Markets End November on a Low Note, but ETFs Stack Inflows

ETFs hauled in $73.1 billion of fresh inflows despite markets' sour end to November.

Another sunny month in the U.S. stock market turned cloudy when news of the Omicron variant of the coronavirus ushered in fresh uncertainty. The Morningstar Global Markets Index (a broad gauge of global equities) lost 2.96% last month. Bonds finished November in the black as investors fled to safety toward the end of the month. The Morningstar U.S. Core Bond Index advanced 0.32% in its first positive month since July.

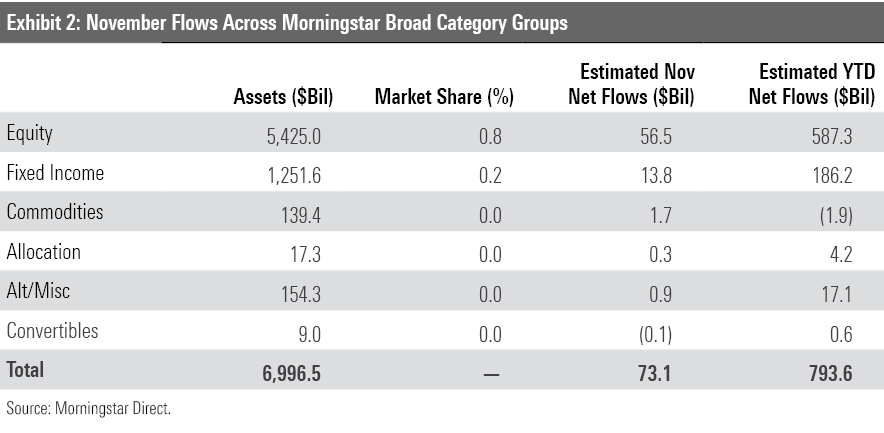

U.S. exchange-traded funds notched more inflows despite November’s shaky conclusion. They collected an estimated $73.1 billion of new money last month, bringing their year-to-date haul to $793.6 billion. The question of whether this year would break the annual ETF flows record was answered in July. With just one month left on the calendar, the question remains: by how much?

Here, we’ll take a closer look at how the major asset classes performed last month, where investors put their money, and which corners of the market look rich and undervalued at month’s end--all through the lens of ETFs.

Stocks Stall

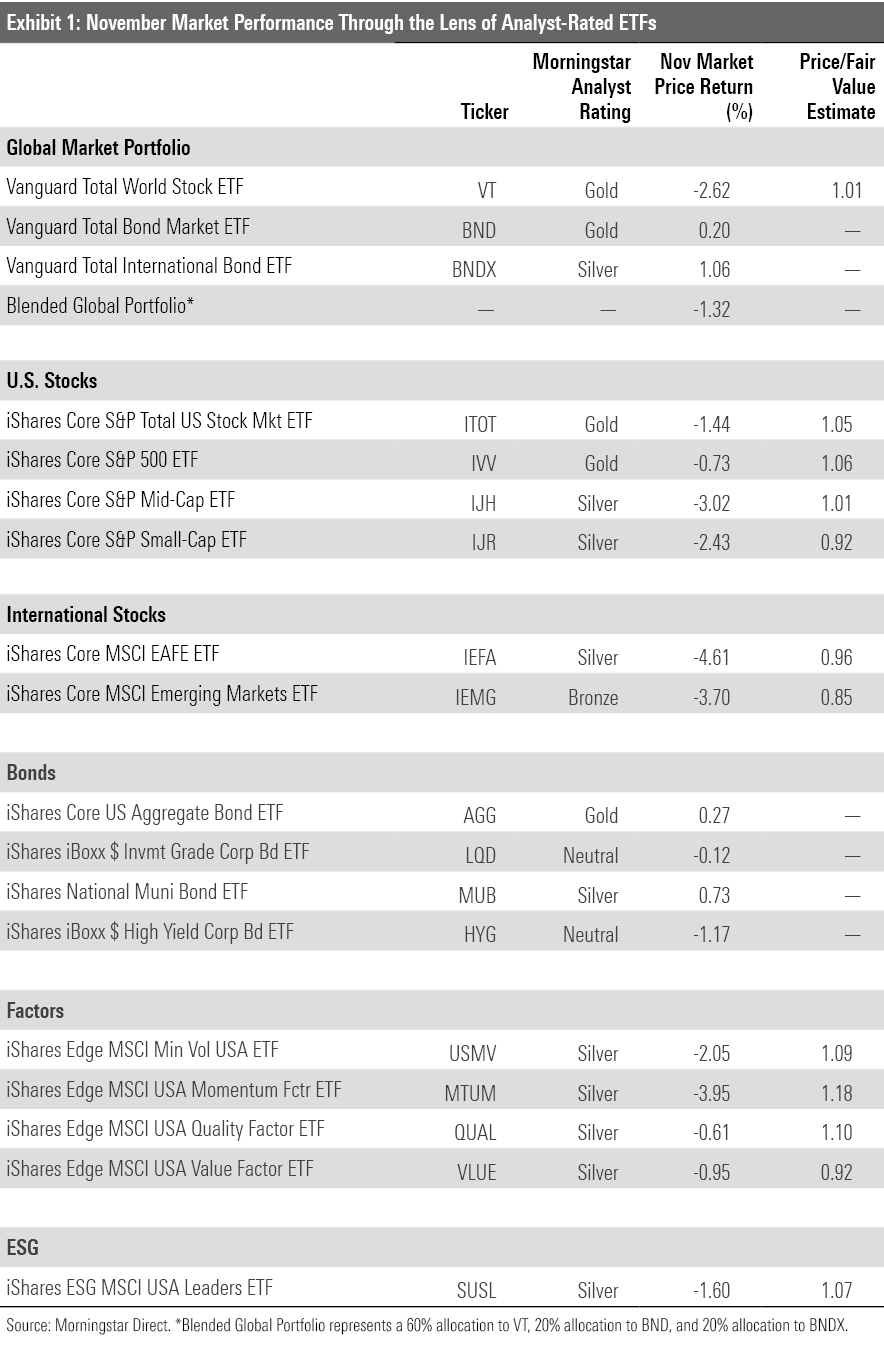

Exhibit 1 shows November returns for a sample of Morningstar Analyst-rated ETFs that serve as proxies for major asset classes. Investors in a blended global portfolio endured a 1.32% loss in November. For only the second time this year, the portfolio’s bond sleeve carried the load. Vanguard Total Bond Market ETF BND added 0.20%, while international counterpart Vanguard Total International Bond ETF BNDX climbed 1.06% in its best month since July. Vanguard Total World Stock ETF VT--which comprises the portfolio’s stock sleeve--dipped 2.62%.

International stocks suffered a dreary month. Vanguard Total International Stock ETF VXUS lost 4.36% in November, its worst month since March 2020. Stocks in developed European markets fared particularly poorly. The United Kingdom, Germany, and Netherlands stock markets saw drawdowns between 5% and 7%. Stocks from these countries had mostly retreated even before news of the Omicron variant surfaced toward the end of November. VXUS has registered a 5.23% gain for the year to date through November, about 15 percentage points behind U.S. counterpart Vanguard Total Stock Market ETF VTI.

U.S. stocks held up better but still finished the month in the red. IShares Core S&P U.S. Total Stock Market ETF ITOT lost 1.44% in November. The fund was on pace for another positive month until it sunk 3.15% over the last three trading days of November. Renewed concerns over inflation and interest-rate hikes likely compounded the negative momentum that the Omicron variant sparked. Federal Reserve Chair Jerome Powell backpedaled on the stance that inflation is transitory on Tuesday and indicated that the Fed may taper its bond purchases sooner than anticipated.

Large-cap stocks fared better than their smaller peers last month. IShares Core S&P 500 ETF IVV shed 0.73%, while iShares Core S&P Small-Cap ETF IJR lost 2.43%. The tech sector--more specifically, semiconductor stocks--kept wind in IVV’s sails. NVIDIA NVDA climbed 27.8% last month. Fellow chipmakers Qualcomm QCOM and Advanced Micro Devices AMD jumped 35.7% and 31.7%, respectively, despite a worldwide semiconductor shortage. These companies are instrumental to widespread digitalization and stand to benefit from the rise of the metaverse in particular. Indeed, NVIDIA is the top holding in Roundhill Ball Metaverse ETF META, which attracted about $664 million of new money in November. Apple AAPL, the S&P 500’s second-largest constituent, notched an excellent month as well, advancing 10.5%.

Financial-services stocks did not see the same success. These companies tend to be more cyclical, and many posted swift declines toward November’s end. Bank stocks particularly suffered; JPMorgan Chase JPM, Bank of America BAC, and Wells Fargo WFC all slid between 6% and 7% last month. Financial Select Sector SPDR ETF XLF lost 5.71% in November, its worst month since March 2020. The energy and industrials sectors did not do much better: State Street’s ETFs that cover those sectors slid 5.01% and 3.56%, respectively.

These sectors’ collective slump did not fare well for value-oriented portfolios, as they tend to favor the cheaper stocks found in the financials, energy, and industrials spaces. Vanguard Value ETF VTV dropped 3.04% last month, while its twin Vanguard Growth ETF VUG climbed 0.71%. VTV spent most of November in the black but slid 4.22% in the three trading days that followed the Omicron variant news. That does not come as much surprise. Cheaper, smaller stocks tend to be more economically sensitive and have reacted more dramatically to material pandemic-related news, good or bad. VUG now leads VTV by about 7 percentage points for the year to date. Should it hold on to its advantage for one more month, this would mark the fifth consecutive year it beat its value counterpart.

IShares MSCI USA Value Factor ETF VLUE weathered the difficult value environment well and limited its loss to 0.95%. As this fund takes a sector-relative approach to value, it reaped more of the tech sector's rewards than most of its value-oriented peers. Favorable exposure to healthcare stocks helped boost the fund. A lofty stake in vaccine maker Pfizer PFE served it particularly well. VLUE held up better than fellow single-factor funds iShares MSCI USA Momentum Factor ETF MTUM and iShares MSCI Minimum Volatility Factor ETF USMV, but Morningstar’s price/fair value estimate still paints this fund as a better deal. It traded at an 8% discount as of end-November, while MTUM and USMV sported premiums of 18% and 9%, respectively.

Plain Is Profitable

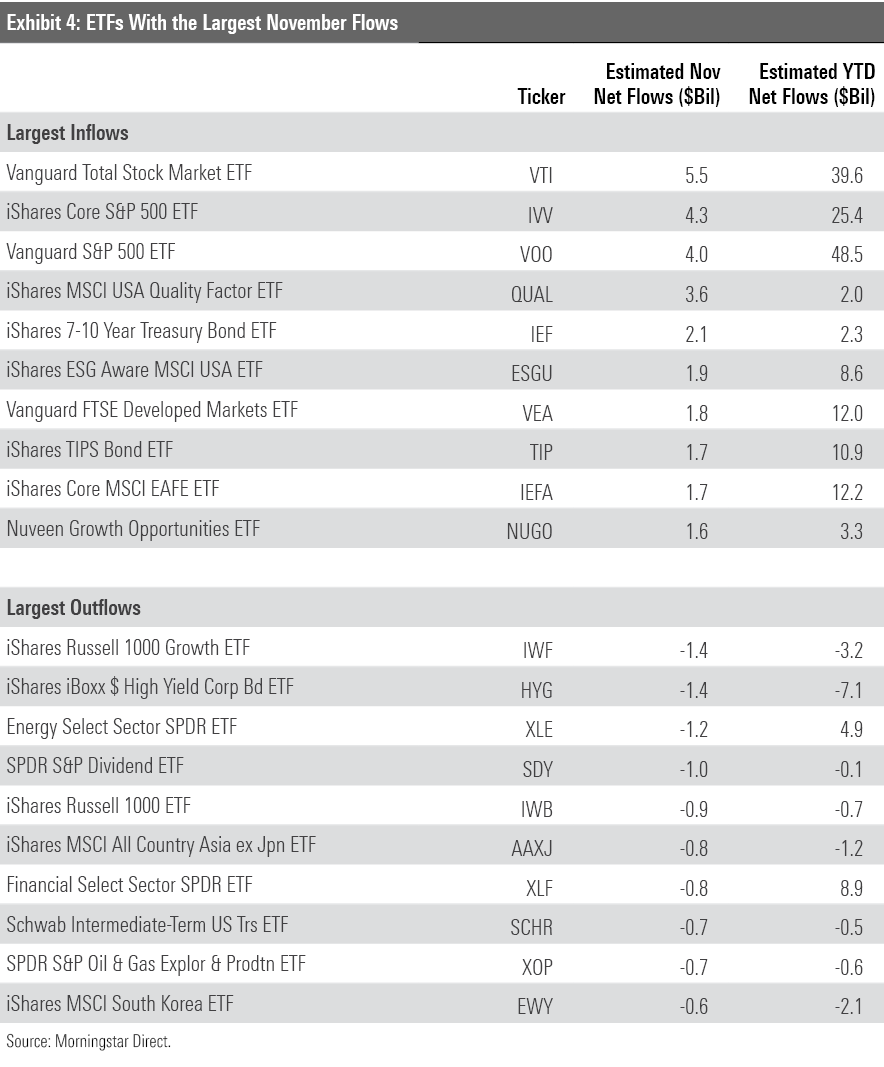

Stock ETFs rattled off another stellar month of flows, pulling in a fresh $56.5 billion in November. Investors have poured at least $50 billion into these funds in three of the past four months. Whether their enthusiasm for equity funds remains after the market’s shaky November conclusion remains to be seen.

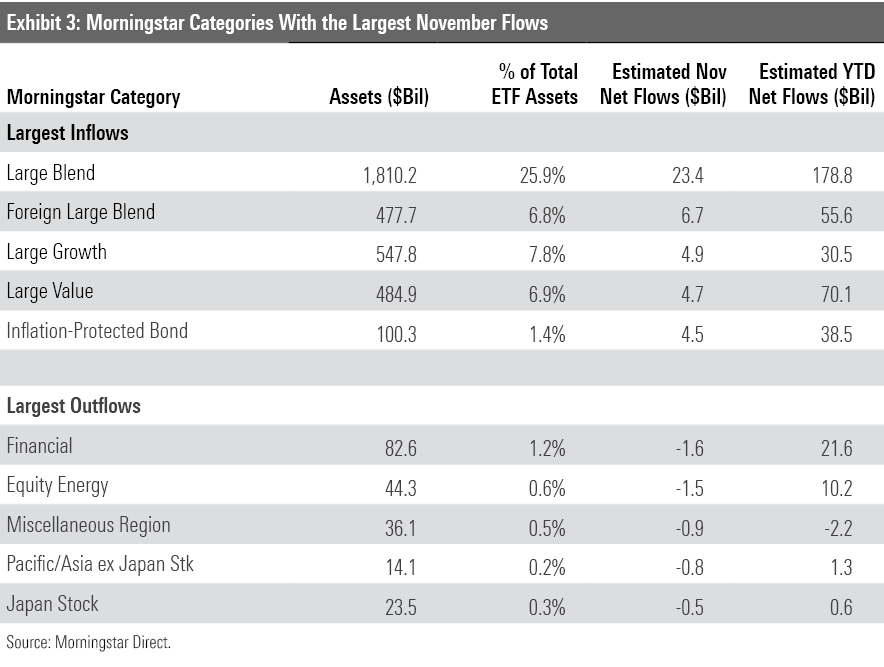

The U.S. and foreign large-blend Morningstar Categories have driven much of stock funds’ lucrative year. ETFs from these two categories have collectively hauled in about 40% of all stock ETF inflows for the year to date. U.S. and foreign large-blend funds led all categories in flows last month, raking in $23.4 billion and $6.7 billion, respectively. November marked the sixth consecutive month that both have ranked among the top five in flows, with U.S. large-blend leading the pack each time.

These funds’ sustained run reflects investors’ continued appetite for low-cost, broadly diversified, market-cap-weighted offerings. Three funds that meet that description lead the November and year-to-date flows standings: VTI, IVV, and Vanguard S&P 500 ETF VOO. This trio has collectively hauled in $113.5 billion for the year to date, a larger figure than any category except the U.S. large-blend space where they reside. IShares Core MSCI EAFE ETF IEFA, Vanguard FTSE Developed Markets ETF VEA, and VXUS have ruled the international arena. Each has pulled in between $10.9 and 12.2 billion of new money in 2021.

That said, funds that target specific investment styles have attracted healthy flows as well. Both the U.S. large-growth and U.S. large-value categories cracked the flows top five last month. While value funds have pulled in more money than their growth peers this year, flow patterns have matched performance. Over the first five months of 2021, a stretch characterized by value stocks’ outperformance, U.S. broad-based value funds collected $61 billion of new money to growth funds’ $5 billion. Fortunes flipped over the next six months. Growth stocks broadly trumped their cheaper peers, adding $33 billion of new money to value funds’ $24 billion. It seems value investors’ enthusiasm has waned as cheaper stocks’ long-awaited comeback lost steam.

Fixed-income ETFs tacked on $13.8 billion in November. While that’s a solid month, the momentum of flows into these funds has decelerated recently. Their annual inflows record, set in 2020, looked to be within reach after a hot start to the year. But it’s unlikely they’ll eclipse the $212 billion milestone after failing to crack $15 billion inflows in back-to-back months.

Inflation-protected bond funds deserve no blame for this slowdown, as they continued to dominate the fixed-income ranks in November. These funds have collected $38.5 billion so far this year, which nearly triples their previous annual flows record of $13 billion set in 2020. IShares TIPS Bond ETF TIP and Vanguard Short-Term Inflation-Protected Securities ETF VTIP have benefited the most, pulling in $10.9 billion and $8.6 billion on the year, respectively. Clearly, inflation is top of mind for many investors.

Corporate bond and long-term government bond funds did not have the same success in 2021, but both cracked the top 10 on the flows leaderboard last month. Investors sank $3.4 billion into long-term government bond funds. Corporate bond funds bounced back from a rocky October and added $1.6 billion in November, though they have still leaked a net $5.8 billion for the first 11 months of 2021.

Active ETFs added $6.2 billion of new money in November, raising their year-to-date haul to $81.1 billion. While that may sound modest, it represents a 28% organic growth rate from December 2020, which exceeds index ETFs’ 11% clip by a healthy margin. Active ETFs represented just 4% of the U.S. ETF market by market cap as of end-November. 236 active ETFs have launched this year, though, compared with 136 passive ETFs. Perhaps none have been as immediately lucrative as Nuveen Growth Opportunities NUGO, which has racked up $3.28 billion since its September inception.

A pair of iShares funds headline this month’s list of ETFs with the largest outflows: iShares Russell 1000 Growth ETF IWF and iShares Russell 1000 ETF IWB, which leaked $1.4 billion and $929 million, respectively. Perhaps investors are keen to the fact that the Russell 1000 Index and its derivative indexes have not stacked up well versus the S&P 500 and its kind. IWB trailed IVV by 1.65 percentage points for the year to date. It is also slightly more expensive. While these large-blend index funds offer very similar exposure, it’s important to remember that differences in their construction may lead to different outcomes.

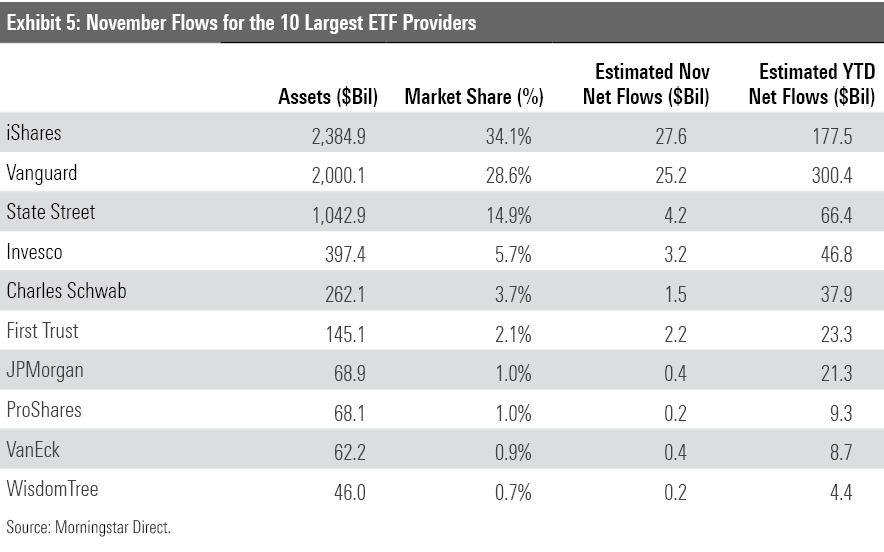

Parental Guidance

For the first time since December 2020, the ETF provider with the largest monthly inflows was not Vanguard. That distinction belongs to iShares, which edged out its rival behemoth with a $27.6 billion November haul. IShares remains squarely in second place in the 2021 flows race, however, as the $177.5 billion the firm has absorbed for the year to date is well behind Vanguard’s $300.4 billion.

IShares’ environmental, social, and governance strategies helped it squeak out its narrow November flows victory. Its funds labeled as sustainable in Morningstar’s database collected $3 billion last month--a small slice of overall flows, but enough to push it into first place. IShares’ lineup of ESG funds has attracted nearly $25 billion of new money in 2021. IShares ESG Aware MSCI USA ETF ESGU has led the way. After a $1.9 billion inflow last month, the fund has raked in close to $9 billion for the year to date. Vanguard’s entire sustainable ETF roster has collectively added only $3.7 billion so far in 2021. To be sure, ESG funds represent a small sliver of these firms’ enormous overall asset bases. Still, iShares’ earlier adoption of sustainable index funds may help it carve out a more pronounced edge versus Vanguard.

Oil Funds Look Cheap Again

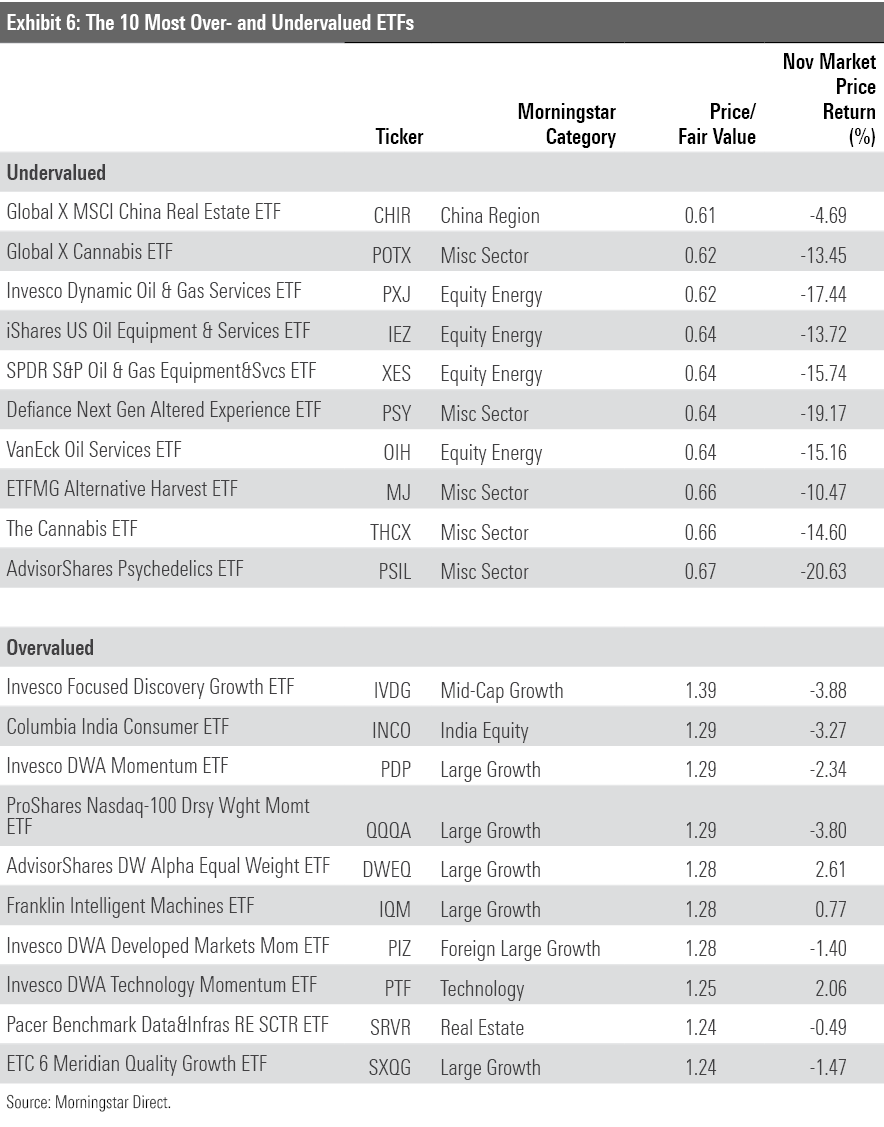

The fair value estimate for ETFs rolls up our equity analysts’ fair value estimates for individual stocks and our quantitative fair value estimates for stocks not covered by Morningstar analysts into an aggregate fair value estimate for stock ETF portfolios. Dividing an ETF’s market price by this value yields its price/fair value ratio. This ratio can point to potential bargains and areas of the market where valuations are stretched.

A harsh November landed a slew of oil ETFs back on the “undervalued” half of Exhibit 6, which shows funds that traded at the lowest price relative to their fair value at last month-end. Many of these funds are former residents on this list. Oil-focused portfolios saw their valuations tank during the initial coronavirus-induced drawdown in early 2020. Many of these funds mounted a comeback, however, and almost all of them had crawled out of Exhibit 6 by October 2021.

Last month brought a new variation of a now-familiar story. News of the freshly detected Omicron variant curbed oil demand and sent these funds into a spiral. Invesco Dynamic Oil & Gas Services PXJ was hit the hardest, sliding 17.4% last month and 5.5% on Nov. 26 alone. It’s difficult to say whether oil will see another drawdown of early-2020's magnitude. Investors who believe this is but a blip on the radar may have another window to capitalize on oil funds’ cheap valuations.

Meanwhile, the pain continues for ETFs that aim to leverage the legalization of cannabis or other drugs. Global X Cannabis ETF POTX, the largest of the bunch, has sunk 26.1% for the year to date. It has lost at least 5% in each month since May 2021. Cannabis stocks have broadly lost steam as legalization efforts have taken a backseat in Washington.

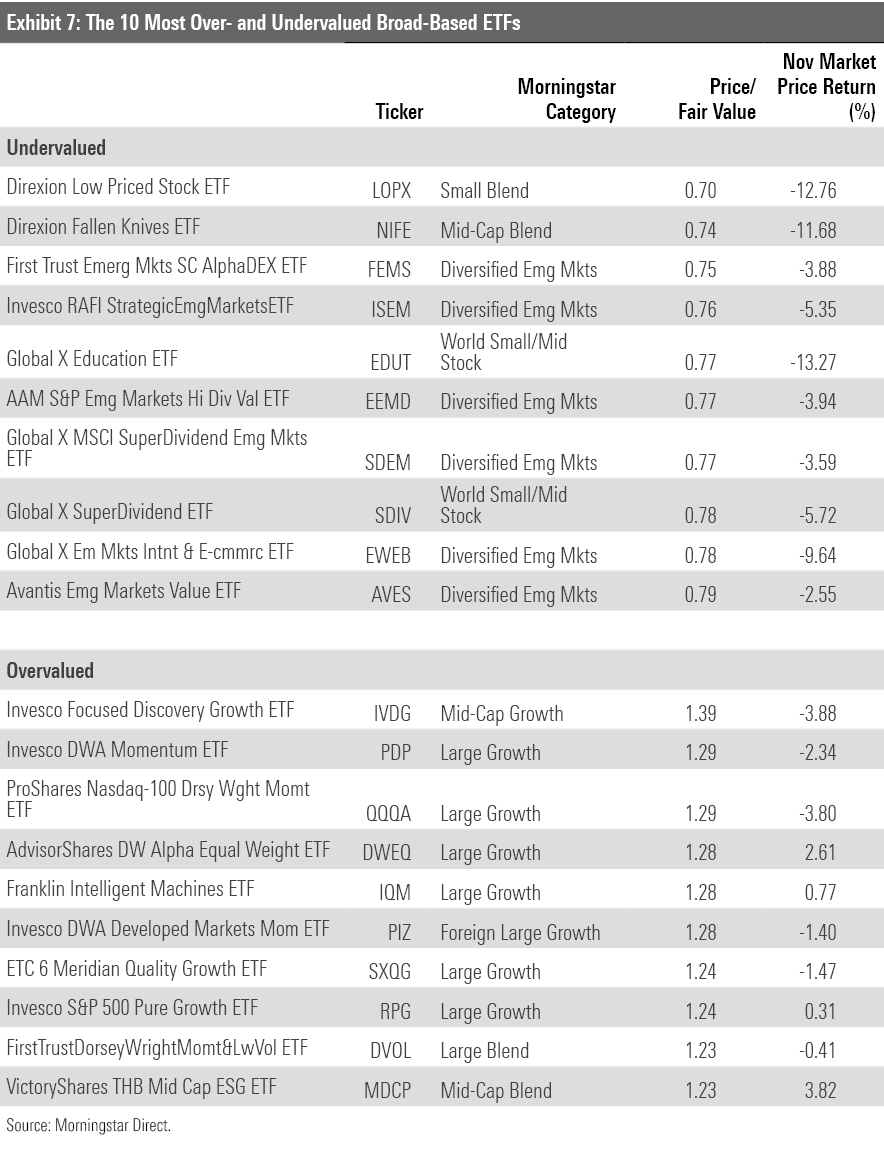

Many of the cheapest valuations among more-diversified portfolios are found overseas. Exhibit 7 indicates that broad-based funds that invest in emerging-markets stocks offer some of the best value. Several of these funds zero in on companies that distribute healthy dividends, attracting value and yield-seeking investors alike. But buyer beware: Many of these funds have not compensated investors for the risk they court. Global X MSCI SuperDividend Emerging Markets ETF SDEM, for example, captured 102% of the MSCI Emerging Markets Index’s downside and only 70% of its upside over the three years through November.

Avantis Emerging Markets Value ETF AVES may be a worthwhile option, however. The nascent fund pursues stocks that marry low valuations with better profitability ratios, which should steer it away from many of the emerging markets’ riskiest names. Its 0.36% expense ratio ranks within its category’s cheapest decile. Avantis U.S. Equity ETF AVUS, which unfurls a very similar approach in the domestic market, carries a Morningstar Analyst Rating of Bronze.

VictoryShares THB Mid Cap ESG ETF MDCP makes its second consecutive appearance on the pricier side of Exhibit 7. This active fund, born at the start of October, features about 30 stocks with sound profitability and ESG characteristics. Investors should not be surprised to see ESG portfolios trade at lofty valuations. Funds that score well in ESG metrics also tend to be high-quality businesses, and those rarely come cheap. ESG strategies also tend to favor technology stocks, whose valuations usually exceed the energy and utilities companies these funds often avoid. To be sure, tech stocks represented about 28% of MDCP as of end-September compared with 19% of the Russell Midcap Index, its category benchmark.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)