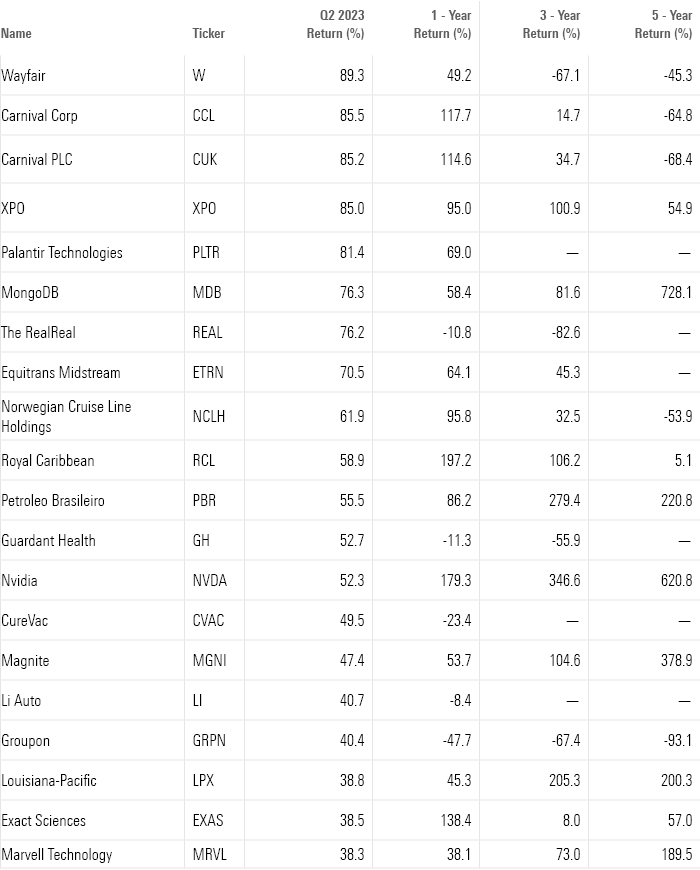

Best-Performing Stocks of Q2 2023

Wayfair, Palantir, and Nvidia stocks were among the biggest gainers during the second quarter.

Technology and consumer cyclical stocks lead the list of the best performers during the second quarter of 2023, continuing a rebound from the battering they suffered in 2022.

The top-performing U.S.-listed stocks of the second quarter that are covered by Morningstar analysts include Wayfair W (up 89.3%), CureVac CVAC (up 49.5%), and Palantir Technologies PLTR (up 81.4%). Other notable winners include Carnival CCL (up 85.5%) and Nvidia NVDA (up 52.3%).

However, reflecting the narrow breadth of the market’s rally in the first half of 2023, among the 862 U.S.-listed stocks covered by Morningstar analysts, 527 rose while 335 fell during the second quarter. Still, it was a much better showing than what was seen in the second quarter of 2022, when 103 stocks rose while 759 fell.

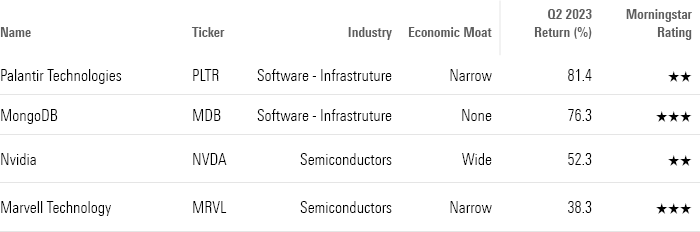

AI Drives Tech Stock Rally

For technology stocks, enthusiasm for companies that may benefit from the artificial intelligence boom continued from the first quarter. Rallies in stocks from semiconductor manufacturers such as Marvell Technologies MRVL and Nvidia were driven by anticipated demand for their products, which are used to power generative AI software such as OpenAI’s ChatGPT.

Palantir’s 81.4% gain made it the fifth-best performer this quarter, reversing its 64.7% loss the previous year. Morningstar equity analyst Malik Ahmed Khan says that “a substantial part of the recent excitement surrounding the software company stems from its involvement in artificial intelligence.” However, he cautions investors that “the uplift in Palantir’s financials due to AI is slightly more nebulous. We believe investors should wait and look for concrete evidence of the positive financial tailwinds generated by AI.”

Marvell expects its sales to quadruple in the next two years. “While we already saw large-scale cloud demand as nearly insatiable, we believe AI takes it to another level and makes Marvell’s new targets achievable,” says Morningstar analyst William Kerwin.

For the second consecutive quarter, Nvidia ranked among the best-performing stocks, though it dropped to 13th place from third place in the previous quarter. Still, the semiconductor company’s stock boasts a year-to-date rally of 189.5%. That’s its best first-half performance since the company went public in January 1999.

Shares of database storage provider MongoDB MDB jumped 76.3% during the second quarter, and the firm also reported better-than-expected first-quarter results for its fiscal year. MongoDB caught the attention of investors with its announcements of new tools for vector research—part of the development of generative AI—and data processing.

“We continue to believe nonrelational database needs will drive the majority of new growth in the database management software market,” says Morningstar equity analyst Julie Bhusal Sharma. “However, this does not undermine the massive conversion opportunity in the existing relational database market, which we believe can help push MongoDB’s share of the fast-growing database management software market from roughly 2% today to 3% by 2030.”

Best-Performing Semiconductor and Software Stocks of Q2 2023

Best-Performing Consumer Cyclical Stocks

In the second quarter, the best-performing stock was Wayfair, whose 89.3% rally reversed a significant share of its 82.7% loss in 2022. In its first-quarter earnings results, the home furniture retailer posted a loss of $1.13 per share—a better performance than the FactSet consensus forecast of a $1.71 loss per share.

One of Wayfair’s tailwinds has been a bounce in the housing market after a slump in 2022. New home sales improved in the first few months of the year, with April’s sales increasing 11% year over year. Wayfair initially anticipated demand to go up nearly 10% during May and June, but while experiencing positive order growth, the firm projected its sequential growth to increase above that estimate.

“Looking forward, we forecast mid-single-digit sales growth, modestly faster than industry growth, as e-commerce adoption across the home furnishing sector continues to improve,” says Morningstar senior equity analyst Jaime M. Katz.

Travel stocks also saw a continued recovery from their pandemic-driven woes. Shares for Carnival, Royal Caribbean RCL, and Norwegian Cruise Line Holdings NCLH made big gains as consumers set aside COVID-19 worries and cruised forward with their travel plans. Governments eased travel restrictions as the severity of the pandemic waned, and cruise line companies took more reservations as they deployed more ships.

As they reported first-quarter earnings, companies attributed their better-than-expected results to increased ticket prices, stronger onboard spending, and solid expense management. Norwegian stock rose 61.9% and Royal Caribbean added 58.9%, both trailing Carnival’s 85.5% gain.

“Carnival remains at a turning point, with the third quarter set to generate the firm’s first positive earnings mark since 2019,” Katz says. “While third-quarter EPS will likely run at 25% of the same period in 2019′s level, most of the compression stems from higher interest expense rather than operating inefficiencies.”

The RealReal REAL gained 76.2% in the second quarter, reversing its 2022 loss of 62.8%. Michael Burry, manager of the hedge fund Scion Asset Management, sent the stock up after he revealed he has a stake in the luxury goods resale platform.

The introduction of new vehicle models led Li Auto LI stock to a 40.7% gain this quarter. The China-based automobile manufacturer’s range-extension powertrain has been an important selling point for its cards, with the firm standing to benefit from the rapid adoption of new energy vehicles in the country. Morningstar equity analyst Vincent Sun forecasts an improved outlook for Li’s sales profits due to increased production and lower unit production cost, leading the company into its first profitable year.

Best-Performing Consumer Cyclical Stocks of Q2 2023

Healthcare Stocks Surge On Cancer Research Developments

In the healthcare sector, companies focused on cancer-related research or care were among the best performers in the second quarter.

CureVac’s 49.5% gain came in response to news of its progress in its research for mRNA vaccines, including the inoculations of candidates for a cancer vaccine and a flu vaccine. The German biopharmaceutical company also reported first-quarter revenue of EUR 7.1 million—more than 90% of which was generated from its collaboration agreement with GSK. Its stock jumped by the quarter’s end.

“We think the company is in a stable position for at least the next couple of years thanks to its ability to raise capital by issuing shares and receiving milestone payments as its pipeline progresses,” says Morningstar equity analyst Rachel Elfman.

Guardant Health GH secured health plan coverage from several major health insurance companies for its liquid biopsy test. Firms such as Humana HUM and Aetna will cover patients who use the precision oncology company’s product, which identifies tumors in the bloodstream. By the quarter’s end, Guardant’s stock gained 52.7%.

In the colorectal cancer screening market, Exact Sciences EXAS made investors confident in its ability to fend off competitors. The diagnostics company’s stock went up 38.5% this quarter, narrowly reversing its 2022 loss of 36.4%. Morningstar senior equity analyst Julie Utterback says strong results for its improved Cologuard test “should help the firm deliver near-term market share gains.”

Best-Performing Healthcare Stocks of Q2 2023

More Top-Performing Stocks from Q2 2023

Other stocks that made major gains during the second quarter include the transportation services firm XPO XPO, oil and gas provider Equitrans Midstream ETRN, and energy company Petroleo Brasileiro PBR.

Morningstar senior equity analyst Matthew Young says XPO “has executed well over the years in terms of avoiding integration issues while driving down duplicative costs and boosting efficiency, especially in the less-than-truckload segment.” The trucking service provider’s stock jumped 18% on April 20 after it announced a new COO, who joined with 27 years of experience at Old Dominion Freight Line ODFL and a strong track record regarding LTL operations. In its first-quarter results, XPO highlighted how its revenue increased to $1.91 billion from $1.89 billion in the same period the previous year. The stock gained 85% in the second quarter.

Equitrans stock rose 70.5%, led by the news that construction of its Mountain Valley Pipeline would move forward as part of a bipartisan debt-ceiling deal passed by Congress.

Petrobras increased 55.5% in the second quarter, having regained investor trust by managing its spending and reducing leverage.

Another leading stock includes online advertising firm Magnite MGNI, which rose 47.4% after reporting higher-than-expected revenue in the previous quarter.

Q2 2023 Best-Performing Stock Returns

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-06-2024/t_bd32499d257a40fe9a757102874ba6c4_name_file_960x540_1600_v4_.jpg)