Here's One Way Shareholders Can Get Companies to Act on Global Warming

Remember 'say on pay'? Tie compensation to emissions cuts, suggests Sustainalytics' Jackie Cook.

Here’s one way your fund can start prodding companies to act on climate change: Link executive pay to their plans to reduce emissions that cause global warming, and then vote every year on how well executives are doing on those goals.

After the global financial crisis, Congress mandated that shareholders OK the compensation every year for a company’s CEO, CFO, and top three most highly paid officers in a measure called “say on pay.” Shareholders would do this by voting on the company’s proxy ballot, as frequently as once a year. The goal was to correct the incentive pay practices that rewarded excessive risk taking that caused the crisis.

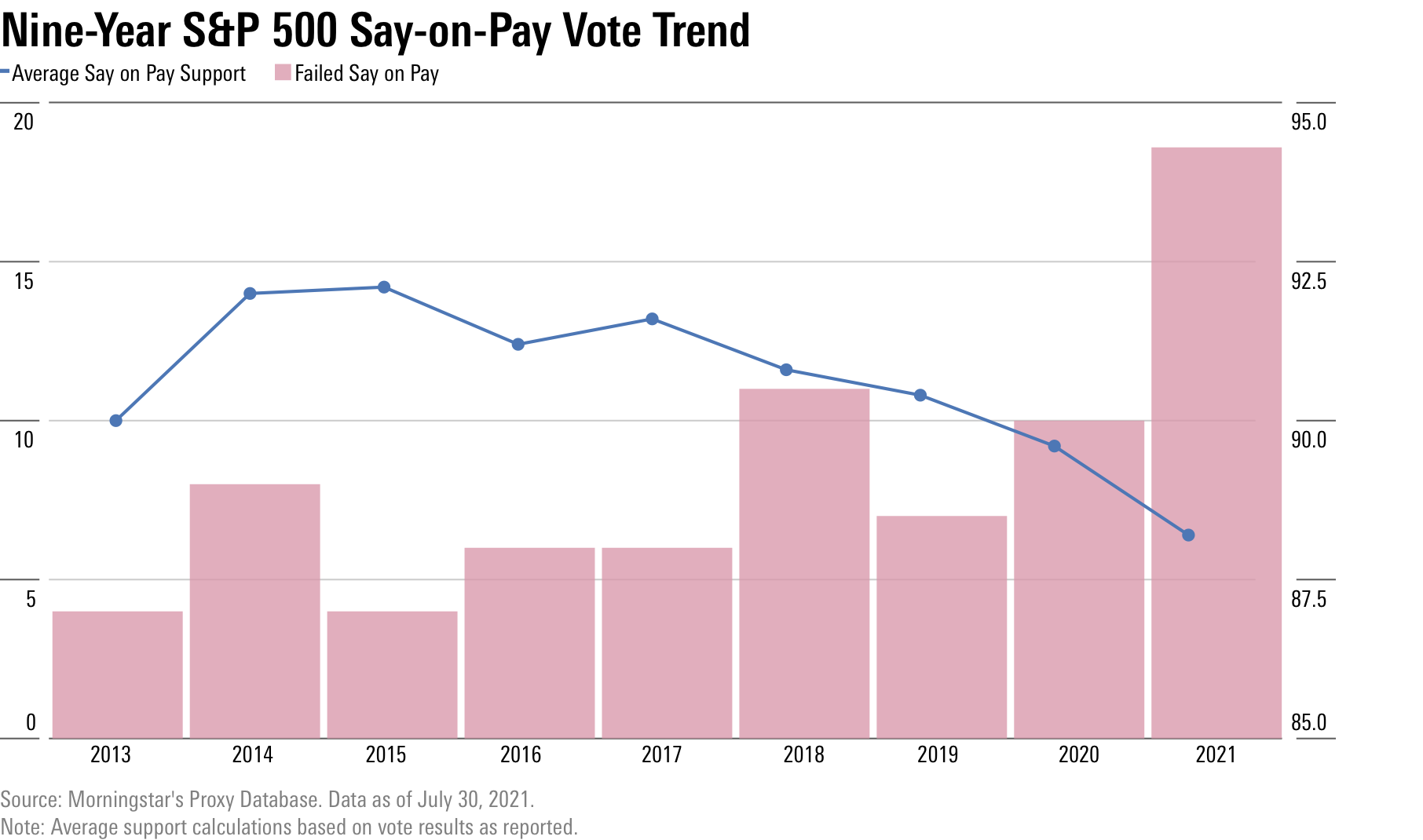

But say-on-pay results have been underwhelming. Today, CEO pay is about 291 times that of the median worker in the S&P 500, according to a Morningstar study. That's because investors have been more attuned to short-term stock price performance, approving stock- and stock-options-heavy pay packages.

When annual say-on-pay votes roll around, they’re nearly always approved by shareholders, including those that oversee some of America’s most popular mutual funds and exchange-traded funds.

The Push to Link Pay to ESG Metrics

All that may be changing because of global warming. This year, a top Securities and Exchange Commission official said the agency would look more closely at climate-related risks, partly by examining how funds vote "to ensure voting aligns with investors' best interests and expectations."

One proposal would make all investors who manage more than $100 million in stocks--that includes a huge swath of money managers--to regularly disclose how they vote on say-on-pay resolutions. If adopted, it "will likely create more pressure [on fund managers] to justify their support for status quo pay practices," writes Jackie Cook, director at the stewardship advisory service of Sustainalytics, a Morningstar company that provides ESG research, ratings, and data. Cook recently published a study on say on pay and climate.

At the same time, a growing chorus is pushing for a link between executive compensation and environmental, social, and governance metrics.

According to a survey by law firm Shearman & Sterling, some 45 of the largest 100 U.S. companies already incorporate such metrics into their compensation plans. Last year, 15 of them were planning to adopt such metrics, including Alphabet GOOGL, Apple AAPL, Visa V, Walgreens Boots Alliance WBA, and Walt Disney DIS, among others.

Compensation Tied to Curbing Emissions

The most specific climate-action plans are so-called net-zero plans, in which companies detail how they will reduce greenhouse gas emissions to net zero by 2050 or before, meaning that, by that date, they will take as much carbon out of the atmosphere as they put in. That's because governments have determined that achieving net zero by 2050 is critical to containing some of the worst effects of global warming.

And that could create a new role for say-on-pay votes in reining in emissions. "Say on pay is an untapped source of strategic influence for investors and could become an increasingly contended vote as investors making pledges to bring financed emissions down to net zero by 2050 tackle carbon emissions at portfolio companies,” Cook says.

Proxy voting on climate resolutions in general reached an all-time high in 2021, Cook observes, as large asset managers began supporting proposals for companies to set and report on emission reduction targets and to clarify their lobbying around the climate. “Strong proxy-voting support for climate resolutions puts shareholders on a stronger footing in engagements with corporate management,” Cook says.

Say on pay has been a backwater--just 4% of S&P 500 companies failed to pass with an outright majority this past year. But recently, shareholders are starting to balk at the wholesale approval of say-on-pay measures, voting down Paycom PAYC, Marathon Petroleum MPC, Starbucks SBUX, General Electric GE, Norwegian Cruise Lines NCLH, and Phillips 66 PSX, Cook says. At Norwegian Cruise Lines, for example, only 17% of shareholders approved of paying CEO Frank Del Rio $36 million, after the shares lost more than half their value in 2020. And while shareholder votes are nonbinding, boards of directors, which oversee executive pay, look at unusual results closely--they know that a bad result reflects poorly on their own performance as directors.

Few U.S. companies specifically refer to emission-reduction targets in pay practices. Indeed, the companies most affected by the energy transition, oil and gas companies, don’t make incentives around achieving net zero. In fact, they incentivize fossil fuel production.

But many of the largest investors that run popular mutual funds, including BlackRock BLK and Vanguard, have committed to achieving net-zero emissions across portfolios by 2050. They are part of a global alliance of net-zero asset managers controlling $57 trillion of assets globally. "Linking leadership incentives to decarbonization targets at the biggest emitters promises the biggest real-world impact for investors," Cook says.

The Role of Shareholders

"Say on pay is underutilized," says Rosanna Landis-Weaver, who steers the Wage Justice & Executive Pay program at shareholder advocate As You Sow, which recently published a study on executive compensation and greenhouse gas emissions.

One problem is that companies are overly focused on short-term incentives, even though climate is a long-term problem. That behavior may change. For example, in response to a proposal by As You Sow, Valero Energy VLO announced in March 2021 that, for long-term incentive pay awards, the company would use a new "energy transition performance measure" that would increase or decrease payouts based on Valero's annual progress in achieving its emissions offset and reduction targets.

"The say-on-pay vote is a tool that gets directors' attention, and it's something people should be thinking about," Landis-Weaver says.

At the very least, many investors will be raising say-on-pay issues in conversations with companies.

Chris Meyer, manager of stewardship investing research and advocacy at Praxis Mutual Funds, has been talking with electric utilities about their net-zero goals and how they'll achieve them. "We don't know how public policy will play out, but we discuss executive compensation and how net-zero goals can be integrated into pay or performance," says Meyer.

Trillium Asset Management, which has filed an array of shareholder proposals around sustainability issues over the years, is also nudging companies to link sustainability factors to executive pay.

"If you want a company that meets its greenhouse gas emissions targets, you have to pay them to meet those targets," says Jonas Kron, Trillium’s chief advocacy officer.

/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)