3 Funds Leaning Into Struggling Growth Stocks

These managers did what Warren Buffett suggested: They were greedy when others were fearful.

After a historic run, growth stocks finally hit a wall. The market’s willingness to pay handsomely for promises of future profits began to decline in 2021, but the party truly ended in 2022. Slowing economic growth, higher interest rates, and soaring inflation led investors to dump many stocks that could do no wrong 12 months earlier.

The crash was painful for some active managers, while for others it vindicated their avoidance of high-flying companies. But there were also funds that saw it as an opportunity. Buying when others are rushing to sell has typically been a prudent long-term move. Those with the foresight and courage to buy U.S. stocks in early 2009 or 2020 earned humongous returns in short order. However, investors who picked up plunging shares of fledgling internet companies in the early 2000s wound up with steep losses. How the current market will turn out is unclear, but the following funds that we rate took some of the biggest bets on a rebound based on the most recently available holdings data.

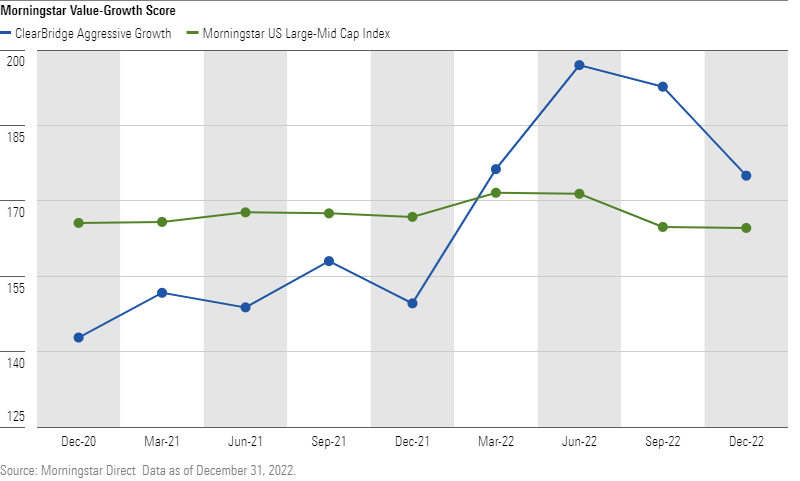

ClearBridge Aggressive Growth SAGYX

This fund had regularly found itself in the large-blend portion of the Morningstar Style Box despite its name—but that changed in 2022. Longtime manager Richie Freeman retired at the end of 2021, and his replacement, Aram Green, transitioned the portfolio to reflect a more targeted growth approach. Green picked up or added to younger stocks with high revenue-growth rates, such as cybersecurity firm CrowdStrike CRWD and software company HubSpot HUBS. He also sold off the portfolio’s stub position in energy stocks and increased weightings in consumer sectors. As a result, the portfolio’s Morningstar value-growth score increased markedly in 2022, indicating a shift toward the growth style.

Because Green added to stocks that were declining, the impact of his activity isn’t readily apparent in the portfolio’s sector weightings, though they are much more evident when compared with the Russell 1000 category benchmark. For instance, the portfolio’s tech stake both began and ended 2022 with around a 35% weighting, while the benchmark’s plummeted. The timing for the strategy’s transition wasn’t ideal, as it finished near the bottom of the large-blend Morningstar Category in 2022, but it could pay off in the long term.

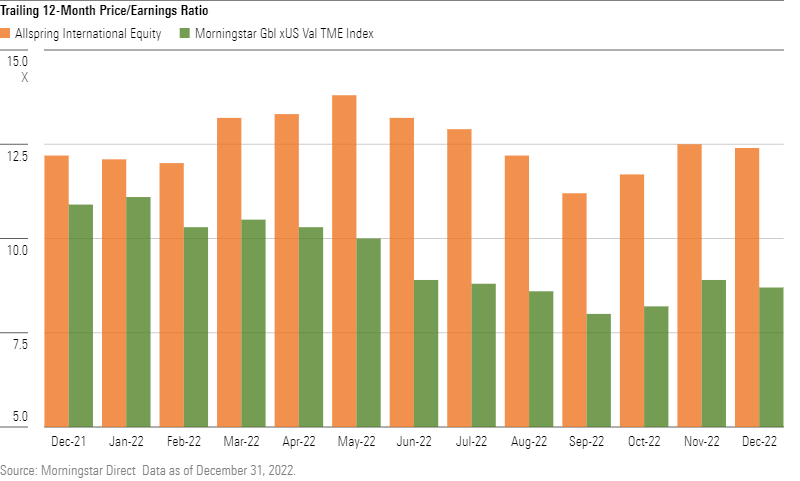

Allspring International Equity WFENX

Managers Dale Winner and Venkateshwar Lal operate a flexible, contrarian strategy. The two often evaluate stocks that are trading below their highs or are otherwise out of favor in hopes of capturing a rebound. Their eyes pivoted to growth stocks in 2022 amid sharp price declines. The portfolio’s weighting in tech stocks soared to a peak of nearly 14% by October 2022 from about 7% at the end of 2021. Even outside of tech, the managers added to companies with a higher growth profile, such as LONGi Green Energy, a Chinese solar power company, and contract research organization Icon PLC ICLR.

The pivot stung in 2022 as the fund trailed over 70% of its foreign large-value Morningstar Category peers. The managers may be willing to lose the battle to win the war over the long term.

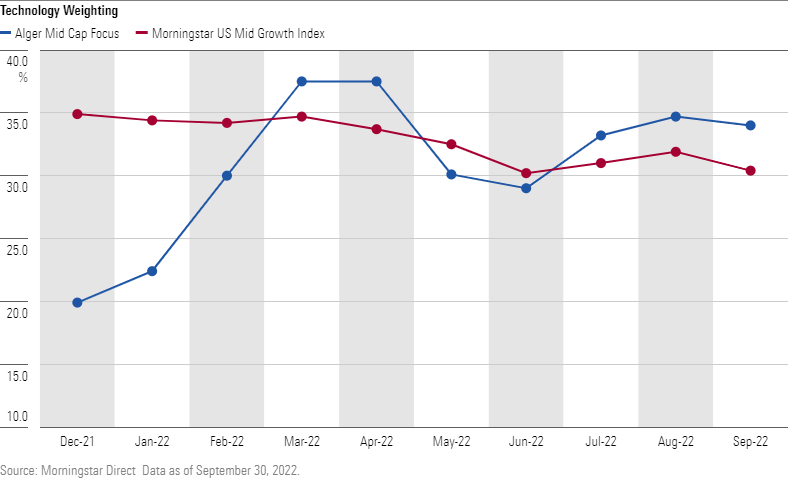

Alger Mid Cap Focus AFOZX

Manager Amy Zhang increased her trading activity over the past few years as markets became more volatile. Her portfolio grades out as one of the largest pivots to growth in 2022, yet the path there was jagged. For instance, she entered the year with a large underweighting to tech stocks relative to the Morningstar US Mid Growth Index but drastically increased exposure, nearly doubling the portfolio’s tech allocation within the first three months of 2022 as the market rout ensued. She then reduced exposure sharply in the subsequent three months but not by enough to offset the initial rise. Key purchases included cybersecurity firm Palo Alto Networks PANW and software company Tyler Technologies TYL.

Zhang also increased exposure to biotech stocks to over 9% of the portfolio by September 2022 after entering the year with 0%. Exposure to value-oriented materials stocks ebbed and flowed, first rising from a 0% allocation to 3% by June, only to be totally eliminated by August. Concerns around a potential recession led her to pivot away from these cyclical companies. Along similar lines, Zhang reduced financials and industrials holdings in 2022 and also increased exposure to utilities in the second half of the year. All told, the portfolio finished 2022 with more of a growth tilt than when it started.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)