Why a Huge Emerging-Markets Fund Is Reopening to New Investors

This prominent offering has been closed for nearly 10 years.

A large, long-shuttered emerging-markets stock fund will reopen to new investors this month as developing-country equities, and the strategy, show signs of life after a stretch of moribund performance.

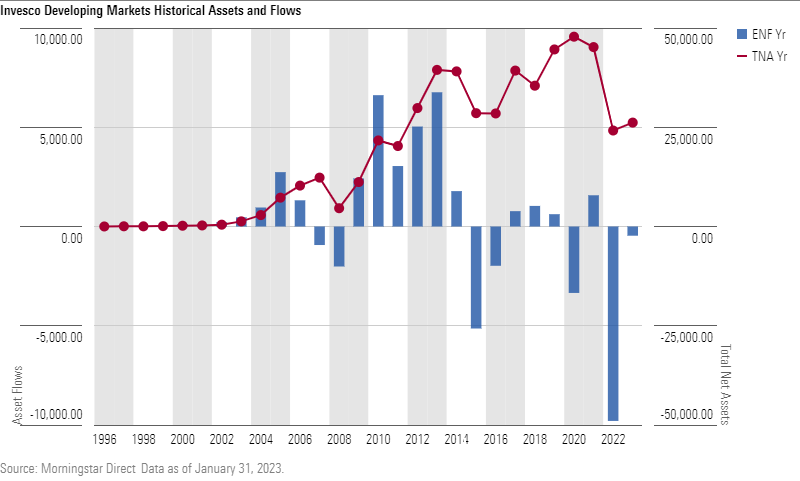

After being soft-closed for nearly 10 years, Invesco Developing Markets ODMAX and its associated accounts will reopen to new investors at the close of business on Feb. 28, 2023. It’s not that the strategy is starving for assets: With $29.6 billion in assets at the end of January—$26.2 billion of that in the mutual fund—it was the third-largest strategy in the diversified emerging-markets Morningstar Category.

Investors had been attracted by its strong long-term record. This strategy, managed by Justin Leverenz since May 2007, has been one of the more successful broad emerging-markets offerings. Or at least it was; the fund stumbled in the past two years. It suffered substantial losses in both 2021 and 2022, landing in the bottom quartile of the category each year. (It had never landed in the bottom quartile In Leverenz’s first 13 calendar years at the helm.) The mutual fund alone had nearly $10 billion in net outflows in 2022, which, along with a 25% decline that year (for the Y shares), greatly diminished the asset base.

The strategy had approximately $37 billion under management when it closed to new investors in April 2013. It subsequently grew even larger; at the end of 2021, the mutual fund alone had $47.8 billion in assets. So, its asset base has declined 45% in just over a year. The firm did not provide detailed reasons for the decision to reopen at this time, saying only that attractive opportunities are currently available in the market. Prices are certainly lower; along with nearly every other asset class, emerging-markets stocks declined sharply in 2022, with the Morningstar Emerging Markets Target Market Exposure Index dropping 18.2%.

There were two main culprits for the fund’s relative weakness in recent years. In the second half of 2021, the drastic regulations imposed by China’s government on the education companies—essentially ending their business prospects—took a toll on several holdings, including New Oriental Education EDU. Then the portfolio entered 2022 with a 9.1% stake in Russia; this was heavily overweight versus indexes and peers. Leverenz later conceded that he considered it unlikely that Russia would invade Ukraine and didn’t trim that stake even as signs became more ominous in early 2022. The fund’s Russia stocks fell sharply in value even before the invasion began in late February 2022, and soon thereafter they were valued at zero.

The strategy retains its Morningstar Analyst Ratings of Bronze for all share classes except the expensive C shares, which carry a Neutral rating.

It’s hard to say what, if anything, the fund’s reopening says about emerging-markets stocks in general. The average diversified emerging-markets equity fund fell nearly 21% in 2022, harder than the average U.S. stock fund’s plunge of more than 18% and the mean non-U.S. stock fund’s near-20% drop.

Emerging-markets funds began to rebound in late 2022, though, and the rally continued into 2023 with the category average rising 8.3% in January alone. (Invesco Developing Markets gained 10.2% in January.) Net cash inflows into emerging-markets stock funds and exchange-traded funds also have bounced back since they registered $6.8 billion in outflows in 2020 at the start of the coronavirus pandemic. From January 2021 through the end of January 2023, these funds took in more than $68 billion in inflows, including more than $4.5 billion so far this year, according to Morningstar Direct.

Thus there are no clear signals about the prospects for such funds, but some reputable asset allocators, such as GMO and AQR, thought emerging markets offered some of the best long-term prospective returns at the start of the year.

However, before jumping into Invesco Developing Markets or any other emerging-markets fund, first be sure to consider the effect on your overall portfolio and long-term financial plan, and to investigate each potential choice to ensure that you are comfortable with its approach, costs, and other traits.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/657019fe-d1b1-4e25-9043-f21e67d47593.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/657019fe-d1b1-4e25-9043-f21e67d47593.jpg)