7 Top-Performing Small-Growth Funds

These funds have delivered for investors in a turbulent market for small-growth stocks.

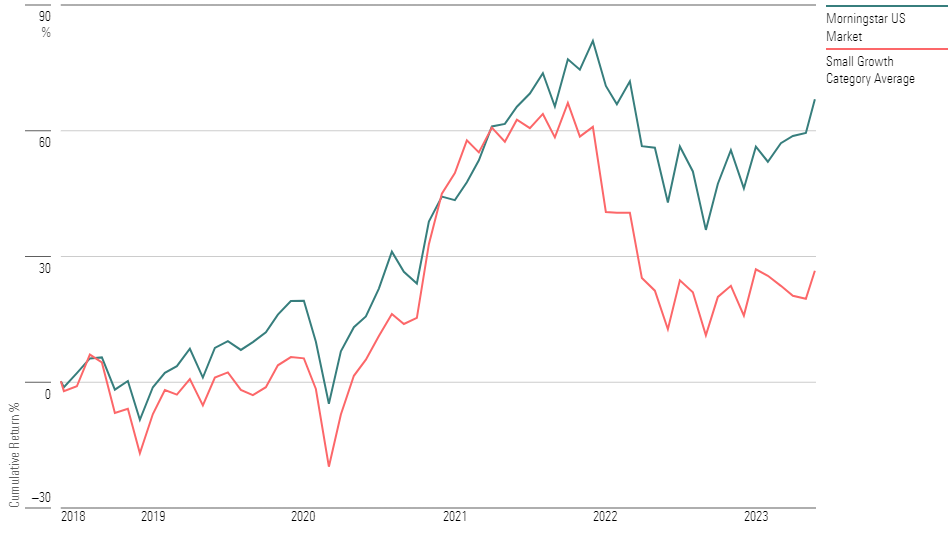

While small-growth funds have lagged the broader market’s bounce back this year from a brutal 2022, some of the top performers in the category are rewarding investors with competitive, even market-beating, returns.

It’s been a difficult market for small-cap stocks overall. Amid higher interest rates and worries about a possible recession, investors in small funds have fallen further than much of the market. Most of the businesses for small-company stocks are closely tied to the U.S. economy, and thus their performance tends to reflect expectations for that economy. In contrast, larger companies are often more multinational and can hold up better in the face of weakening domestic conditions.

Last year proved particularly painful for investors in small-growth stock funds, as the average one lost 28% while the Morningstar US Market index only lost 19.4%.

In 2023, the category average for small-cap funds has gained just 9.9% through June 20, remaining below the market index, which rose 14.8% for the same period. With help from this year’s bounce, the 12-year trailing period ending June 20 paints a better picture; on average, small-growth funds gained 16% compared to the 21% gain of the overall stock market.

Against this challenging backdrop, small-growth funds with higher-quality exposure have generally posted the strongest returns. Notably, the top performers include several micro-cap stock strategies, where the funds invest in some of the smallest—and most volatile—companies in the market.

Small-Growth Funds vs. the U.S. Stock Market

What Are Small-Growth Funds?

Stocks in the bottom 10% of the capitalization of the U.S. equity market are defined as small cap. Small-growth portfolios focus on faster-growing companies. Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields).

Small-growth fund portfolios tend to favor companies in up-and-coming industries or young firms in their early growth stages. Because these businesses are fast-growing, their stocks tend to be volatile.

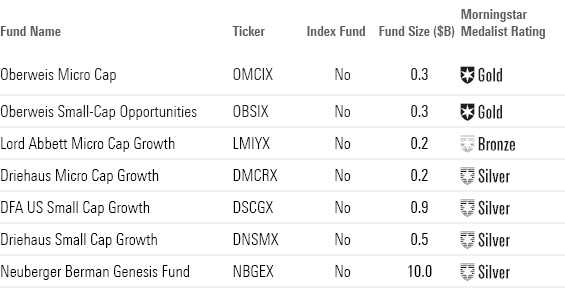

7 Top-Performing Small-Growth Funds

To screen for the best-performing funds in this Morningstar Category, we looked for those that have posted top returns across multiple time periods.

We first screened for funds that ranked in the top 33% of the category using their lowest-cost share classes over the past one-, three-, and five-year time frames. In addition, we screened for funds with Morningstar Medalist Ratings of Gold, Silver, or Bronze for those classes. We also excluded funds with less than $100 million in assets.

From this group, we’ve highlighted the seven funds with the best year-to-date performance. This group only consists of active funds. Because the screen is created with the lowest-cost share class for each fund, some funds may be listed with share classes not accessible to individual investors outside of retirement plans. The individual investor versions of those funds may carry higher fees, which reduces returns to shareholders.

Top-Performing Small-Growth Funds

Oberweis Micro Cap

- Ticker: OMCIX

- Morningstar Medalist Rating: Gold

- Morningstar Rating: 5 stars

“Oberweis is an investment boutique with several strengths. While the Oberweis family retains significant control, the firm is 100% employee-owned, which has contributed to high retention among its investment team. Moreover, the firm has placed thoughtful capacity estimates for its strategies, which is welcome given the firm’s focus on small-cap strategies with high portfolio turnover.

“A strong management team and sound investment process underpin Oberweis’ Morningstar Medalist Rating of Gold.

“Over the past three-year period, it beat the category index, the Russell 2000 Growth Index, by 25.6 percentage points and outperformed its average peer by 24.1 percentage points. More importantly, when extended to a longer time frame, the strategy surpassed the index. On a five-year basis, it led the index by an annualized 10.1 percentage points. Although the overall rating does not hinge on one-year performance, its impressive 9.3% return is worth mentioning—a 12.8-percentage-point lead over its average peer, placing it within the top 10% of its category.”

—Morningstar Manager Research

Oberweis Small-Cap Opportunities

- Ticker: OBSIX

- Morningstar Medalist Rating: Gold

- Morningstar Rating: 5 stars

“A strong management team and sound investment process underpin Oberweis’ Morningstar Medalist Rating of Gold. When looking across a longer horizon, the strategy outpaced the index. On a five-year basis, it led the index by an annualized 11.5 percentage points.

“This strategy has exhibited a tilt toward high-volatility stocks or the shares of companies with histories of the higher standard deviation of returns, compared with category peers in the last few years. Such exposure tends to pay off when markets are hot and to be costly when they are not. Additionally, in recent months the strategy was more exposed to volatility compared with its peers. This strategy has also tilted in favor of high-quality stocks that have demonstrated low financial leverage and solid return on equity during these years. Such holdings could cause it to trail peers during economic booms but help it better withstand busts.”

—Morningstar Manager Research

Lord Abbett Micro Cap Growth

- Ticker: LMIYX

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 5 stars

“Over time, this strategy has preferred smaller-market-cap companies compared with others in its category. But in terms of style (value/growth) exposure, it is similar.

“This share class surpassed the category index over the past 10-year period, outperforming by an annualized 6.9 percentage points. It has also led its average peer by an annualized 6.4 percentage points over the same 10-year period. Although the overall rating does not hinge on one-year performance, its impressive 4.9% return is worth mentioning—an 8.4-percentage-point lead over its average peer, placing it within the top 10% of its category.”

—Morningstar Manager Research

Driehaus Micro Cap Growth

- Ticker: DMCRX

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

“This firm specializes in high-conviction, actively managed, and growth-oriented strategies designed to complement an investor’s core equity and fixed-income exposure. Historically, Driehaus has had the most success with small-cap and emerging-markets strategies.

“An analysis of the strategy’s portfolio shows it has maintained a significantly overweight position in liquidity exposure and momentum exposure compared with category peers. High liquidity exposure is attributed to stocks with a high trading volume, lending managers more flexibility. And momentum exposure is rooted in holding stocks currently on a winning streak.

“When looking at the fund’s absolute return track record, it also came out ahead. On a nine-year basis, this share class beat the category index on an annualized basis by 8.1 percentage points. It has also beaten its average peer by an annualized 7.5 percentage points over the same nine-year period.”

—Morningstar Manager Research

DFA US Small Cap Growth

- Ticker: DSCGX

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

“This share class outpaced its average peer by 1.2 percentage points annualized over a 10-year period. And it also exceeded the return of the Russell 2000 Growth Index by an annualized 1.7 percentage points over the same period. Although the overall rating does not hinge on one-year performance, its impressive 3.9% return is worth mentioning, a 7.4-percentage-point lead over its average peer, placing it within the top 10% of its category.

“The share class outstripped the index with a higher Sharpe ratio (a measure of risk-adjusted return) over the trailing 10-year period. Notably, these strong risk-adjusted results have not come with more volatility for investors.

“Analyzing additional factors, this strategy has consistently had a defensive tilt owing to its exposure to high-quality stocks over the past few years. High exposure to the quality factor means holding companies that are consistently profitable, growing, and have solid balance sheets.”

—Morningstar Manager Research

Driehaus Small Cap Growth

- Ticker: DNSMX

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 5 stars

“An analysis of the strategy’s portfolio shows it has maintained a substantial overweight position in momentum exposure and volatility exposure compared with category peers. Momentum exposure is attributed to holding stocks currently on a winning streak and selling those that are on a downtrend. High volatility exposure is rooted in stocks that have a higher standard deviation of returns.

“Over the past three years, it beat the Russell 2000 Growth Index by an annualized 7.3 percentage points and outperformed the category average by 5.8 percentage points. More importantly, when extended to a longer time frame, the strategy outpaced the index. On a five-year basis, it led the index by an annualized 9.5 percentage points.

“The risk-adjusted performance only continues to make a case for this fund. The share class had a higher Sharpe ratio than the index over the trailing five-year period. Higher returns are often associated with higher risk. This strategy is no exception, with a standard deviation of 26.9%, exceeding the benchmark’s 24.3%.”

—Morningstar Manager Research

Neuberger Berman Genesis Fund

- Ticker: NBGEX

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

“This strategy has often looked best amid market declines. During the global equity market selloff that began in late 2021, its focus on profitable high-quality companies whose shares trade at modest multiples of their earnings has once again helped it curb losses.

“The strategy’s bear market dexterity is no accident. Its four co-managers seek to own 90-150 stocks whose underlying businesses have low debt, high returns on assets, and defensible competitive advantages. Their five analysts study at least 10 years of each prospect’s financial statements to find growing free cash flow and how it’s used. The managers then build new positions slowly, making sure their thesis is correct. They will buy and hold for long periods, and exit gradually as well.

“The managers’ many years of collective experience inspire confidence. Co-managers Judy Vale and Bob D’Alelio have run the fund together since August 1997. Each has more than four decades of industry experience, and they remain engaged despite their lengthy careers.

“Despite its size, the strategy has done well across various market environments and has stayed competitive versus relevant peer groups and benchmarks over the long term.”

—Paul Ruppe, research analyst

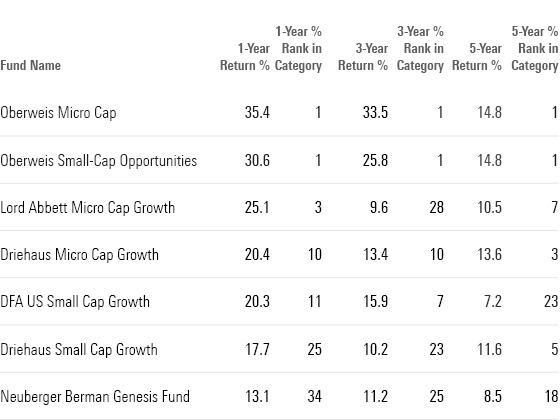

Long-Term Returns of Top-Performing Small-Growth Funds

Correction: (June 29, 2023): A previous version of this article omitted Neuberger Berman Genesis Fund from the list of top-performing funds.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)