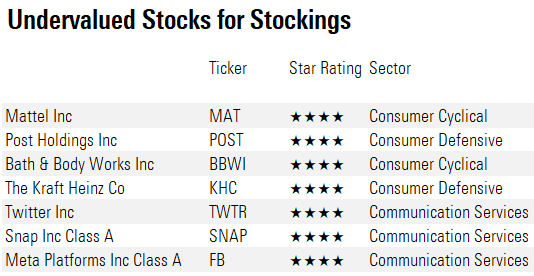

7 Stocks for a Kid's Stocking

These popular brand names are undervalued.

'Tis the season for stocks? Indeed, the holidays are a time when parents, grandparents, and others often purchase stocks for the children in their lives, trying to capture that young person's interest in a brand or product they know about and expose them to the basic concepts of investing, compounding, dividends, and what makes a stock go up and down.

For a few stocking-stuffer ideas, we looked for undervalued U.S. stocks according to the Morningstar Rating for stocks and compiled a list of some names that should be familiar to kids. (Some suggest that simply buying an all-market index fund, which would include many highly recognizable brands, is a superior way to get kids investing).

While you may be tempted to buy shares of companies that your young investor has been talking about, it may not be the right time to buy. Our analysts currently find the most value in these seven well-known names. Here's what our analysts have to say about three of the companies on the list.

Mattel MAT

- Morningstar Rating (as of Dec. 15, 2021): ★★★★

- Morningstar Economic Moat Rating: Narrow

- Mattel makes many toys that can be found in children's bedrooms, including Barbie, Hot Wheels, Fisher-Price, American Girl dolls, and Uno.

"Mattel continues to harvest gains from its turnaround, delivering above break-even operating margins starting in 2019 and set to reach 13% in 2021. We expect Mattel to produce further adjusted operating margin expansion ahead, helped by the execution of its $250 million cost-saving program. Furthermore, the company's shift to a capital-light strategy should offer structurally lower capital and operating expenditures than in the past, supporting profit growth while allowing for investment in product innovation.

"We expect such investments will be focused on elevating core brands (Barbie, Hot Wheels, Fisher-Price), winning licenses, and decreasing time to market, which should support sales and market share growth at Mattel. A complementary digital plan, which has focused on strategic relationships with Alphabet GOOG, Alibaba BABA, and others, should help brand visibility, potentially preventing share losses to other digital toy peers. Over time, stronger brands could lead to gross margin leverage stemming from a focus on higher-margin franchise brands and the optimization of retail inventory positions (shipments more closely aligned with demand). We expect inventory levels will remain a key focus for management, given that inventory clearance and stock-keeping-unit creep of lower-productivity brands had a significant negative impact on Mattel's performance throughout 2014-18. Currently, Mattel is mitigating holiday supply chain issues via earlier input and finished-good procurement as well as delivery efforts (more port and shipping-lane access).

"Mattel still holds a top position in toy marketing thanks to its well-recognized brands. We believe this has allowed it to recapture key license relationships and win new ones (Despicable Me, Pixar), supporting positive sales growth. Mattel has historically had some of the most popular toys in the industry, which could support consistent point-of-sale results with rightsized product lines, maintaining brand equity stability. Mattel's market share and scale support its narrow Morningstar Economic Moat Rating, which remains constrained by low barriers to entry that force continuous innovation as peers converge on the traditionally high-return-on-invested-capital business."

--Jaime M. Katz, senior equity analyst

Post Holdings POST

- Morningstar Rating (as of Dec. 15, 2021): ★★★★

- Morningstar Economic Moat Rating: None

- Post Holdings makes foods that kids regularly enjoy, such as Fruity Pebbles, Chips Ahoy, and Honey Bunches of Oats.

"Post has a unique portfolio of businesses. As the cereal category has come under pressure, the firm diversified its revenue base by entering categories that were driving the legacy business' deterioration, such as eggs and protein-based nutritional products. While these actions have stabilized the top line, we believe a competitive edge remains elusive.

"The cereal business (42% of fiscal 2020 revenue) has been declining (outside of the pandemic) as consumers have shifted away from processed, high-sugar, high-carbohydrate fare. Adding to the challenge, Post, the third-largest player, has had to compete for ever-decreasing shelf-space with market leaders General Mills GIS and Kellogg K. That said, Post's cereal business is very profitable, with EBITDA margins around mid-20% and low-30% for the U.S. and European businesses, respectively.

"The refrigerated segments (41%, with 24% food service and 17% retail) consist primarily of egg and potato products. While this business has more attractive growth prospects than cereal (growing 1% to 2% versus cereal's modest declines), agricultural commodities are difficult to differentiate and therefore generally do not command a price premium. As a result, this business is relatively low margin (10%-12%) and does not offer the firm a competitive advantage, in our view.

"Post holds a majority stake in BellRing Brands BRBR (17%), which makes protein shakes, bars, and powders. The business has realized low-double-digit growth and attractive operating margins (17%-18%). The Premier Protein brand represents over 80% of this segment and exhibits signs of brand strength, but it has not been a large enough segment to warrant a moat rating for Post. Post recently announced plans to reduce its stake in BellRing from 71% to no more than 20% in the first half of calendar-year 2022, which will undoubtedly result in slower sales growth for Post. While Post will likely use the proceeds to acquire other assets, we suspect targets will not boast BellRing's double-digit sales growth."

--Rebecca Scheuneman, equity analyst

Bath & Body Works BBWI

- Morningstar Rating (as of Dec. 15, 2021): ★★★★

- Morningstar Economic Moat Rating: Narrow

- Lotions, body sprays, and candles are a staple among teens.

"We believe Bath & Body Works has carved out a solid competitive edge in the sizable addressable markets that it operates in. The company's strong brand intangible asset is supported by its leadership position across the bath and shower and candle air freshener industries in recent years, which has been bolstered by its quick response to consumer trends. Quantitatively, BBW's narrow moat rating is reinforced by a 31% average return on invested capital including goodwill that we expect the business to generate over the next decade, well ahead of our 8% weighted average cost of capital estimate.

"We think the $71 billion bath, body, and beauty industry, $11 billion home fragrance market, and $5 billion soap and sanitizer market still offer a plethora of upside given BBW's 2020 sales mark of $6.4 billion. The company has outlined a compelling pipeline of opportunities across existing and adjacent categories to reach new consumers and stimulate higher sales conversion ahead. For example, not only can BBW add expansion products like spray hand sanitizer (and recently, bar soap), but it can also break into underpenetrated categories like skincare and haircare.

"This robust pipeline of opportunities should help BBW grow at a healthy 7% pace over fiscal 2022-25. We forecast sales of $10 billion in 2025, which is contingent on average sales growth of 3% from North American stores, 11% from the digital channel, and 17% from international opportunities. This should be supported by elevated engagement with the brand, as there is more than 80% brand awareness of women 18-59 years old (and 60% of men in the same cohort). Longer term, operating margins should return to the low 20s (from a pandemic-induced peak of 28% in 2020) as the firm cedes some scale gains from higher pandemic-related demand. Furthermore, while post-coronavirus consumer spending could shift back to categories like dining and travel, BBW should see solid demand trends ahead, with our forecast growth outpacing a flat growth projection (according to Euromonitor) for the beauty and personal care industry during 2020-24."

--Jaime M. Katz, senior equity analyst

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)