Consumer Cyclical Stock Outlook: Investors Warm Up to Stocks, Propelling Market Outperformance, but Sector Still on Sale

Apparel and travel stand out as the most undervalued, although rising interest rates and persistent inflation threaten near-term profits.

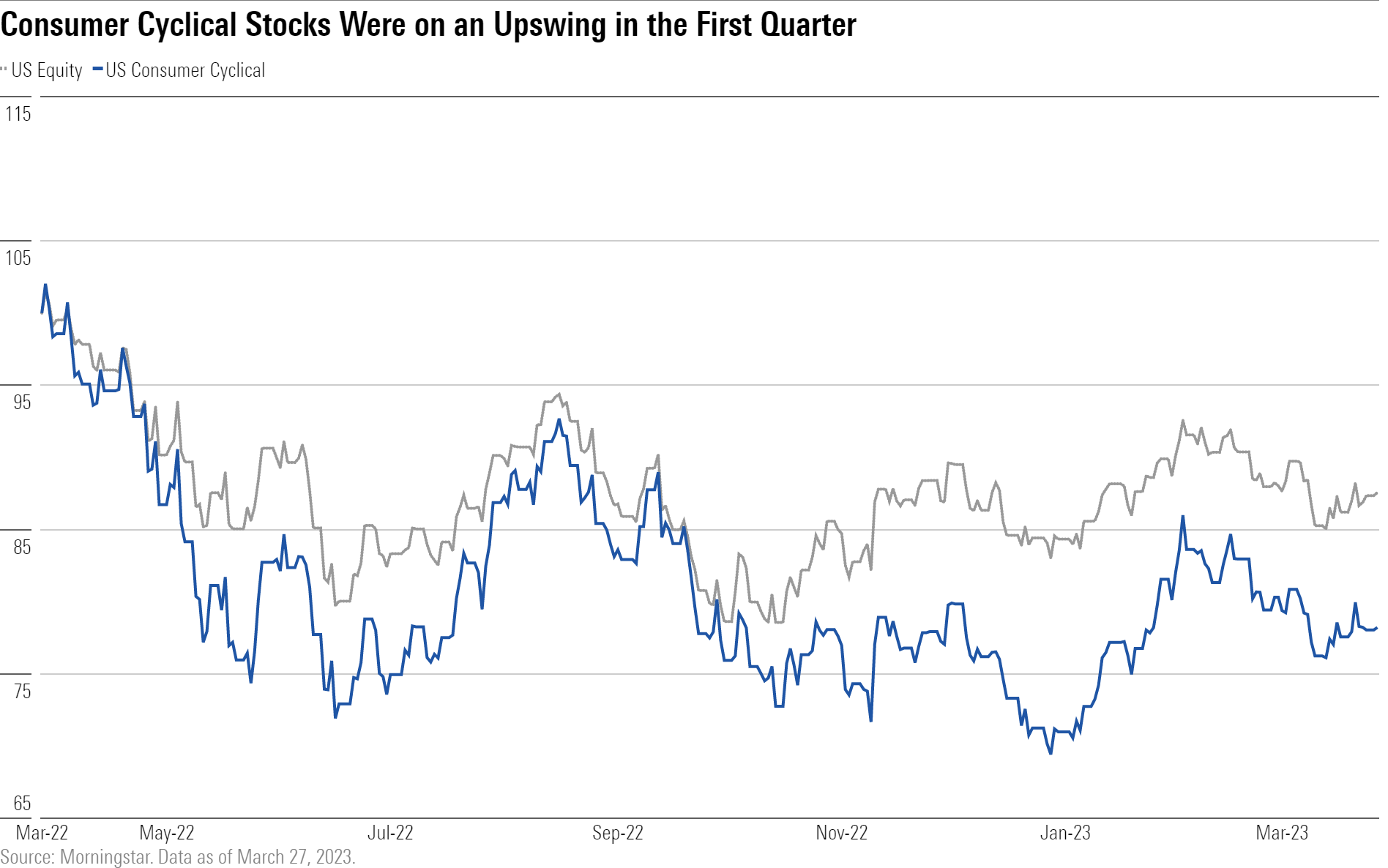

The US Morningstar Consumer Cyclical Index popped 10.18% in 2023′s first quarter (as of March 27), besting the market’s 3.83% increase. We suspect the reopening of the Chinese economy from virus restrictions in January, a weakening U.S. dollar, declining commodity costs, and low unemployment fueled investor optimism.

Even so, the median stock within the consumer cyclical sector trades at a 20% discount to our fair value estimates, with 58% of our coverage trading in 4- or 5-star territory. Apparel and travel stand out as the most undervalued sectors, trading at 45% and 24% respective discounts to our intrinsic valuations. Although rising interest rates and persistent inflation threaten near-term profits, we don’t think these factors will prove a drag longer term and thus fail to warrant such meaningful discounts.

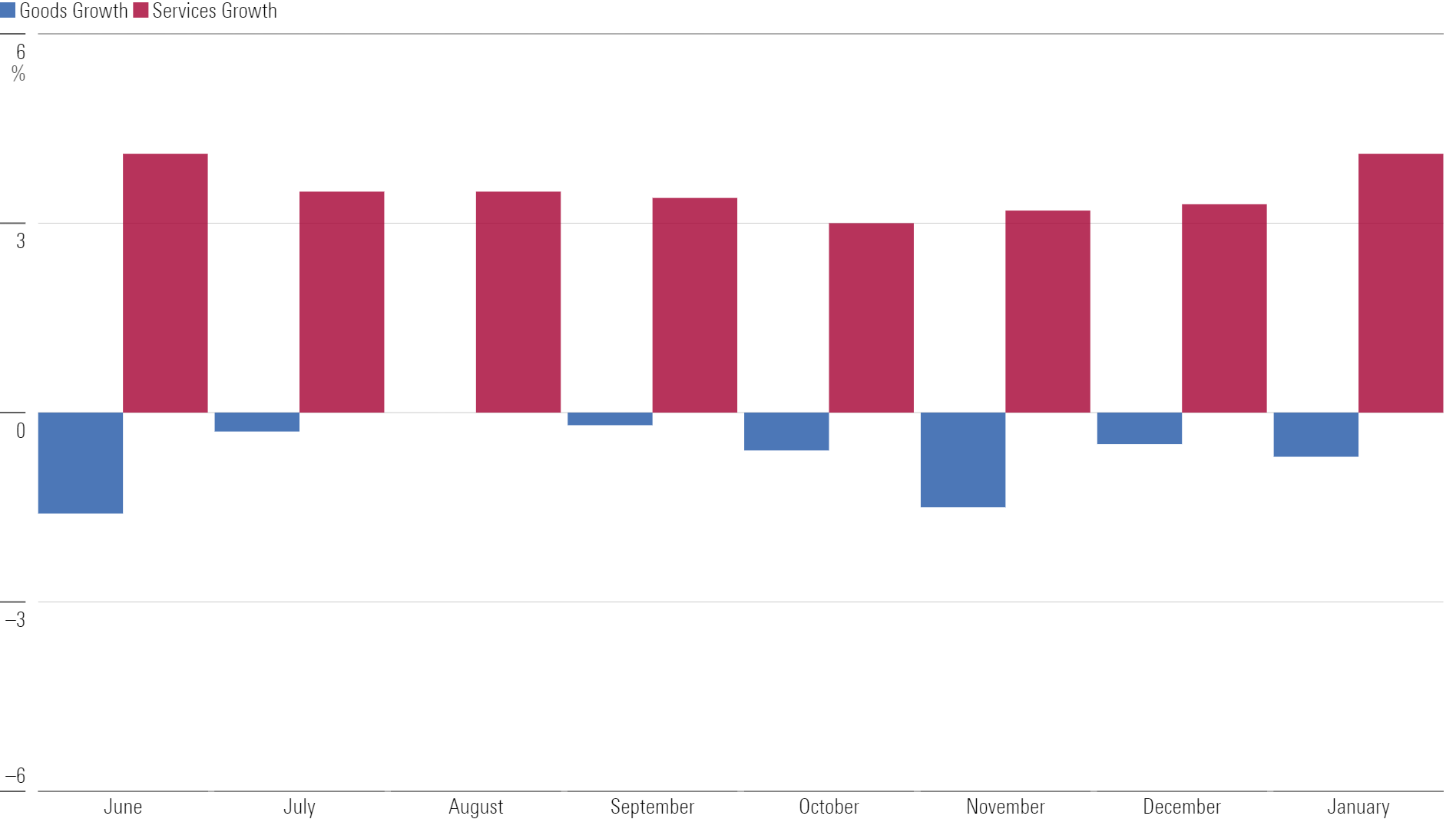

While outsize savings and mobility restrictions lured discretionary dollars to goods spending during the pandemic, services spending growth has since outpaced its counterpart in recent months. Specifically, services delivered 3.5% average spending growth in the six months through January 2023 compared with a 0.7% decline for goods. This trend has benefited travel services and positions the sector well to recapture demand.

Even with inflation, we think travel benefits from an elevated perceived value. Conversely, the transition to services has hurt apparel spending, resulting in discounting to clear inventories, thereby damaging profits. Still, we suspect a turnaround is more likely than anticipated as sales persist above 2019 levels, indicating the industry may be healthier than it appears.

Investors Warm Up to Consumer Cyclical Stocks, Propelling Market Outperformance, but Sector Still on Sale

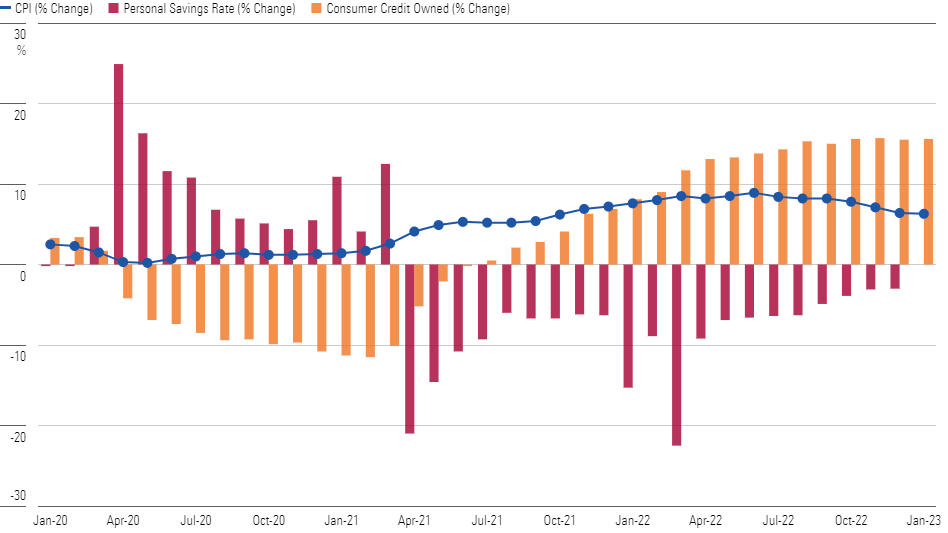

Inflation hasn’t let up despite the Fed’s interest rate hikes, eating into consumer pocketbooks and taking a toll on personal savings rates, which remain below historical levels. As consumers burn through excess savings from COVID-19 stimulus measures, they’ve started turning to other means of capital, like credit, keeping spending afloat for now.

With more time to adjust, we expect belt-tightening, creating challenges (particularly in driving top-line growth) for select industries like restaurants. Our contention is based on restaurants’ per-meal cost exceeds grocery alternatives. We posit that moaty firms with cost advantages are best equipped to resonate with inflation-stricken consumers and defend against trade down.

Top Picks

Hanesbrands HBI

Fair Value Estimate (USD): 20.00

Star Rating: 5 Stars

Uncertainty: High

Economic Moat: Narrow

We believe narrow-moat Hanesbrands, trading at a deep 75% discount to our $20 fair value estimate, offers a good opportunity for investors. We surmise the market has been overly focused on short-term issues, including the impact of inflation, high interest rates, and softer consumer demand, and is therefore underestimating its strengths, including the popularity of Champion and its improving mix shift. We are optimistic that the firm’s long-term strategy to boost Champion and North American innerwear, streamline its portfolio, and engage consumers will improve profitability after a difficult 2023.

Carnival CCL

- Fair Value Estimate (USD): 22.00

- Star Rating: 5 Stars

- Uncertainty: High

- Economic Moat: None

No-moat Carnival shares trade at around a 60% discount to our $22 fair value estimate. We contend investors are fixating on the potential for economic conditions to weaken, hence, diminishing the appetite for travel. However, demand signals remain positive as cumulative advance-booking volumes, prices (in constant currency), and customer deposits are above 2019 figures. As demand normalizes, we think pricing could grow at a low-single-digit clip, ahead of costs. And we have more confidence in Carnival’s ability to raise prices with a market-to-fill strategy rather than discounting, a prudent approach to which no-moat Norwegian adheres.

Hasbro HAS

- Fair Value Estimate (USD): 105.00

- Star Rating: 5 Stars

- Uncertainty: Medium

- Economic Moat: Narrow

Trading at a more than 50% discount to our $105 fair value estimate, we think investors should consider narrow-moat Hasbro, a leader in the North American toy industry. We suspect the market is overweighing concerns about inventory hangover, given a below-expectations holiday season in terms of productivity. This contributes to a weak 2023 revenue outlook on top of an ongoing restructuring focused on accelerating revenue opportunities and cost savings. However, we see innovation and a stockpile of ideas for movie tie-ins providing robust visibility for Hasbro’s goods, which should drive solid average adjusted ROICs including goodwill of 15% through 2027.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-06-2024/t_b352832973d64180aa6ad7ea086e0643_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IRAS2PNXWNDGRPQXLGHV6T7QWE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6A6R4SGLDNGMXHAH3K2CIQTF3Q.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)