6 Top-Performing Core Bond Funds

Among the best-performing funds in this key bond category are offerings from Guggenheim, BlackRock, and J.P. Morgan.

In recent years, becoming a top-performing bond fund has required weathering some of the biggest extremes in bond market history. We’ve seen a renewed period of interest rates locked at zero, followed by the worst bear market for bonds on record, and then this year’s snapback in performance. This period has been difficult for investors to navigate, especially when it comes to core bond funds.

A Brutal 2022 and a 2023 Rebound

For bond investors, 2022 was a grim year. The market contended with the highest inflation rate in four decades, as well as aggressive interest-rate increases by the Federal Reserve. The bond market as measured by the Morningstar US Core Bond Index lost 12.9%, while funds in the intermediate-term core bond Morningstar Category lost 13.4% on average.

The first quarter of 2023 turned out to be a roller coaster for the bond market, as expectations for the Fed swung widely. It was first believed there’d be an end to the rate hikes, and then the consensus formed that there’d be more tightening as economic data proved stronger than expected and inflation remained high. But as the second quarter ended and the third quarter got underway, bonds rallied after the collapse of Silicon Valley Bank led to worries about a recession kicked off by a credit crunch.

So far, 2023 has been a smoother ride for bond investors, as core bonds have on average returned 2.4%, compared with a 2.2% gain for the Morningstar Core Bond Index.

But for the past 12 months, bond investors have still been nursing losses. Core bond funds are down 1.6% for the 12-month trailing period ending June 8, 2023, while the bond market is off 1.3%.

Intermediate Core Bond Funds vs. the US Core Bond Index

What Are Core Bond Funds?

Core bond funds are key building blocks of most diversified portfolios. The intermediate-term core bond category consists primarily of high-quality, investment-grade U.S. bonds. Core bond funds typically hold roughly 40% of their portfolios in U.S. Treasuries, about 25% in government agency mortgage-backed securities, and the remaining 25% in investment-grade corporate bonds.

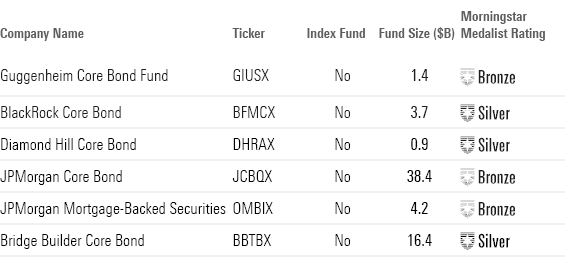

6 Top-Performing Core Bond Funds

To screen for the best-performing intermediate-term core bond funds, we looked for those that have posted top returns across multiple time periods.

We first screened for funds that ranked in the top 33% of the category using their lowest-cost share classes over the past one-, three-, and five-year time frames. In addition, we screened for funds with Morningstar Medalist Ratings of Gold, Silver, or Bronze for those classes. We also excluded funds with less than $100 million in assets.

From this group, we’ve highlighted the six funds with the best year-to-date performance. The group only includes actively managed funds. For details on each fund’s performance track record, see the table at the end of this article.

Top-Performing Core Bond Funds

Guggenheim Core Bond

- Ticker: GIUSX

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 5 stars

“The good news for investors is that the strategy has historically enjoyed peer-beating long-term returns and modest volatility, and neither cutting risk in 2018 and 2019 nor its 2022 weakness badly tarnished that record. Reducing risk in recent years made the strategy one of the best performers during the early 2020 pandemic selloff, and pivoting to add risk back quickly after markets plummeted helped produce top-decile returns in 2020 and relative success in 2021. As such, its trailing returns of three years or longer, including its gains since CIO Anne Walsh joined the fund in late 2012, still hovered near the top of the category through February 2023.

“After markets imploded in the 2020 pandemic selloff, the team dumped most of its short-term holdings and government debt and backed up the truck to load up on beaten-down corporate credit. By the end of 2020, nearly 40% of its assets consisted of investment-grade corporate exposure, with another 11% in below-investment-grade fare.

“The team has since balanced out the portfolio, shifting some assets back into a mix of collateralized loan obligations, asset-backed securities, residential mortgage-backed securities, and commercial MBS. Those sectors totaled 45% at the end of 2022, still well below their peak level in early 2017, with a higher-quality profile. At the same time, investment-grade bonds accounted for 30% of the portfolio.”

—Eric Jacobson, director

BlackRock Core Bond

- Ticker: BFMCX

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

“Over a 10-year period, this share class outpaced the category’s average return by 37 basis points annualized. It also beat the category index, the Bloomberg U.S. Aggregate Bond Index, by an annualized 17 basis points over the same period.

“The risk-adjusted performance only continues to make a case for this fund. The share class outstripped the index with a higher Sharpe ratio, a measure of risk-adjusted return, over the trailing 10-year period. These strong risk-adjusted results have not come with a bumpier ride for investors. This strategy took on a similar risk as the benchmark, as measured by standard deviation. Finally, the share class proved itself effective by generating positive alpha over the same 10-year period against the category group index.

“This strategy has a 2.9% 12-month yield, higher than its average peer’s 2.7%. And its 30-day SEC yield (a measure similar to yield to maturity) sits at 4.1%. While a higher yield may deliver more income, it also tends to indicate higher credit risk. But that isn’t always the case. Over the past 12 months, the average yield of the fund has been higher than the average yield of its category peers.”

—Morningstar Manager Research

Diamond Hill Core Bond

- Ticker: DHRAX

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

“Over the past three-year period, it beat the Bloomberg U.S. Aggregate Bond Index by an annualized 95 basis points and outperformed its average peer by 65 basis points. And more importantly, when looking across a longer horizon, the strategy outpaced the index. Over five years, it led the index by an annualized 29 basis points.

“The share class outstripped the index with a higher Sharpe ratio over the trailing five-year period. Often, higher returns are associated with more risk. However, this strategy stayed in line with the benchmark’s standard deviation. Finally, the share class proved itself effective by generating positive alpha over the same period against the category group index.

“This strategy has a 3.1% 12-month yield, higher than its average peer’s 2.7%. In addition, it has a 4.0% 30-day SEC yield.”

—Morningstar Manager Research

JPMorgan Core Bond

- Ticker: JCBQX

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 4 stars

“Since Rick Figuly’s first full month as managing director on the strategy in October 2015, the U.S.-domiciled fund’s R6 share class’ 1.56% annualized return through March 2023 beat the Aggregate Index’s 1.15% and its unique intermediate core bond category median peer’s 1.18%. While this ranked in the upper quintile of peers, volatility-adjusted performance was just as strong; the fund’s Sharpe ratio was better than the benchmark and ranked in the upper quintile. That it achieved this result with lower volatility relative to peers speaks to the team’s ability to effectively select securities with stable cash flows and manage overall risk.

“Over the past year through March 2023, amid sharply higher yields and wider credit spreads, the R6 share class’ 3.95% loss was less severe than its benchmark’s 4.61% and its median peer’s 4.89% drop, led by strong security selection in agency MBS and ABS sectors.”

—Paul Olmsted, senior analyst

JPMorgan Mortgage-Backed Securities

- Ticker: OMBIX

- Morningstar Medalist Rating: Bronze

- Morningstar Rating: 5 stars

“Agency-backed residential and commercial mortgages dominate the portfolio, typically 65% to 75% of assets, which differentiates the strategy from peers that often maintain stakes in bonds of this ilk that range from 20% to 25% of assets. The fund complements its agency-backed stake with nonagency residential and commercial MBS and asset-backed bonds, while the team maintains a small U.S. Treasuries to bolster liquidity.

“The strategy’s contours differ from those of many of its category peers. Its lack of corporate-bond exposure causes it to lag more credit-focused options when markets embrace risk. But in broadly risk-averse markets, its high-quality, mortgage-centric holdings tend to give it a boost. This resiliency, paired with the team’s strong security selection and subtle shifts across securitized sectors, has paid off with impressive performance over portfolio manager Michael Sais’ July 2005–August 2022 tenure. The I share class’ 3.8% annualized return outpaced its median distinct rivals’ 3.2%, landing in the top decile of its peers and delivering a category-best Sharpe ratio.”

—Paul Olmsted, senior analyst

Bridge Builder Core Bond

- Ticker: BBTBX

- Morningstar Medalist Rating: Silver

- Morningstar Rating: 4 stars

“An analysis of the strategy’s portfolio shows it has maintained an underweight position in A-rated bonds and government bonds compared with category peers. The strategy’s parent organization is industry standard, albeit with some strong attributes like overall affordable fees and a strong risk-adjusted track record.

“This share class led its average peer by an annualized excess return of 69 basis points over a nine-year period. It also beat the Bloomberg U.S. Aggregate Bond Index by an annualized 44 basis points over the same period.

“The risk-adjusted performance only continues to make a case for this fund. The share class led the index with a higher Sharpe ratio over the trailing five-year period. Notably, these strong risk-adjusted results have not come with more volatility for investors.”

—Morningstar Manager Research

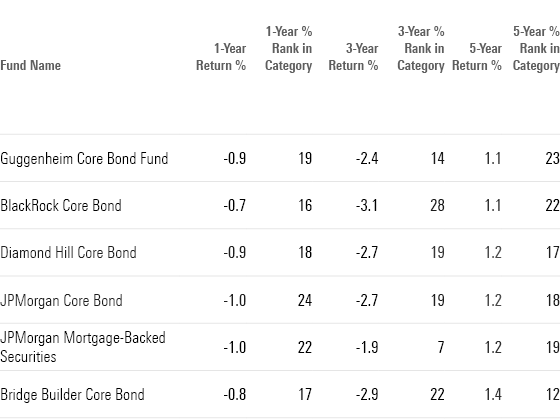

Long-Term Returns of Top-Performing Core Bond Funds

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4513c31c-df10-4538-9285-4707e579cd32.jpg)