The Tax Efficiency of ETFs Alleviated Some Pain for Investors in 2022

One less worry for ETF investors during a tumultuous year for the market.

Key Takeaways

- Much fewer ETFs are distributing capital gains this year, due in part to the yearlong market downturn.

- However, capital gains as percentage of NAV are higher than usual for distributing ETFs.

- Forty-six percent of distributing ETFs belong to the international equity category group, overtaking taxable-bond funds as the category group with the most capital gains.

- Currency hedging and the inability to trade securities in-kind in some foreign markets are the main reasons for ETFs’ capital gains in 2022.

- As the mutual-fund-to-ETF conversion trend continues, converted ETFs carry over capital gains from their mutual fund past.

Exchange-traded funds once again proved their tax efficiency in 2022—very few will be distributing capital gains this year. And for the ones that will, their tax bills are nowhere near as large as those of mutual funds.

As of November 2022, 15 of the biggest ETF sponsors had reported their estimated capital gains distributions for the year. These firms back a combined 1,662 ETFs, holding more than $6.5 trillion of investors’ assets. Among those funds, just 41 (2.5%) are expected to distribute capital gains to investors in 2022. This is nearly half of what we saw in the past few years, which has hovered around 5-7% of all surveyed ETFs.

While the lack of gains during the market downturn is the main reason for the lower tax bills this year, ETFs’ structure also protected them from the redemption pains plaguing mutual funds. Thus, while many mutual funds are seeing outflows and capital gains at the same time, ETFs can take one thing off of investors’ plates during this already difficult year.

2022 Capital Gains Culprits

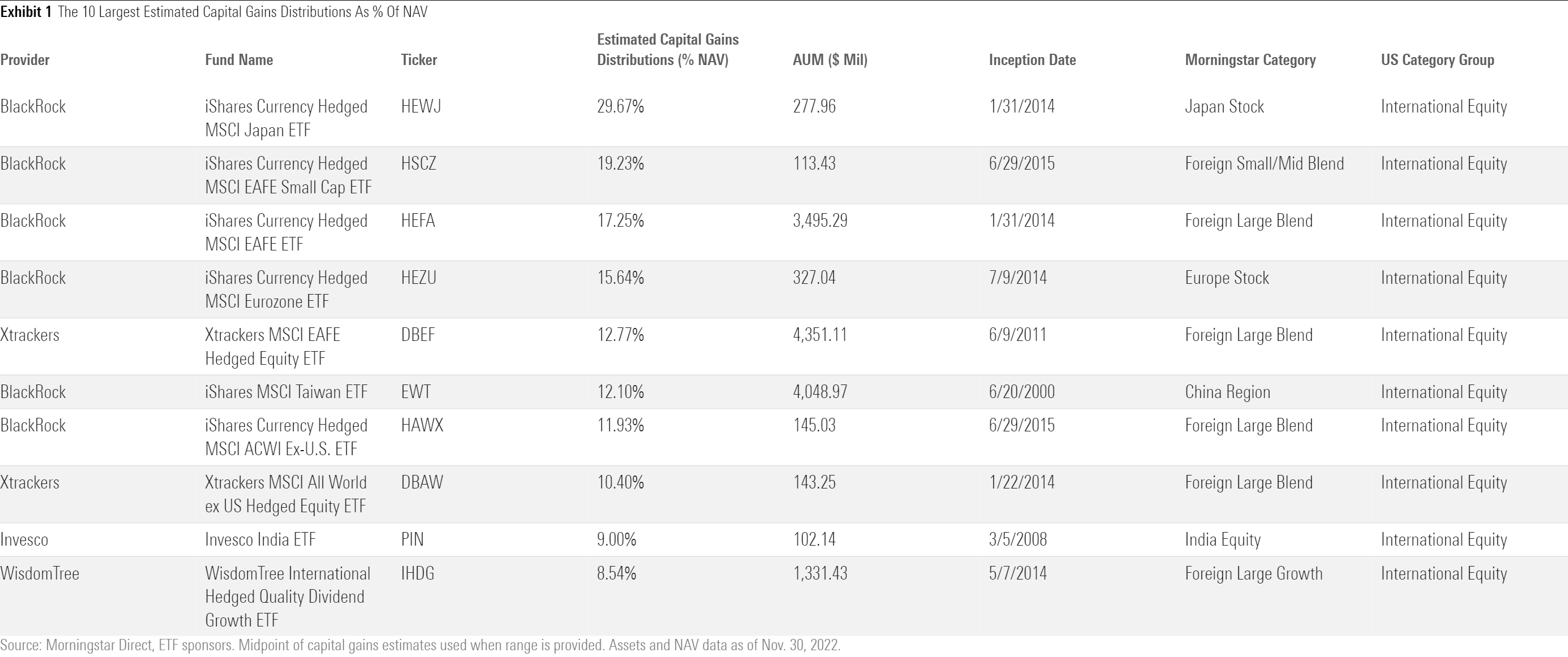

Exhibit 1 displays the 10 funds with the largest estimated capital gains distribution as a percentage of their net asset value. Since we started keeping score a few years back, there were only a couple of outliers with capital gains north of the 10% mark. This year has been different. Eight out of the 10 funds on this list will be paying out more than 10% of their NAV, with the highest distributions going up to nearly 30%.

All of these ETFs, and the majority of ETFs distributing high gains this year, belong to the international equity category group. A combination of currency hedging and local market securities laws explains the unusually high figures.

Most of these funds employ currency hedging, which involves frequent buying and selling of currency-forward contracts. Because the in-kind mechanism does not extend to these contracts, the fund locks in taxable gains when the contracts are profitable. The Federal Reserve has raised rates more aggressively than international central banks, causing the U.S. dollar to strongly appreciate. Currency-hedged ETFs have boosted performance through positive hedging returns, but those gains come at the cost of tax efficiency.

For the unhedged ETFs listed in Exhibit 1, certain foreign markets do not allow in-kind creation/redemption and severely handicap the tax efficiency of ETFs operating there. Without the tax benefits of in-kind redemptions, every portfolio change becomes a taxable event, similar to a mutual fund. A combination of high outflows and local securities laws aggravated 2022 tax bills for iShares MSCI Taiwan ETF EWT and Invesco India ETF PIN. Major foreign markets that do not allow in-kind include, but are not limited to, Brazil, China A and B shares, India, South Korea, and Taiwan. Investors can also look through the risk section of their fund’s prospectus for more details (usually under “Cash Transactions Risk”).

It’s worth noting that the fund at the top of the list, iShares Currency Hedged MSCI Japan ETF HEWJ, does not suffer from an inability to perform in-kind transactions. Its 29.67% distribution is the result of successful currency hedging and massive year-to-date outflows of more than 60% of its December 2021 asset base.

International Equity Investors Beware

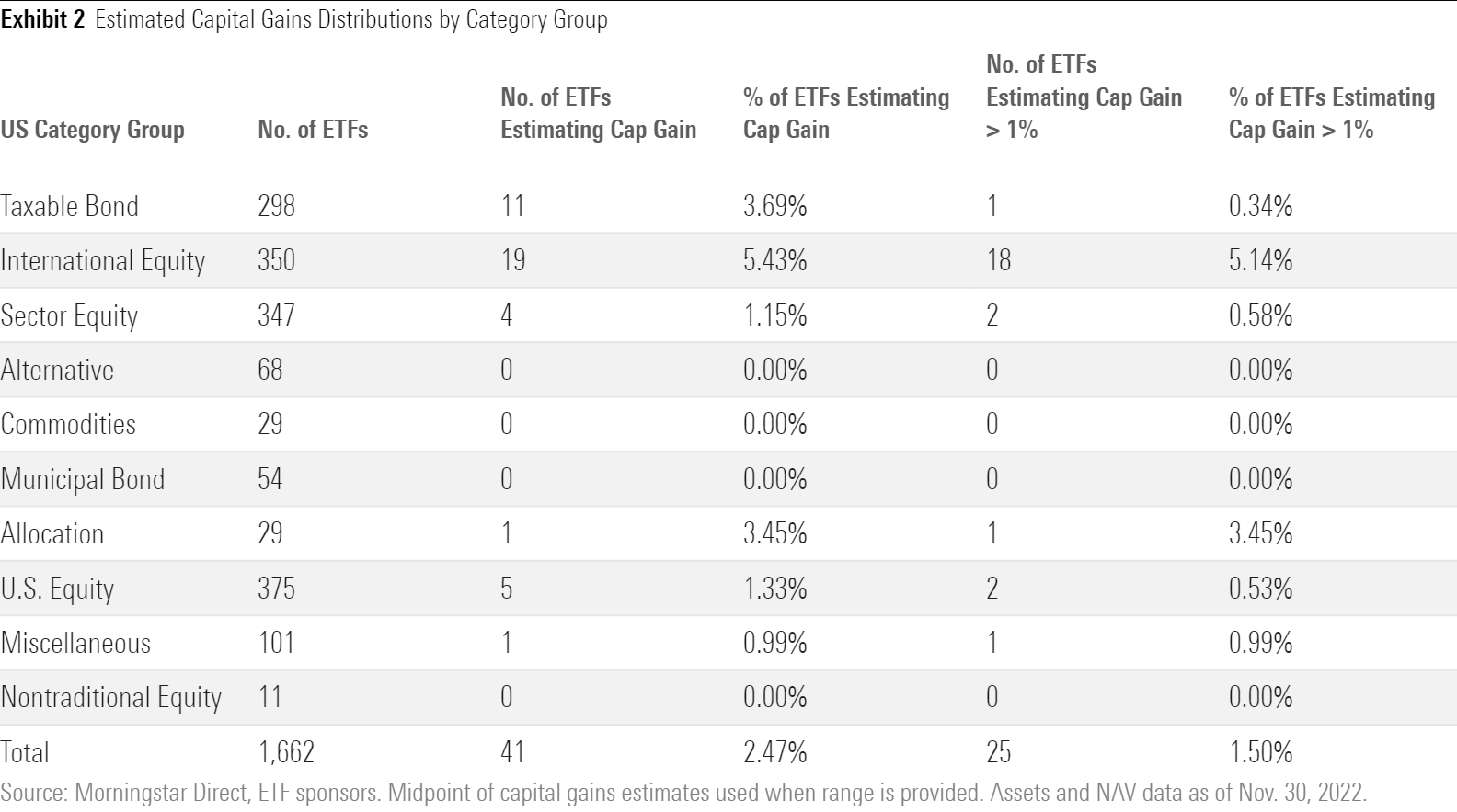

Exhibit 2 breaks down estimated capital gains distributions from the ETFs we’ve collected data for across their respective category groups. Due to the nature of their asset class, bond funds are the usual suspects on the capital gains distribution list. However, only 11 bond ETFs are paying out gains this year compared with 28 equity ETFs.

While 2021 saw an uptick in the number of equity ETFs distributing capital gains, 2022 has completely turned the tide. International equity overtook taxable bond as the category group with the highest number of distributing ETFs at 19 funds. More importantly, 18 out of these 19 ETFs will be distributing more than 1% of their NAV in capital gains, compared with only one out of 11 for the taxable-bond category group.

Following the trend seen in Exhibit 1, capital gains as a percentage of NAV increased this year. Nearly 61% of the distributing funds (25 funds) are paying out more than 1% of their NAV, and more than 34% (14 funds) are paying out more than 5% of their NAV. While these numbers are but a blip on the radar compared with the total number of ETFs surveyed, they indicate a concentration of high capital gains in this year’s roster.

Who Let the Gains Out?

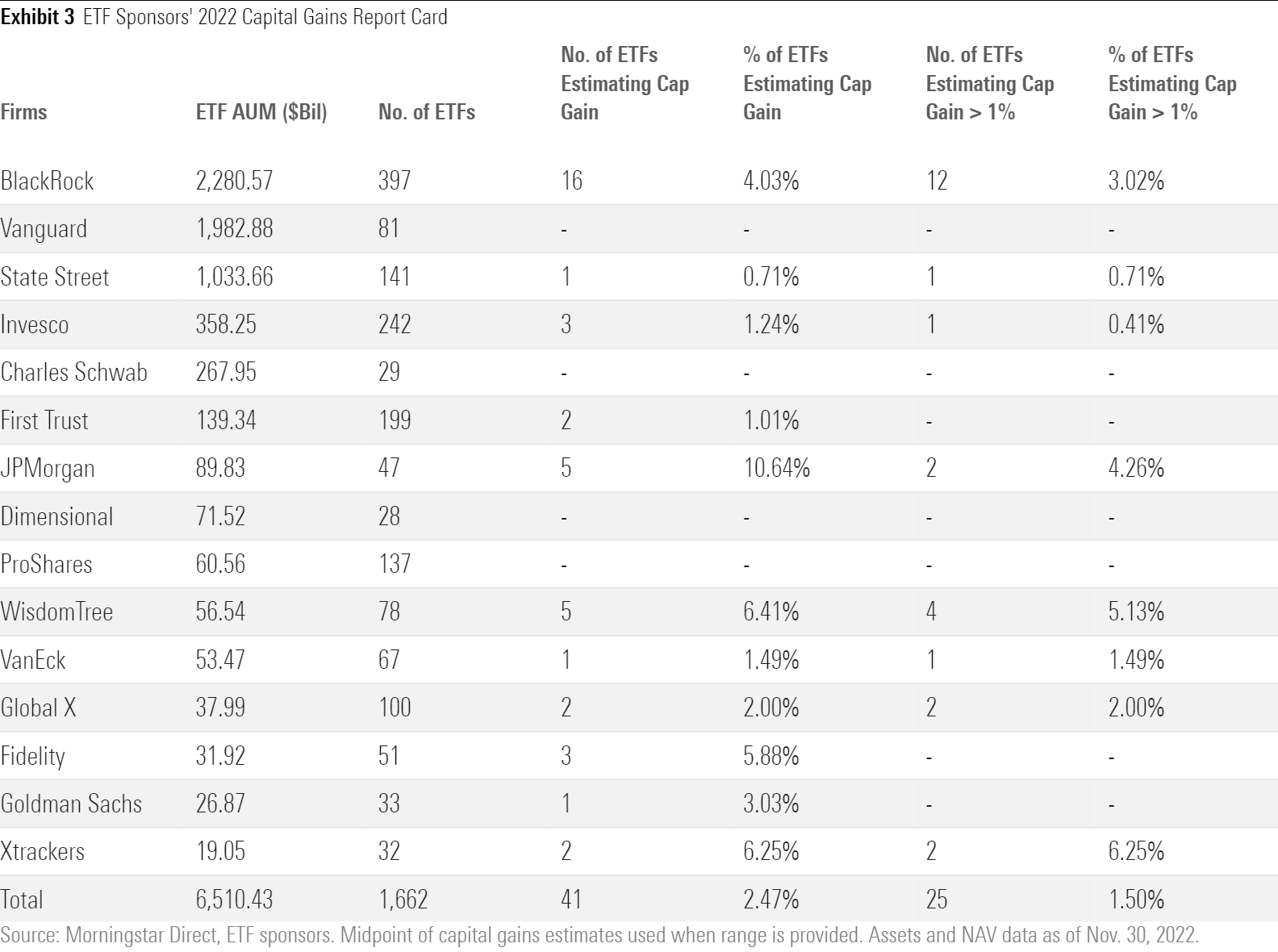

Exhibit 3 tallies the distributions among the ETF sponsors from whom we collected capital gains estimates. These figures illuminate the difference in the makeup of these firms’ ETF lineups. Firms with the highest amount of ETFs paying out gains have a large number of ETFs with single-country focus or currency hedging.

BlackRock tops the chart of ETFs distributing capital gains with 16 funds. Eleven are funds investing in international equities and nearly half are currency-hedged strategies. WisdomTree and Xtrackers lead the pack with the highest percentage of their ETFs paying out gains. Most of their distributing funds this year are, again, currency-hedged ETFs.

Firms with a strong domestic equity focus are not seeing much of a tax bill this year. Vanguard, Schwab, Dimensional, and Proshares don’t even have any ETFs distributing capital gains in 2022.

All of Fidelity and JPMorgan’s distributing ETFs this year are actively managed strategies, which tend to have higher turnover and consequently more taxable events. Four of the five JPMorgan ETFs paying out gains have been converted from mutual funds earlier this year.

Largest Distributing ETFs

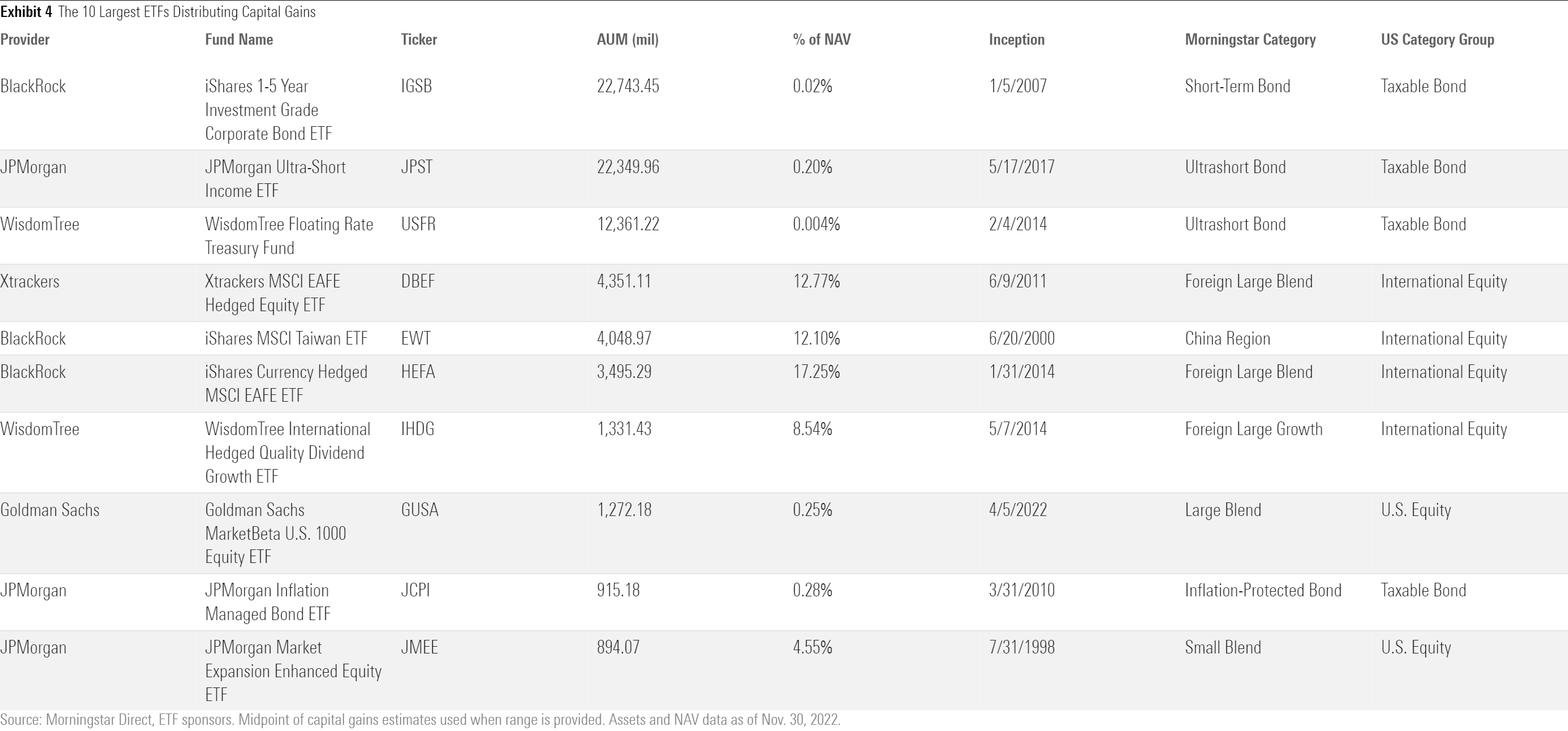

Exhibit 4 displays the 10 largest ETFs making capital gains distributions in 2022. Taxable-bond funds are topping the list again this year. However, equity offerings account for more than half of this year’s list, particularly international equity ETFs.

Of the three actively managed JPMorgan ETFs here, the bottom two entrants were converted from mutual funds earlier this year. Passive ETFs make up the rest of this list, as they tend to have larger asset bases. Thirteen out of the 41 distributing ETFs in 2022 are actively managed. As a percentage of all the ETFs we surveyed, nearly 5% of active ETFs are distributing capital gains compared with 2% of passive ETFs.

More Gain, Less Pain

While it’s still true that ETFs are more tax-efficient than mutual funds, it’s important to remember where these advantages come from. ETFs’ tax benefits aren’t airtight, and taxable investors will still get a bill for regular distributions of income. But most do a very good job of helping investors defer capital gains taxes, allowing them to pay the taxes that they owe when they owe them, and not when others might stick them with the bill—as has been the case for years for many mutual fund investors.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)