Departure of Invesco CEO Unlikely to Spur Change of Course

Firm veteran tapped to replace longtime chief Marty Flanagan.

A changing of the guard at Invesco IVZ is unlikely to result in a significant change of direction, at least in the short term. The firm retains its Morningstar Parent Pillar rating of Average.

On Feb. 8, Invesco announced that its longtime CEO, Marty Flanagan, will retire at the end of June 2023. He will remain available in an advisory role with the title of chairman emeritus until Dec. 31, 2024, but after his retirement, he will no longer serve on Invesco’s board of directors.

Andrew Schlossberg, an Invesco veteran who currently serves as head of the Americas, will replace Flanagan as CEO, as well as president and board member. Since joining Invesco in 2001, Schlossberg has held a variety of positions covering many different aspects of the firm’s business, including head of Europe, Middle East, and Africa; and head of U.S. retail distribution and global ETFs.

Greg McGreevey, head of investments, also will retire on March 31, 2023. Two other Invesco veterans will share his role after he departs: Stephanie Butcher, currently CIO for EMEA, and Tony Wong, global head of fixed income. Butcher and Wong joined Invesco in 2003 and 1996, respectively.

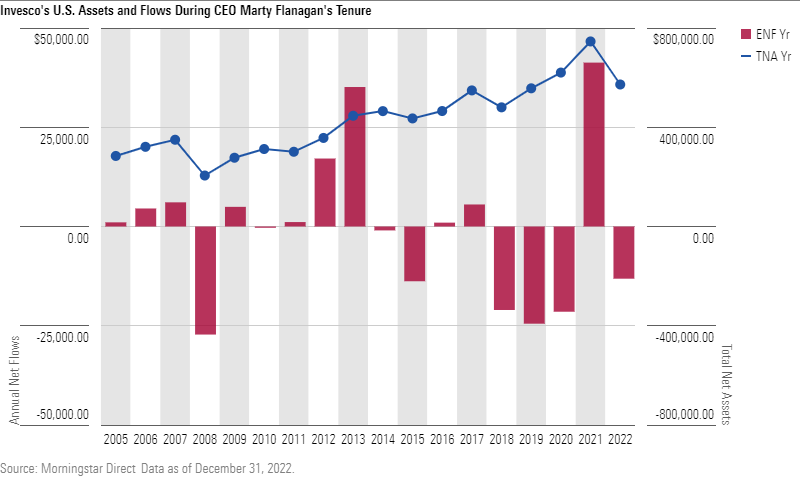

Flanagan has held Invesco’s CEO position for 18 years, a long tenure for a fund company leader. In that time the firm has seen much growth in its asset base. That growth owed in part to several acquisitions; Flanagan believed that the increasing pace of competition and consolidation in the asset-management field made it imperative for firms of Invesco’s large-but-not-dominant size to add scale. Invesco’s takeover of PowerShares in 2006 was a pivotal move in that direction, and the exchange-traded fund business that came under Invesco’s umbrella has become a critical piece of its business as investors’ appetite for ETFs has exploded.

The most recent acquisition, which closed in 2019, was of OppenheimerFunds. That action brought the well-respected Oppenheimer international-stock funds into the fold. Back-office cost-cutting was also an avowed purpose of the merger.

Flanagan’s desire to add scale had its limits, though. When powerful investor Nelson Peltz of Trian acquired substantial stakes in both Invesco and rival fund firm Janus Henderson, and reportedly pushed for a merger of the two, Flanagan’s public comments were muted; he seemed quite reluctant to bite. No merger took place, and Peltz has turned his attention to other investments. It’s hard to know how much influence Flanagan exerted to head off the merger push or if it failed to occur for other reasons. But if he did play a role it seems a wise decision. At the time, Invesco was still heavily engaged in the complicated details of absorbing OppenheimerFunds; moreover, Janus Henderson’s fund lineup wasn’t all that enticing a target, either.

In an industry dominated by the passive-fund giants—BlackRock, Vanguard, and State Street—it may well be true that getting bigger through acquisition, organic expansion, or both is essential for an asset manager to compete or even to survive. But a large, complex organization with a global footprint will find it extremely difficult to field strong managers and analyst teams for hundreds of funds in multiple asset classes across several geographical regions. And Invesco has not managed to pull this off. Performance of the firm’s mutual funds has been mixed, with some areas of strength, such as the international funds offered in the U.S. and certain fixed-income strategies, but that’s been offset by persistent struggles in other realms such as the funds focused on the U.S. stock market and the Asia-domiciled lineup.

As for the future, Schlossberg, Butcher, and Wong all have had lengthy careers with Invesco, working with Flanagan, as has Doug Sharp, who will take over Schlossberg’s role as head of Americas while keeping his current duties as head of EMEA. Therefore, although this group likely will put forth some new ideas, there’s no reason to expect a noteworthy change of direction for Invesco after Flanagan departs.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/657019fe-d1b1-4e25-9043-f21e67d47593.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/657019fe-d1b1-4e25-9043-f21e67d47593.jpg)