The New Investor’s Guide to Building an ETF Portfolio

How to put your extra cash to good use.

You have built an emergency fund, started a plan to pay off your debt, and stashed away some extra cash. Congratulations, you are now ready to put your money to work by investing!

And yes, you need to put that cash to use if you want to keep up with rising costs from the current 3% inflation rate. Even if you start with as little as $100, the magic of compounding can make a difference over the long term.

Getting started with investing can feel overwhelming, but there’s no need to panic. Here, we’ll walk through the steps to build a portfolio of index exchange-traded funds that works for your financial needs.

Why should you focus on index ETFs? These funds are the easiest, most straightforward way to gather your money into a collective pool that invests in a broad range of stocks or bonds. They give you the return of a broad segment of the market at a razor-thin price tag, and you can buy one on any trading platform at no investment minimum.

The Basics: How to Start Building Your Investment Portfolio

A broad portfolio of stocks is typically a good starting point for younger investors: It allows you to capture stock market gains without betting on a single company. Adding a small dash of bonds to your stock portfolio can provide a cushion when the stock market occasionally falters in the short term.

How many stocks and how many bonds should you own? If you invest in index ETFs that hold a large swath of the entire stock or bond market, you can focus on a general ratio instead of worrying about exact numbers. The ratio between stocks and bonds depends on your risk tolerance, time horizon, and investment goals.

Generally, younger investors with longer time horizons should invest more in stocks and hold on to them, because their price volatility typically smooths out over longer periods.

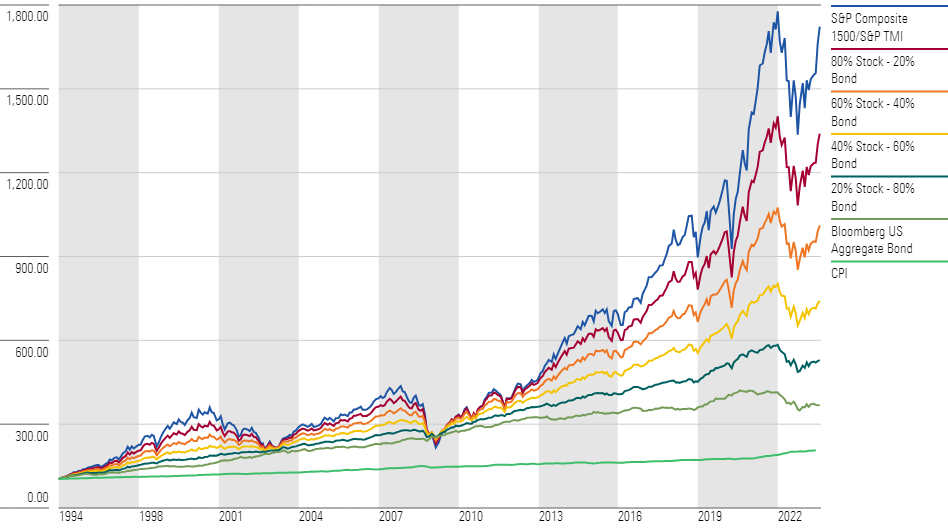

Let’s look at how $100 would have increased and decreased in value when invested in different mixes of stocks and bonds. The chart below shows this journey over nearly 30 years from January 1995 through July 2023.

The S&P US Total Market Index represents the stock piece of each portfolio, while the Bloomberg US Aggregate Bond Index represents the bond piece.

Growth of $100 for Various Asset Mixes over the Past 30 Years

What can we learn from this chart? Two main things:

- Power of compounding: All of the asset mixes in the chart had positive returns that outgrew inflation (proxied by the Consumer Price Index); the investor came out ahead in every scenario. The real magic here is time: The longer investment period erased even the most significant market drawdowns, such as the 2000 dot-com bubble, the 2008 global financial crisis, or the 2020 pandemic shock.

- With lower risk comes lower reward: During those market shocks, asset mixes with more bonds suffered less than stocks. However, stocks recovered their losses over the next few years and vastly outperformed bonds over the long term. Investors with a longer time horizon can significantly miss out on gains if they focus on short-term risks and put too much in bonds.

While we have no BuzzFeed quiz or sorting hat to determine exactly what your target asset mix should be, target-date funds can provide a handy approximation. These funds are designed to maximize your investments over a predetermined time period, assuming that you’ll start withdrawing money at a target year (typically, the year you retire).

For instance, let’s say a 25-year-old investor is trying to retire by age 57. They can invest in a 2055 target-date fund, which would likely have between 85% and 95% of its portfolio in stocks, as of mid-2023.,

By buying a target-date fund, you outsource the decision-making to a professional asset manager, who will slowly move your money toward less risky, bonds as you get closer to the target date.

However, it can be cheaper and easier to customize your portfolio if you do it yourself. And using ETFs instead of mutual funds can reduce the income tax you pay on interest income if you are holding these outside of your 401(k) or IRA.

The Recipe for Investing in ETFs

Ingredients: Index-tracking ETFs, which means they hold a broad swath of stocks or bonds in order to replicate the returns of an entire market segment. Why? They are accessible, generally diversified, and, most importantly, cheap.

- Accessible: ETFs do not require any minimum amount to invest, unlike mutual funds. They are also available on most brokerage platforms.

- Diversified: Put your eggs into different baskets so you won’t lose them all should any basket fall. This means investing in a mix of stocks and bonds, as well as investing in different stocks and different bonds. Even the biggest companies lose money sometimes, but chances are they’re not all going down together, or to the same extent. A broad index fund with thousands of stocks or bonds will ensure not all of your money is invested in a losing name and will help you capture a bit from each of the market’s winners.

- Cheap: On average, broad-market, passive ETFs have lower fees than any other type of funds available. That’s because they rely less on a human to pick a winner (and more on tracking the overall market), and any dollar not paid to an investment manager is a dollar back in your pocket. With the magic of compounding, that advantage will add up big over time. ETFs are also more tax-efficient than their mutual fund counterparts.

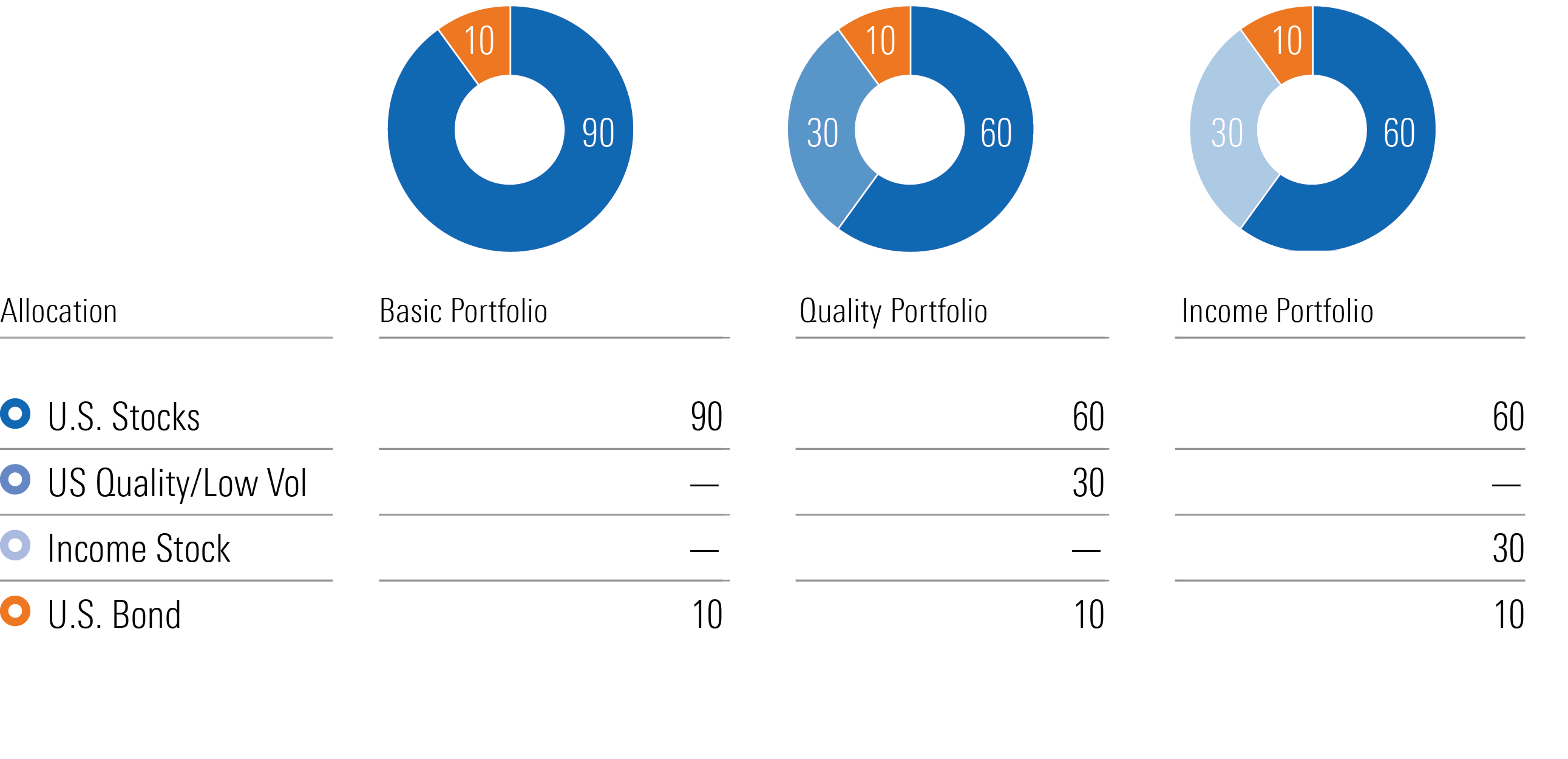

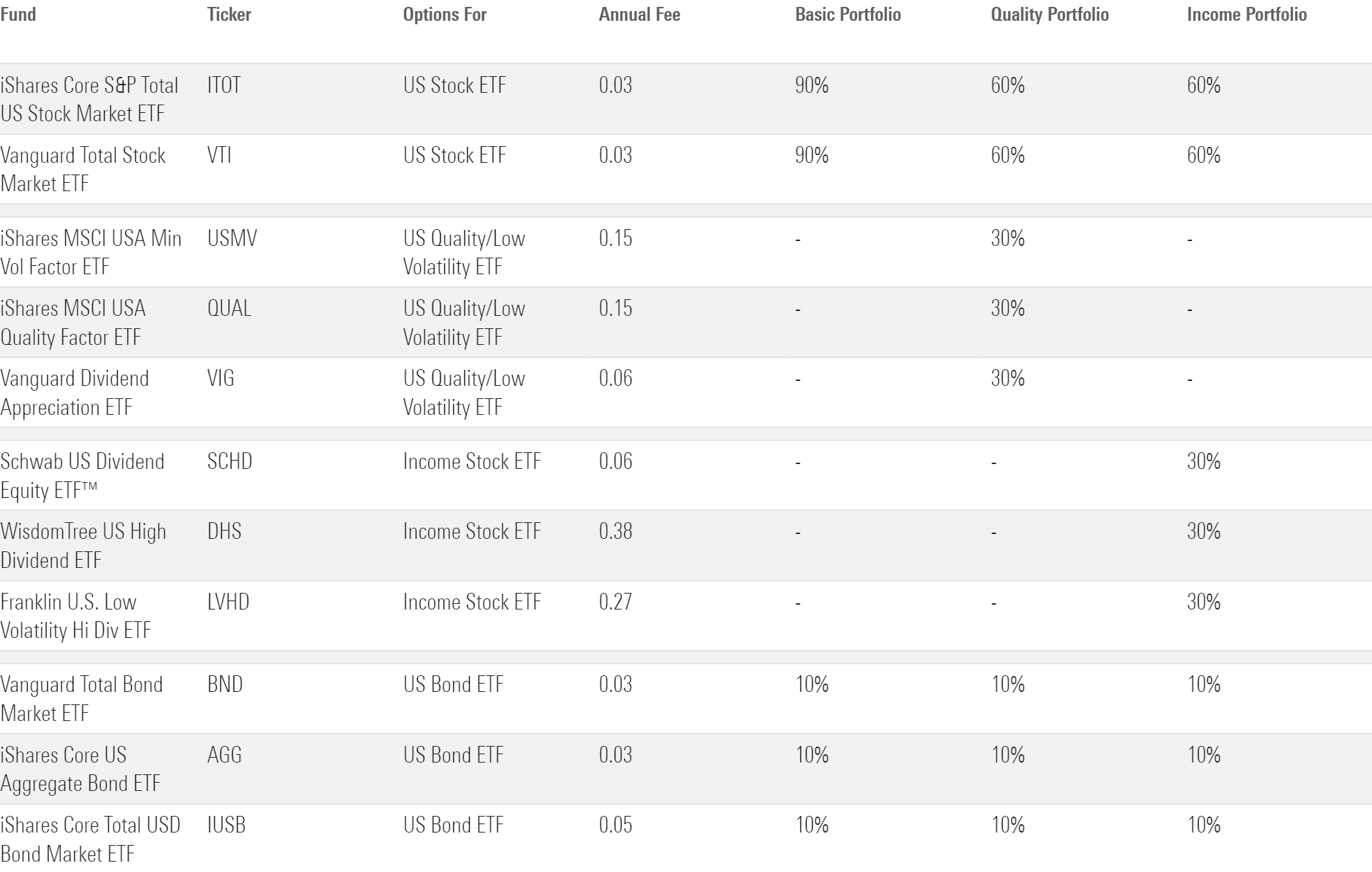

Instructions: So what do these portfolios look like? The next two exhibits provide several sample ETF portfolios as starting points for your journey. This assumes your portfolio is holding 90% stocks and 10% bonds, which is appropriate for most young investors.

- Basic Portfolio: Like a classic family recipe, this portfolio is convenient and time-tested. Two broad index funds that capture most of the U.S. stock market and investment-grade (that is, less risky) bond market form the backbone of this portfolio.

- Quality Portfolio: If holding onto a fund during a downturn sounds like too much to bear, you can rest easier by investing some of your stock sleeve in ETFs with lower volatility than the broader market. Try ETFs that explicitly choose stocks for minimal volatility, like iShares US Minimum Volatility Factor USMV. ETFs that target high-quality companies, such as iShares MSCI USA Quality Factor ETF QUAL or Vanguard Dividend Appreciation ETF VIG, are also compelling options.

- Income Portfolio: If the benefit of regular dividends outweighs the cost of paying taxes on that income for you, these ETFs might be worth a look. They all target high-yielding companies while employing additional screens to avoid distressed firms with shaky balance sheets.

Sample ETF Portfolios

What ETFs to Invest In?

Like a plant, your ETF portfolio needs regular care:

- Feed your portfolio with nutrients—set aside a portion of your income for regular contributions. Many brokers allow you to automatically deposit a fixed amount monthly, as well as automate any necessary trades. That’s one less thing on your to-do list and one more month your money is invested.

- Establish a rebalancing frequency—whether it’s monthly, quarterly, or annually—to keep your portfolio from drifting away from its target allocation as the market moves. (Here’s more on the ins and outs of rebalancing.)

“It’s Me, I’m the Problem”

While your time horizon and investment goals might allow you to take on more risk, you might not necessarily feel like doing so. On the other hand, some people might think they can afford to take on more risk than they actually do. Behavioral biases such as loss aversion or recency bias might be at the root of these mismatches, and it’s important to recognize them.

It’s understandable if newer investors are not impressed by all the recent commotions in the market.

However, a stock-heavy portfolio generally recovers well from the deepest of market downturns over longer stretches, as we saw in the first chart. Simply sticking to the instructions laid out above and holding on through the worst of times is enough.

Our experts can offer some more guidance to make sense of the uncertainties during difficult markets.

If you still feel skittish, try putting things in perspective by adopting a bucketing approach to your financial needs.

- Living expenses or health emergencies should come from the first bucket: cash from your checking account.

- A second bucket with moderate risk can grow your income to take care of planned large purchases (such as a house or a car).

Once you’ve handled these items, the rest of your money should go into a general investment portfolio with a simple goal to grow in value and battle inflation. This last portfolio can be left alone until you retire, which allows it to handle more risk.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)