In Consumer Defensive Sector, Alcoholic Beverages Bear Most of the Buzz

Overblown supply chain fears may be spooking wary investors, even as Beyond Meat and Boston Beer look attractive.

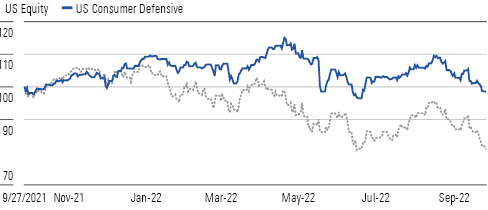

The Morningstar US Consumer Defensive Index languished in the third quarter, in line with the overall market’s negative 3% return, as of September 27.

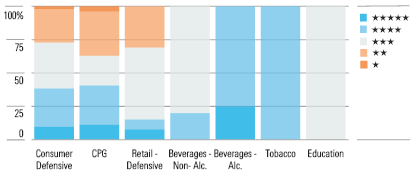

However, this more tempered appreciation hasn’t unlocked much in the way of attractive opportunities on which to stock up, and the consumer defensive sector trades at just 3% discount to our fair value estimates. For investors interested in the consumer defensive space, we’d point to alcoholic beverages, where shares trade at a 22% discount to our intrinsic valuations, and consumer packaged goods where more than one-third of our coverage trades in 4- or 5-star territory. We reckon investors’ reluctance to embrace shares in these niches is attributable to overweighting the persistence of supply chain constraints while underweighting efforts related to product innovation and brand prowess that ultimately conjure pricing power.

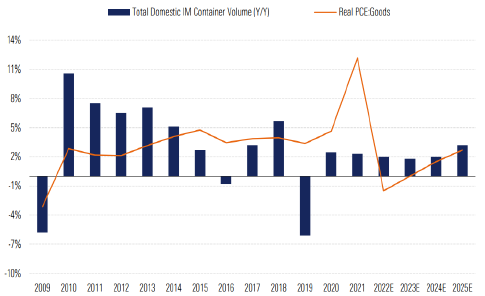

To be sure, supply chain constraints have served to upend stock at the shelf and compound cost pressures. In this context, the heightened demand that ensued since the pandemic took hold strangled the intermodal industry, given insufficient capacity and labor needed to boost volumes. While it appears some of these challenges could be subsiding, we aren’t blind to the fact that the pressure on freight capacity is real and other impediments could lead to greater disruption, as exemplified by the threat of rail strikes. We surmise any potential freight relief will still take time, but we think competitively-advantaged operators with negotiating prowess should navigate this volatile backdrop relatively unscathed.

Market Bests Consumer Defensive’s Modest Q3 gains.

Source: Morningstar Analysts

The Alcoholic Beverage Space Seems Particularly Attractive

S

ource: Morningstar Analysts

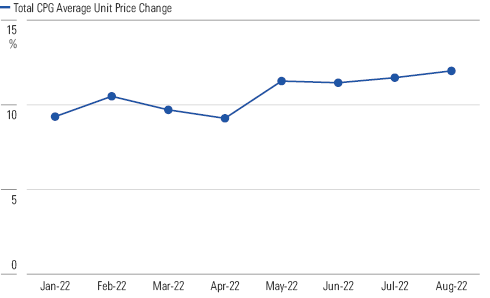

Despite a Dearth of Undervalued Options, Favor To Be Found With Competitively Advantaged Consumer Defensive Firms

To blunt pronounced inflationary headwinds stemming from heightened input, labor, and freight costs, CPG firms raised prices to the tune of 12% in August against the previous year. But with an influx of strains on their pocketbooks, we think consumers may ultimately alter purchasing patterns by pursuing lower unit prices found in larger pack sizes (fewer trips to the store), opting for lower-priced private label, and/or defaulting to products with lower opening price points. To defend against this, we posit moaty firms will continue investing in consumer-valued innovation and marketing to enable products to win at the shelf.

Demand Normalization Could Relax Supply Chain Constraints

Source: IANA. St. Louis Federal Reserve. NielsenIQ USxAOC. Morningstar. Data as of Sept. 27, 2022.

Top Picks

Beyond Meat BYND Star Rating: ★★★★★ Economic Moat Rating: None Fair Value Estimate: $63 Fair Value Uncertainty: High

Beyond Meat shares are attractive, trading at a 75% discount to our $63 fair value estimate. We think investor fears about slowing demand are overblown, as the slowdown in the category is related to widespread inflation, leading consumers to trade down to lower-priced meat since plant-based meat demands a premium. Beyond Meat’s products require 99% less water, 93% less land, 46% less energy, and emit 90% fewer greenhouse gases than their meat equivalents and should benefit from consumer demand for sustainable goods. We believe Beyond Meat will capture a 20% sales CAGR over the next 10 years with operating margins in the high teens.

Boston Beer SAM Star Rating: ★★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $680 Fair Value Uncertainty: Medium

Shares of narrow-moat Boston Beer, a leader in U.S. high-end malt beverage and adjacent categories, trade more than 50% below our $680 fair value estimate. We posit that the firm has shown a proclivity to augment its portfolio in alignment with the latest consumer trends and capture a disproportionate share of the economic rents generated from this growth by being one of the first movers. While seltzer trends have slowed, negatively affecting its Truly seltzer line, the firm’s innovation prowess should continue to support Boston Beer’s sales, evidenced by the launches of hard seltzer Truly Margarita and Hard Mountain Dew.

Hain Celestial Group HAIN Star Rating: ★★★★★ Economic Moat Rating: None Fair Value Estimate: $37.50 Fair Value Uncertainty: Medium

Hain trades at a 55% discount to our $37.50 fair value estimate, partially the byproduct of weakness in its European arm, as well as inflation and supply chain disruptions in the U.S. We view these issues as largely transitory, and with a portfolio of organic and natural fare aligned with consumer preferences, we surmise Hain is well positioned for the long term. Additionally, Hain’s supply chain integration efforts strike us as prudent, which should generate significant cost efficiencies and purchasing synergies. All in all, we expect a 13.5% operating margin by 2032, a notable improvement from 2021’s 7.5%.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_eae1cd6b656f43d5bf31399c8d7310a7_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)