Why There Is Good News for Investors in the Jobs Report

Rise in labor force participation and slowdown in wage growth bodes well for inflation and the economy.

Despite all the chatter about economic pain and recession, the jobs market remains healthy. The question now is whether it’s still too hot to bring inflation down to where the Federal Reserve wants it to be.

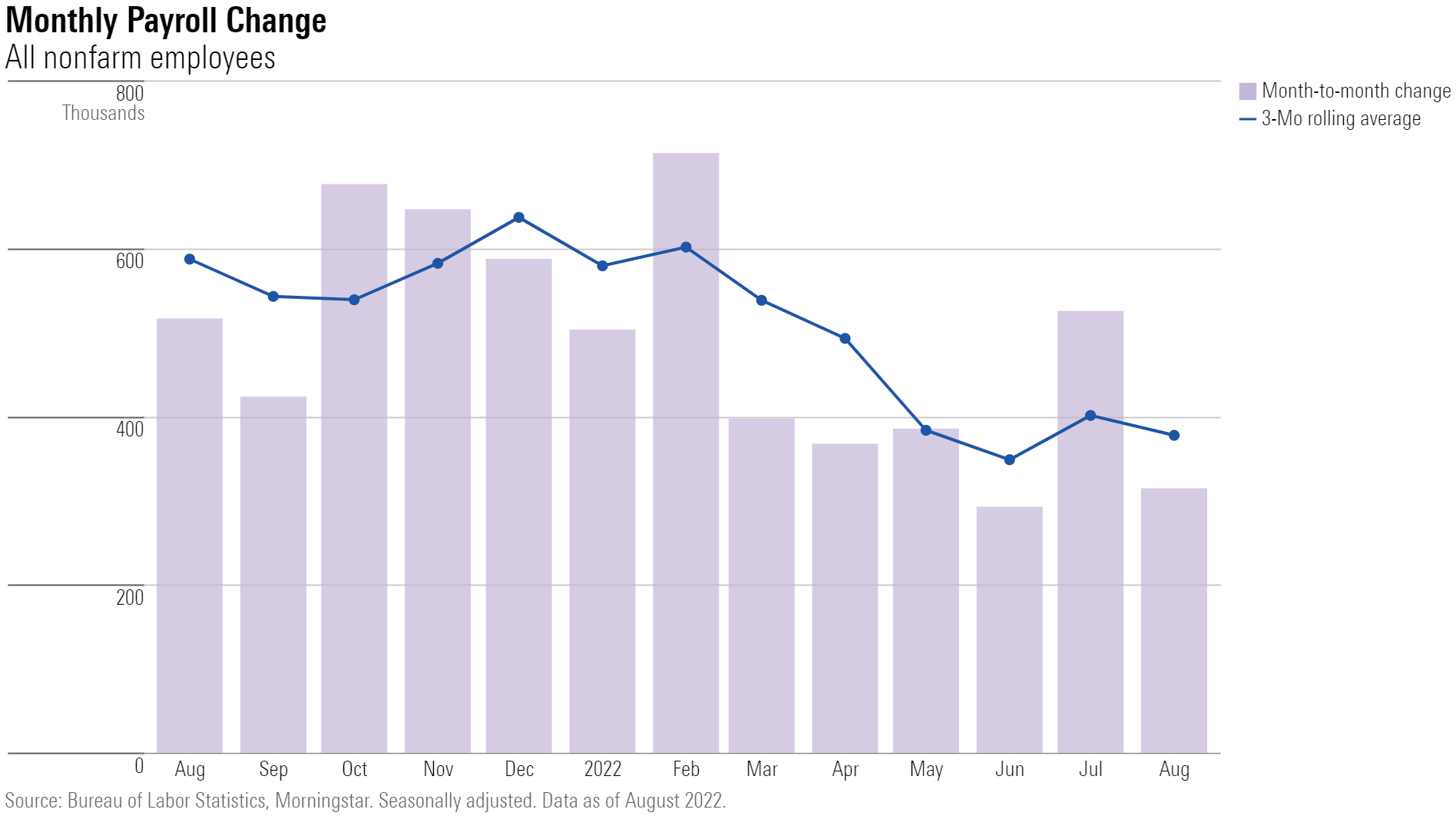

The August jobs report from the Bureau of Labor Statistics showed total nonfarm payroll employment rose by 315,000, a drop from the 528,000 jobs added in July but still a healthy number and largely in line with estimates.

“Today's jobs report shows early signs that labor supply is increasing—thereby slowing down runaway wage growth—but it's unlikely to have a major impact on the Fed's plans to hike interest rates,’’ says Morningstar’s chief economist Preston Caldwell.

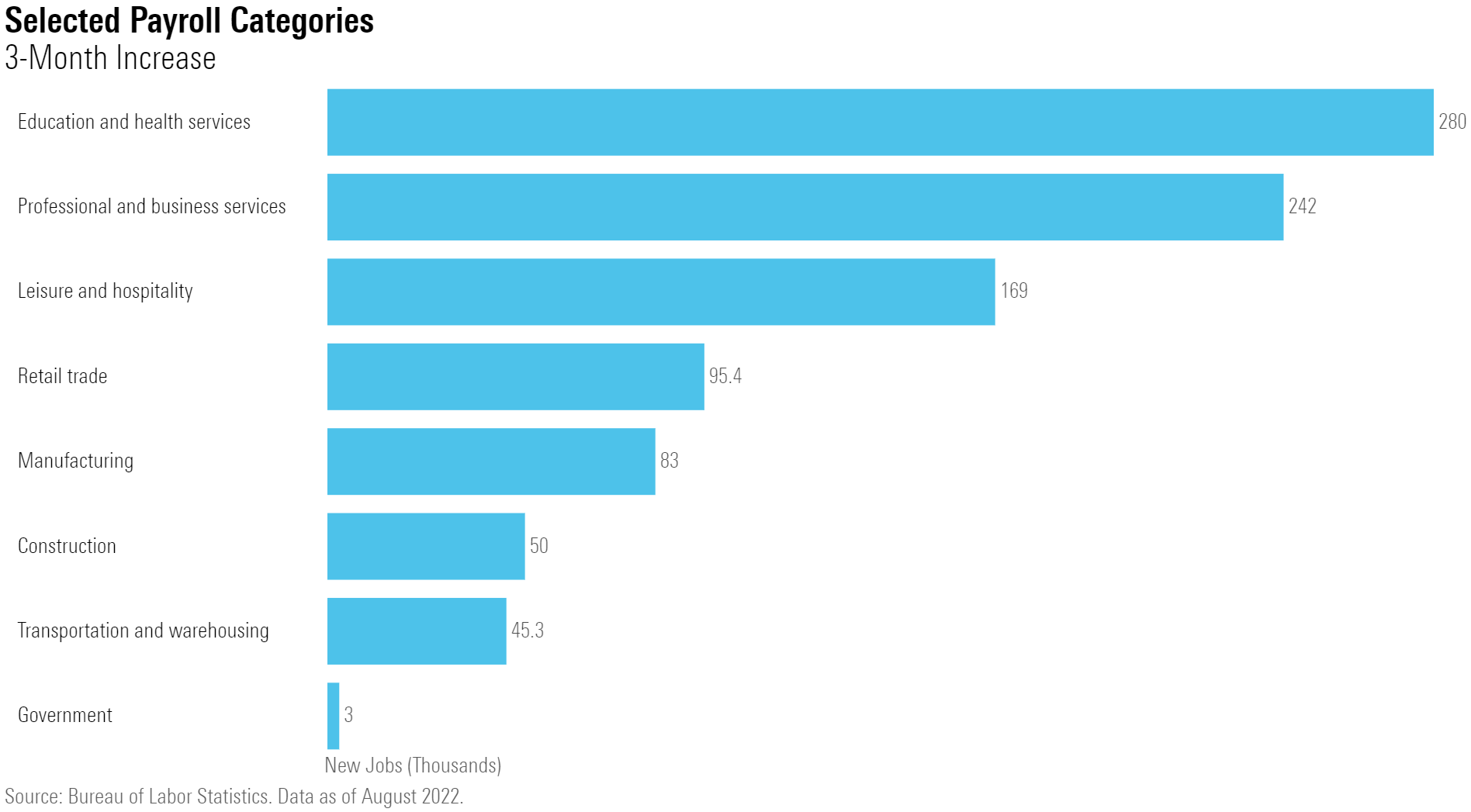

The latest jobs report revealed a huge jump in labor force participation, reflected in the increase in the unemployment rate to 3.7% from 3.5% in July. Notable job gains came from professional and business services, healthcare, and retail trade in August, the Labor Department said.

"Employment growth remains stronger than normal, signaling a need to continue cooling off the economy," Caldwell says. "But the large increase in labor force participation (which signals higher labor supply) suggests the Fed may need a lighter touch." A fast pace for job growth is only a concern to the Fed if labor demand outstrips the labor supply, causing wages to drive an increase in inflation.

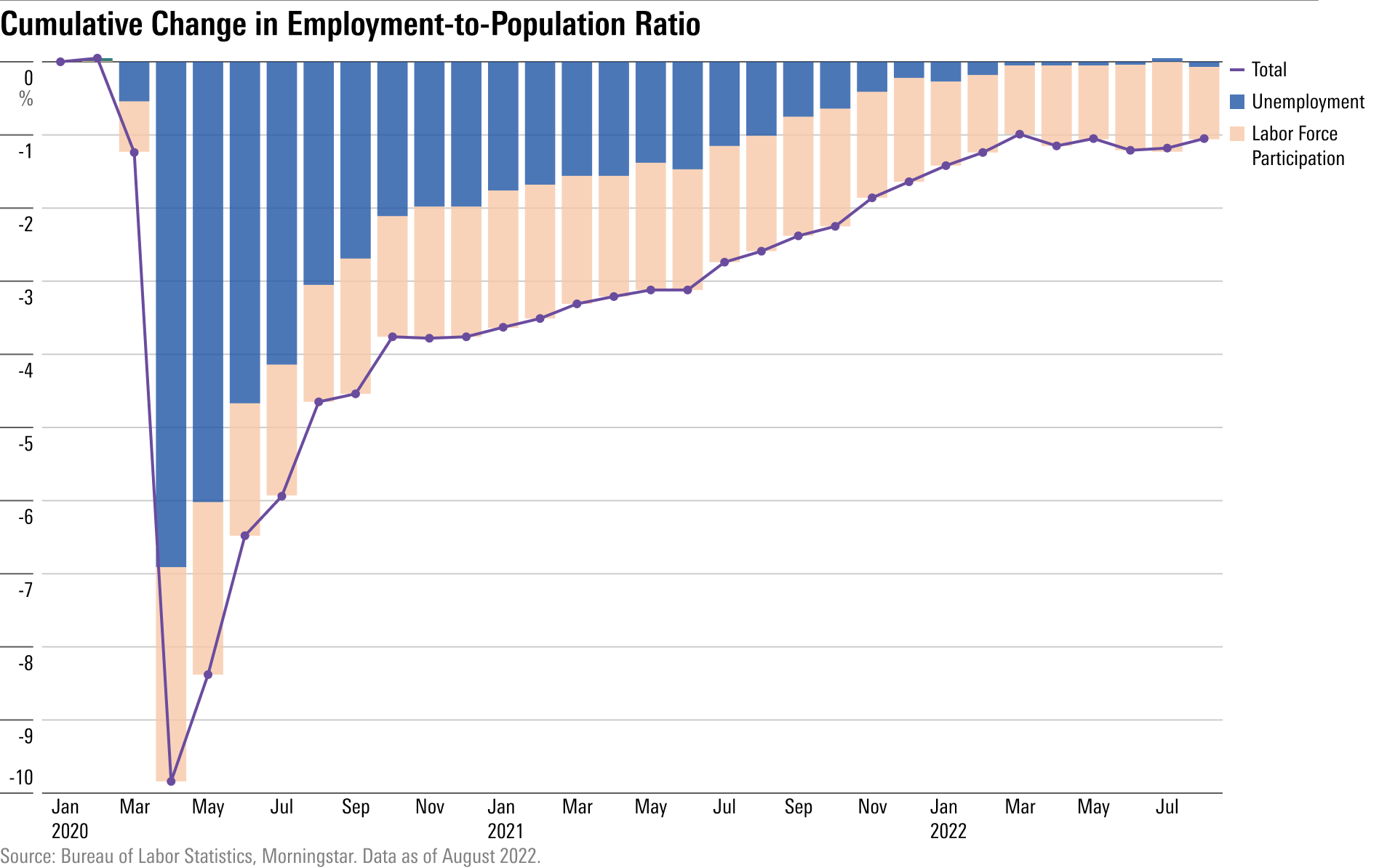

The labor force participation rate jumped 0.3% in August, to 62.4%, just shy of its prepandemic level.

“This is a very positive development for the economy if it continues, as it's a signal of increased labor supply,” Caldwell says.

The labor force participation rate was stagnant in the first half of 2022. Caldwell says that with the unemployment rate already having recovered to its prepandemic mark, further gains in employment will come from rising labor force participation.

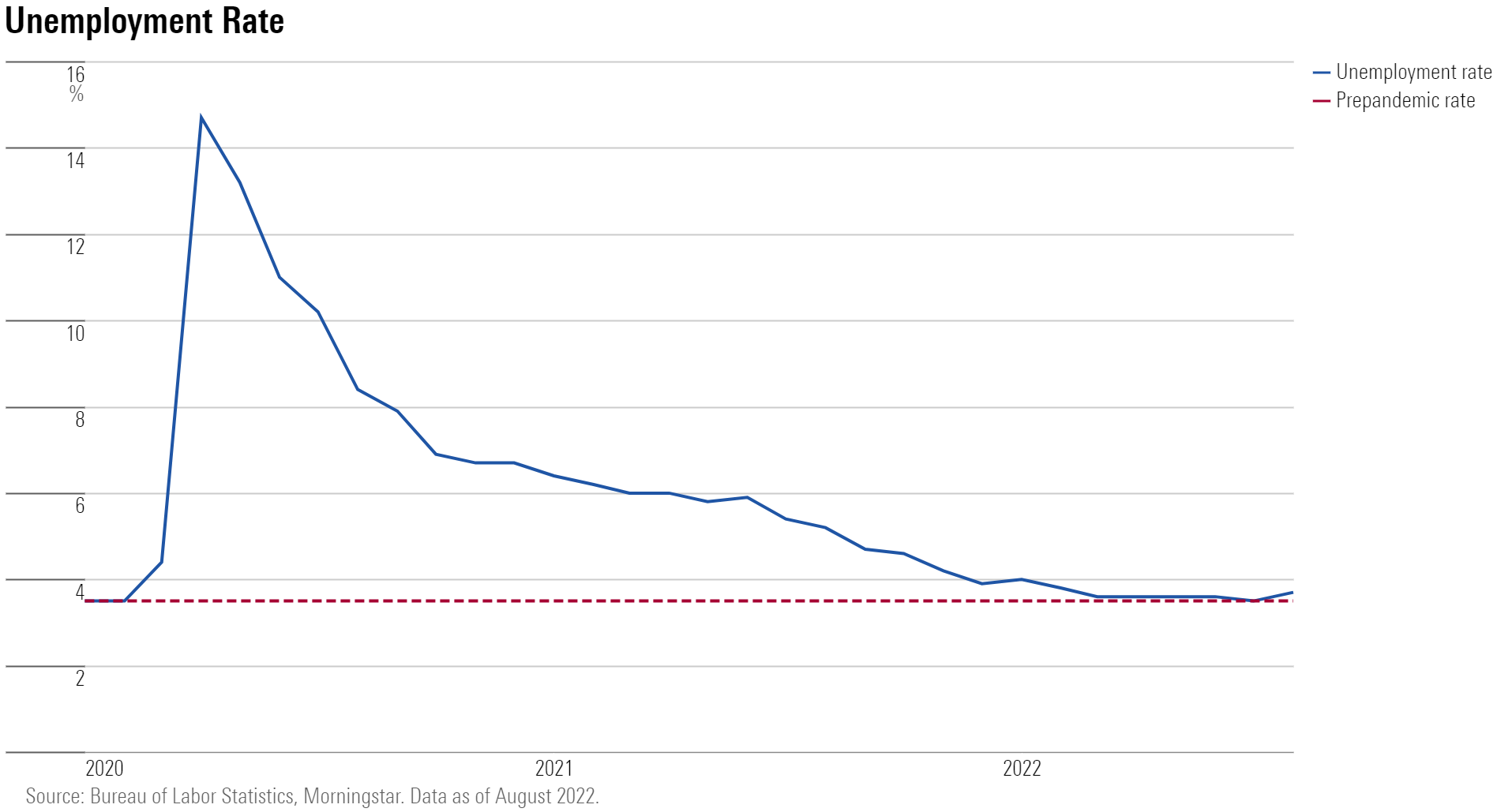

The unemployment rate rose 0.2 percentage points to 3.7% in August after reaching its February 2020 prepandemic level of 3.5% in July.

"The uptick in the unemployment rate came only because the increase in the labor force overshadowed the increase in employment," Caldwell says. People are only counted as "unemployed" if they are actively looking for work.

The composition of hiring by industry has largely held steady over the past several months, Caldwell says. Construction employment continued to grow at a healthy pace, 0.2% on average over the past three months, and in line with total employment.

"This is somewhat surprising given the abrupt drop in housing starts (down about 20% in July compared with the April peak), although homebuilders still have a large backlog of uncompleted homes to catch up with," Caldwell says.

Eventually, the housing slowdown will impact job levels in construction and supporting industries. "This will mark the beginning of the impact of Fed rate hikes on the labor market."

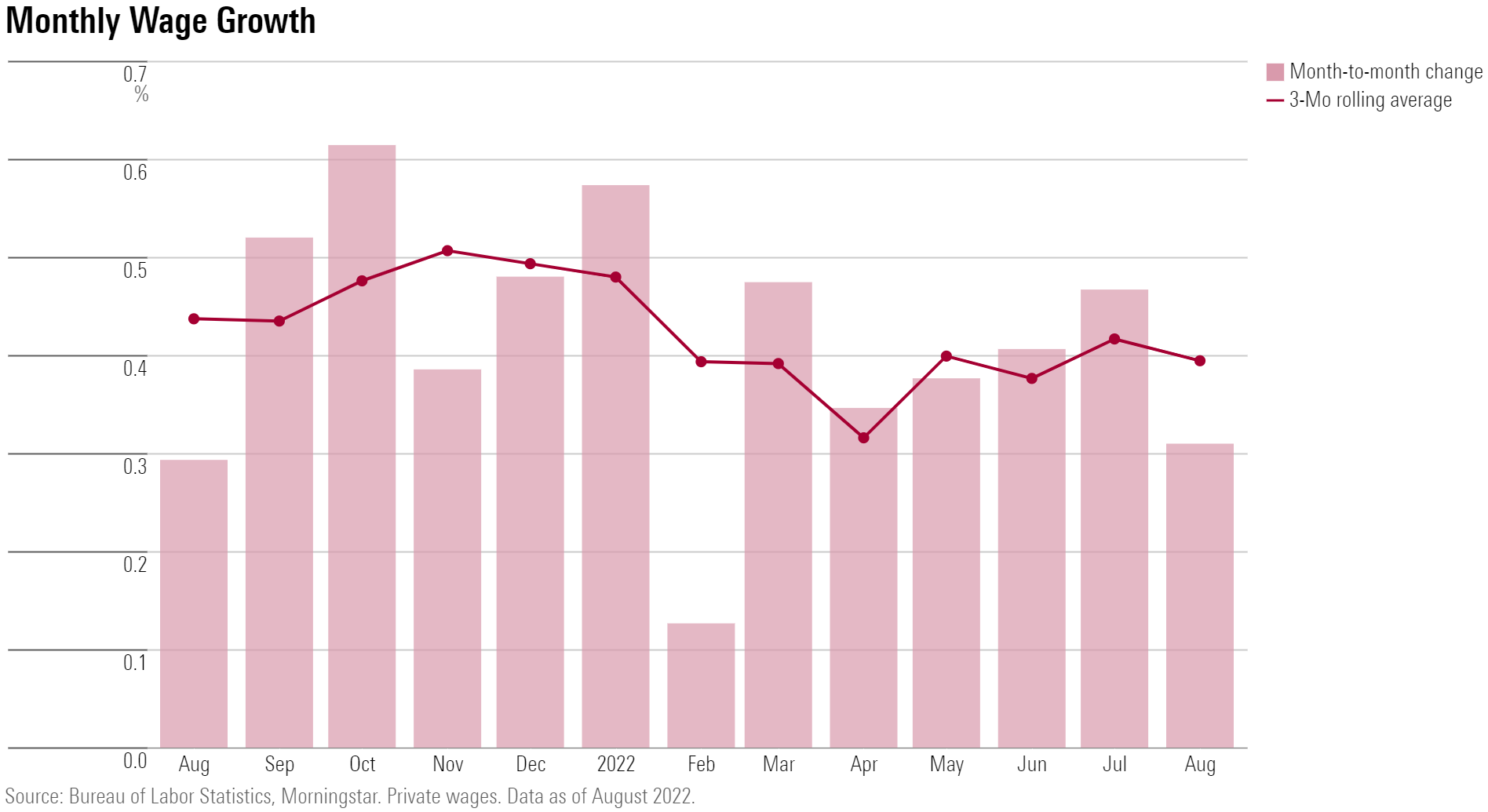

In a sign of good news on the inflation front, upward pressure on wages eased in August. Wage growth fell to 3.8% annualized, compared with 5.8% in July. Wage growth of around 3% to 4% is consistent with the Fed's 2% inflation target.

"It's unlikely that today's news will sway the Fed's upcoming late September decision on rate hikes in a major way," Caldwell says. "Employment data is noisy, and it's unwise to react strongly to a single month's report."

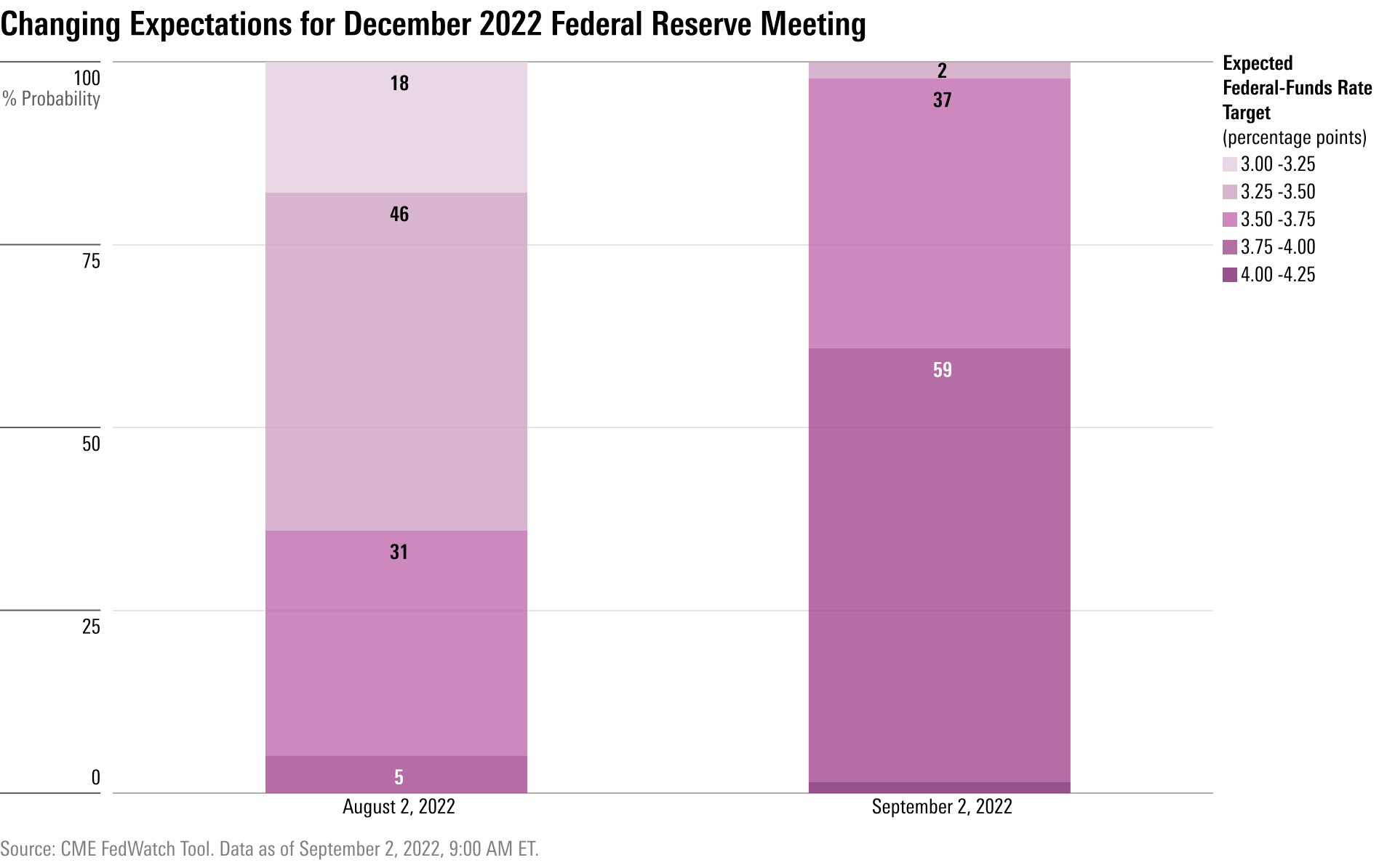

Markets are uncertain about whether the Fed will hike by 0.50 or 0.75 percentage points at September’s meeting. And by December, current market expectations have moved toward a target for the federal-funds rate of 3.75% to 4.0%. A month ago, the majority of investors expected a rate closer to 3.25% to 3.5% by December.

"The Fed will be paying more attention to the upcoming CPI report as a more direct signal of whether the inflation problem is getting better," says Caldwell, in reference to the Consumer Price Index. The Bureau of Labor Statistics is set to release the August CPI report on Sept. 13.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/N7VBPGEKIZDBPEAHLKIWYNRLBE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)