7 Undervalued Small- and Mid-Cap Quality Stocks

Easily overlooked stocks like Bath & Body Works and Paramount have strong fundamentals and room to run.

Stocks of high-quality companies with small and midsize market capitalizations have been on a tear this year. And for now, several such companies with lasting competitive advantages are still trading at steep discounts.

The Morningstar US Small-Mid Cap Moat Focus Index is 9.8 percentage points ahead of the broader market, as measured by the Morningstar US Market Index, this year as of Aug. 22. These stocks, which all trade with attractive valuations and durable competitive advantages, from the small- and mid-cap corners of the market are trading at 75% of their analyst-assessed fair value estimates, while the Morningstar US Market Index’s valuation is fairly valued on balance.

Investors can scoop up high-quality names such as Bath & Body Works BBWI, which has plunged 47.0%; BorgWarner BWA, off 17.8%; and Paramount PARA, down 7.0%, at especially low prices.

“Smaller-cap stocks are generally less covered by the analyst community,” says Dan Lefkovitz, strategist at Morningstar indexes. “They’re less well-known, so they are more likely to be overlooked.”

More than a thousand small- and mid-cap stocks collectively account for just 30% of all U.S. equities by market cap, when looked at through the lens of the Morningstar Style Box. In contrast, the five largest U.S. stocks—Apple AAPL, Microsoft MSFT, Amazon.com AMZN, Tesla TSLA, and Alphabet GOOGL GOOG—by themselves add up to 18% of U.S. equities by market cap.

The Morningstar US Small-Mid Cap Moat Focus Index has risen 14.2% as of Aug. 22 since the bear market's low point on June 16, edging out the broader equity market's gain of 13.6%. But several companies are still trading at prices well below their fair value estimates.

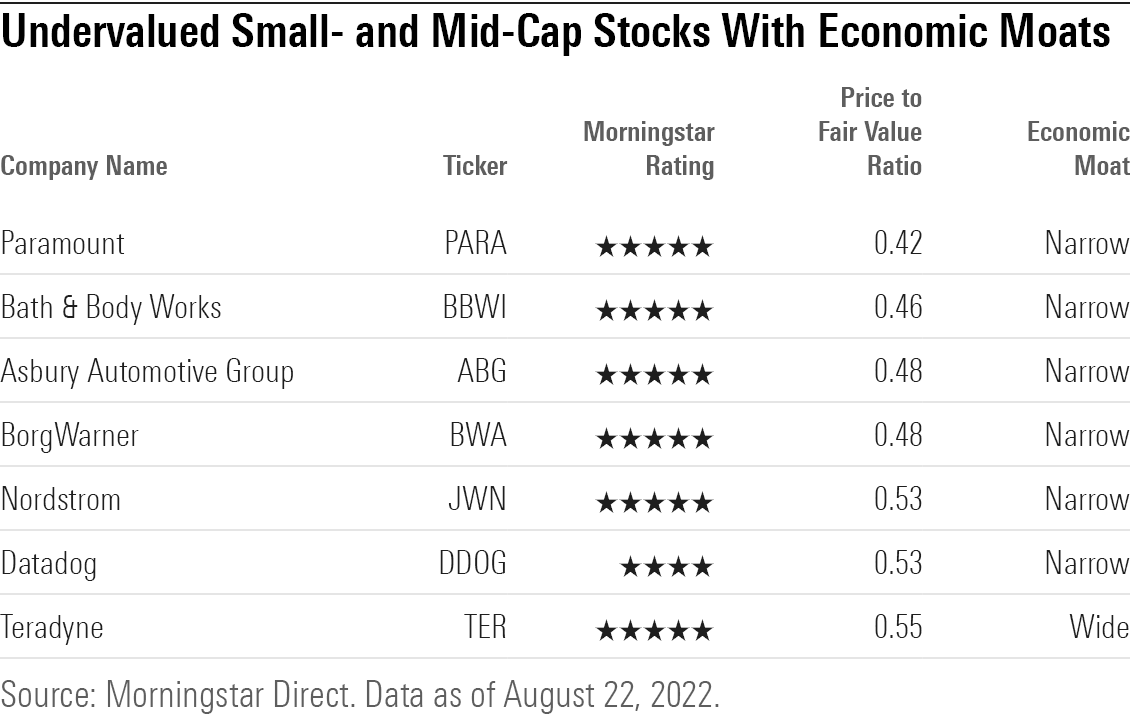

7 Undervalued Small- and Mid-Cap Moat Stocks

- Paramount PARA

- Bath & Body Works BBWI

- Asbury Automotive Group ABG

- BorgWarner BWA

- Nordstrom JWN

- Datadog DDOG

- Teradyne TER

“Active managers are better suited in markets where information is less accessible and mispricing is abundant, like in small-cap stocks or emerging markets,” writes Bryan Armour, director of passive strategies research at Morningstar. “However, it is difficult for active managers to consistently identify and take the right side of mispriced stocks, so manager selection is crucial.’’

With valuations in the space so low, the small-/mid-cap portion of the market looks ripe for opportunities to beat the broad indexes.

The Morningstar Small-Mid Cap Moat Focus Index contains companies that also earn a Morningstar Economic Moat Rating, meaning they can fend off competition and earn high returns on capital for many years to come.

A screen of the index reveals stocks with a trifecta of advantages: durable competitive qualities, smaller market caps, and discount prices. Here are the seven stocks in the index with the lowest valuations.

Paramount

- PARA

- Industry: Entertainment

- Investment Style: Mid Value

- 2022 Performance YTD: Down 17.0%

“We think that top-line growth will be driven by streaming revenue from both Paramount+ and Pluto TV. The two services build on the firm's strong content creation abilities, deep programming library, and the secular trend toward greater streaming adoption. As a result, Paramount+ can still carve out a position in this intensely competitive market despite the large head start of the incumbents.”—Neil Macker, senior equity analyst

Bath & Body Works

- BBWI

- Industry: Specialty Retail

- Investment Style: Mid Value

- 2022 Performance YTD: Down 47.0%

“Bath & Body Works has demonstrated its ability to maintain or gain market standing independent of external conditions (particularly in the bath and shower and candle businesses), which indicates a brand intangible asset exists.”—Jaime M. Katz, senior equity analyst

Asbury Automotive Group

- ABG

- Industry: Auto & Truck Dealerships

- Investment Style: Small Value

- 2022 Performance YTD: Up 5.0%

“Although no auto dealer is immune to macroeconomic risks, Asbury Automotive Group's size, focused acquisition strategy, and diverse revenue streams should allow the firm to grow at the expense of smaller dealers.” —David Whiston, equity sector strategist

BorgWarner

- BWA

- Industry: Auto Parts

- Investment Style: Mid Core

- 2022 Performance YTD: Down 17.9%

“BorgWarner is well positioned to capitalize on industry trends arising from global clean air regulations, consumers' demand for fuel economy, and the popularity of sport utility and crossover vehicles around the world. The company benefits from its ability to continuously innovate, a global manufacturing footprint, highly integrated long-term customer ties, high customer switching costs, and moderate pricing power from new technologies.”—Richard Hilgert, senior equity analyst

Nordstrom

- JWN

- Industry: Department Stores

- Investment Style: Small Value

- 2022 Performance YTD: Up 3.0%

“Nordstrom continues to be a top operator in the competitive U.S. apparel market. The firm has, in our view, cultivated a loyal customer base on its reputation for differentiated products and service and has built a narrow moat based on an intangible brand asset. Despite a rocky couple of years, we believe Nordstrom’s full-price and Rack off-price stores have competitive advantages over other apparel retailers.”—David Swartz, equity analyst

Datadog

- DDOG

- Industry: Software – Application

- Investment Style: Mid Growth

- 2022 Performance YTD: Down 42.8%

“We believe Datadog is poised for success in the full-stack monitoring and analysis space. Datadog's monitoring platform benefits from secular tailwinds driving an exponential increase in machine data for companies to monitor and analyze. In our view, the firm's sticky product portfolio, combined with a broad range of monitoring capabilities, has helped Datadog build a narrow economic moat around its business.”—Brian Colello, equity sector director

Teradyne

- TER

- Industry: Semiconductor Equipment & Materials

- Investment Style: Mid Core

- 2022 Performance YTD: Down 43.3%

“We think [Teradyne’s] collaborative and autonomous robots will augment top-line growth over the next five years as well as be accretive to gross margins…We view Teradyne as an agnostic play on the global chipmaking with muted cyclicality arising from its vital role in the supply chain and nature as a capital expense at customers.”—William Kerwin, equity analyst

Correction (Aug. 30): A previous version of 7 Undervalued Small- and Mid-Cap Quality Stocks had a table where a column was mislabeled. The column should have labeled ``economic moat,'' not ``value-growth score.''

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)