3 Sectors With the Largest Fair Value Increases

While few companies’ fair value estimates increased, some sectors saw particularly strong gains.

Corporations saw the rate of increase in their fair values slow as basic materials, energy and real estate sectors had the most businesses rise in value, according to a review of fourth-quarter earnings by Morningstar analysts.

The average fair value estimate of a company increased by 2.6%, down from 3.3% in the previous quarter and 5.6% from the prior year. Basic materials and energy firms gained on an uptick in near-term commodity prices, and the real estate sector advanced as occupancy rates increased at a faster pace.

Fair value estimate growth slowed despite a change in projections for the U.S. tax rate in models used by Morningstar analysts. Corporations are now expected to face a 21% tax rate, versus the 26% that had been previously seen.

Morningstar analysts conduct a fundamental review and create models to determine both a company's intrinsic value and a fair value for its shares. While Morningstar analysts stick to a long-term approach to investing, they monitor quarterly earnings results to update their assumptions, and potentially their estimates.

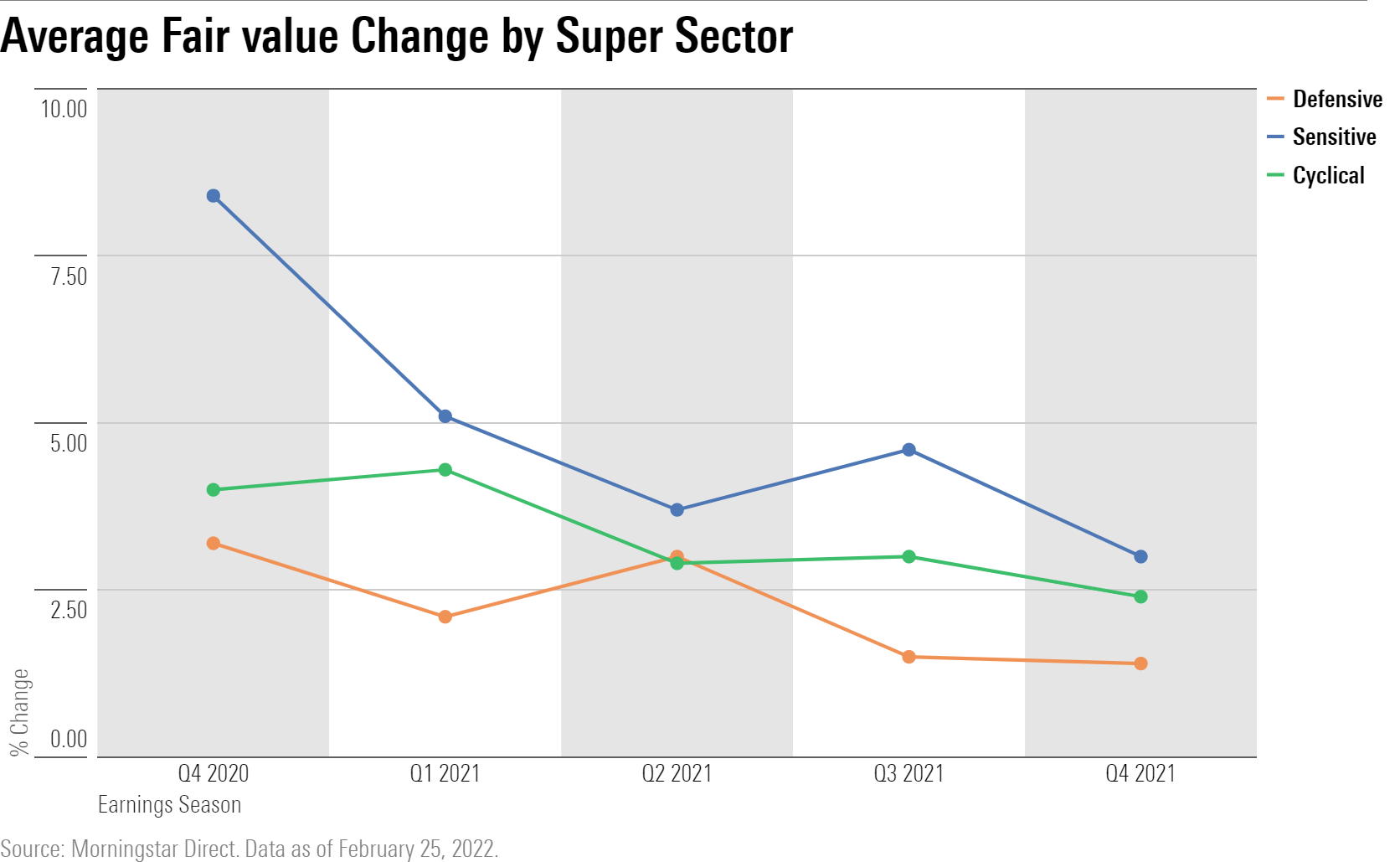

The chart below shows the average percentage change in fair value estimates following and during earnings for the past five quarters. Fair value estimates were pulled from Morningstar Direct for the end dates of each quarter and compared against the estimates six weeks after each quarter. An explanation of the methodology can be found at the end of this article.

We’ve sorted data by what Morningstar calls Super Sectors, companies that fall into the categories of cyclical, defensive, and sensitive.

Cyclical sectors are those that are heavily correlated with the business cycle. As the economy grows and expands, cyclical sectors follow.

The defensive sector includes industries that are relatively immune to economic cycles.

Sensitive sector industries ebb and flow with the overall economy all be it with less volatility and fall between defensive and cyclicals.

The rate of fair value estimate changes decreased across the board for each Super Sector. Sensitive sectors, which include technology and energy, saw their rate of increase slow to 3.0% from 4.6% in the prior period. Defensive and cyclical sectors were mostly on pace with their last earning season’s fair value rise rate.

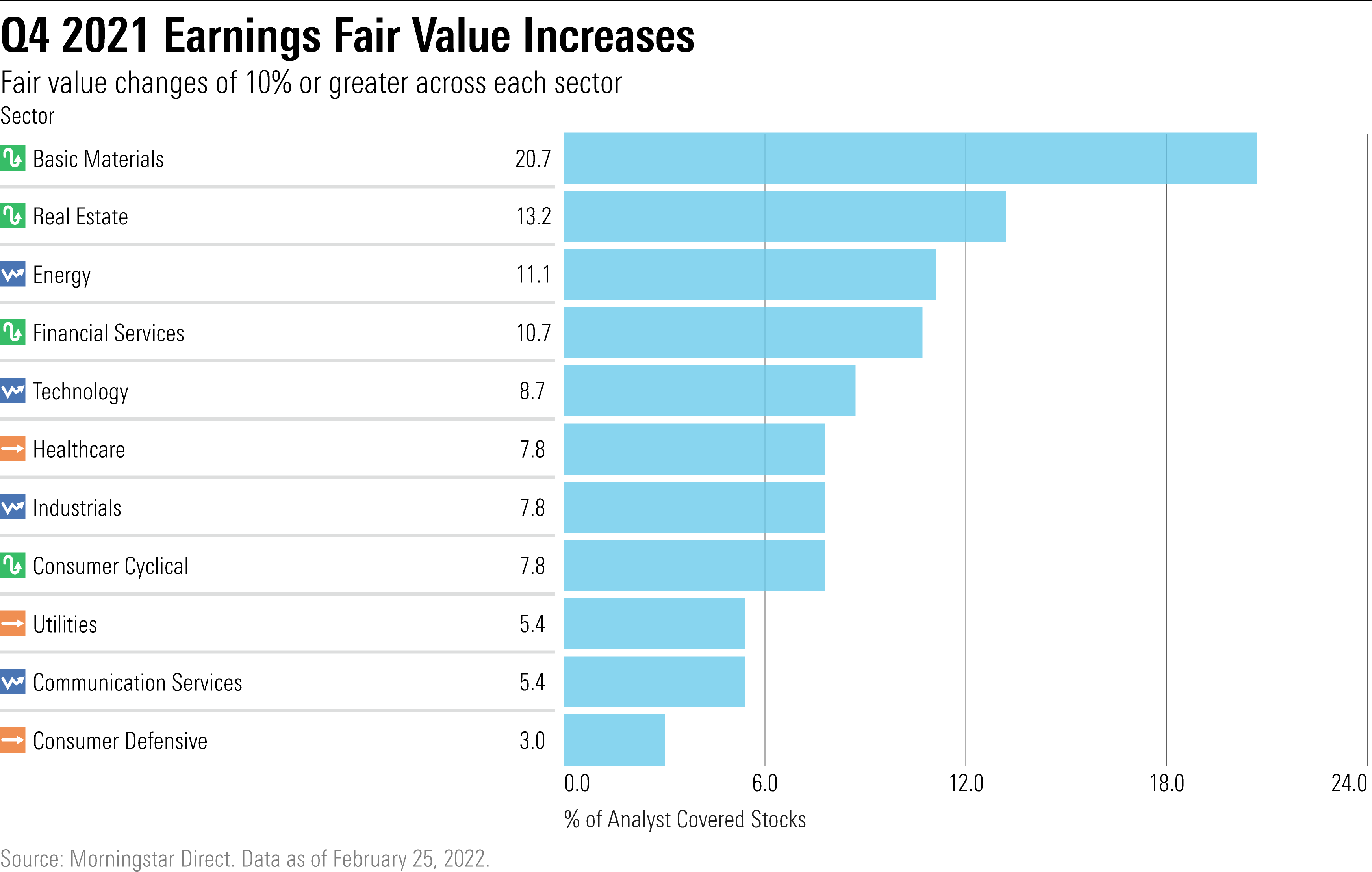

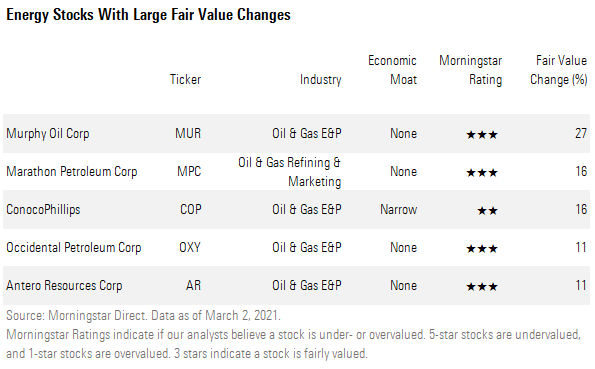

This earnings season increases were concentrated in basic materials and real estate. In the chart below, we screened for increases of 10% or more to capture the most meaningful changes.

Basic Materials

Basic materials saw six of the 29 companies covered by Morningstar have a fair value increase of 10% or more. Five of 38 real estate and six of 54 energy companies covered by Morningstar had meaningful fair value increases.

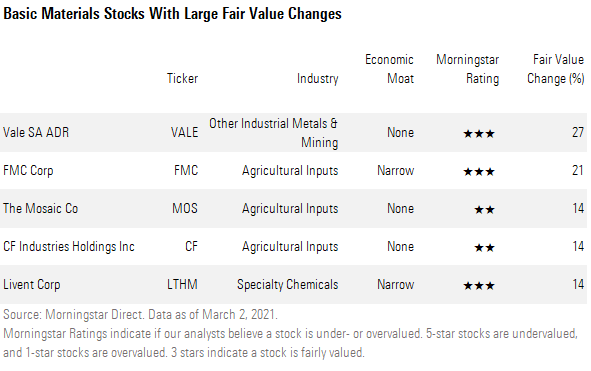

Higher near- to mid-term prices for commodities helped push the fair value of basic materials stocks up. Morningstar equity sector director for basic materials Matthew Hodge boosted the fair value of Vale VALE, the world’s largest iron ore miner, to $16.50 from $13 on higher prices.

Hodge says valuations rose on optimism about China’s economic growth and steel production. However, he sees iron ore prices falling in the long-term.

“Vale is highly leveraged to Chinese raw materials demand, which we expect to decelerate as the country's infrastructure-led investment boom wanes,” he says. “As China’s population falls and its existing housing stock and infrastructure mature, we foresee lower demand for iron ore and metallurgical coal as demand for, and production of, steel reduces, combined with increased recycling and use of steel scrap.”

CF Industries CF, a nitrogen fertilizer producer, rose to $65 from $57 on higher near- and long-term prices, says senior equity analyst Seth Goldstein. Lithium producer Livent’s LTHM fair value increased to $25 from $22 was also driven by an updated forecast for prices. Long-term volume and price forecasts are mostly unchanged, Goldstein says.

Real Estate

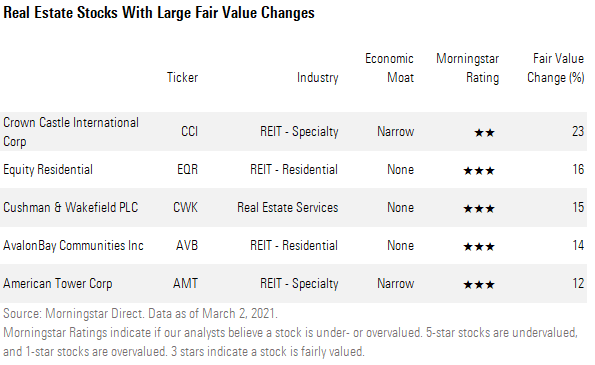

A number of real estate firms had their fair value estimates raised due in part to a faster-than-expected rise in occupancy rates.

“The high occupancy levels allowed many apartment REITs to keep operating costs down, particularly payroll and marketing costs, as management teams no longer needed to take on the extra costs to attract new tenants that were incurred at the height of the pandemic,” says Morningstar analyst Kevin Brown. “This reduced expenses for 2022, and to a lesser extent, the next few years.”

Equity Residential EQR fair value rose by 16%, and AvalonBay Communities AVB was up 14%. For special REITs such as Crown Castle International CCI, and American Tower Corp AMT, both of which lease towers to wireless carriers, enjoyed fair value boosts due to updated lower equity risk assumptions by Morningstar analyst Matthew Dolgin.

Energy

Driving fair value increases in the energy sector were companies in the oil and gas exploration and production (E&P) space.

Morningstar energy research sector director David Meats and his team raised fair values for the companies they cover by an average of 5% due to higher near-term prices, which they expect to remain elevated for the next two years.

“We assume oil (WTI) prices in 2022 and 2023 will average $80 and $70 per barrel, respectively,’’ Meats says. “In the same periods, natural gas prices are expected to average between $4.00 and $3.50 per thousand feet.”

Their long-term price view remains unchanged at $55 per barrel for WTI oil, $60 for Brent, and $3.30 per thousand cubic feet for natural gas.

Murphy Oil MUR saw its fair value benefit the most from the increase in prices, according to Morningstar’s analysis.

Data notes: Fair value estimates were sourced from Morningstar Direct for the end dates of each quarter. In some cases, fair value adjustments may have been made prior to company earnings reports. Stocks without a fair value estimate at the beginning and/or end of the six-week period were excluded from data aggregation to account for any changes in our equity coverage list. The underlying list of stocks can change from quarter to quarter owing to changes in analyst coverage or other factors. Stocks portrayed in sector tables may not reflect those that had the largest fair value moves within the sector. Demonstrated stocks were selected to emphasize sector wide trends and/or at the recommendation of Morningstar analysts.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)