13 Undervalued Stocks With Big Fair Value Estimate Upgrades

Tencent and Siemens were among the stocks that saw valuation increases of 10% or more.

With the latest earnings season in the rearview mirror, it’s a good time for long-term investors to scout for stocks where the quarterly results signified a stronger outlook.

At the same time, higher fair value estimates—Morningstar’s measure of a stock’s intrinsic value—can open up new undervalued stock opportunities for long-term investors.

We ran a stock screen to highlight opportunities where Morningstar analysts significantly raised fair value estimates recently and are also trading in undervalued territory.

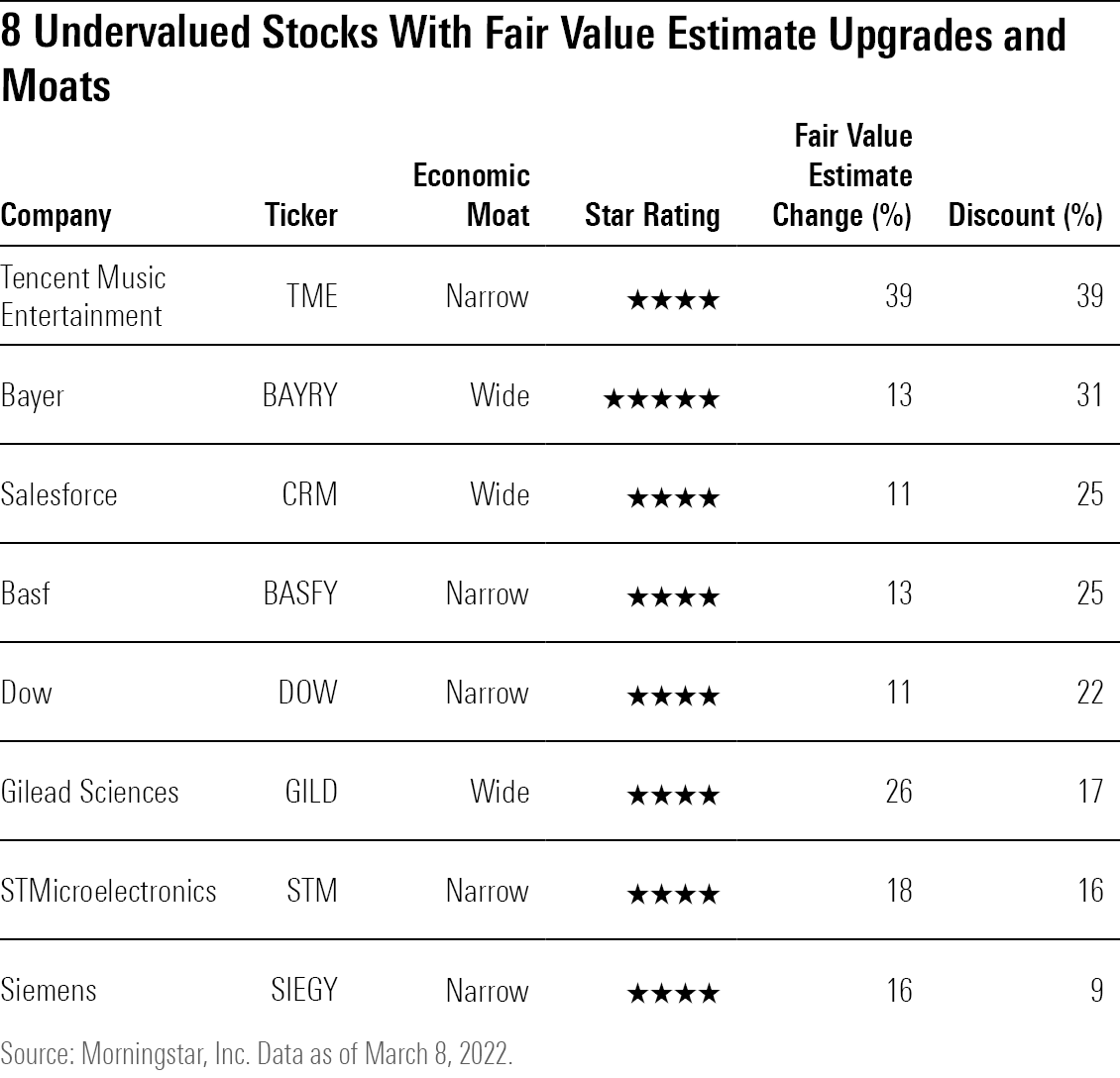

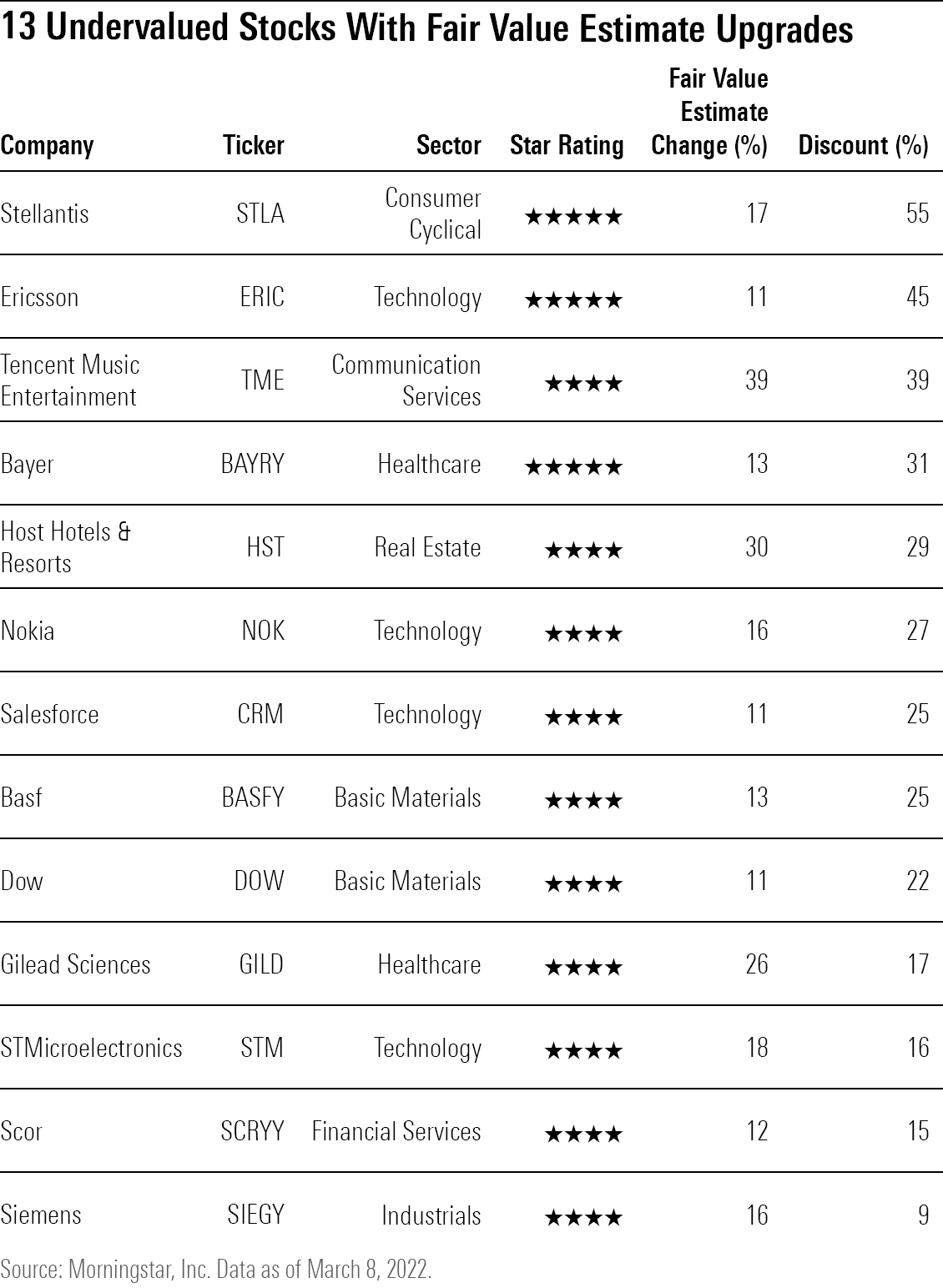

Out of 843 U.S.-listed stocks covered by Morningstar analysts, only 13 made it through our screen. Here’s a quick preview of the results. We also culled the list further, down to eight names, to highlight those stocks that Morningstar analysts deem as having competitive advantages, known as economic moats. Historically, Morningstar data shows, stocks with moats perform better over time than those without moats.

More details on our screen, along with comments on the stocks from Morningstar analysts, can be found later in this article.

- Tencent Music Entertainment TME

- Bayer BAYRY

- Salesforce CRM

- Basf BASFY

- Dow DOW

- Gilead Sciences GILD

- STMicroelectronics STM

- Siemens SIEGY

Screening for Undervalued Stocks

Morningstar equity analysts have been incorporating results from the latest round of earnings reports as they adjust their valuation models. While analysts stick to a long-term approach to assessing a company’s value, quarterly results can have an impact on near-term assumptions, which in turn may affect long-term growth estimates. Additionally, analysts may adjust their fair value estimates outside of earnings-related reasons, such as because of a new product reveal or even mergers and acquisitions.

Morningstar fair value estimates rose by about 0.35% between Jan. 1 and March 8. Of the 843 U.S.-listed stocks covered by Morningstar analysts, 260 received fair value increases. Among those, only 52 saw increases of 10% or more.

Fair value estimate increases can lead to fresh undervalued stock opportunities for the long-term investor. To highlight those new opportunities, we ran a screen for undervalued stocks that saw substantial fair value increases of 10% or more, which became either recently undervalued as a result or became even more attractive in recent weeks. Only 13 stocks passed this first set of criteria. A full list of these results can be found at the bottom of this article.

To increase the margin of safety for our picks, we also screened for stocks with Morningstar Economic Moat Ratings of either wide or narrow, which designates whether our analysts believe the firm has a durable competitive advantage over peers. Stocks with wide moats are expected to retain their competitive advantage for 20 or more years, while those with narrow moats are expected to retain it for at least 10. At the end of it, we were only left with eight stocks that passed our screen.

Our screen also resurfaced Gilead Sciences GILD as a pick, which we have omitted from the analyst notes below, as we recently covered it in our article highlighting 9 undervalued stocks that crushed fourth-quarter earnings.

For the rest of the stocks from our screen, here’s what Morningstar analysts had to say about them.

Tencent Music Entertainment

- Industry: Internet Content & Information

- Morningstar Rating: 4 Stars

- Morningstar Economic Moat Rating: Narrow

- Discount: 39%

“We are raising our fair value estimate of Tencent Music to USD 12.50 (HKD 49.10) from USD 9.00 (HKD 35.30) after reviewing the firm’s long-term revenue growth and margin prospects. We now expect the firm to generate higher music subscription revenue over the next five years thanks to effective paywall and subscription pricing strategies. Top-line accretion will also translate to better profitability, as the majority of Tencent Music’s operating costs are fixed (in the form of music licensing fees). Our updated fair value estimate implies a 27.4 times price to our 2023 forecast earnings.”

“While Tencent Music’s stock price has more than doubled from the trough in March 2022, the shares are still trading at an undemanding forward price/earnings ratio of 21.4 times as of market close on Jan. 19, 2023. We believe the market is underestimating the firm’s long-term subscriber growth and margin expansion potential.”

—Ivan Su, senior equity analyst

Bayer

- Industry: Drug Manufacturers—General

- Morningstar Rating: 5 Stars

- Morningstar Economic Moat Rating: Wide

- Discount: 31%

“After reviewing Bayer’s pipeline and changes to exchange rates, we are increasing our fair value estimate of Bayer’s local shares to EUR 83 from EUR 76 per share (to $22.50 from $20 on the ADR). Cardiovascular drug asundexian is partly driving the improving outlook for the firm’s pipeline. The drug recently started phase 3 development with data likely in 2025. The drug is still a higher-risk asset, as the phase 2 data was encouraging but didn’t fully de-risk the drug. Nevertheless, the timing of the phase 3 data may give Bayer a first-mover advantage for the next generation factor XI drugs. Also, Bayer is not partnering development of the drug with another firm (as was the case with older cardiovascular drug Xarelto) so the firm will retain all the upside if the drug is successful. The drug holds the potential to offset the likely generic competition for Xarelto that could begin in 2026. Bayer’s ability to develop the next generation of drugs to offset generic competition increases our conviction in the firm’s wide moat.”

—Damien Conover, director of equity research, healthcare

Salesforce

- Industry: Software—Application

- Morningstar Rating: 4 Stars

- Morningstar Economic Moat Rating: Narrow

- Discount: 9%

“Salesforce delivered an epic quarter in what we believe is truly a seminal moment within its lifecycle. For its fiscal fourth quarter, the company delivered substantial upside to both revenue and profitability, which is an impressive achievement. However, the company’s pivot toward profitability over the next two years was well beyond our expectations. Further, the company has already expanded its share repurchase authorization to $20 billion, from $10 billion previously, while also disbanding its mergers and acquisitions committee as the company focuses on organic growth. We think this margin expansion is achievable and, in turn, we are raising our fair value estimate to $245 per share from $220. Shares look attractive even after an aftermarket pop, and the stock remain one of our top picks.”

—Dan Romanoff, senior equity analyst

Basf

- Industry: Chemicals

- Morningstar Rating: 4 Stars

- Morningstar Economic Moat Rating: Narrow

- Discount: 9%

“BASF posted a decent fiscal 2022, as the firm grappled with myriad macroeconomic headwinds including input cost inflation and reduced product demand around the world. Though some of the current market dynamics will likely persist in 2023, we expect much of these challenges will abate in the long run, especially as BASF makes headway on several initiatives targeting operational efficiency gains. We’re therefore raising our fair value estimate to EUR 65 ($17) from EUR 59 ($15), mostly due to our improved outlook for the firm’s profitability over the next five years. We maintain our narrow moat rating and stable moat trend following results.”

“Quite a bit of uncertainty remains around several of BASF’s end markets in 2023—it’s unclear when exactly Chinese demand will normalize, for example—but we’re cautiously optimistic about the firm’s prospects moving forward. We therefore expect 2023 revenue will dip slightly in 2023 but will average growth of about 3.5% per year thereafter.”

—Katherine Olexa, equity analyst

Dow

- Industry: Chemicals

- Morningstar Rating: 4 Stars

- Morningstar Economic Moat Rating: Narrow

- Discount: 22%

“Fourth-quarter revenue declined 17% year over year and 16% sequentially due to reduced volumes and unfavorable pricing movements on top of standard seasonal impacts. On the whole, 2022 results were solid for Dow due to a strong first half. Annual revenue increased 3.5% year over year following an exceptionally strong 2021. The firm’s annual EBITDA margin contracted to 21% from 28% but remained above its historical average of 17%. Many of the challenges that materialized at the end of 2022 will likely persist into the first quarter of 2023, but we maintain our view that these near-term headwinds—some of which are already abating—are unlikely to materially constrain Dow’s potential value generation over the long run. In fact, we’re raising our fair value estimate to $72 from $65 following results.

“Most of Dow’s problems arose from rampant destocking across several end markets, which drove roughly two thirds of its fourth-quarter EBITDA decline (the remainder is attributable to seasonality). We expect this dynamic will improve over the next few months—the firm generally sees elevated volumes in the second and third quarters.”

—Katherine Olexa, equity analyst

STMicroelectronics

- Industry: Semiconductors

- Morningstar Rating: 4 Stars

- Morningstar Economic Moat Rating: Narrow

- Discount: 16%

“Narrow-moat STMicroelectronics reported solid fourth-quarter results and provided investors with a surprisingly rosy forecast for the first quarter and all of 2023. We’re raising our fair value estimate to EUR 55/$59 from EUR 50/$50 based on the time value of money as we roll our valuation model, but also because we see a clearer path to ST achieving its key long-term targets of $20 billion of revenue and 50% gross margins. The shares are up about 8% after the release, but we still see an attractive margin of safety for investors.”

“ST will shift even more of its business toward higher-margin automotive and industrial chip design wins, and based on its backlog and visibility, the company thinks this revenue pipeline is relatively secure, even as macroeconomic headwinds persist. The mix shift will also likely be a material tailwind to gross margins. The strong growth and gross margin expansion suggest that ST might be one of the biggest winners of the global chip shortage in 2021 and 2022. We remain impressed by the firm’s silicon carbide product leadership, as ST expects to exceed $1 billion of SiC revenue in 2023.”

—Brian Colello, director of equity research, technology

Siemens

- Industry: Special Industrial Machinery

- Morningstar Rating: 4 Stars

- Morningstar Economic Moat Rating: Narrow

- Discount: 9%

“We increase our fair value estimates for Siemens AG to EUR 160 from EUR 145 for the locally traded shares and to $87 from $75 for the ADR. The drivers behind our changes include increased 2023 management guidance following the robust first-quarter 2023 results, the time value of money, and currency movements. We maintain our narrow moat rating for Siemens and see moderate upside for the shares relative to our fair value estimates.

“Siemens has unusually high visibility for 2023 on revenue growth and margins due to an exceptionally high order backlog. This is thanks in a large part to supply chain constraints causing slower-than-normal supply chain issues in 2022. At the end of the first quarter the company had a backlog of EUR 102 billion. To put this into perspective, Siemens booked around EUR 72 billion in 2022 and includes nine months worth of revenue on short-cycle products within the company’s digital industries and smart infrastructure divisions.”

—Denise Molina, director of pricing strategy

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)