Strong March Jobs Report Shows the Fed Still Has Clearance to Hike Interest Rates

Current solid pace of hiring likely to slow sharply in 2023.

Strength in the March jobs report doesn’t provide a clear signal for the Federal Reserve to shift gears in monetary policy, meaning that inflation data will be the main determinant for the Fed’s actions in the near-term.

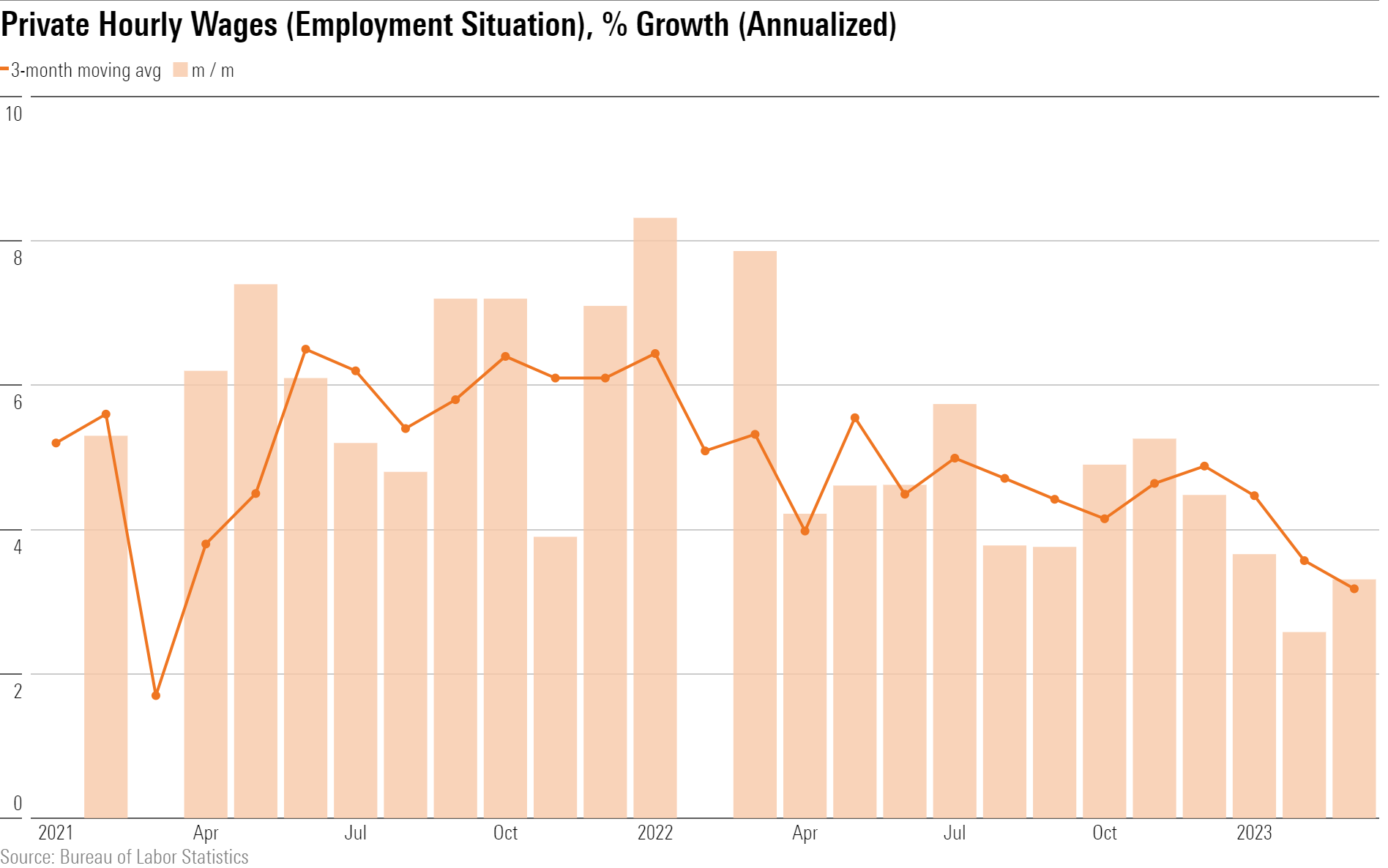

In one potential positive sign for the inflation outlook, the March jobs report showed continued moderation of the upward movement in wages, which could help contain price pressures across the economy in coming months.

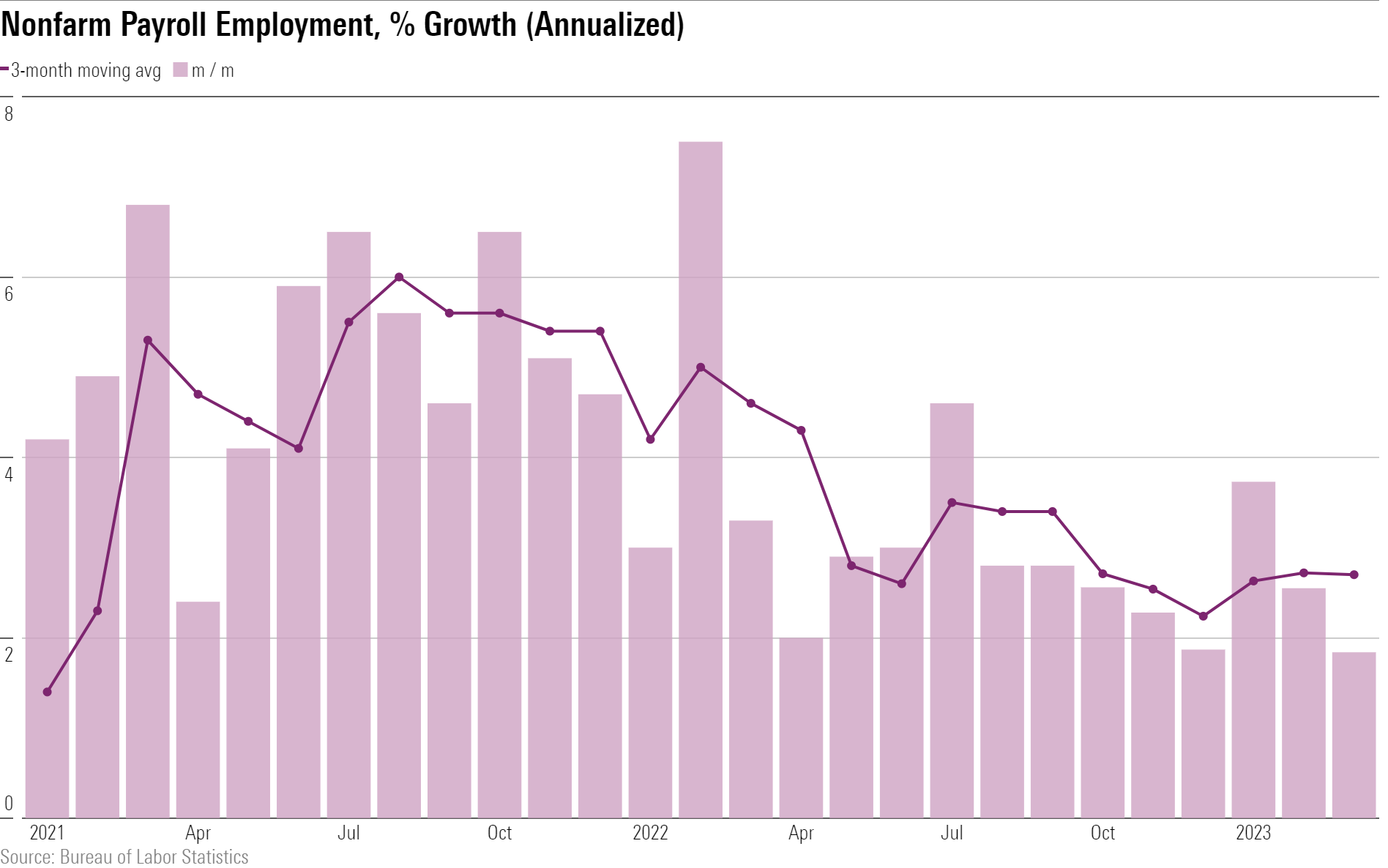

Nonfarm payroll employment increased by 236,000 jobs in March, or 1.8% annualized, slightly exceeding the 1.6% growth rate seen in the years (2015-19) before the pandemic. Over the past three months, nonfarm employment has averaged a strong 2.7% annualized growth rate. In three-month moving average terms, job growth has held steady so far in 2023, after having trended downward most of 2022.

Job Growth Outpacing Gross Gains

The continued strength of the labor market shown in the March jobs report is somewhat of an anomaly. In year-over-year terms, employment was up 3% for first-quarter 2023, while real gross domestic product growth is expected to be up around 2%. It’s unusual for job growth to outpace GDP growth. If this discrepancy persists, it will eventually cut into businesses’ profits. Employers seem to still be stuck in the mentality dominant a year ago of struggling against rampant labor shortages. We do expect businesses to curtail their hiring sharply over the course of 2023, especially if profit margins begin to erode.

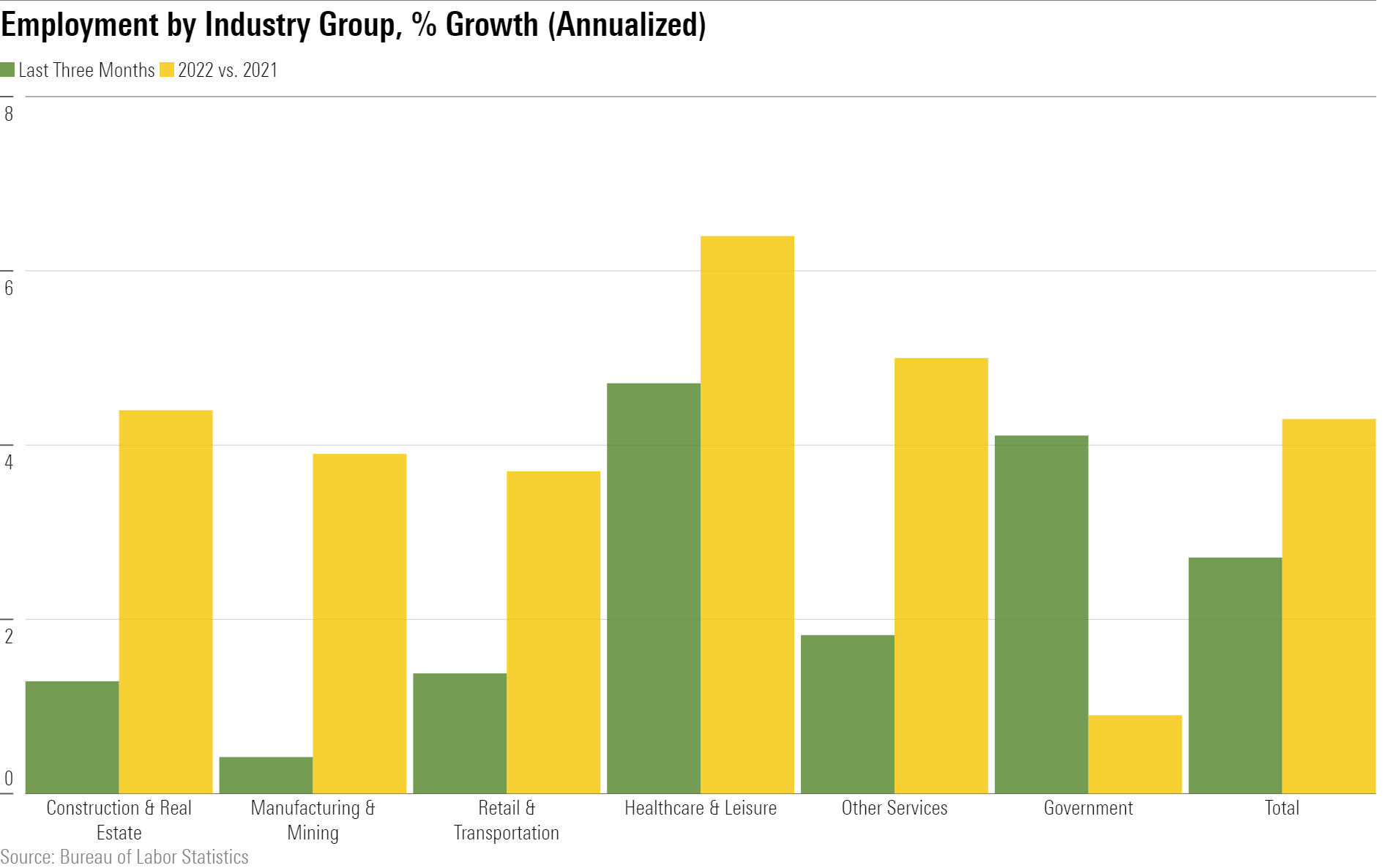

At the industry level, we’ve continued to see the strongest growth in the health and leisure categories (which includes restaurants), with a 4.7% annualized growth rate in the past three months. With the return to normal in terms of consumer spending in its finishing stages, we’re likely to see this growth slow over the next year.

Construction Hiring Strength May Be Turning Down

Notably, construction and real estate employment still posted a 1.3% annualized increase in the past three months, though a decline of 9,000 construction jobs in March itself signals a potential trend shift. The ongoing housing downturn is very likely to create job loss in construction and real estate over the next year. This could be exacerbated by heightened financial distress in the banking sector, which could hit nonresidential construction (that is, commercial real estate) particularly hard.

One explanation for continued strong job growth is that labor supply is expanding at a healthy pace. The labor force participation rate reached 62.6% in March, with a 0.3-percentage-point increase over the past three months. For people aged 25-54 (“prime age”), the participation rate has fully recovered to prepandemic levels. For people aged 55 and older, the participation rate is still somewhat depressed owing to higher-than-normal retirement during the pandemic.

Labor demand does appear to be moderating, with the job openings rate in February dipping to 6% compared with a peak of 7.4% in March 2022.

Wage Growth Moderates

An expansion in labor supply in conjunction with moderating labor demand has helped to moderate wage growth. Wage growth has averaged just a 3.2% annualized rate in the past three months, which is completely back to normal (prepandemic) levels. In year-over-year terms, wage growth was 4.2%, which is still consistent with an underlying inflation rate of around 3%, much closer to normal than we’ve seen over the past year (with core CPI up 5.5% year over year in February). We’ll have to wait for confirmation from other data to proclaim the excessive wage growth problem fixed, but for now this data is very comforting.

Only a regime switch to much weaker job growth (or especially net job loss) would provide a strong incentive for the Fed to change direction in terms of monetary policy. The moderating wage growth data is encouraging, but until it shows up in the form of moderating inflation data, the Fed can’t be completely assuaged.

Therefore, next week’s inflation report will remain pivotal in determining if the Fed hikes the federal-funds rate in its upcoming May meeting or opts to pause. Ahead of the March jobs report, bond futures prices—which reflect investors’ thinking on the direction of interest rates—suggest the Fed is expected to raise the federal-funds rate by a quarter of a point at the May meeting from the current target of 4.75%-5%.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)