republic Bank FRC, BlackRock BLK, UnitedHealth Group UNH, and Delta Air Lines DAL report earnings.

For the trading week ended Jan. 6:

- The Morningstar US Market Index rose 1.4%.

- The best-performing sectors were communication services, up 4.1%, and financial services, up 3.6%.

- The worst-performing sector was energy, down 0.51%.

- Yields on the U.S. 10-year Treasury fell to 3.56% from 3.88%.

- West Texas Intermediate crude-oil prices fell 8.1% to $73.77 per barrel.

- Of the 847 U.S.-listed companies covered by Morningstar, 668, or 79%, were up, and 179, or 21%, declined.

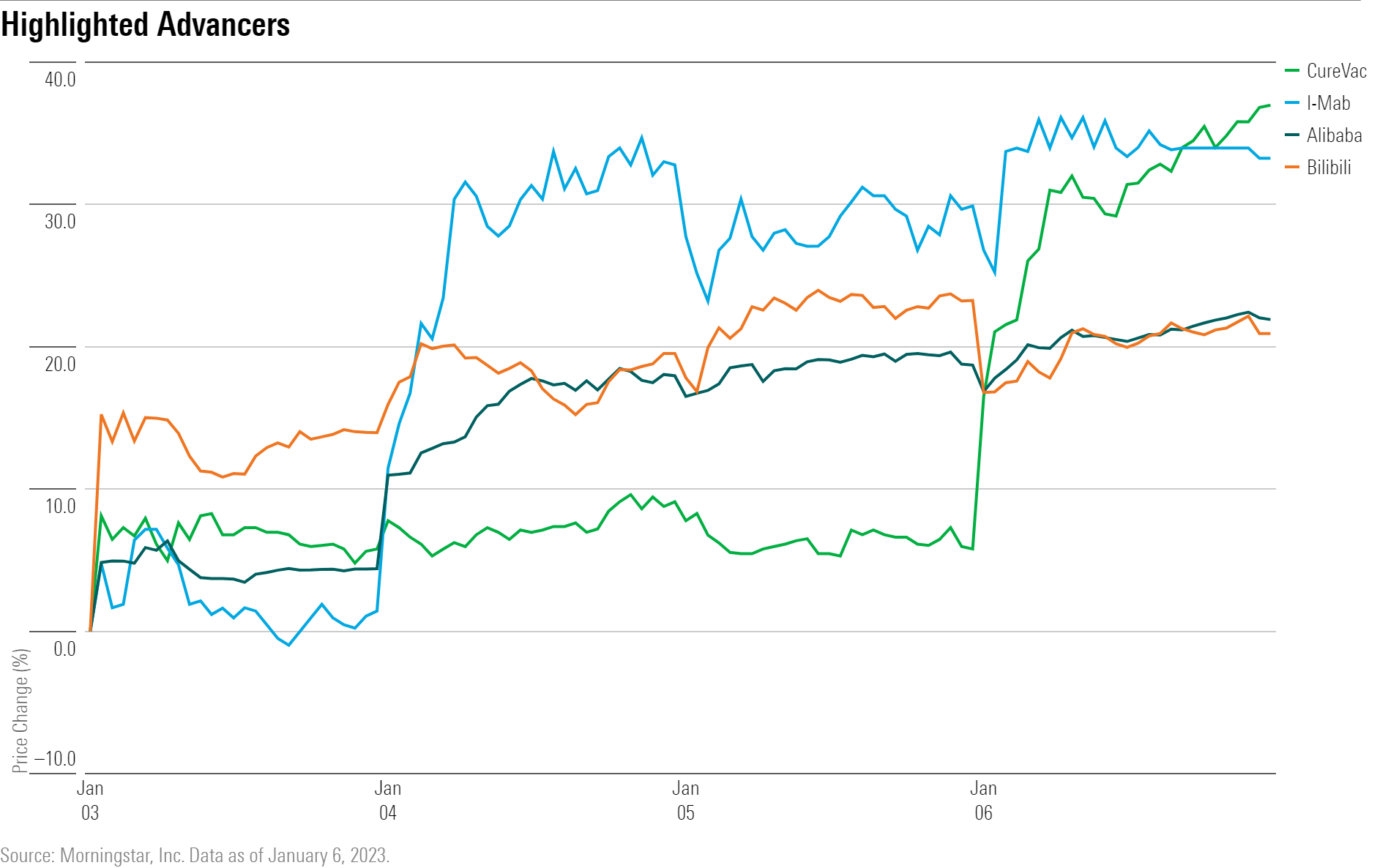

What Stocks Are Up?

Chinese ADR-listed stocks surged, further extending gains as the government continues to roll back its “zero-COVID” policy. I-Mab Biopharma IMAB, Alibaba Group BABA, and Bilibili BILI were some of the top performers.

CureVac’s CVAC stock rallied after preliminary data for its second-generation COVID-19 vaccine showed it produces antibodies that can neutralize the BA.1 subvariant of omicron.

What Stocks Are Down?

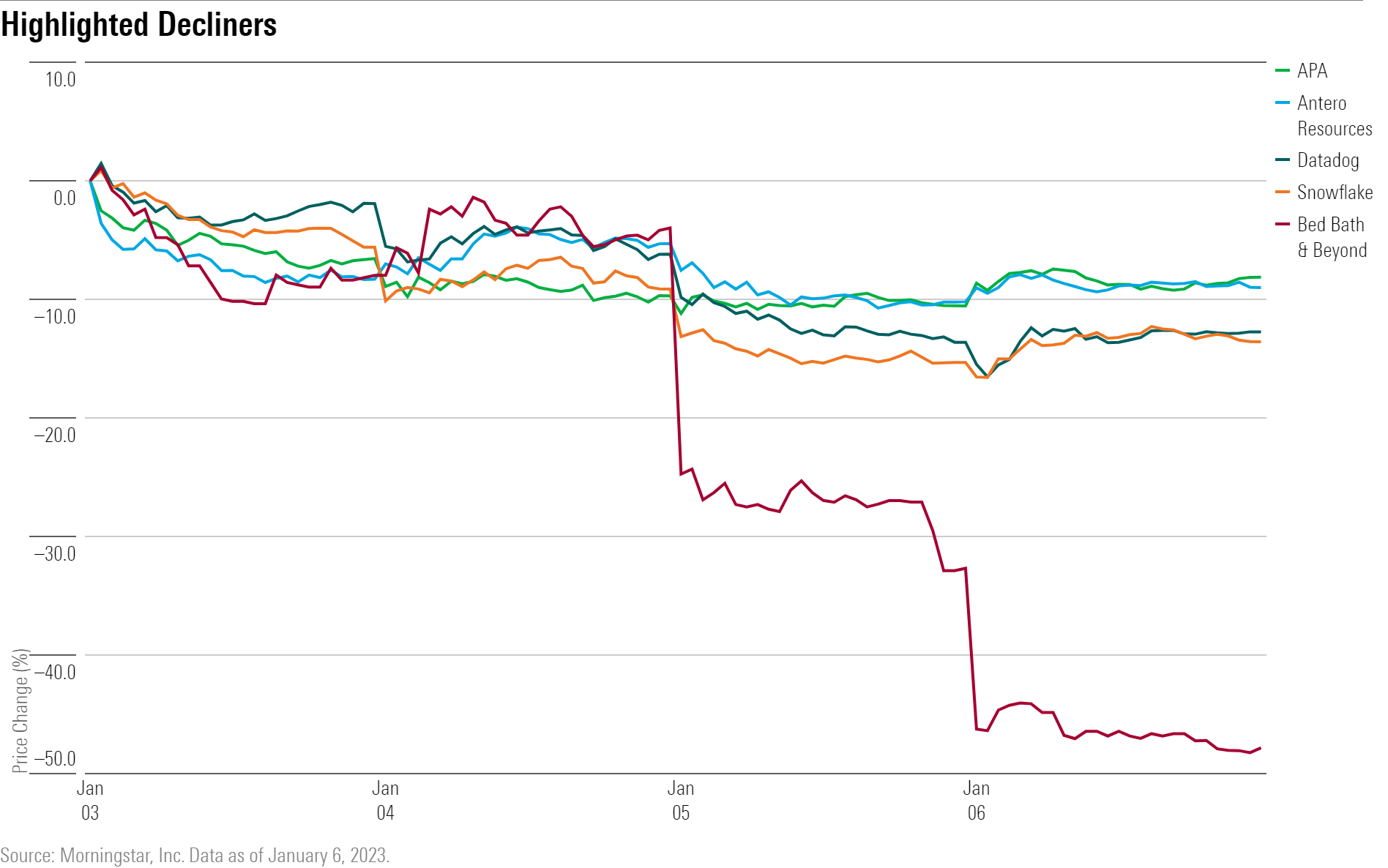

Bed Bath & Beyond’s stock plunged after the retailer said in a business update that it may file for bankruptcy.

``This indicates potential bankruptcy is a much nearer-term risk than we previously anticipated,” Morningstar senior equity analyst Jaime M. Katz wrote in a note. Morningstar slashed its fair value estimate of the company to zero.

“Lower sales in 2022 reduces our $7.60 fair value estimate by $2. Further sales reductions in our outlook (including another 20% decline in 2023) reduces the value by another $2. Significantly more stringent payable terms perpetually take another $2 off. The continued elevation of selling, general, and administrative costs eliminates the remaining value,” Katz wrote in the note.

Software companies Snowflake SNOW, Datadog DDOG, and Cloudflare NET were some of the worst-performing stocks in the first week of 2023, as macroeconomic concerns continue to batter the technology sector.

Plummeting natural gas prices, set off by lower expectations for demand following milder winter weather in the United States and in Europe, led to a decline in the stocks of energy production companies. APA APA, Antero Resources AR, and Range Resources RRC were among those that fell the most in the industry.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)