Too Early to Celebrate, but the November CPI Report Gives the Fed Breathing Room

Goods prices slide into deflation, but services show continued upward pressure.

For the second month in a row, there’s clear good news on the inflation front.

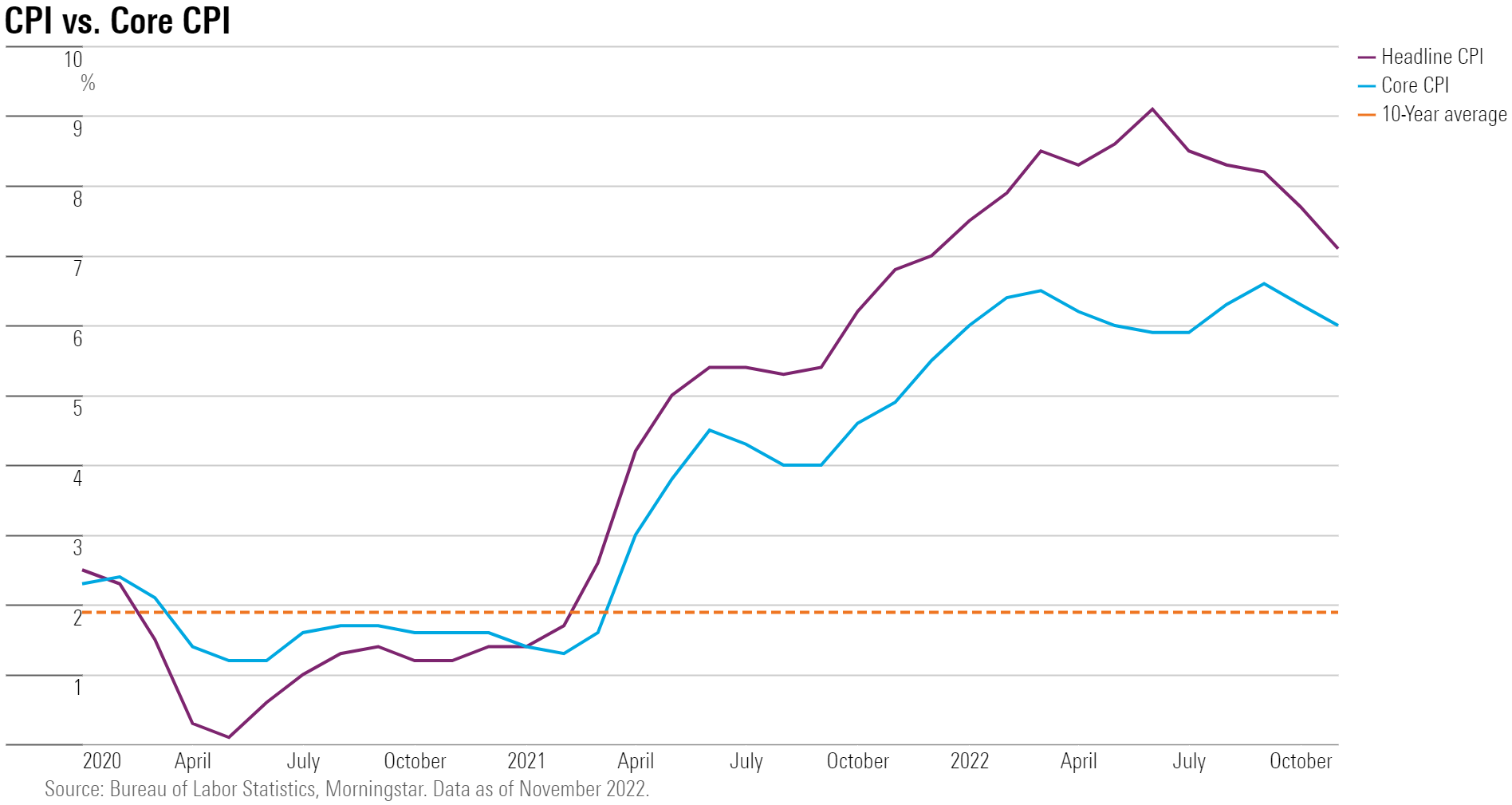

While the November Consumer Price Index report showed that the overall pace of inflation remains high, upward prices on goods consumed by households rose by a smaller-than-expected amount came in cooler than most economists had expected, signaling that after the worst bout of inflation in four decades, the Federal Reserve’s efforts to slow the march higher in prices appear to be having an impact.

“Today’s report shows another month of lower inflation,” says Preston Caldwell, Morningstar’s chief U.S. economist. “It’s still too early to celebrate, but our confidence that inflation is returning to normal has increased.”

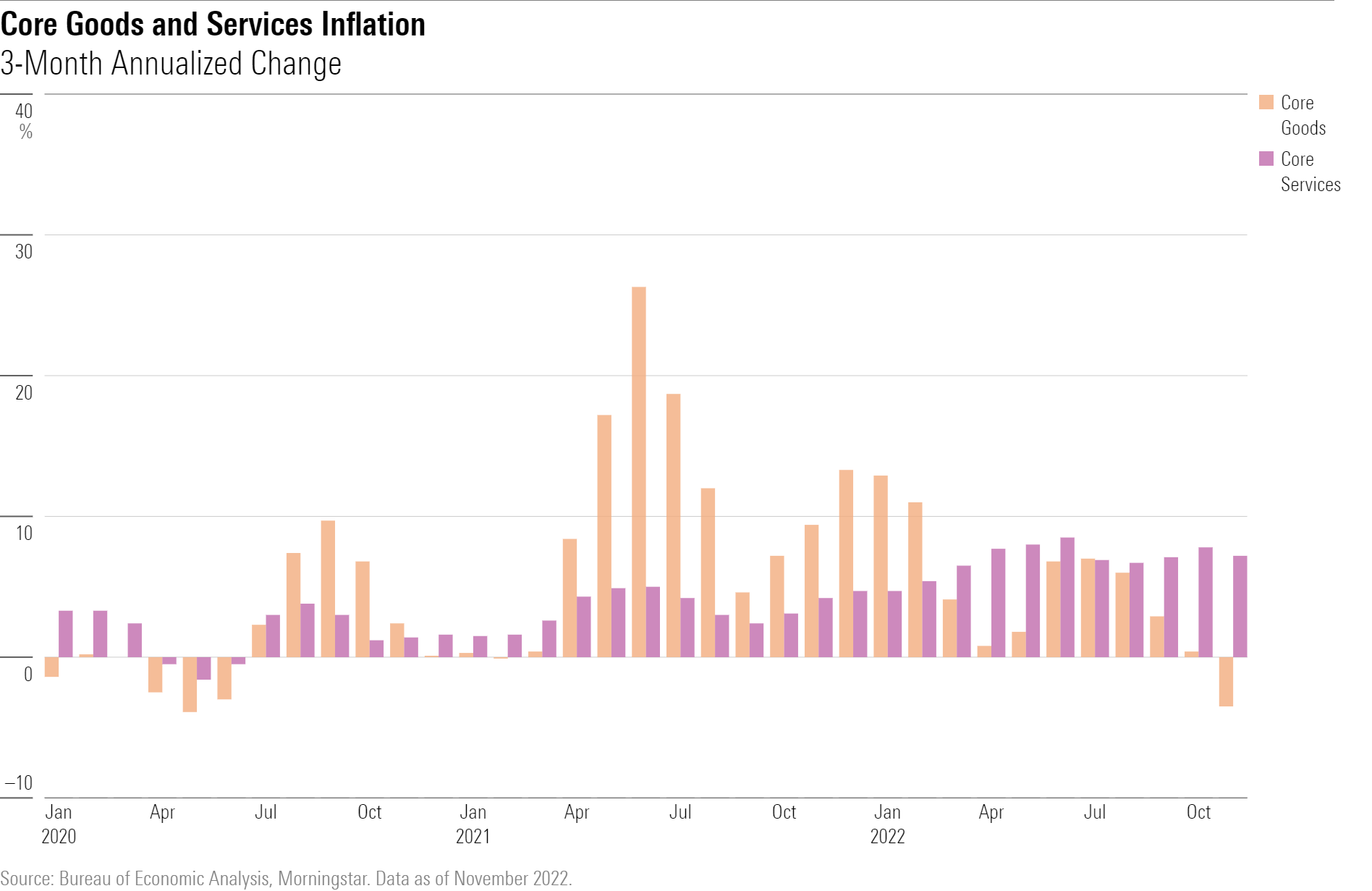

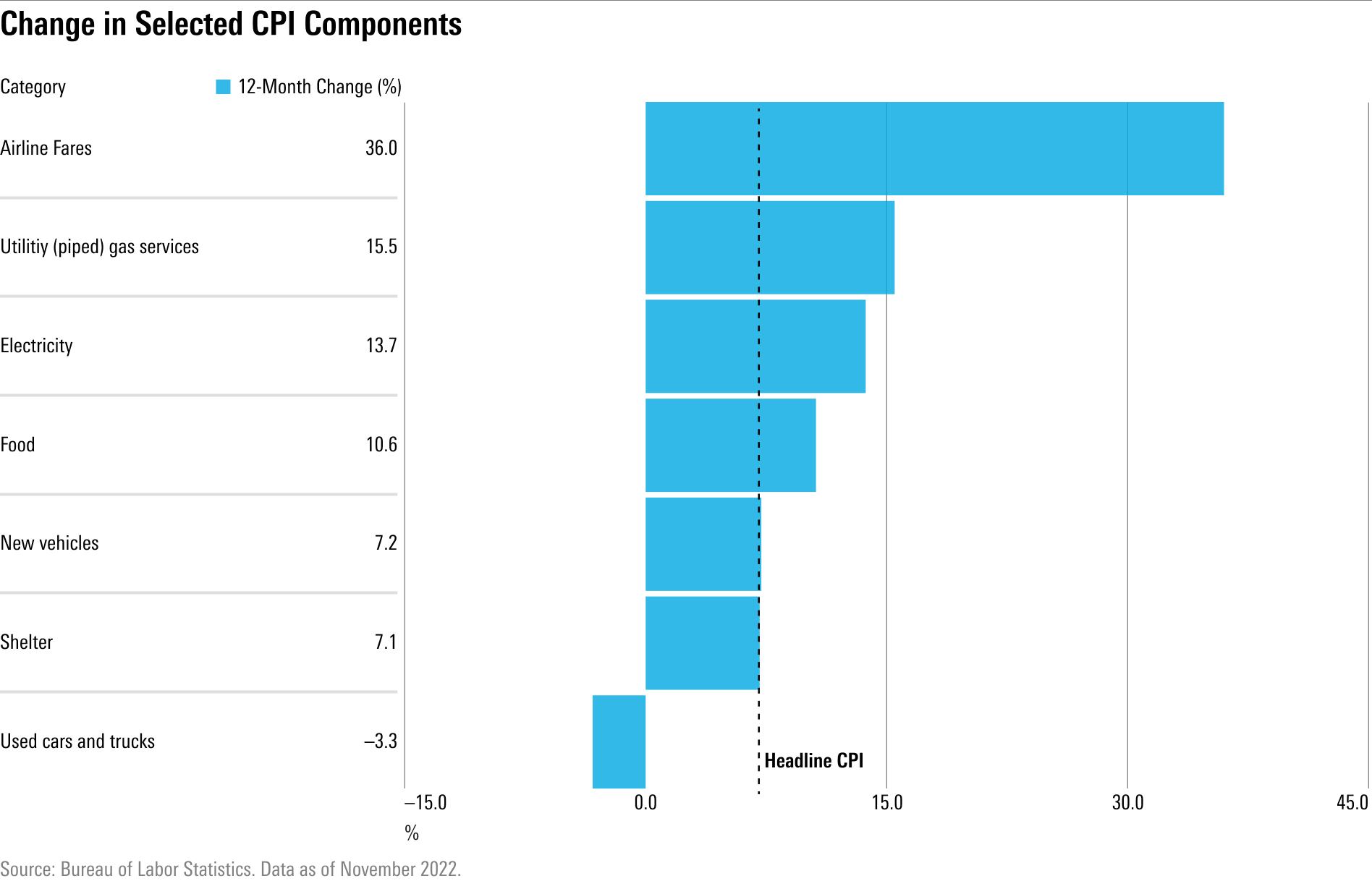

Particularly good news on the inflation front came on the goods side of the report, where prices showed outright declines on items such as autos, a range of consumer electronics, toys, furniture, and other household goods.

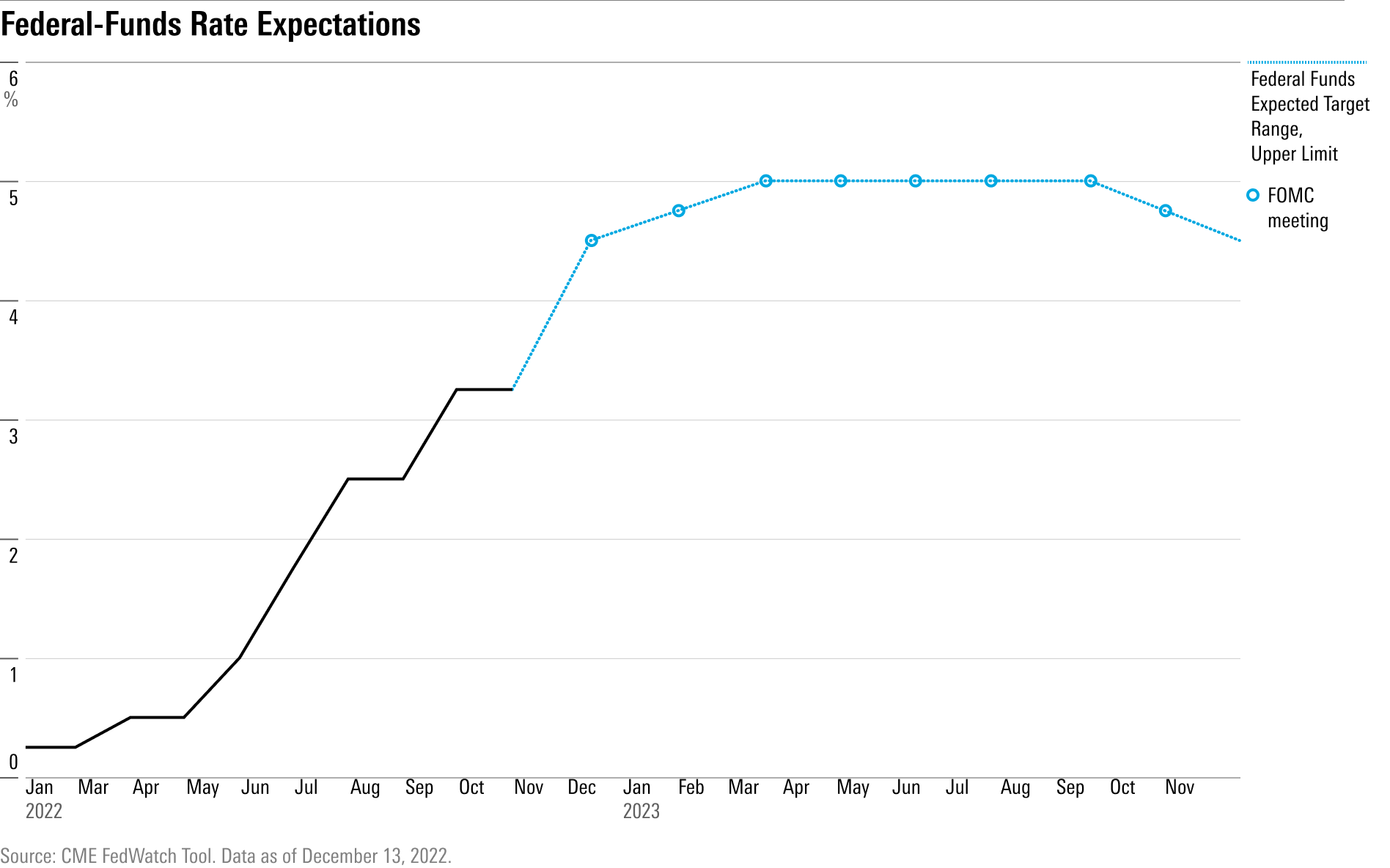

Markets cheered the November CPI report, with stocks rallying and bond yields falling sharply. The CPI report isn’t seen changing the outlook for the Fed’s decision on interest rates this week, where officials are expected to raise short-term interest rates by another half of a percentage point.

However, continued progress on inflation could mean the Fed won’t have to raise rates as high as some in the markets have been expecting, and could pave the way to a faster move toward lowering rates next year.

But caveats remain. The overall pace of inflation on a year-over-year basis remains well above the Fed’s 2% target. Services inflation—a key focus of the Fed—also remains high, and with job growth remaining strong some economists worry that may limit potential progress on inflation unless the economy begins to show broader signs of slowing.

Good News From the November CPI Report

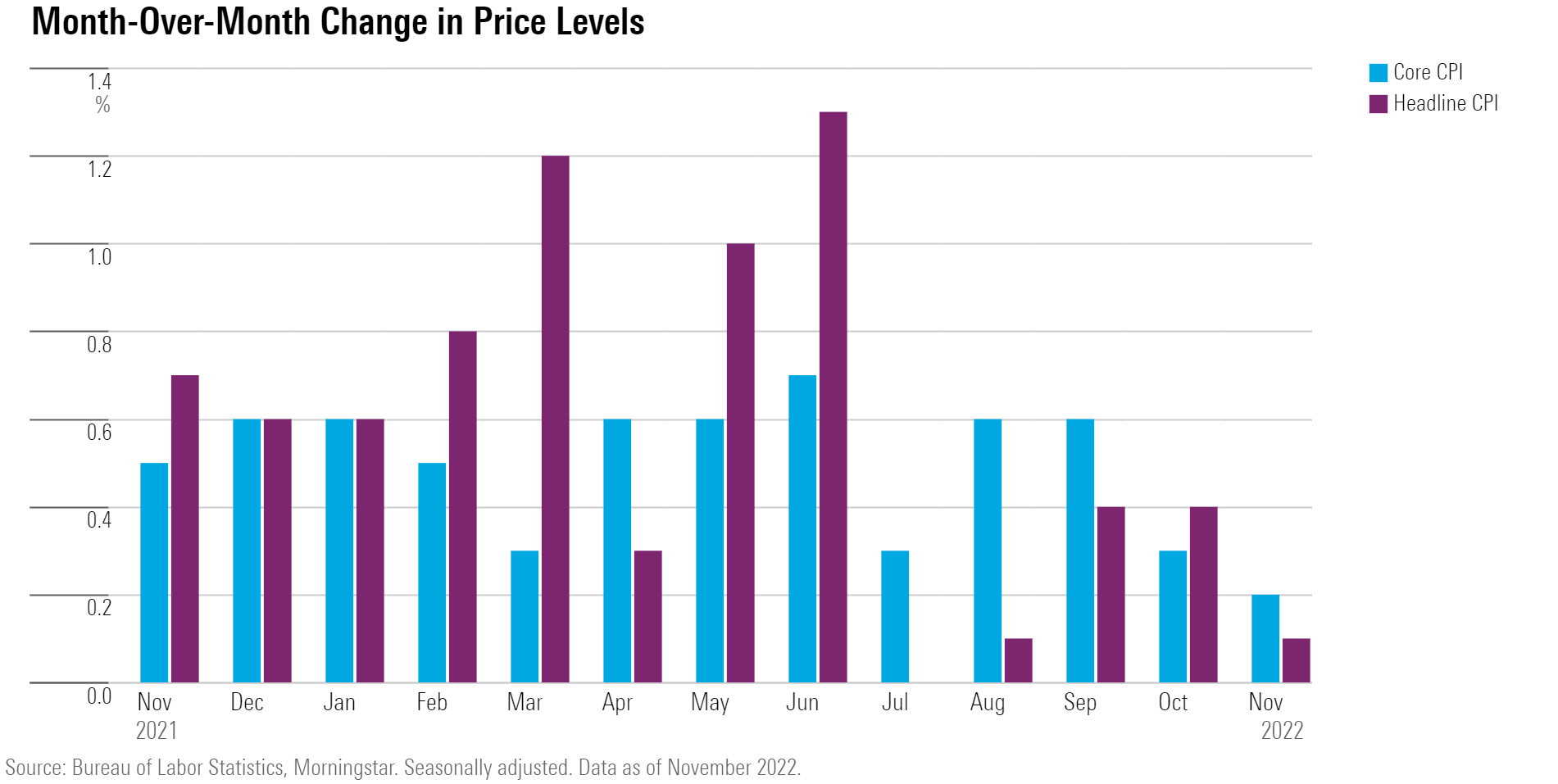

The Labor Department reported the CPI rose 0.1% in November, softer than the 0.3% increase economists were expecting and down from a 0.4% rise in October.

Core CPI—which excludes the volatile food and energy components—rose 0.2% in November, also weaker than expected and down from an October reading of 0.3%. The November core CPI increase was the smallest since August 2021.

On a year-over-year basis, the inflation rate ebbed to 7.1% in November. Excluding food and energy, CPI rose 6.0% in November from year-ago levels. Both readings came in softer than economists had expected, according to FactSet.

“As always, we eschew focusing on a single month’s data—which is very noisy—by taking a moving average,” says Caldwell. “Core inflation increased by 4.3% annualized in the three months ending in November, a marked reduction from the 6%-7% annualized rate that core inflation averaged in the first three quarters of 2022.”

The Outlook for Shelter Costs

Within the report, one of the most watched categories of inflation has been housing, measured in the report as “shelter” prices.

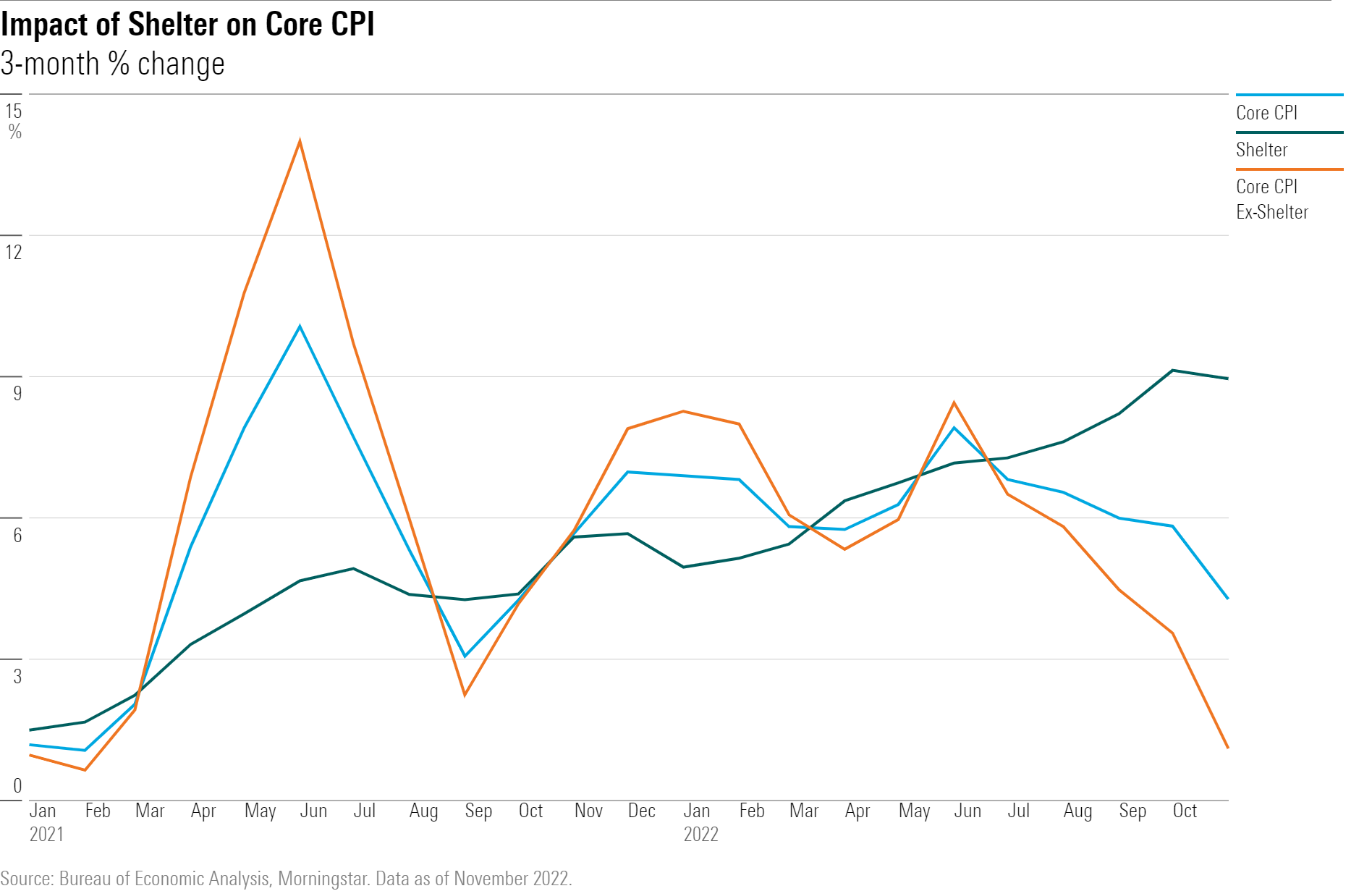

“Shelter prices grew at an 8.9% annualized pace in the last three months, which continued to single-handedly prop up core inflation given its large weighting,” Caldwell says. “But we have good reason to look past the large increase in CPI shelter prices, because they respond with a substantial lag with respect to actual market conditions.”

Caldwell says the high November figures on shelter costs reflect the very high inflation in market rents—as measured by indexes like Zillow’s Observed Rent Index—which occurred over the last two years. “But those same market rents are now decelerating sharply,” Caldwell says. The Zillow index has increased at just a 3.5% annual rate in the last three months.

Another piece of good news in the report comes from another metric, core inflation excluding shelter. “Strikingly, core inflation excluding shelter decelerated to a 1.1% annualized rate in the three months ending in November,” Caldwell notes. “Core goods prices are in outright deflation—falling at a 3.5% rate.”

“This is being driven by a wide assortment of goods, but the unwinding of the price spike in used autos is playing a key role,” Caldwell says. “We expect deflation in core goods prices to persist for the next two to three years as supply chains heal.”

One Area of Concern

Caldwell points to one area of concern in the November CPI report: core services inflation excluding shelter and healthcare. This measure has increased at a 7.5% annual rate in the last three months. “It’s possible that inflationary pressures remain somewhat high in these categories, perhaps fueled by continued high wage growth.”

In a recent speech, Fed Chair Jerome Powell pointed to core services inflation excluding housing as perhaps the “most important” measure in understanding the potential for future inflation.

Among core services excluding shelter, healthcare fell at a 1% annual rate in the last three months owing mainly to a quirk in the CPI’s methodology, Caldwell says. He notes that this issue artificially boosted CPI healthcare inflation earlier in 2022.

Overall, the November CPI report is likely welcome news at the Fed. A likely decision by the Fed to slow the pace of interest-rate increases this week “is bolstered by today’s positive inflation news,” Caldwell says. “We expect the Fed to shift to a 0.50% hike in tomorrow’s meeting, down from the 0.75%-sized hike executed in the four previous meetings. And a further moderation to a 0.25% hike in the February 2023 meeting now seems more likely.”

Caldwell expects inflation to slow significantly in 2023, allowing the Fed to cut interest rates before year-end.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)