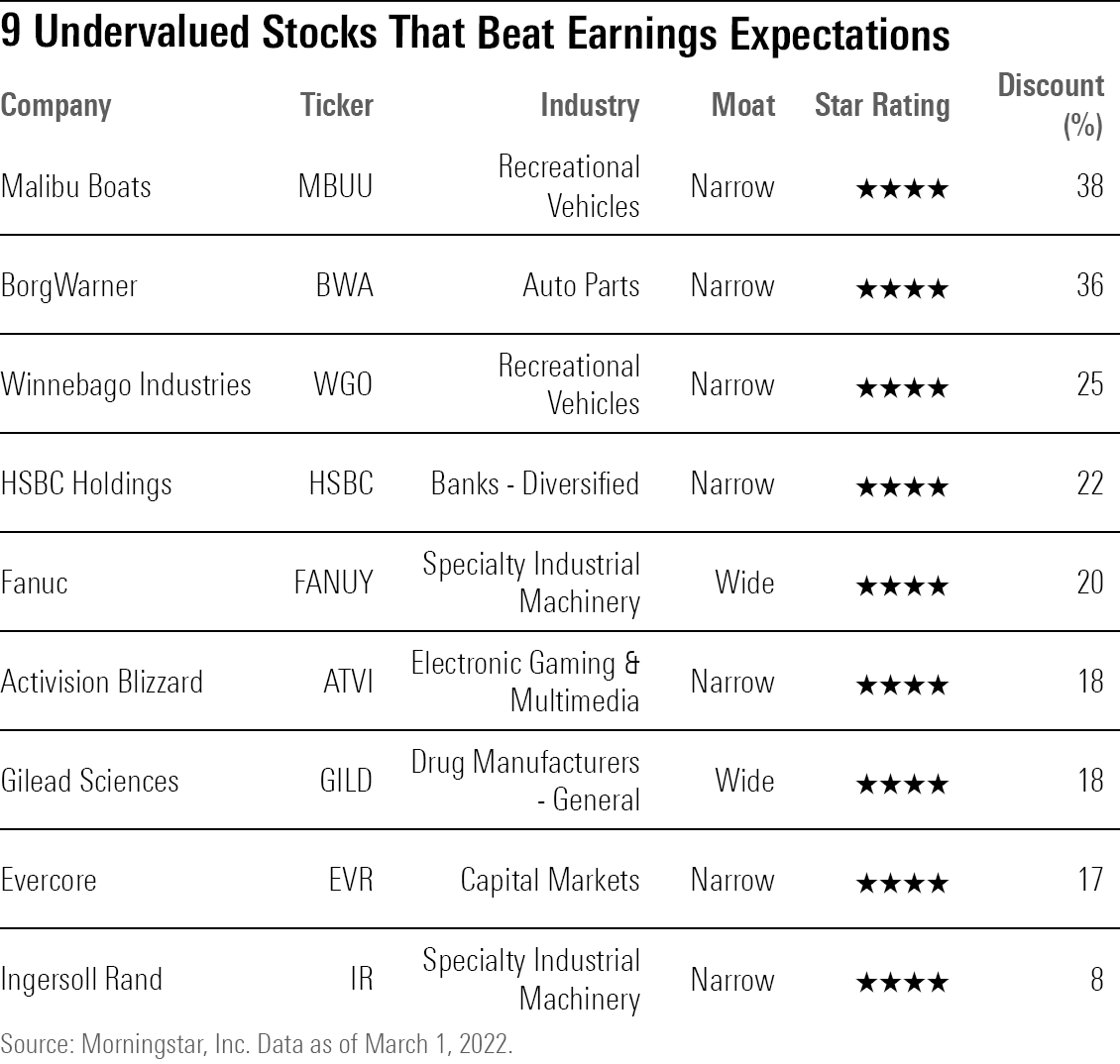

9 Undervalued Stocks That Crushed Earnings

Activision Blizzard, Gilead, and HSBC are among those beating expectations, but remain undervalued.

For stock investors, there hasn’t been much to cheer about in fourth-quarter earnings.

Fourth-quarter quarter earnings growth turned negative for the first time since the third quarter of 2020, as demand deceleration and a tougher macroeconomic environment finally curtailed the booming growth of the previous two years.

But while companies in the Morningstar US Market Index are showing earnings down 3.8% year over year, there were, as always, companies that defied expectations. And while some of these names saw their stock prices surge on the news, they’re still undervalued according to Morningstar’s analysts.

To highlight opportunities for the long-term investor, we ran a screen for undervalued stocks that crushed fourth-quarter earnings expectations. These stocks also showed strong fourth-quarter revenue and are deemed by Morningstar analysts to have substantial competitive advantages.

More details on our screen, along with comments on the stocks from Morningstar analysts, can be found later in this article.

9 Undervalued Earnings Crushers

- Malibu Boats MBUU

- BorgWarner BWA

- Winnebago Industries WGO

- HSBC Holdings HSBC

- Fanuc FANUY

- Activision Blizzard ATVI

- Gilead Sciences GILD

- Evercore EVR

- Ingersoll Rand IR

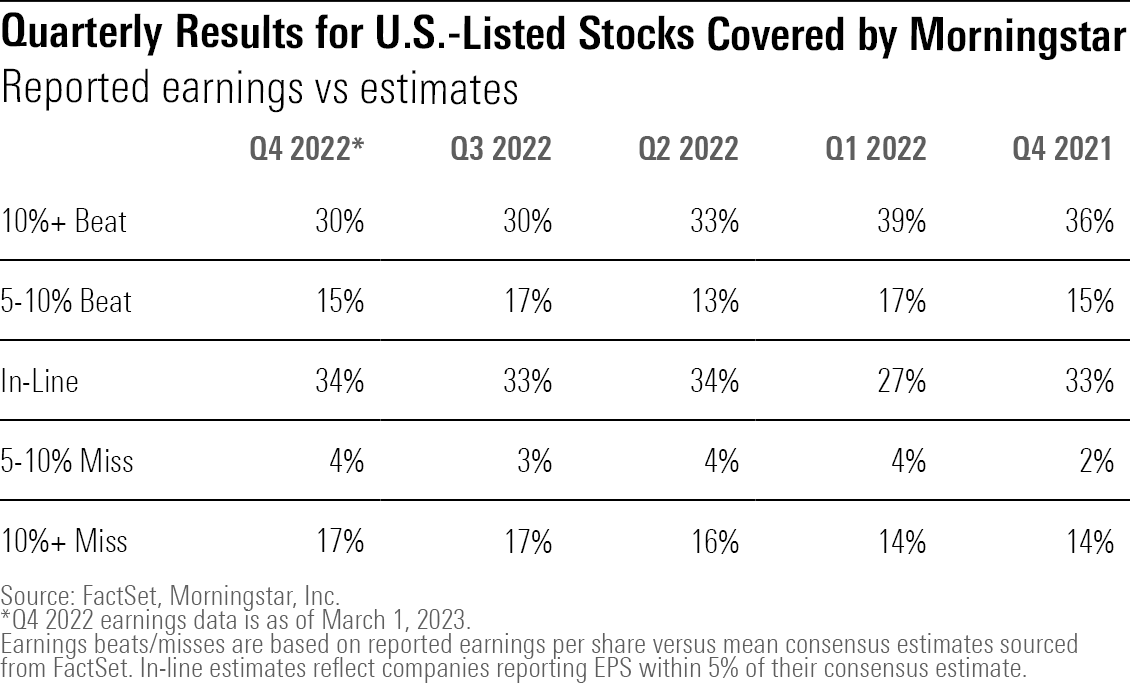

How Do Fourth-Quarter Earnings Stack Up?

The nearly 4% year-over-year decline in fourth-quarter earnings came as companies struggled to top their strong performance from the fourth quarter of 2021. More challenging macroeconomic pressures and decelerating demand put an end to the era of rapid growth that occurred between 2020 and 2021.

As of this writing, 701 of the 843 U.S.-listed stocks covered by Morningstar analysts reported fourth-quarter earnings. Of those that have reported, 45% beat FactSet mean earnings estimates by 5% or more, down from 51% a year ago.

On a quarter-to-quarter basis, however, earnings results for the fourth quarter look similar to the third quarter. On this basis, for both the fourth and third quarters, roughly 30% of reported companies beat earnings results by 10% or more.

Digging deeper shows a mixed picture of earnings. The number of companies beating earnings estimates by 5% to 10%, slipped to 15% from 17% in the previous quarter.

However, the number of companies reporting earnings misses has been mostly unchanged, with 21% of reported companies missing earnings estimates, up slightly from 20% in the third quarter. Meanwhile, the share of companies whose results were in line with estimates ticked up slightly by 1 percentage point to 34%.

How We Did Our Stock Screen

While Morningstar stock analysts pay close attention to earnings, they focus on long-term results and valuations. One quarter usually doesn’t lead to a change in the long-term assumptions behind the assessment of a stock’s fair value estimate, unless a company also comes out with new, material information that affects the assumptions that opinion is based on. For example, new data on a drug that raises the probability of approval, or pricing gains on a key product line could affect an analyst’s long-term thinking.

Still, looking at quarterly earnings against the valuation backdrop can help long-term investors identify opportunities.

We screened for stocks that beat expectations but remained undervalued to help investors capitalize on new investment opportunities that arose during earnings season.

To help keep the focus on those that had truly strong results and did not beat on earnings through accounting gimmicks or one-time factors, companies were also screened for revenue beats of 5% or more. We filtered for stocks with a Morningstar Rating of 4 or 5 stars. Those stocks were then screened for a Morningstar Economic Moat Rating of either wide or narrow, which is designated if a Morningstar analyst believes a firm has a durable competitive advantage over its peers. Stocks with wide moats are expected to retain their competitive advantage for 20 or more years, while narrow moats are expected to retain them for at least 10 years.

Of the 843 U.S.-listed companies that Morningstar analysts cover, only 11 stocks made the cut, however, two of them, Koninklijke Philips PHG and Evergy EVRG, were removed from our screen owing to idiosyncratic events. Philips’ management has struggled with meeting its own financial targets on top of issues with product recalls. Evergy’s recent earnings outperformance owed to favorable weather conditions that Morningstar utilities strategist Travis Miller does not expect to recur.

For the remaining nine stocks, we’ve highlighted what analysts had to say about their earnings results below.

Malibu Boats

- Earnings Per Share: $1.83 versus the consensus estimate of $1.66.

- Revenue: $339 million versus the consensus estimate of $314 million.

- Star Rating: 4 Stars

- Discount: 38%

“Despite cost pressure in the period, Malibu held firm on its full-year guidance, including mid- to high-single-digit sales growth and a slight downtick in EBITDA margin. This implies low-single-digit sales growth and modest EBITDA pressure in the back half of fiscal 2023 on volume declines at Malibu. We expected shipments to align more closely with retail demand as the dealer backlog is increasingly refilled to ensure appropriate network inventory. Our five-year industry outlook calls for below 2% retail sales growth, considering the normalization of category spending and our internal GDP forecast.

“Longer term, we don’t think the opportunity set has changed for Malibu, and the firm should still be able to grow sales at an average of 8% over the next decade, outpacing the industry given its exposure to “growthy” segments of the boating market and its penchant for acquisitions. Furthermore, as inflationary pressures normalize, we believe the gross margin should trend upward, bolstered by innovation across products and features, protecting high-teens adjusted EBITDA margin performance.”

—Jaime M. Katz, senior equity analyst

BorgWarner

- Earnings Per Share: $1.26 versus the consensus estimate of $1.08.

- Revenue: $4.11 billion versus the consensus estimate of $3.90 billion.

- Star Rating: 4 Stars

- Discount: 36%

“Narrow-moat-rated BorgWarner reported fourth-quarter earnings per share before special items of $1.26, beating the FactSet consensus by $0.18 and $0.20 higher than last year. Revenue rose 12% to $4.1 billion from $3.7 billion a year ago when the chip shortage was still raging, beating the consensus by 5%. Excluding negative currency, divestitures, and acquisitions, organic revenue jumped 21%, outperforming a 1% increase in global light-vehicle production weighted to BorgWarner’s customer base, by 20% points on new business and customer price recoveries for raw materials. We maintain our investment thesis that BorgWarner will increase revenue at above-market rates as its products reduce emissions and support vehicle electrification.”

“Due to uncertainty from the chip shortage, Ukraine war, China’s COVID-19 resurgence, and inflation, management’s new 2023 guidance was somewhat disappointing. New 2023 guidance includes an organic revenue increase of 7%-12% to $16.7 billion-$17.5 billion, adjusted EBIT margin of 10.0%-10.4%, and EPS of $4.50-$5.00. Management assumes flat to up 3% global light-vehicle production, which we would have pegged at up by around 2%-6%.”

“The 4-star-rated shares of BorgWarner currently trade at an attractive 37% discount to our fair value estimate.”

—Richard Hilgert, senior equity analyst

Winnebago Industries

- Earnings Per Share: $2.07 versus the consensus estimate of $1.82.

- Revenue: $952 million versus the consensus estimate of $852 million.

- Star Rating: 4 Stars

- Discount: 25%

“Winnebago reported an excellent fiscal 2023 first quarter, given the macroeconomic environment and declining year-over-year figures from a very tough comparable with the first quarter of fiscal 2022 … Revenue fell 17.6% as a 47% decline in towable revenue more than offset 10% growth in the motor home segment and 66% growth in marine.”

“Winnebago passed through price increases for higher input costs, which helped mitigate a 49% decline in recreational vehicle unit sales split as 56% towable and 8% motor home. Despite revenue growth, free cash flow fell 94% to $2.1 million as higher input costs and $50 million of lost revenue from the Mercedes chassis recall disclosed last month ate into cash flow.”

—David Whiston, sector strategist

HSBC Holdings

- Earnings Per Share: $2.47 versus the consensus estimate of $1.06.

- Revenue: $15.40 billion versus the consensus estimate of $14.51 billion.

- Star Rating: 4 Stars

- Discount: 22%

“Fourth-quarter earnings were better than expected, with bottom-line annualized ROE of 10.1%, several percentage points above Morningstar and market expectations. Most of the upside, however, was owing to an abnormally low effective tax rate because of one-time factors, and the beat above the pretax line was modest. That said, we are encouraged that HSBC seems to be increasingly gaining traction in a turnaround after it doubled down on restructuring at the end of 2019, reaching deals to pare its presence in secondary markets such as France and Canada while focusing more investment on Asia and the Middle East where its competitive position is stronger.”

“We forecast that it will generate ROE in excess of 10% throughout our forecast horizon, above our assumed cost of equity of 9.5%, as the increased focus on relatively more profitable areas finally starts to pay off. HSBC also plans to resume quarterly dividend payments this year after having been forced to make dividends temporarily more sporadic in 2020 amid the pandemic.”

—Michael Makdad, senior equity analyst

Fanuc

- Earnings Per Share: $0.18 versus the consensus estimate of $0.15.

- Revenue: $1.69 billion versus the consensus estimate of $1.51 billion.

- Star Rating: 4 Stars

- Discount: 20%

“Robot segment orders in the December quarter continued to be at record levels, growing 18.5% year on year, supported by electric vehicle, or EV, automation demand. We now project companywide revenue will grow by 14.5% and 1.0% year on year in fiscal 2022 and 2023 (ending March) respectively, after raising our robot sales growth assumptions to 29% and 12%, from 22% and 8%, in the same period. Further, we think Fanuc’s longer-term prospects for robots remain strong and are underestimated by the market, as its businesses are supported by secular drivers, like EV production automation and increasing robot adoption in nontraditional fields like food. As such, we think Fanuc is undervalued.”

—Jason Kondo, equity analyst

Activision Blizzard

- Earnings Per Share: $1.87 versus the consensus estimate of $1.52.

- Revenue: $3.57 billion versus the consensus estimate of $3.19 billion.

- Star Rating: 4 Stars

- Discount: 18%

“Activision Blizzard reported a stronger-than-expected end to 2022 with fourth-quarter revenue and EBITDA ahead of FactSet consensus. As expected, non-GAAP revenue returned to growth after four quarters of declines. This year’s Call of Duty installment, Modern Warfare II, posted an impressive start since its launch on Oct. 28, boding well for the next few quarters as the firm laps the weak 2022 installment.

“Total non-GAAP revenue jumped 43% year over year to $3.6 billion as Activision, Blizzard, and King all contributed … Bookings at the Activision segment jumped by 60% year over year to $1.9 billion as Modern Warfare II and the new Warzone 2.0 helped to reverse the negative trend in users. The number of monthly active users in total for Activision improved to 111 million from 97 million last quarter and 107 million a year ago.”

“Due to the pending acquisition by Microsoft MSFT, management is foregoing earnings calls. Despite the decisions by U.S. and EU regulators to block the deal, we still believe that the merger is more likely to be approved than not, though the closing will likely not occur until the fourth quarter of 2023 at the earliest. We are maintaining our fair value estimate of $92, which balances our stand-alone valuation (also at $92), the acquisition value of $95 a share, and the potential for further delays from regulatory actions.”

—Neil Macker, senior equity analyst

Gilead Sciences

- Earnings Per Share: $1.67 versus the consensus estimate of $1.52.

- Revenue: $7.39 billion versus the consensus estimate of $6.64 billion

- Star Rating: 4 Stars

- Discount: 18%

“While Gilead’s 2022 bottom-line results were in line with our estimates, several drugs outperformed our sales expectations, and Gilead’s guidance and progress with its pipeline give us more confidence in the firm’s ability to sustain growth going forward (excluding volatility in demand for COVID-19 antivirals). We’re substantially raising our fair value estimate to $97 from $77, as we have boosted our long-term sales forecast for HIV drug Biktarvy after another quarter of outperformance, factored in long-term growth for cell therapy Yescarta as it works its way into earlier lines of treatment in more types of blood cancer, and also added Gilead’s oral COVID-19 antiviral, GS-5245, to our model, as it recently entered phase 3.”

“Overall, we think Gilead’s infectious disease and oncology franchises support a wide moat, and we think shares look slightly undervalued.”

—Karen Andersen, sector strategist

Evercore

- Earnings Per Share: $3.50 versus the consensus estimate of $2.54.

- Revenue: $835 million versus the consensus estimate of $680 million.

- Star Rating: 4 Stars

- Discount: 17%

“Evercore had a fairly good fourth quarter, but revenue and earnings will likely go back to being subdued for the next several quarters. The company reported net income to common shareholders of $140 million, or $3.44 per diluted share, on $831 million of net revenue for the fourth quarter. Net revenue grew 44% from the previous quarter, as the fourth quarter has positive seasonality, but it was down 25% from the previous year’s record quarter. For the full year, net revenue declined 16% to $2.76 billion and net income declined 36% to $477 million.”

“While asset prices have recently rallied, we’re likely still several quarters away from knowing if inflation is under control and experiencing the full effects of tighter monetary policy that has a time lag, such as unemployment and consumer spending. This economic uncertainty should keep corporate heads nervous and merger deal activity low compared with the previous couple years. There will be cyclical earnings headwinds, but the company is strong and undervalued on a long-term basis.”

—Michael Wong, director of equity research, financial services

Ingersoll Rand

- Earnings Per Share: $0.72 versus the consensus estimate of $0.62.

- Revenue: $1.62 billion versus the consensus estimate of $1.54 billion

- Star Rating: 4 Stars

- Discount: 8%

“Ingersoll Rand grew its fourth-quarter organic revenue by 19% from the prior-year period. Industrial technologies and services organic revenue was up 22%, with broad-based growth across all regions and product lines. Precision and science technologies organic revenue increased by 9%, driven by continued strong momentum in product lines serving industrial end markets, including ARO and YZ Systems. Despite persistent cost inflation and supply chain constraints, Ingersoll Rand expanded its fourth-quarter adjusted EBITDA margin by 180 basis points year over year, from 24.1% to 25.9%.

“Management initiated its outlook for 2023 and anticipates full-year organic revenue growth of 3%-5%, adjusted EBITDA of $1,570 million-$1,630 million, and adjusted EPS of $2.48-$2.58. The midpoint of management’s guidance range came in above our previous $2.49 estimate. The company remains on track to deliver mid-single-digit organic revenue growth through 2025.”

—Krzysztof Smalec, equity analyst

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)