ETF Flows Freeze in February Reality Check

U.S. ETFs saw modest outflows as global markets wavered.

Key Takeaways

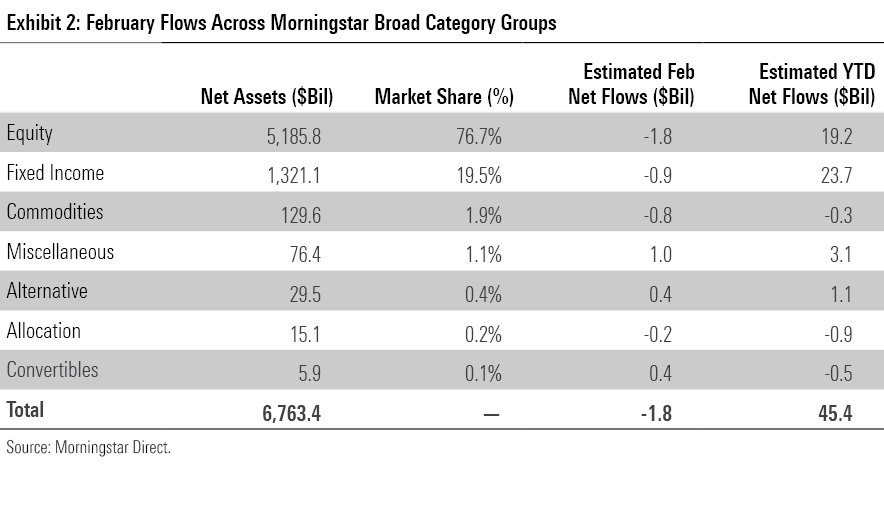

- U.S. exchange-traded funds shed an estimated $1.8 billion in their first month of outflows since April 2022.

- Investors pulled more than $8 billion from U.S. stock funds but piled nearly $9 billion into their foreign counterparts.

- Bond ETFs saw modest outflows as investors fled from riskier fixed-income Morningstar Categories.

- Active ETFs bucked the outflow trend with nearly $9 billion in new money.

- The Morningstar Global Markets Index retreated 2.78% on the heels of its January rally.

- Inflation concerns stung longer-dated bond funds, resembling the performance that characterized 2022.

Rates Concerns Rear Their Head

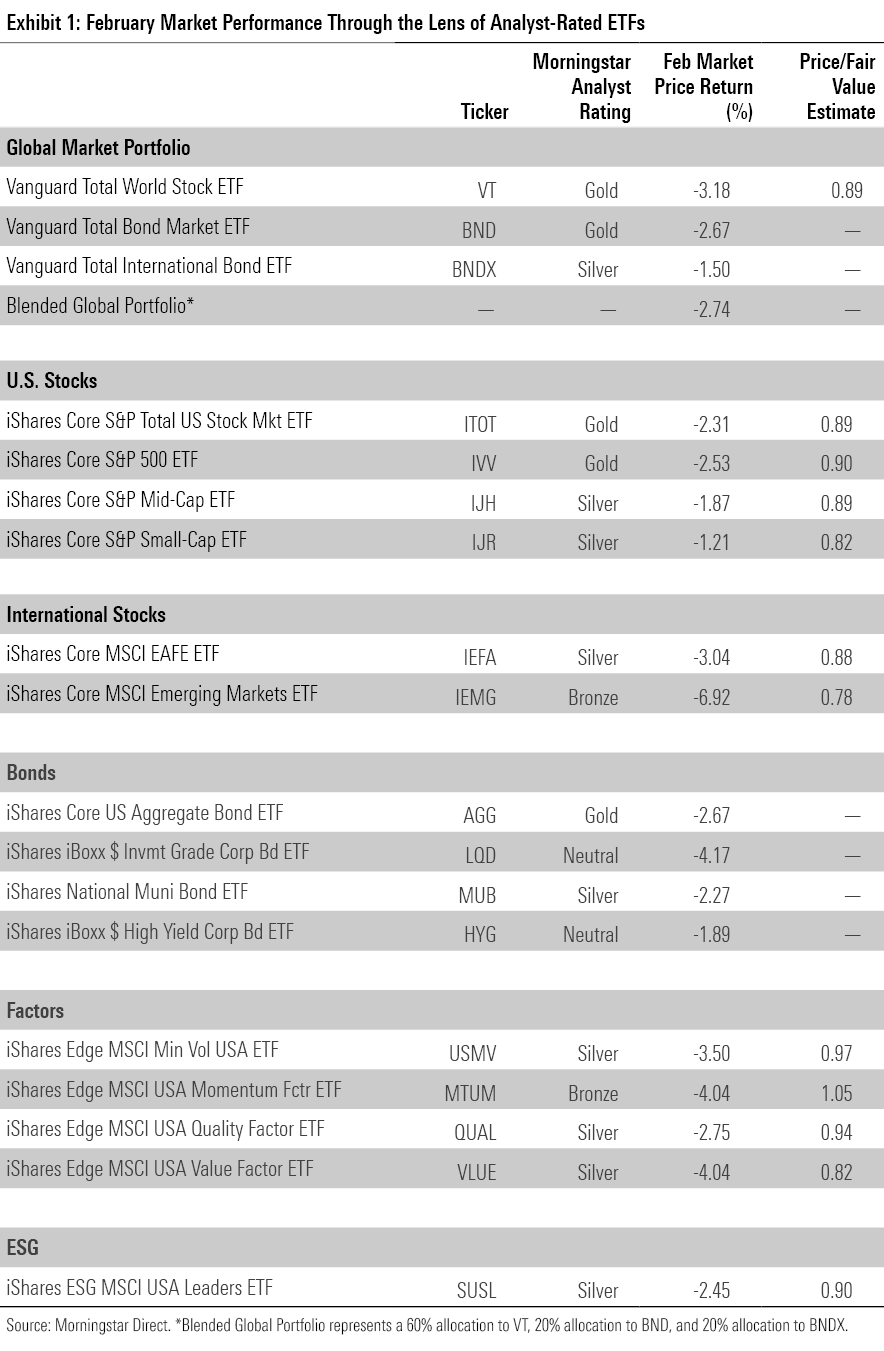

Exhibit 1 shows January returns for a sample of Morningstar analyst-rated ETFs that serve as proxies for major asset classes. A blended global portfolio slid 2.74% last month, as stocks and bonds failed to sustain their momentum from a hot start to the year.

The specter of interest-rate hikes resurfaced in February after economic data came in hotter than expected. Labor market, consumer spending, and inflation data all painted the picture of an economy that hasn’t wilted on interest-rate raises. That implied that the Fed has more work to do, lifting bond yields and saddling Vanguard Total Bond Market ETF BND with a 2.67% February loss. Impact from the economic data reverberated outside the U.S., too; Vanguard Total International Bond ETF BNDX slid 1.5% in February.

Bond funds with longer time horizons bore the brunt of the renewed interest-rate concerns. Consider the disparate returns of Treasury portfolios, whose minimal credit risk means that interest rates alone drive performance. IShares 20+ Year Treasury Bond ETF TLT pulled back 4.85% in February, while iShares Short Treasury Bond ETF SHV squeezed out a 0.29% gain. That was a swift U-turn from January, when TLT climbed 7.64% and beat its short-term sibling by more than 7 percentage points. Investors hoped that was a bellwether at the time, but February made it look more like a flash in the pan.

Fixed-income ETFs that focus on credit risk didn’t stand out in February, either. IShares Broad USD Investment Grade Corporate Bond ETF USIG fell 3.22%—a bit further than BND, whose average maturity it approximates. SPDR Bloomberg High Yield Bond ETF JNK finished the month 1.9% lower than where it started. Invesco Senior Loan ETF BKLN showcased its flexibility amid rate increases, standing pat with a modest 0.13% February decline.

Stocks Step Back

After sprinting out of the gates in 2023, U.S. stocks took a breather in February. Vanguard Total Stock Market ETF VTI slid 2.4%, as the economic concerns that spoiled bond returns weighed on stocks as well. That said, returns between different market segments looked different in February than in 2022. Steeper interest rates hammered Vanguard Growth ETF VUG last year, but its 1.42% decline in February was shallower than Vanguard Value ETF’s VTV 3.24% drawdown.

February challenged the cheaper sectors that VTV favors. Last year’s hero, Energy Select Sector SPDR ETF XLE, retreated 6.94%, last among SPDR’s suite of sector ETFs. Even the defensive sectors wavered. Utilities Select Sector SPDR ETF XLU shed 5.92% in its worst month since September 2022. Power provider Dominion Energy’s D 12.6% decline made it the main detractor, but each of XLU’s 30 holdings finished February in the red. Health Care Select Sector SPDR ETF XLV fell 4.64%, as a wide earnings miss sent Moderna MRNA into a 21% drawdown. Other pharmaceutical firms Johnson & Johnson JNJ, Eli Lilly LLY, and Pfizer PFE each slid between 5% and 10%. Troubles in more-resilient sectors led to substandard February performance for low-volatility funds like iShares MSCI USA Minimum Volatility Factor ETF USMV (3.5% loss) and Invesco S&P 500 Low Volatility ETF SPLV (3.34% loss).

On the other hand, Technology Select Sector SPDR ETF XLK scratched out a 0.41% gain to finish February as the lone SPDR sector ETF in positive territory. It has Nvidia NVDA to thank for that. The semiconductor giant climbed 18.83%, in part because the suddenly ubiquitous ChatGPT illuminated the value of the firm’s artificial intelligence exposure. Nvidia has soared 58.86% since the start of 2023 after losing about half of its value in 2022. Tesla TSLA and Meta Platforms META also continued their bounceback campaigns with gains of 18.76% and 17.43%, respectively.

Small-cap stocks tend to be more volatile and sensitive than their large-cap peers, but stature didn’t breed success in February. IShares Core S&P 500 ETF IVV fell about 2.53%, while iShares Core S&P Small-Cap ETF IJR held its decline to about half of that—after it more-than doubled IVV’s return in January. Some of small caps’ advantage may be traced to the strengthening of the U.S. dollar. A higher share of their revenue comes from American soil, while the multinational firms that commonly reside in large-cap indexes have translated foreign revenue into U.S. dollars at increasingly unfavorable rates. A stateside recession would test the mettle of economically sensitive small caps, but they have held their own in adverse markets thus far.

Broad international stock indexes had an even rougher month than domestic ones. Vanguard Total International Stock ETF VXUS retreated 4.27% in its worst month since September 2022. Emerging markets fared among the worst. Hamstrung by poor performance from Asian equities, iShares Core Emerging Markets ETF IEMG shed 6.92%. Deteriorating U.S.-China relations peeled 9.8% off the Morningstar China Index in February, a firm step back after Chinese stocks started 2023 with promise. European stocks held up better. IShares Core MSCI Europe ETF IEUR capped its drawdown at 1.46%, as modest gains in France and U.K. markets helped keep it afloat.

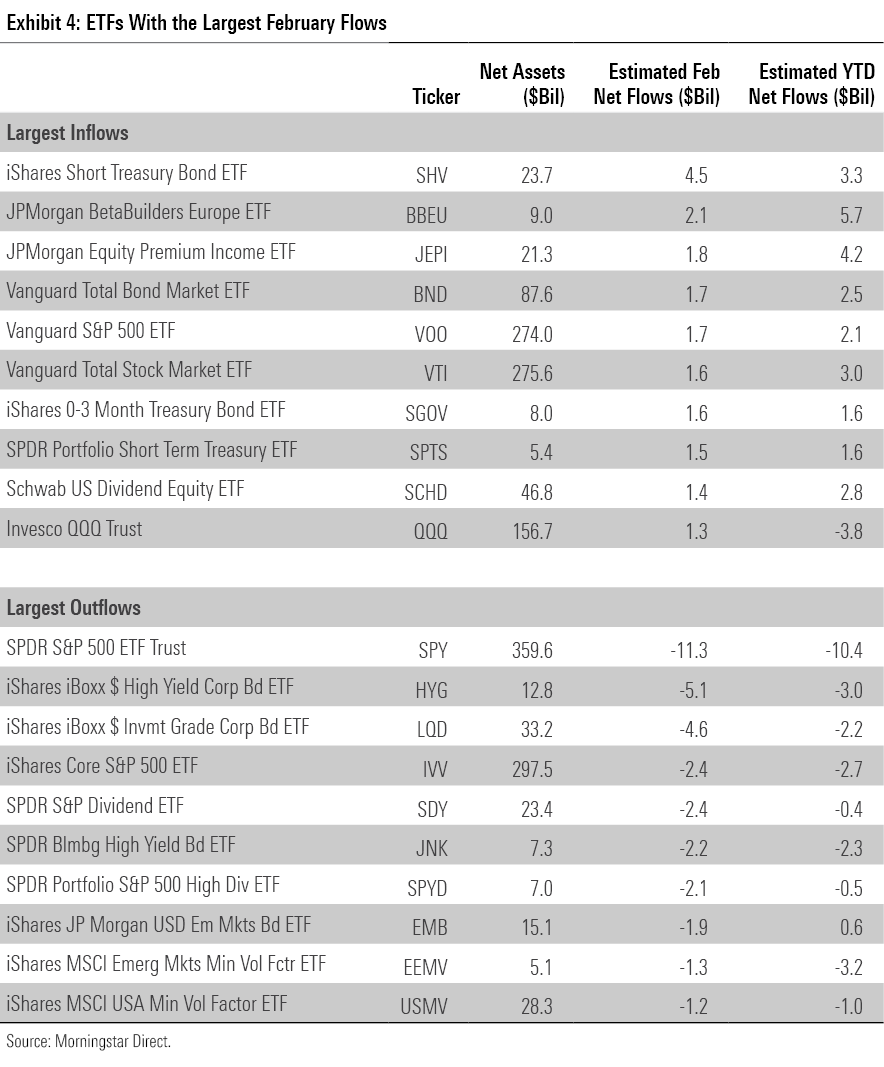

Stock ETF Flows Fall Flat

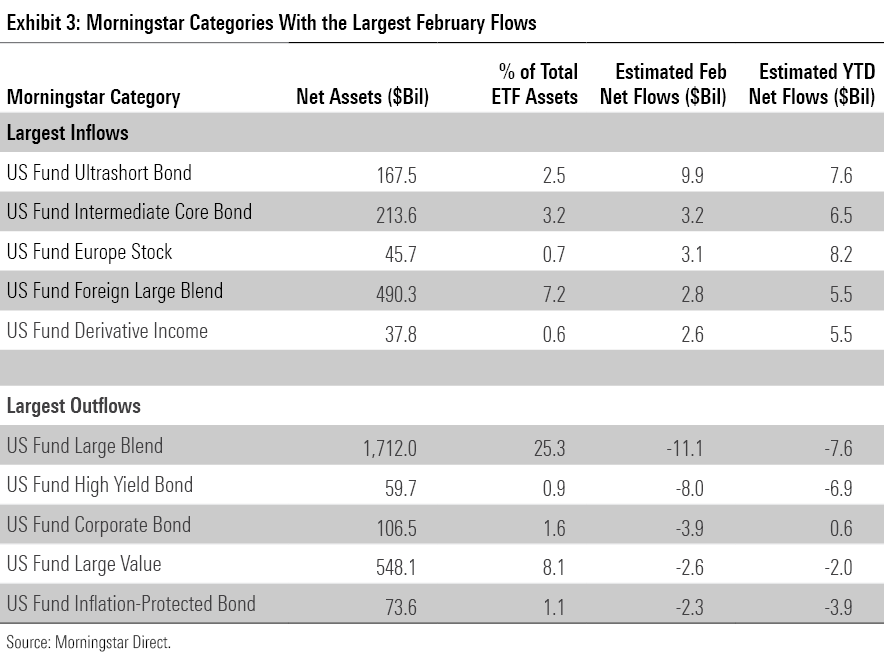

Stock ETFs finished the month in outflows for the first time since April 2022. The $1.8 billion they surrendered in February is a far cry from the $26.4 billion that rushed out of its doors then. But U.S. stock funds were to blame in both cases. Investors yanked $8.2 billion from them in February. More than $11 billion came directly from SPDR S&P 500 ETF Trust SPY, whose common use as a liquidity instrument can prompt volatile month-to-month flows. February marked its fourth month of $10-billion-plus outflows since the start of 2022. More-consistent stalwarts couldn’t cover for SPY’s outlfows last month: IVV lost money, while VTI and Vanguard S&P 500 ETF VOO saw relatively modest inflows.

U.S. large-value funds bled $2.6 billion to cinch back-to-back months of outflows for the first time since April and May 2020. Dividend funds—the lifeblood of the value category’s lucrative 2022—lost some luster, leaking about $4.8 billion in February. Furthermore, three of the five heaviest large-value outflows came from funds with “high dividend” in their name. Many of these riskier, energy-heavy strategies trounced the market last year, but their shaky start to 2023 has forced investors to study them with a fresh set of eyes.

Foreign-stock performance didn’t pass the eye test in February, either. But their tremendous January seems to have bought them more leeway. International-stock ETFs reeled in $8.9 billion, roughly the same amount their domestic counterparts lost. Europe-stock funds continued their hot start with $3.1 billion of inflows in February. Investors have dumped $8.2 billion into these funds in 2023, sending them well on their way to recover the $10 billion they shed in 2022. JPMorgan BetaBuilders Europe ETF BBEU has single-handedly driven the category to new heights, reeling in $5.7 billion for the year to date after another huge month. Foreign large-blend and diversified emerging-markets—the two largest international-stock categories—pulled in more than $5 billion apiece for the year to date, too.

Sector-equity funds endured their third consecutive month of outflows in February. It didn’t matter whether sectors were cheap or frothy, defensive or cyclical: Investors wanted their sector investment off the table. They pulled a total of $5.1 billion out of these ETFs in February. The only U.S. sectors to finish with inflows were financials ($1.7 billion), industrials (646 million), and communications ($14 million).

Risk Reversal

After carrying strong flow momentum into the new year, bond ETFs stumbled in February. They shed a modest 915 million in their first month of outflows since January 2022.

Within the fixed-income universe, the difference in flow patterns from January to February reveals an investor base that lost its appetite for risk. In January, investors lined up for riskier bond portfolios. Corporate, high-yield, and emerging-markets bond portfolios all reeled in between $1 billion and $5 billion, while cashlike ultrashort bond funds lost about $3.5 billion. Those inflows stopped on a dime in February. Ultrashort bond funds raked in $9.9 billion to lead all categories, while money rushed out of emerging-markets ($1.8 billion outflow), corporate ($3.9 billion), and high-yield bond ($8 billion, an absolute outflow record). It’s unclear whether investors’ newfound risk aversion is here to stay. For now, investors have flocked to safety.

Portfolios constructed to weather or battle inflation continued to take it on the chin in February. Inflation-protected bond funds cemented their sixth consecutive month of outflows with a $2.3 billion February exodus. Between that outflow streak and suboptimal performance in 2022, these funds sported a total of $73.6 billion in assets at the end of February, almost 30% lower than their peak size at the end of 2021. Bank-loan funds, another bond category that tends to manage inflation well, surrendered about $603 million. And the commodities-broad basket space suffered outflows for the 10th consecutive month. That stretch has been particularly unkind to iShares GSCI Commodity Dynamic Roll Strategy ETF COMT; its $1.5 billion outflow over the past 12 months more-than doubled its next-closest peer.

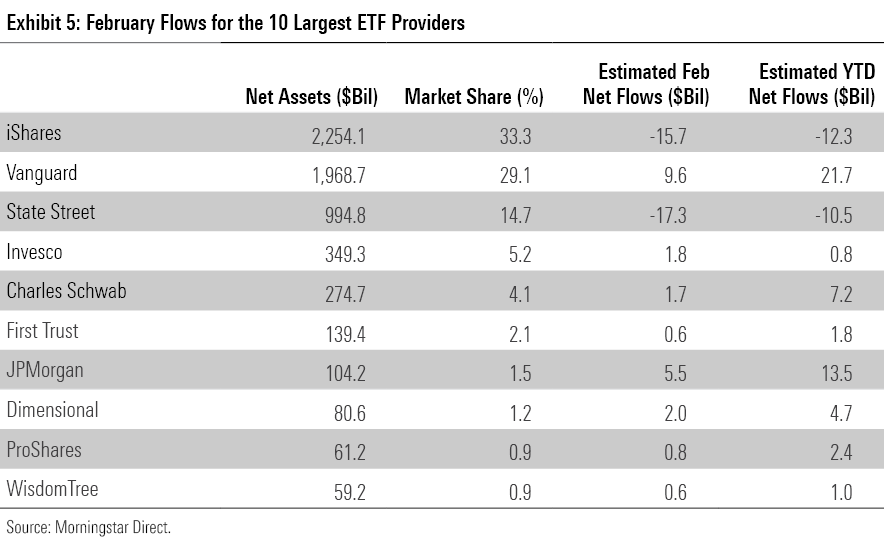

JPMorgan’s Active ETFs Shine

In a cloudy month for both returns and inflows, active ETFs were a bright spot. They hauled in about $8.6 billion as their index-tracking counterparts shed about $10.4 billion. Perhaps no firm has capitalized on the swelling interest in active ETFs like JPMorgan. The firm’s active ETF lineup reeled in over $21 billion in 2022, then followed it up with about $6.3 billion thus far in 2023. The unquestioned star is JPMorgan Equity Premium Income JEPI, but active offerings like JPMorgan Ultra-Short Income ETF JPST and JPMorgan Nasdaq Equity Premium Income ETF JEPQ have thrived this year too, pulling in about $1.2 billion and $601 million this year, respectively. Whether JPMorgan’s active funds continue to increase at this rate is uncertain, but they have proved to be more than a one-year wonder.

Picking Up the Pace

Relatively tame inflows were enough to earn Vanguard the number-one spot on the ETF providers table in February. Its $9.6 billion inflow marked its lowest monthly total since last September, but it provided ample cushion as money rushed out of iShares ($15.7 billion outflow) and State Street ($17.3 billion). For Vanguard, the standard blueprint helped it stay ahead. BND, VOO, and VTI reeled in between $1.6 and $1.8 billion apiece, even as returns on all three sunk—a testament to the unflappable mindset of their investor base.

Pacer ETFs spent the first years after its 2015 launch on the periphery of the ETF universe. But its breakout came in 2022, when investors poured $9.4 billion into Pacer U.S. Cash Cows 100 ETF COWZ, a fundamental strategy that spots the top 100 large-cap stocks by free cash flow and weights them by that metric. As COWZ utterly trounced most stock funds in 2022, the bovine bonanza spread: Pacer’s cash-cow ETFs for small-cap, global, and developed foreign markets soon welcomed healthy inflows, too. The firm nearly doubled its assets in 2022 in spite of the difficult market conditions, finishing the year with $19.5 billion in its coffers.

So far, Pacer looks determined to avoid a letdown in 2023. COWZ has already added a fresh $2 billion to its ranks. Three other cash-cow derivatives have cracked $100 million in year-to-date flows. Pacer’s run has landed them inside the top-20 largest ETF providers; whether COWZ and its offshoots can keep it there remains to be seen.

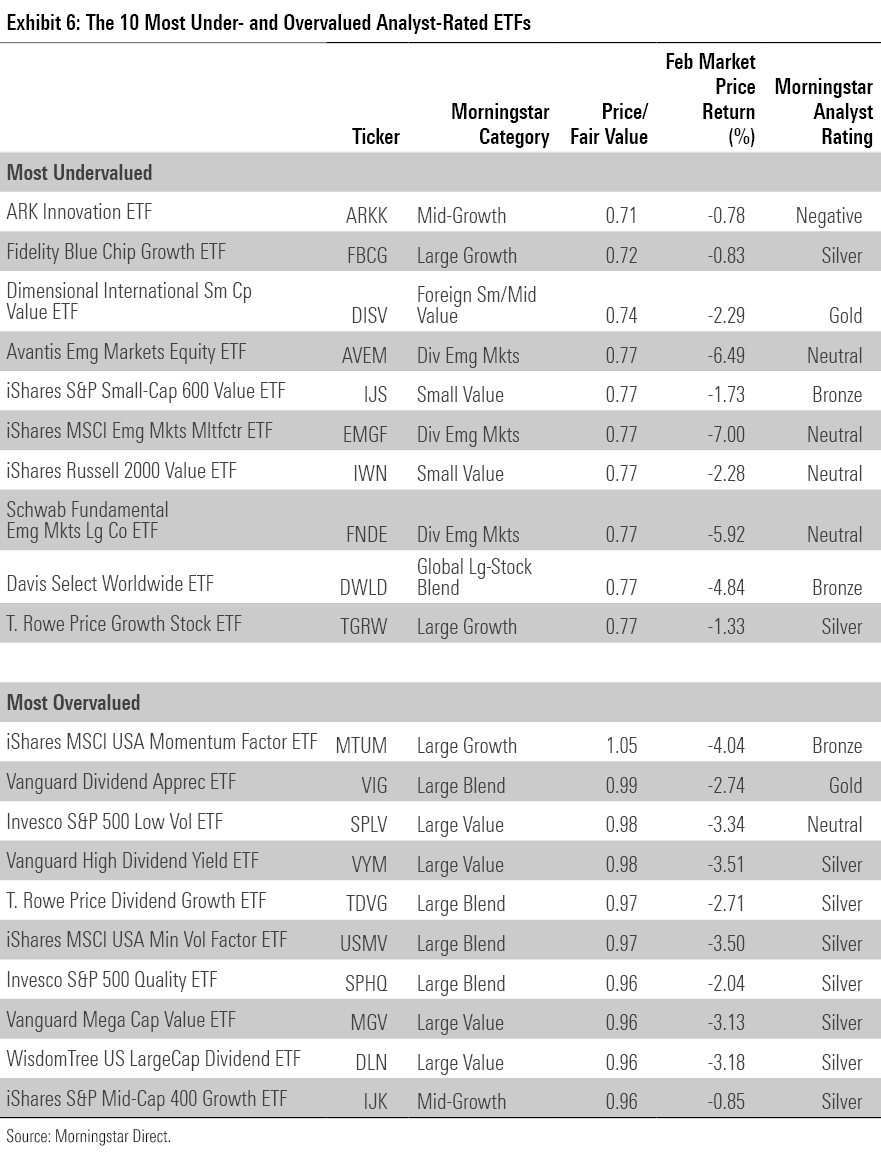

Emerging Markets Look Cheap

The fair value estimate for ETFs rolls up our equity analysts’ fair value estimates for individual stocks and our quantitative fair value estimates for stocks not covered by Morningstar analysts into an aggregate fair value estimate for stock ETF portfolios. Dividing an ETF’s market price by this value yields its price/fair value ratio. This ratio can point to potential bargains and areas of the market where valuations are stretched.

Relative to their fair value, stock ETFs are cheap across the board. At February’s end, only one of the 176 Analyst-rated stock ETFs traded at a premium (iShares MSCI USA Momentum Factor ETF MTUM). VTI traded 10% below its fair value at the end of February, and VXUS came in cheaper still with a 14% discount. Even for investors that want as much breadth as they can get it, valuable opportunities exist.

Investors most drawn to the bargain bin may turn to emerging markets. Funds that focus on these markets come with a particular set of risks, but their low valuations leave them room to run. Avantis Emerging Markets Equity ETF AVEM does not escape all these risks, but its broad reach and modest factor tilts should confer benefits. It emphasizes stocks with low valuations and high profitability, a pair of well-vetted factors that have historically been tied to market-beating returns. For a more run-of-the-mill emerging-markets fund, Bronze-rated IEMG and its 0.09% expense make for a solid choice.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)