6 Charts on the Market's Reaction to Russia-Ukraine War

Volatility has reigned with oil prices soaring, stocks falling and inflation fears worsening.

Editor's note: Read the latest on how Russia's invasion of Ukraine is affecting the global economy and what it means for investors.

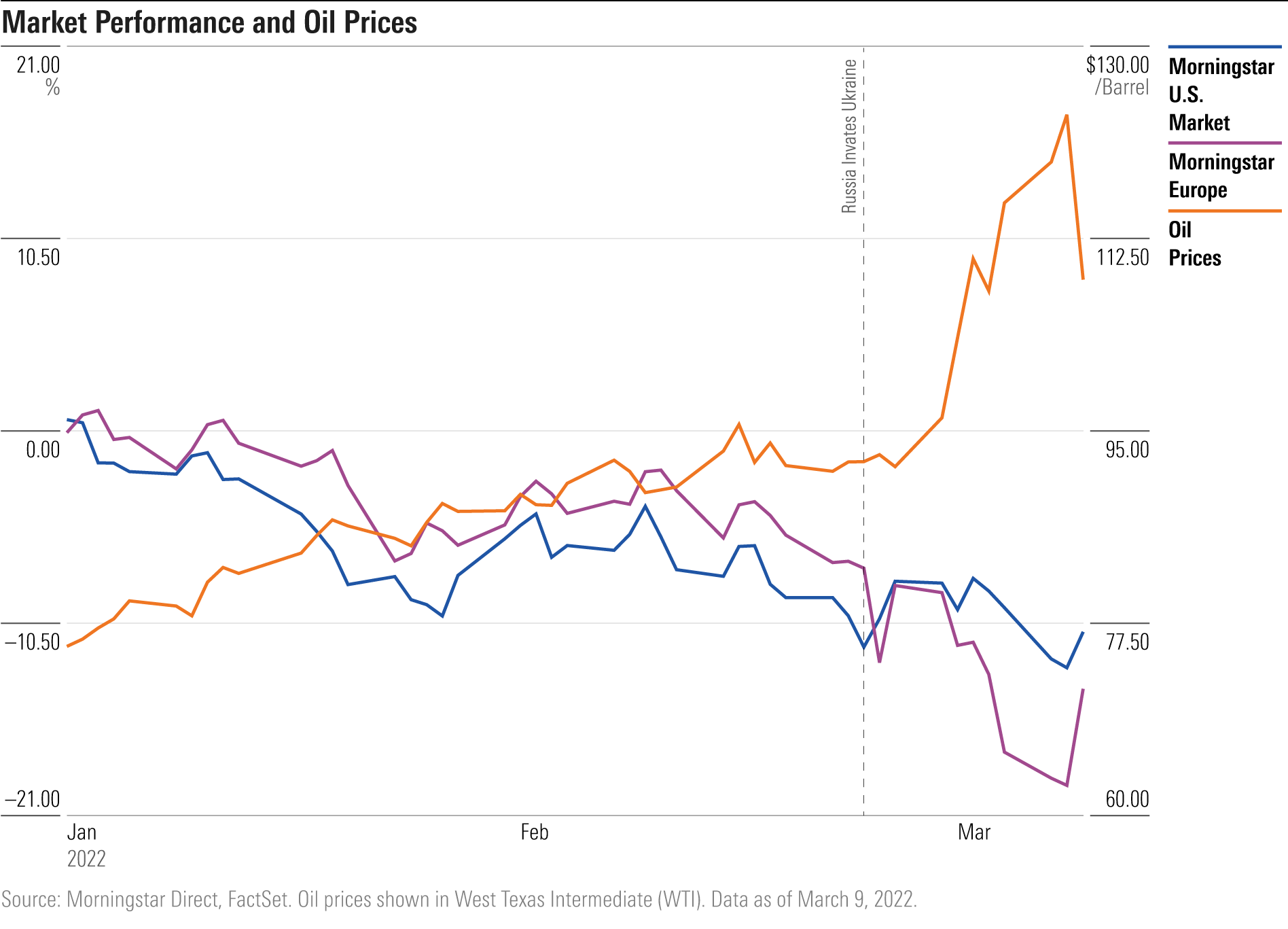

For two weeks investors have been feeling the impact of Russia's invasion of Ukraine in their portfolios, primarily in waves of volatility across the world's financial markets.

Since the conflict began, Morningstar’s U.S. Market Index is down 1.4% and the Morningstar Europe Index dropped 7.7%. The drop in Europe has wiped out nearly 60% of the gains earned last year. Volatility continues as the market correction extends into March. Shares in energy companies are up as travel and bank stocks have declined. And investors have had to temper expectations for interest rate hikes, even as inflation continues.

Oil prices are on a tear, closing at $108.70 per barrel on March 9. Prices have risen as non-energy sanctions have made it more difficult for Western customers to purchase oil from Russia oil, says David Meats, Morningstar director of equity research for energy and utilities. The cost for other commodities exported by Russia and Ukraine are up as well.

For the year, the U.S. market index is down 11%, and the European index has fallen about 14%, dropping to its lowest levels since March 2021.

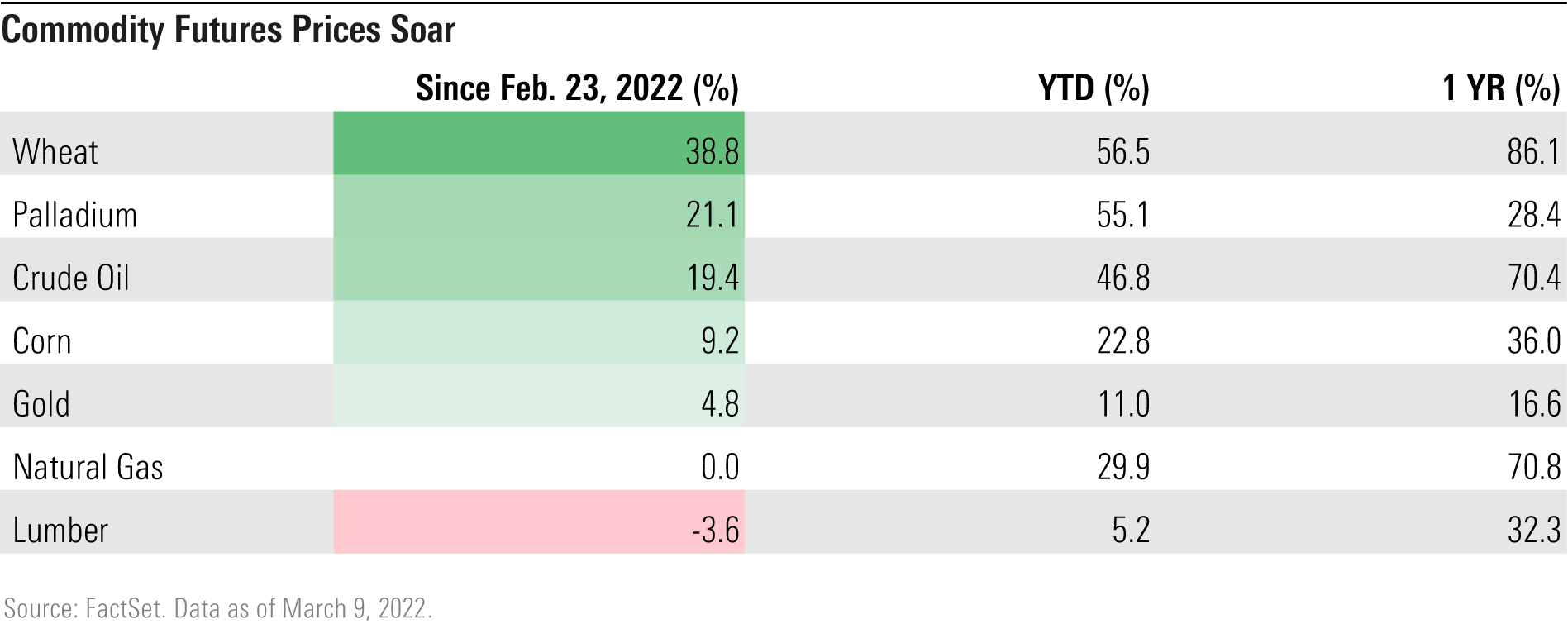

Commodities

Russian and Ukrainian commodity exports have rallied. Among the largest gainers is wheat, of which Russia is the world's largest exporter, providing 18.4% of the world's supply in 2019. Ukraine exported 7%, the fifth-largest exporter in 2019, according to the Observatory of Economic Complexity (OEC). Prices have soared 38.8% since the start of the invasion, adding to last year's gain of 86.1%. They are now at their highest levels since March 2008.

Palladium, another major Russian export, is up 21.1% since Feb. 23. This is the first bull market for the precious metal in over a decade. The all-time high was set in 2001, and current prices are nearly three times the number from that period. Corn is approaching a 10-year high.

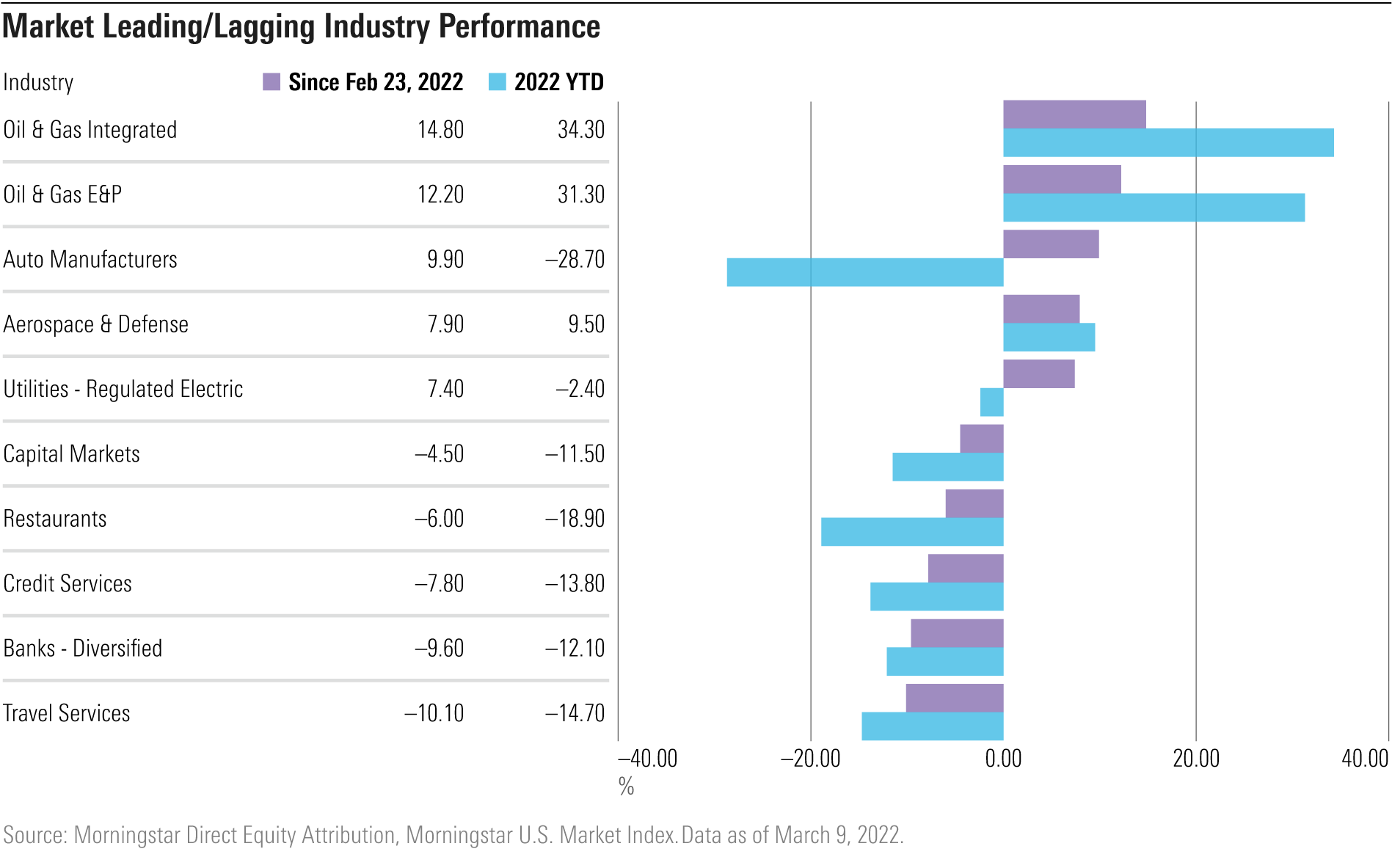

Equities

The energy sector has been the top performer in the market since Feb. 23, continuing the strong run it had in 2021. Exxon Mobil XOM is this year’s top contributor for the Morningstar U.S. Market Index, rising about 35.3% year-to-date. Its competitor Chevron CVX has gained 25.6% since the war started, and is up about 36% for the year. The oil exploration and production firm Occidental Petroleum OXY, makes up a smaller portion of the U.S. market index compared to Exxon and Chevron, is up nearly 94% this year. Also on the rise are aerospace and defense contractors.

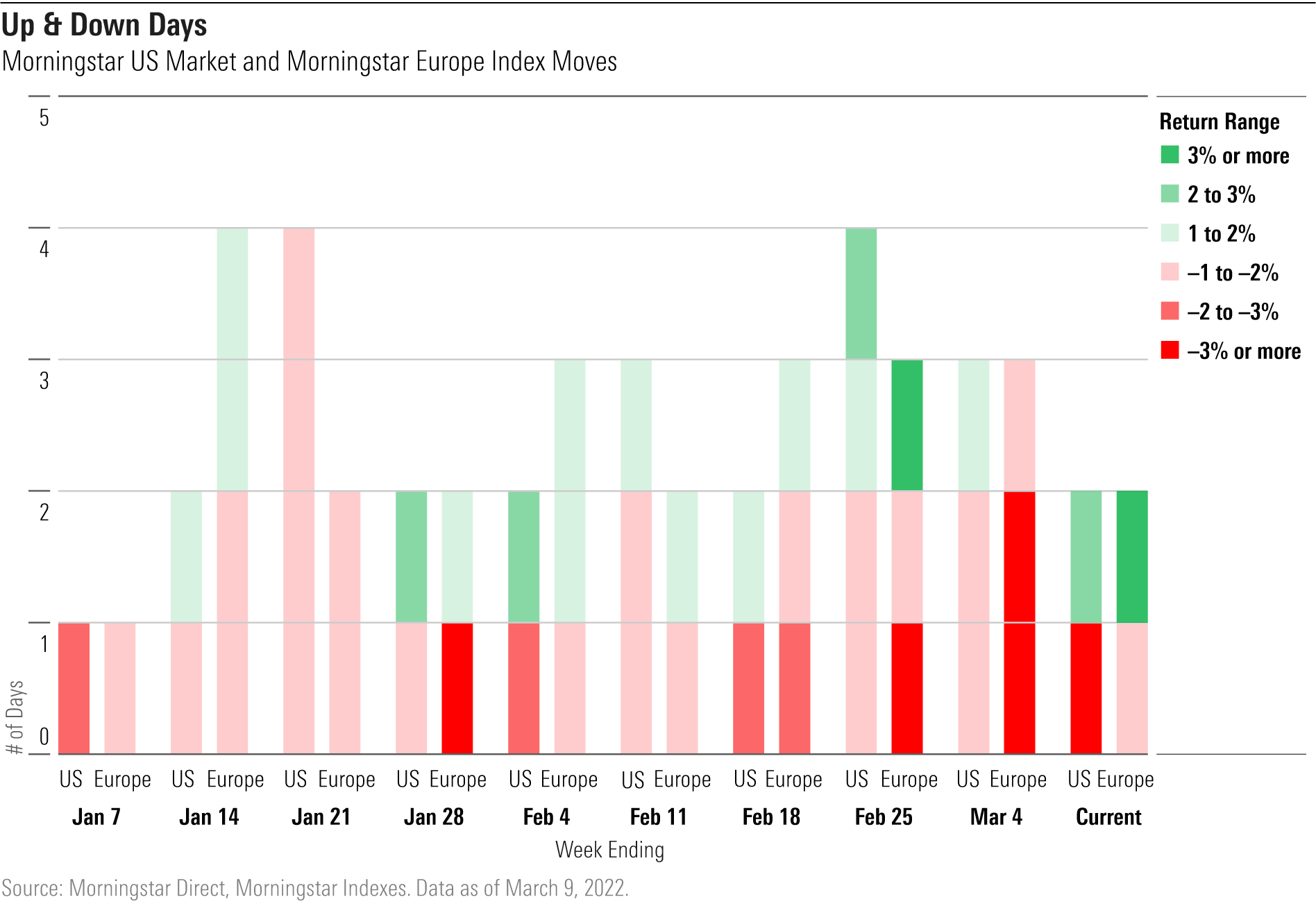

Volatility

U.S. and European markets have faced similar amounts of volatility in 2022. However, European stocks have seen slightly more drastic swings in day-to-day trading. Since the start of the year, Europe has had four days where the market fell more than 3% in a single day, with two after the war started. The U.S. has experienced just one day with a loss of 3% or more this year.

-

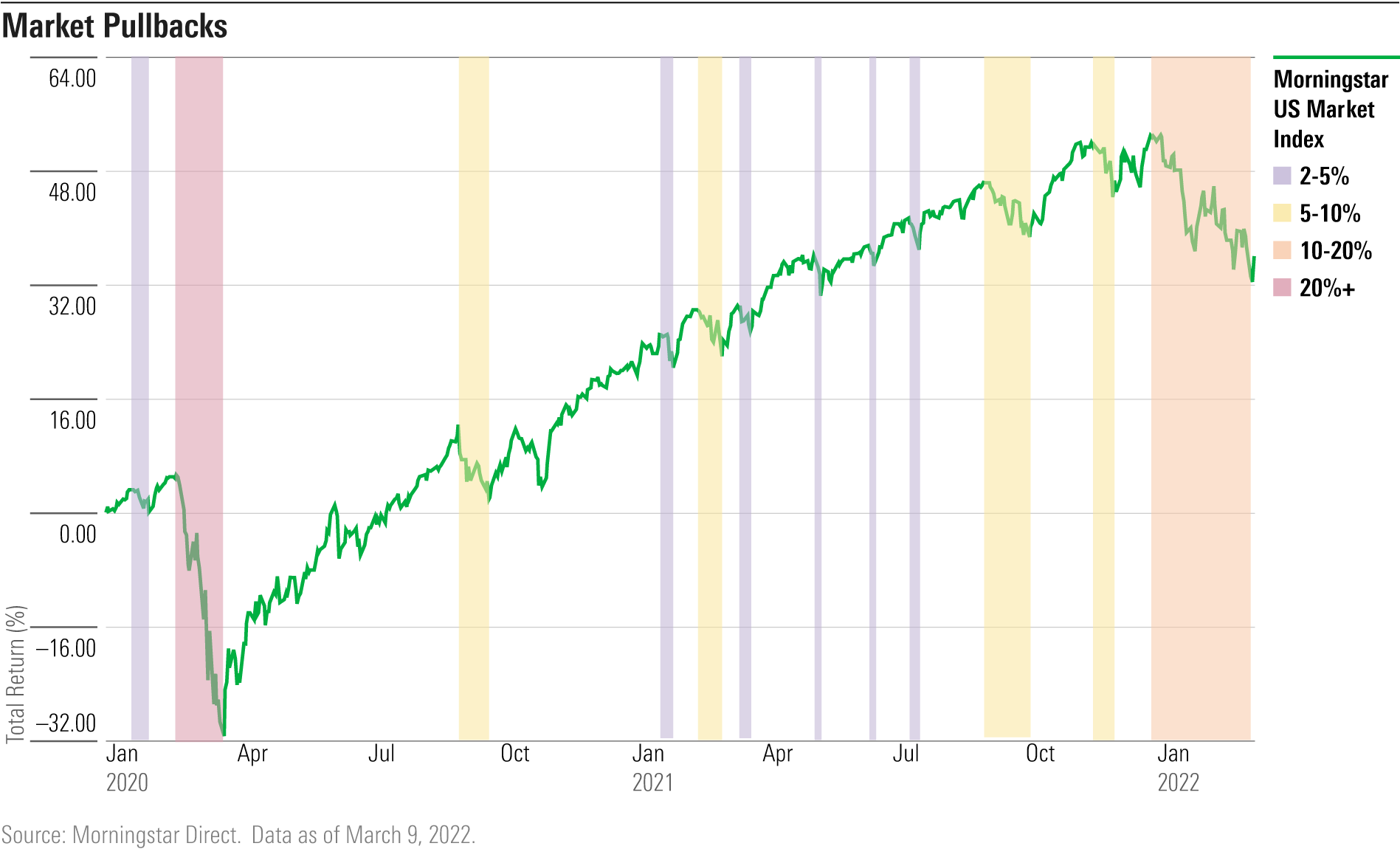

Market losses continue, expanding the correction that the Morningstar US Market Index has seen this year. A "correction" is a drop of 10% in the market from its most recent peak. As of March 8, the index is 13% below its all-time high on Jan. 3, the largest pullback since the pandemic sell off in March 2020.

Inflation

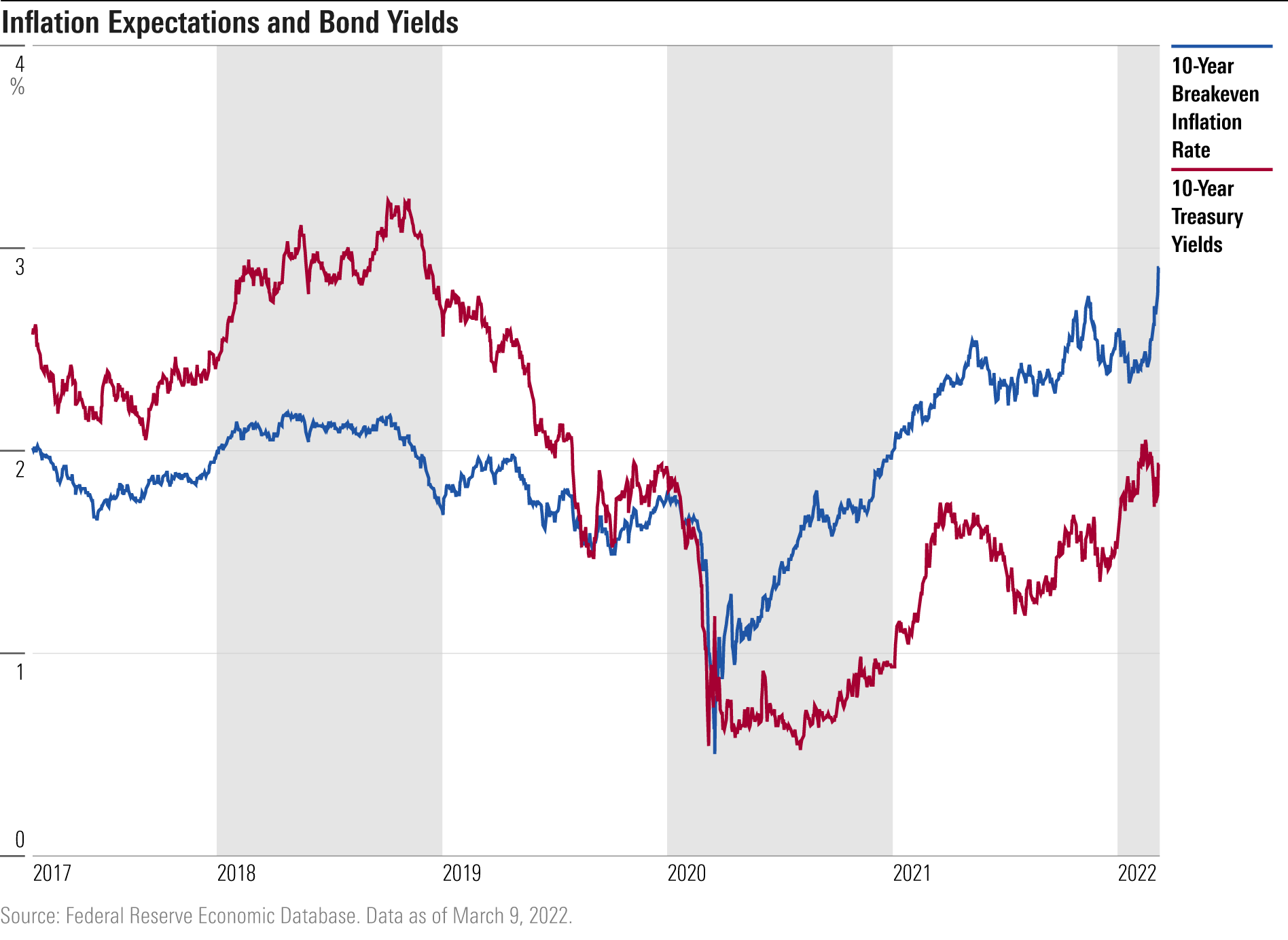

Since March 2020, the 10-year breakeven inflation rate--a measure of where the market thinks inflation will be in a decade--has been higher than yields on 10-year treasury bonds. This implies that investors who own treasuries will lose money.

This pattern, which showed signs of recovery in early February, has now renewed in strength after Russia’s invasion. The gap between the breakeven inflation rate and 10-year treasury yields is 0.97%, after narrowing to 0.42% on Feb.16.

Expectations are low that the Fed will strike a hawkish stance when raising interest rates to curb inflation. A month ago , there was a 24% chance of a 0.5% interest rate hike, but those expectations have virtually disappeared. The market has now priced in a more cautious boost of 0.25% , which Federal Reserve chief Jerome Powell has signaled he will support at the March 16 Fed meeting.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)