The Best Target-Date Funds for 2022 and Beyond

Only one series earned an upgrade to the coveted Gold-medalist ranking this year.

Target-date strategies play an integral role for many Americans saving for retirement. They typically serve as the default investment option in their defined-contribution plan. In 2021, investors poured net inflows of $170 billion into target-date strategies--more than double the year prior--and pushed assets managed to a record $3.27 trillion. Although net contributions into target-date mutual funds bounced back from their 2020 dip, the prominent shift to collective investment trusts accounted for most of the new money. In 2021, net inflows to CITs outpaced mutual funds $146 billion to $24 billion; CITs now comprise 45% of assets in target-date strategies. If this trend continues, CITs will overtake mutual funds as the most popular target-date vehicle within a few years.

Morningstar covers the uptick in flows and the growing popularity of CITs as well as other trends shaping target-date strategies in the recently published 2022 Target-Date Strategy Landscape. Morningstar Direct and Office clients can download the full report here.

In this article, we'll take a closer look at our Morningstar Analyst Ratings for target-date mutual funds and highlight our top-rated series.

Industry Leaders

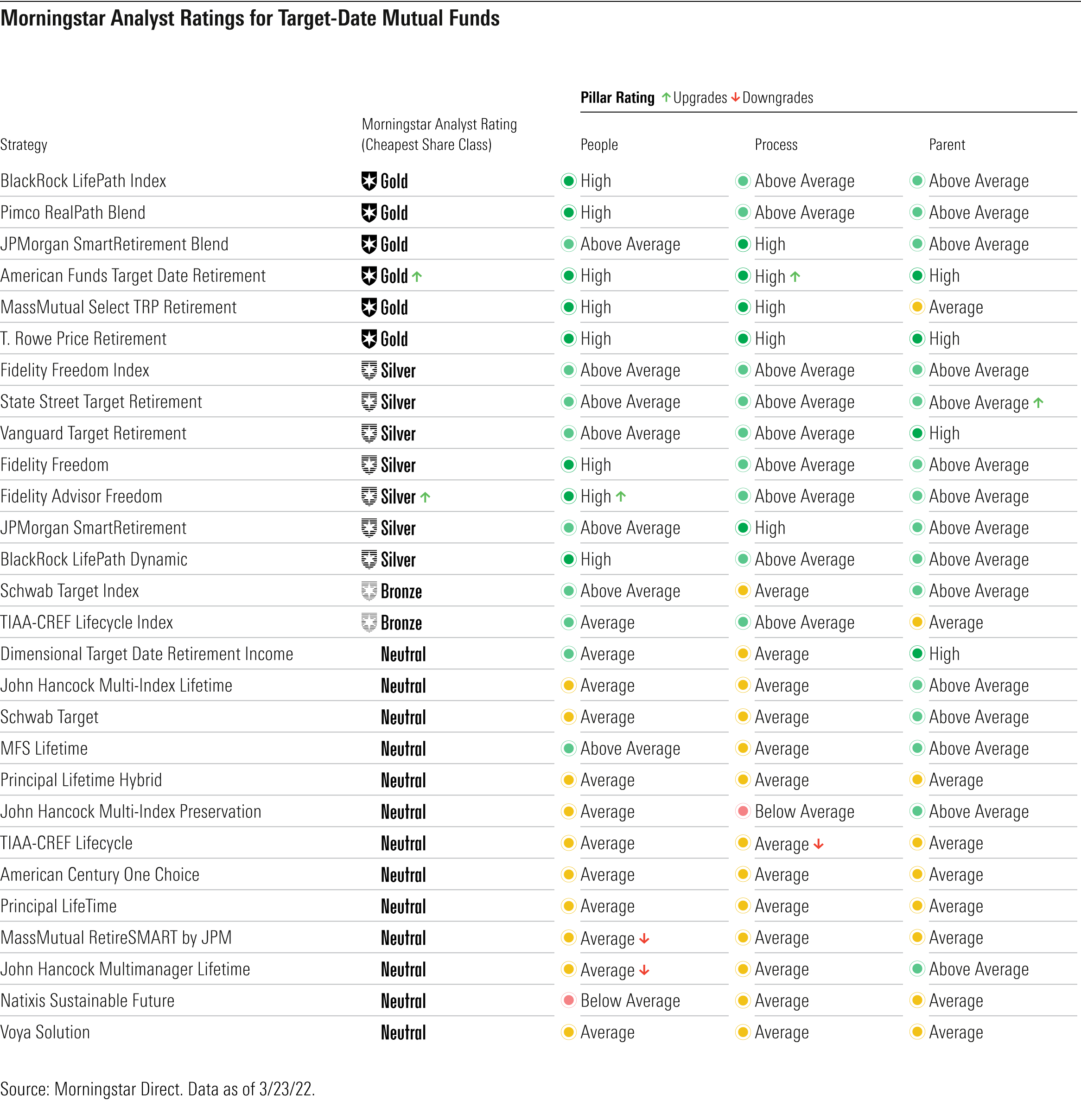

The table below shows ratings assigned to the cheapest share class of the target-date fund series covered by Morningstar analysts, as of March 2022. It also highlights how the Analyst Rating, People Pillar, Process Pillar, and Parent Pillar changed between March 2021 and March 2022.

Higher confidence in American Funds Target Date Retirement series’ approach boosted its Process Pillar to High from Above Average, and that in turn shifted its Morningstar Analyst Rating to Gold from Silver. Fidelity Advisor Freedom’s strong allocation team and impressive underlying funds boosted its People Pillar to High from Above Average, leading to an upgrade to its Morningstar Analyst Rating of Silver from Bronze. Schwab Target Index Series debuted at a Morningstar Analyst Rating of Bronze, supported by its use of compelling building blocks and a low-price tag of 0.08% across its vintages.

A few other pillar changes (three downgrades and one upgrade) reflect our reassessment of the industry and its best practices, but they did not impact the overall Morningstar Analyst Rating of those offerings.

American Funds Earned Top Marks Across Its Target-Date Ratings

Only one series earned an upgrade to the coveted Gold-medalist ranking this year. Increased confidence in American Funds Target Date Retirement’s asset-allocation process and the robust processes of its underlying funds support this higher rating. It is the second target-date series to earn a High rating across all Pillars, indicating Morningstar analysts’ strong conviction in the series’ long-term potential. It features a standout lineup of actively managed funds, with 90% of assets in Morningstar Medalist funds. The equity funds are paired with high-quality bond funds that provide downside protection during equity selloffs, such as the coronavirus-driven drawdown in 2020’s first quarter. Overall, its ability to balance top-down and bottom-up decision-making provides potential for the long run.

Target-Date Series That Maintained Their Gold Allure

- BlackRock LifePath Index benefits from a strong asset-allocation team with deep resources. Low cost, broad passive funds serve as this series' foundation. The innovative team holding the reins here gives this index-based series an edge. Rather than delivering the status quo, the team consistently conducts research to enhance this series. For the past few years, for example, the team took a deep dive into its fixed-income exposure and announced at the end of 2021 that it would migrate to more targeted fixed-income funds rather than holding iShares US Aggregate Bond Index BMOAX, which currently serves as its core fixed-income holding. The transition is scheduled to occur in the second quarter of 2022.

- Pimco RealPath Blend has struck the right balance between passive and active exposure. The sharp management team tactfully allocates the equity portion of the glide path to low-cost broad market Vanguard index funds and uses its stellar in-house active bond funds for fixed-income exposure. The index funds have an enduring edge versus most actively managed equity funds thanks to their low fees and broad market-cap-weighted exposure that have been difficult to beat consistently over the long term. Although the bond funds are a bit more adventurous than those in other series, they include firm stalwarts Pimco Total Return PTTRX and Pimco Income PIMIX, both rated Gold, providing confidence in their long-term potential. The series also protects retirees' nest eggs as they near retirement with strategic capital protections in place across the last three vintages, which benefited investors during the 2020's first-quarter equity drawdown.

- JPMorgan SmartRetirement Blend continues to modify its offering to serve investor needs. In March 2022, J.P. Morgan will implement the SmartSpending program across its four target-date series, including this one. The approach is quite distinctive: The team tries to manage investors' discretionary spending in retirement by advising them at the start of each year as to what percentage of their assets in the fund they should spend down by selling shares. The unique approach could benefit investors who are looking to better manage their spending in retirement. The process is implemented by an experienced and collaborative team supported by the firm's deep multi-asset solutions group.

- T. Rowe Price Retirement and MassMutual Select T. Rowe Price Retirement, which T. Rowe Price's portfolio managers run in an identical fashion, benefit from a topnotch allocation team and a research-centric process. T. Rowe Price Retirement was the first target-date series to earn a High rating across each of its pillars (MassMutual Select T. Rowe Price Retirement earns an Average Parent rating). Our conviction in the skilled team and proven process provides confidence in this series' long-term success. The series recently upped its equity allocation across the glide path, a process that the team announced in early 2020 and which it has implemented over the past two years. The higher equity stakes and its riskier bond funds will provide a bumpier ride for investors during stress periods, but the series has a history of rebounding quickly from economic drawdowns, and over the long term, thoughtfully applied risks increase the possible return potential. Ultimately, if investors can stay the course, the combination of forward-thinking managers and excellent underlying strategies should serve them well.

Editor's Note: The table and article were corrected to include mention of Fidelity Advisor Freedom’s upgrade.

/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

/s3.amazonaws.com/arc-authors/morningstar/502d0355-28ed-483c-ae9d-b67bfbf5291b.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/502d0355-28ed-483c-ae9d-b67bfbf5291b.jpg)