Tech Stocks Collapse, Oil and Gas Risks Rise, and Your End-of-Year Portfolio Review

We’ll review the top stocks, funds, and exchange-traded funds this week as well as updates you can make to your portfolio.

What You Missed

This week, Big Tech stocks collapse, oil and gas risks grow, and the CPI report looks promising. We name the top 10 wide-moat stocks of 2022 and announce the one cheap stock top managers are buying. Christine Benz shares tips on taking last-minute required minimum distributions, John Rekenthaler talks investing lessons from the World Cup, and Sarah Newcomb discusses tolerance and perception.

Chart of the Week

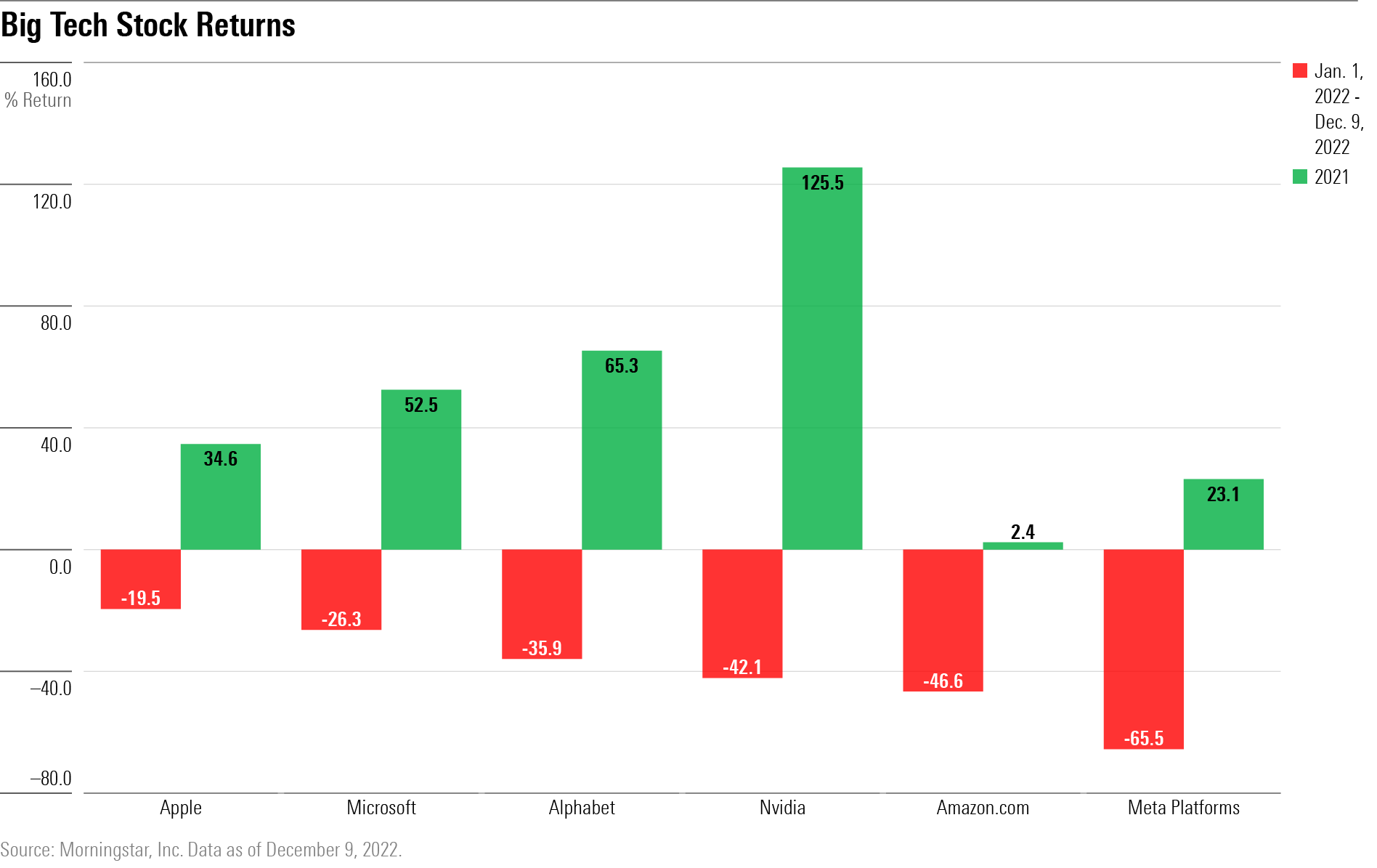

5 Charts on Big Tech Stocks’ Collapse

Big Tech stocks collectively lost nearly $4 trillion in market value in 2022.

In 2020 and 2021, one of the best places for stock investors to have their money was in mega-cap technology stocks. In 2022, it was one of the worst.

Tech has been one of the worst-performing sectors of the year, largely pulled down by the poor performance of software companies. As of Dec. 9, 2022, the Morningstar US Technology Index was down 28.7% for the year, underperforming the Morningstar US Market Index, which was down 18.7%.

Glossary Term of the Week

A 401(k) is a retirement savings plan offered by employers and funded by an employee with pretax contributions.

- 401(k) contributions and investment growth aren’t taxed, but withdrawals are taxed after a specific age, 55 or 59 ½.

- Some companies may offer a Roth 401(k) option, employee match, or automatic enrollment into traditional 401(k)s.

See Morningstar’s Investing Definitions and Financial Terms for the full definition.

Check out Carole Hodorowicz’s article “How Much Should I Have in My 401(k)?”:

If you ask any Morningstar specialist for advice, they’ll tell you to save early and save often. No matter the stage of life and investing you’re in, one thing is for certain: You need to save for retirement.

One popular way to do this is by enrolling in your company’s 401(k) retirement plan. With this retirement savings vehicle, your contributions aren’t taxed, and many companies offer an employee match.

What to Watch

Tips on Taking Last-Minute RMDs in 2022

Tax and IRA expert Ed Slott says that people taking required minimum distributions may have a bit of sticker shock this year.

Articles We Love

The 10 Best Wide-Moat Stocks of 2022

Do any of this year’s top performers have gas left in the tank for 2023?

Given the dismal performance of the market this year, some may be surprised to learn that the 10 best-performing wide-moat stocks of 2022 that our analysts currently cover have posted double-digit returns—all in excess of 30%, in fact. As a refresher, we assign wide Morningstar Economic Moat Ratings to only the highest-quality companies, those we think can outearn their costs of capital over the next two decades.

- Cheniere Energy LNG

- Cheniere Energy Partners CQP

- Merck MRK

- Aspen Technology AZPN

- BAE Systems BAESY

- Lockheed Martin LMT

- Northrop Grumman NOC

- Corteva CTVA

- Eli Lilly LLY

- Campbell Soup CPB

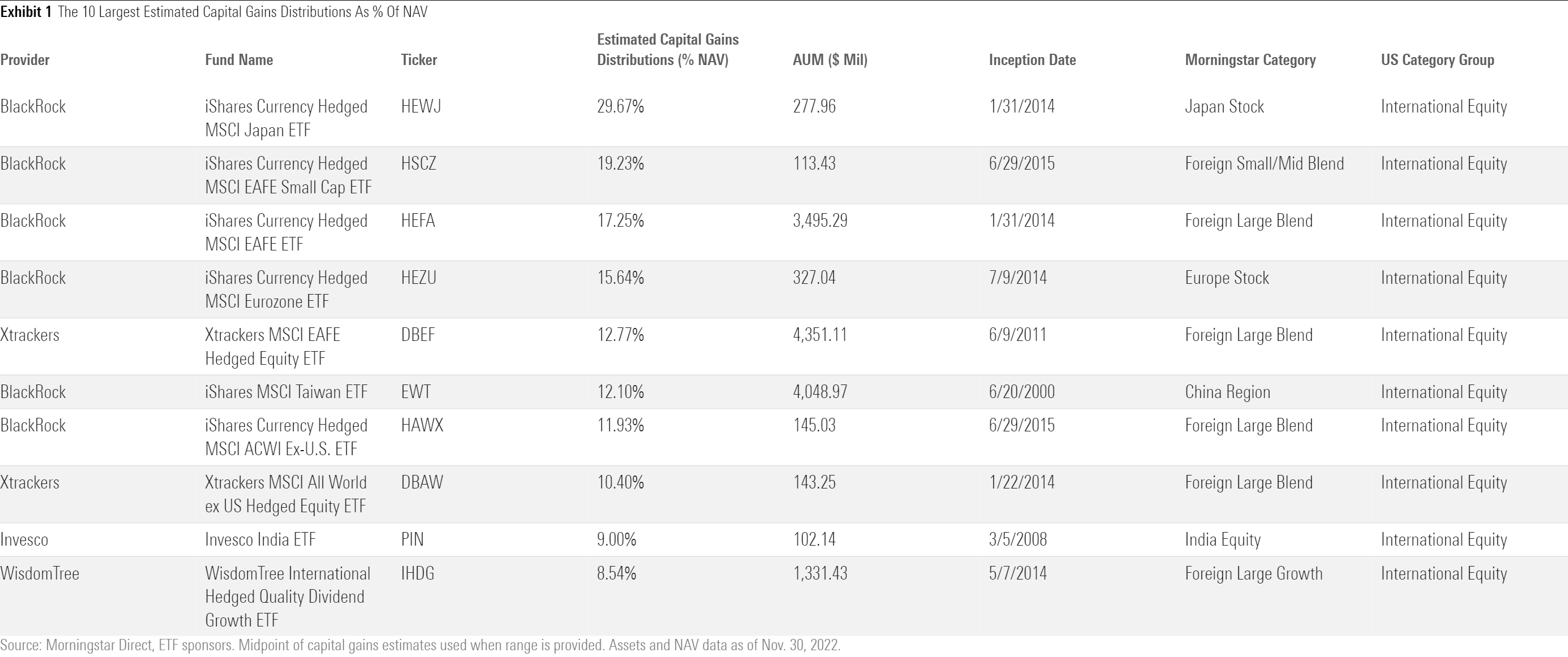

The Tax Efficiency of ETFs Alleviated Some Pain for Investors in 2022

One less worry for ETF investors during a tumultuous year for the market.

Exchange-traded funds once again proved their tax efficiency in 2022—very few will be distributing capital gains this year. And for the ones that will, their tax bills are nowhere near as large as those of mutual funds.

How the World Cup Can Teach You to Be a Smarter Investor

Sports fans and investors are prone to the same mistakes.

On Tuesday, Dec. 6, manager Fernando Santos benched his veteran forward, Cristiano Ronaldo, for Portugal’s round of 16 game with Switzerland in the 2022 World Cup. The two had recently scrapped. Also, it was the team’s fourth match in 13 days, and Ronaldo was 37 years old. He could use the rest.

To write that this choice made news is akin to stating that the Beatles were popular. Ronaldo is not only among the sport’s greatest-ever players, but he is also a world-class diva who attracts attention like sugar draws flies. (If Cleopatra and Maria Callas had somehow created a love child, Ronaldo would be he.) Across the world, save for the United States, the headlines blared.

A Year-End Portfolio Review in 7 Easy Steps

Check up on your portfolio’s health—and that of your whole plan—as the year winds down.

As 2022 winds down, it’s looking very much like an annus horribilis and an extreme turnabout from last year, when most investors enjoyed their third-straight year of big gains. Rising interest rates, the result of the Federal Reserve’s plan to tamp down inflation, led to dual routs in the stock and bond markets. Bright spots have been few and far between. Investment types like energy stocks, commodities, and managed futures funds have generated positive returns, but they tend to be light weightings in most investors’ portfolios.

If you’re a disciplined investor, you can use an annual portfolio review as a way to check up on your portfolio—and potentially make some changes—within the context of your well-thought-out plan. After all, even if you haven’t actively made changes to your portfolio mix, the contents of your portfolio may have shifted.

Oil and Gas ESG Risks Extend Beyond Carbon Emissions

We see pockets of value in midstream, integrated, and oilfield-services stocks.

With oil and gas set to remain major multidecade contributors to our energy mix, the industry’s range of environmental, social, and governance risks will remain pertinent for energy sector investors in the long term.

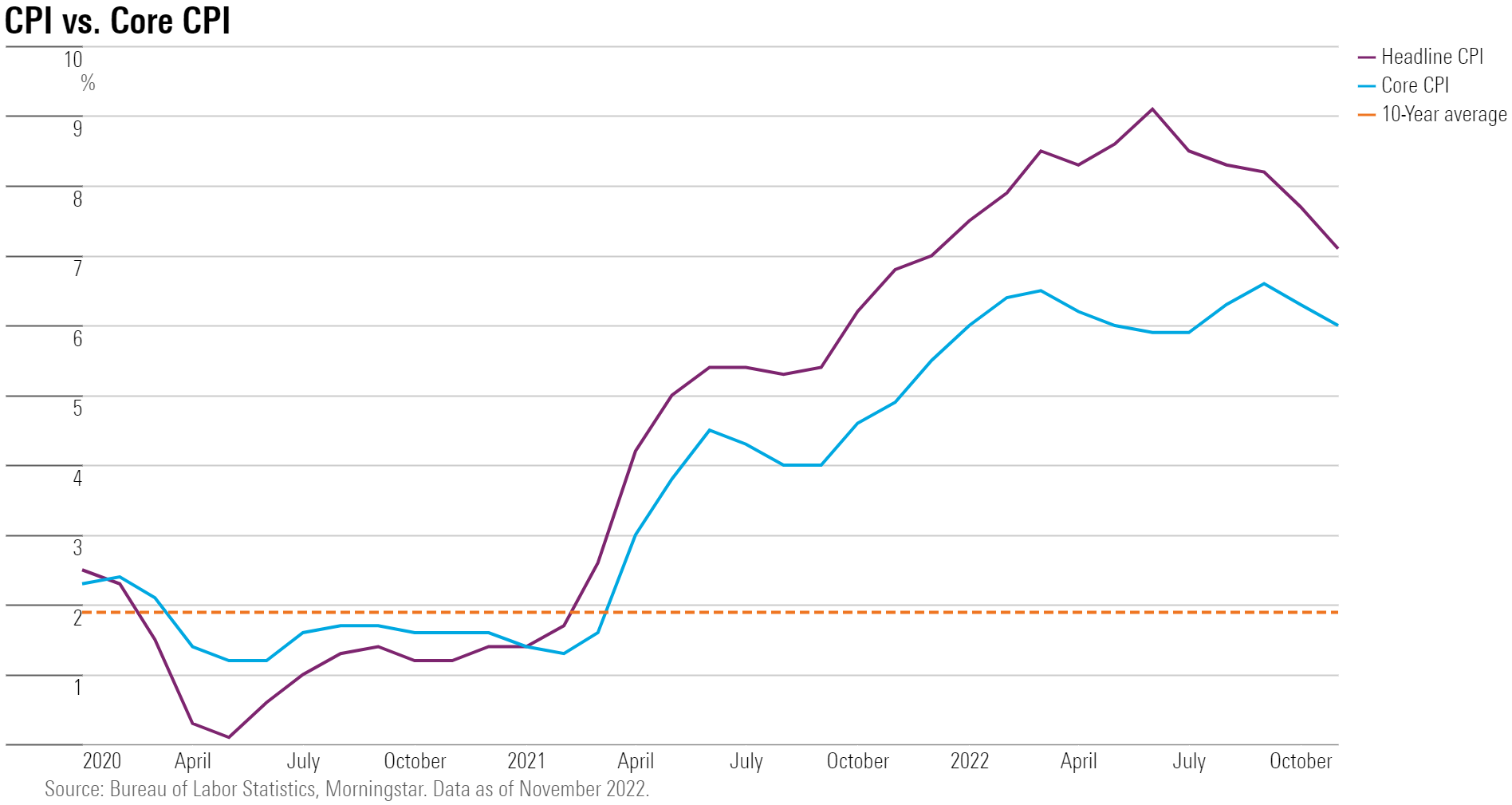

Too Early to Celebrate, but the November CPI Report Gives the Fed Breathing Room

Goods prices slide into deflation, but services show continued upward pressure.

For the second month in a row, there’s clear good news on the inflation front.

While the November Consumer Price Index report showed that the overall pace of inflation remains high, upward prices on goods consumed by households rose by a smaller-than-expected amount came in cooler than most economists had expected, signaling that after the worst bout of inflation in four decades, the Federal Reserve’s efforts to slow the march higher in prices appear to be having an impact.

Stocks, Funds, and Exchange-Traded Funds

Why Vanguard Total International Stock ETF Has an Advantage in 2023 and Beyond

Vanguard Total International Stock Index captures nearly all of the international stock market for a low fee. Most share classes earn a Morningstar Analyst Rating of Gold, including the exchange-traded fund VXUS, while the more expensive investor share class earns a Silver rating.

The fund tracks the FTSE Global All Cap ex US Index. It targets small-, mid-, and large-cap stocks from most overseas markets, pulling in almost 8,000 names. The final portfolio weights its holdings by market cap, which harnesses the market’s collective wisdom of each stock’s intrinsic value. This approach also helps mitigate turnover and the associated trading costs. The market tends to accurately price stocks over the long term. From time to time, it may chase stocks or sectors that are in vogue. This potentially leaves the portfolio exposed to overvalued parts of the market.

The One Cheap Stock Top Managers Are Buying

Each quarter, we take a look at the recent transactions of some of the top money managers around today—who we call our Ultimate Stock-Pickers.

Last quarter, one stock was a high-conviction purchase for a whopping 17 of our favorite managers.

What’s considered a high-conviction purchase? A high-conviction purchase is one that makes a meaningful addition to a portfolio, as measured by the size of the purchase in relation to the size of the portfolio.

And that one stock is …

Vanguard Slipping to Second Place in Fund Flows Race

For the first time since 2007, it looks like there’s going to be a new number-one fund company when it comes to where investors are sending their money.

Heading into 2022, Vanguard funds were the top destination for investor money for 15 consecutive years. While there’s still one more month to go to close out the year, BlackRock’s iShares looks poised to snatch the crown from Vanguard.

Through the end of November, iShares’ lineup of exchange-traded funds has collected $152.4 billion compared with Vanguard’s overall inflows of $80.3 billion.

Missed Us?

Check out our investing specialists on Twitter:

Do you know the difference between risk TOLERANCE and risk PERCEPTION? The distinction could save you from well-intentioned mistakes. https://morningstar.com/articles/1129151/when-it-comes-to-risk-its-dangerous-to-trust-your-instincts … #risk #investing #behavioral #financialliteracy - Sarah Newcomb @finance_therapy

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)