7 Top-Performing High-Yield Bond Funds

Among the best-performing funds in this category are offerings from Fidelity, iShares, and BrandywineGlobal.

After a grim 2022, this year has so far brought a sense of relief for investors in high-yield bonds, and with it a changing dynamic for the top-performing funds in that category. Among the funds providing investors with the best performance over the last one-, three-, and five-year time frames are Fidelity Investments, iShares, and Manning & Napier.

Sam Kulahan, senior manager research analyst at Morningstar, notes that for the high-yield bond funds that outperformed last year, that meant holding shorter-duration bonds that were less sensitive to rising interest rates and additional debt issued by energy companies. In addition, some funds benefitted by venturing from traditional high-yield bonds into floating-rate bank loans, which performed better as yields rose.

In general, funds with higher-quality bonds proved more buoyant. Overall, the average high-yield bond fund lost 10.3% in 2022, while the Morningstar US Core Bond Index lost 12.9%.

This year has been a different story. As worries about recession have faded and the Federal Reserve has increasingly been seen to be nearing the end of its rate hike cycle, lower-quality bonds have outperformed. So far in 2023, high-yield bond funds have on average returned 5.8%, while the bond market has gained only 2.1%.

High-Yield Bond Funds vs. the Core Bond Market Index

What are High-Yield Bond Funds?

High-yield bond portfolios primarily invest in U.S. high-income debt securities where at least 65% or more of bond assets are either rated by a major agency such as Standard & Poor’s or Moody’s at the level of BB (considered speculative for taxable bonds) and below, or else not rated by such agencies. These portfolios concentrate on lower-quality bonds, which are riskier than higher-quality ones. These portfolios generally offer higher yields than other types, but they are also more vulnerable to economic and credit risk.

7 Top-Performing High-Yield Bond Funds

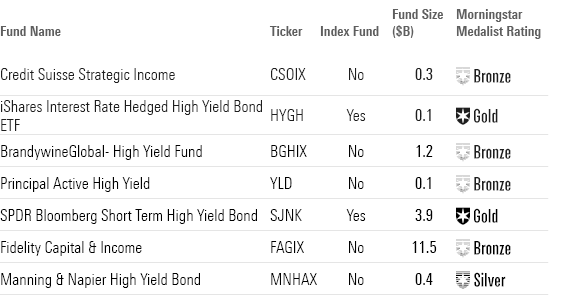

To screen for the best-performing funds in this Morningstar Category, we looked for the ones that have posted top returns across multiple time periods.

We first screened for funds that ranked in the top 25% of the category using their lowest-cost share classes over the past one-, three-, and five-year time frames. In addition, we screened for funds with Morningstar Medalist Ratings of Gold, Silver, or Bronze for those classes. We also excluded funds with less than $100 million in assets and those with minimal or no input in the Medalist Rating from Morningstar analysts.

From this screen, we’ve highlighted the seven funds with the best year-to-date performance. The group includes five active funds and two index funds. Because the screen was created with the lowest-cost share class for each fund, some funds may be listed with share classes not accessible to individual investors outside of retirement plans. The individual investor versions of those funds may carry higher fees, which reduces returns to shareholders.

Top-Performing High-Yield Bond Funds

Credit Suisse Strategic Income

- Ticker: CSOIX

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 5 Stars

“Owing to the strategy’s typical roughly 50%-50% allocation to high-yield bonds and bank loans, it doesn’t tend to hugely benefit from a favorable upswing or a downturn within either sector, which sets it apart from its typical category peer. This avoidance of extremes has in turn led to a smooth ride for its investors.

“The strategy’s impressive maneuvering in leveraged finance markets for sector allocation and credit selection has contributed to its strong long-term returns. From October 2012 through February 2023, its I share class returned 5.3% annualized, outperforming more than 90% of distinct peers in the process.”

—Saraja Samant, analyst

iShares Interest Rate Hedged High Yield Bond

- Ticker: HYGH

- Morningstar Medalist Rating: Gold

- Morningstar Rating: 4 stars

“This share class led its average peer by an annualized excess return of 45 basis points over a nine-year period. However, it had a mixed track record compared with the category benchmark, the ICE BofA US High Yield Bond Index. Its impressive 3.4% one-year return is worth mentioning—a 3.6-percentage-point lead over its average peer, placing it within the top 10% of its category.

“Over the past five years, the fund’s shares have returned an average of 3.6% per year, landing it in the 1st percentile of the category. For the last three years, the fund has returned an average of 5.8% a year, leading it to the 4th percentile. And for the past 12 months, the fund has landed in the 1st percentile with an 11.1% gain.”

—Morningstar Manager Research

BrandywineGlobal High Yield

- Ticker: BGHIX

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 5 stars

“The strategy’s distinct approach gives its managers the freedom to take advantage of market inefficiencies. To this end, they tend to hold concentrated positions (issuers often account for 3%-5% of assets) in their best ideas that are often sourced from areas where larger rivals can’t operate as meaningfully. Most of the portfolio’s holdings aren’t found in the top 100 issuers of the ICE BofA U.S. High Yield Index. To be sure, ownership of smaller deal sizes could be harder to sell in stressed environments. The managers look to balance that concentration risk through individual issue ownership limits, which typically sit well below 5% of an outstanding issue. While the portfolio’s concentration and idiosyncratic risks are material, the managers’ analytical rigor and responsible balancing of risks provide comfort.”

—R.J. D’Ancona, senior analyst

Principal Active High Yield

- Ticker: YLD

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 4 stars

“Over the past five years, this fund’s shares have returned an average of 3.58% per year, putting it in the 22nd percentile of the category. For the last three years, the fund has returned an average of 5.23% a year, leading the fund to the 7th percentile. And for the past 12 months, the fund has been in the 8th percentile with an 8.32% gain.

“This strategy’s 12-month yield is 6.5%, higher than its average peer’s 5.9%. Plus, its 30-day SEC yield (a measure similar to yield-to-maturity) sits at 7.5%. Typically, higher yields come at the cost of higher credit risk. But that isn’t always the case. Over the past 12 months, the average yield of the fund has been higher than the average yield of its category peers.”

—Morningstar Manager Research

SPDR® Bloomberg Short Term High Yield Bond

- Ticker: SJNK

- Morningstar Medalist Rating: Gold

- Morningstar Rating: 4 stars

“Over the past five years, the fund beat the ICE BofA US High Yield Bond Index by 31 basis points and exceeded the category average by 1 percentage point. More importantly, on a 10-year basis, this share class fell behind the index by an annualized 71 basis points. Although the overall rating does not hinge on one-year performance, its impressive 2.1% return is worth mentioning—a 2.4-percentage-point lead over its average peer, placing it in the top 10% of its category.

“The investment seeks to provide investment results that correspond generally to the price and yield performance of the Bloomberg US High Yield 350mn Cash Pay 0-5 Yr 2% Capped Index.”

—Morningstar Manager Research

Fidelity® Capital & Income

- Ticker: FAGIX

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 5 Stars

“This strategy benefits from its long-tenured leadership and a well-resourced supporting cast. Fidelity veteran Mark Notkin has guided this offering since August 2003. In late 2019, he was joined by co-manager Brian Chang. Fidelity’s deep resources, including its 19-person high-income research team, back the duo.

“During Notkin’s tenure, which has included a sharp rebound in high-yield bonds from the depths of the credit crisis, his willingness to hold significant stakes in the lower-quality tiers of the junk-bond market and his strong security selections have earned one of the best long-term results in its category.”

—Sam Kulahan, senior analyst

Manning & Napier High Yield Bond

- Ticker: MNHAX

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 Stars

“Over a 10-year period, this share class outpaced the category’s average return by 1.9 percentage points annualized. And it was also ahead of the ICE BofA US High Yield Bond Index by 94 basis points over the same period.

“Over the past five years, the shares have returned an average of 5.34% per year, putting the fund in the 2nd percentile of the category. For the last three years, it has returned an average of 6.04% a year, putting it in the 3rd percentile. And for the past 12 months, the fund has been in the 23rd percentile with a 7.23% gain.”

—Morningstar Manager Research

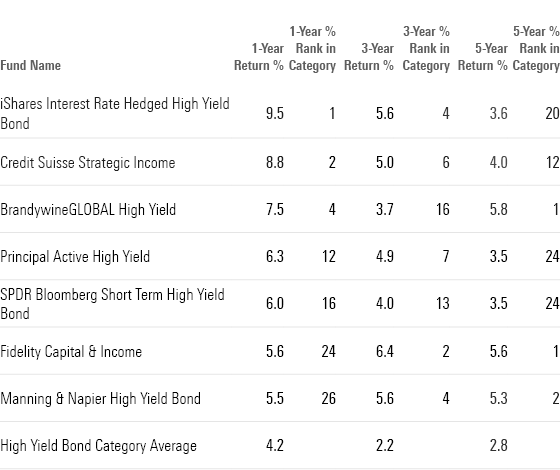

Long-Term Returns of Top-Performing High Yield Bond Funds

Correction: Aug. 1, 2023: A previous version of this article included incorrect chart information. BrandywineGlobal High Yield Fund's 5-year category rank is 1, not 10.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)