15 Top-Quality Stocks

These names were recently added to the Morningstar Wide Moat Focus Index.

Good news: The National Oceanic and Atmospheric Administration's Climate Prediction Center's latest forecast calls for warmer-than-average temperatures for much of the U.S. this winter. Those of us in Chicago sure hope that's true: Last winter's stretch of double-digit subzero temperatures is still fresh in our minds. The NOAA updates its three-month outlook each month; fingers crossed that the forecast stands in the next update.

Like the NOAA, Morningstar updates the constituents in its indexes regularly. Today, we’re taking a look at the latest updates to the Morningstar Wide Moat Focus Index.

The Morningstar Wide Moat Focus Index tracks companies that earn Morningstar Economic Moat Ratings of wide and that are trading at the lowest current market price to fair value. How has this collection of high-quality names performed over time? Pretty well: The index has beaten the S&P 500 during the trailing one-, three-, five-, and 10-year periods. As a result, the index's constituents are a fertile hunting ground for investors looking for high-quality stocks trading at reasonable prices.

In an effort to keep the index focused on the least-expensive high-quality stocks, we reconstitute the index regularly. The index consists of two subportfolios containing 40 stocks each, many of which are overlapping positions. The subportfolios are reconstituted semiannually in alternating quarters, on a "staggered" schedule. We re-evaluate the index's holdings and add and remove stocks based on a preset methodology. Because stocks are equally weighted within each subportfolio, the reconstitution process also involves right-sizing positions.

After the most recent reconstitution on Sept. 20, half of the portfolio added 15 positions and eliminated 15. The index now holds 51 positions.

The stocks of three drugmakers--Bristol-Myers Squibb BMY, Merck MRK, and Amgen AMGN--joined the index. Like most in their industry, these stocks are lagging the broader market this year.

“U.S. politicians have continued to focus on new policies limiting drug pricing power, creating pressure on valuations in the industry,” explains sector director Damien Conover. “However, we believe the focus of drug development is in areas of unmet medical need, which tends to support strong pricing even within the context of the new policies aimed at restricting drug pricing.”

Also from the healthcare sector, UnitedHealth Group UNH makes the list.

“Under one roof, UnitedHealth houses the largest private health insurer, a leading ambulatory care and health analytics franchise, and the soon-to-be second-largest pharmacy benefit manager by volume in the country,” notes Conover. “Cost advantages and network effects generated by the company's size and scope underpin UnitedHealth's wide moat and we think support its ability to serve clients at a lower overall cost than that of rivals. The result is enrollment growth and returns on capital that are nearly unachievable by competing firms.”

Two energy companies--Cheniere Energy LNG and Core Laboratories CLB--made the cut. The former is a significant player in the liquefied natural gas space; its moat is driven by an intangibles moat source.

“The intangibles moat source is derived primarily from the 20-year take-or-pay contracts that both entities have signed with multiple customers to liquefy natural gas that essentially put Cheniere in an incredibly strong competitive position as a pure toll-taker with no commodity price risk,” argues sector strategist Stephen Ellis.

The latter possesses the strongest moat across our entire oilfield-services coverage, reports analyst Preston Caldwell.

“The company’s foundational core analysis business in the reservoir description segment, in particular, has been virtually unchallenged over the past three decades,” he reports. “The business passes the Warren Buffett quality test, whereby even an ‘idiot’ could likely run the business with some profitability.”

{Deep dive: Core Lab Has the Strongest Moat in the Industry}

Here's a little about each of the remaining additions. Altria Group MO: Although no longer a pure play on U.S. cigarettes (smokeless tobacco and wine also contribute to EBIT, as will vaping and cannabis in the near future), they drive earnings today. And although the U.S. cigarette market is in secular contraction, the ability to price above the rate of volume declines should allow Altria to continue to boost its earnings, revenue, and dividend, assures director Phil Gorham.

Veeva Systems VEEV: A leading supplier of vertical software solutions for the life sciences industry, Veeva boasts a wide moat thanks to its high switching costs and its domain expertise, maintains analyst Soo Romanoff. Incremental offerings and a global rollout only further solidify Veeva’s leadership position.

{Deep Dive: Veeva Extends Its Leadership}

Berkshire Hathaway BRK.A BRK.B: Sector strategist Gregg Warren thinks two concerns--that the firm’s size will muffle future growth and that Warren Buffett’s eventual departure will pummel shares--have kept investors on the sidelines. But we nevertheless like Berkshire for its diversification, strong balance sheet, and attractive valuation today.

{Deep Dive: 5 Reasons to Consider Buying Berkshire Hathaway}

Polaris PII: An old timer in the power sports field, Polaris’ brands, innovative products, and efficient manufacturing underpin its wide economic moat, asserts senior analyst Jaime Katz. We expect the business to continue to capture increasing volume and profits as it reaches new users.

{Deep Dive: Polaris Revs Up Profit Growth With Acquisitions}

ServiceNow NOW: The software solutions provider practices a classic land and expand strategy, observes analyst Dan Romanoff. The firm built a best-of-breed software solution for IT service management and since then has introduced additional features and add-on solutions that have allowed it to expand into the larger IT operations management market.

{Deep Dive: ServiceNow: An Undervalued Disruptor Firing on All Cylinders}

Cerner CERN: An early mover, Cerner is now the largest healthcare IT service provider. The firm has benefited from the healthcare digitization trend, observes analyst Soo Romanoff. And as the industry has matured, Cerner has expanded its services to expand beyond acute medical records to outpatient and analytics, too.

Domino’s Pizza DPZ: Although it faces growing competition, we’re nevertheless optimistic about the company’s asset-light business model and long-term growth potential, says sector strategist R.J. Hottovy. Its well-known brand, peer-beating technology developments, and cost advantages have helped the firm dig a wide economic moat--no easy task for restaurant operators.

NIKE NKE: We view Nike as the leader of the athletic apparel market, stresses analyst David Swartz. Given its brand, we think the firm will be able to continue to command premium prices. Moreover, its investment in its direct-to-consumer network should bring the brand even closer to consumers, allowing the firm to hold market share.

United Technologies UTX: The diversified industrial recently announced plans to spin off both Otis and Carrier. We’re fond of the decision: We think the move will unlock considerable shareholder value based on our sum of the parts analysis, estimates analyst Josh Aguilar. And its forthcoming merger with Raytheon will create the second-largest aerospace and defense firm.

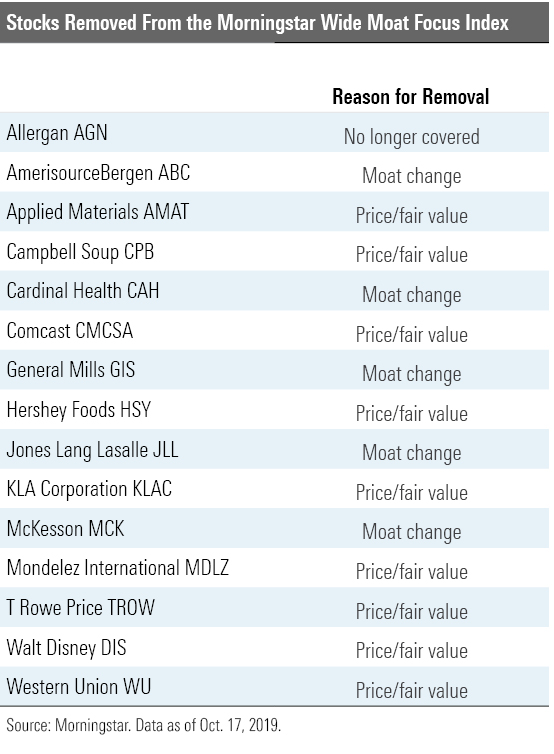

On the other side of the ledger, three pharmaceutical distributors--Cardinal Health CAH, McKesson MCK, and AmerisourceBergen ABC--were let go from the index because their moat ratings were downgraded. We discussed these downgrades at length in our last reconstitution update.

Jones Lang LaSalle’s JLL and General Mills’ GIS moats were also downgraded; both have therefore been removed from the index.

We downgraded Jones Lang LaSalle’s economic moat rating to narrow in May. While we still believe the firm has robust competitive advantages, it operates in a cyclical industry that’s rapidly consolidating, argues analyst Yousuf Hafuda--and competition may be more fierce among those who remain.

Secular headwinds related to evolving consumer nutritional preferences drove us to lower General Mills’ economic moat rating to narrow from wide, explains analyst Rebecca Scheuneman. While we still think the firm has a competitive edge and that its brands demand pricing power, we think the trend toward fresh items will nip at profits.

Allergan AGN got the heave-ho, as well, because we no longer have an analyst covering the company.

The remaining stocks--Applied Materials AMAT, Campbell Soup CPB, Comcast CMCSA, Hershey Foods HSY, KLA Corporation KLAC, Mondelez International MDLZ, T. Rowe Price TROW, Walt Disney DIS, and Western Union WU--were elbowed aside by stocks trading at more attractive price/fair values at the time of reconstitution.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)