We're Still Bullish on U.S. GDP Growth

The third quarter served as a reminder that the economic recovery is far from over.

Supply chain constraints and the delta variant conspired to push U.S. gross domestic product growth down to just 2% in the third quarter of 2021, the slowest rate in the recovery so far. However, we see this as a minor bump in the road, as we continue to expect several years of above-2% GDP growth before the economy is fully recovered. Continued recovery in the labor market underpins our views on U.S. GDP growth, which are above consensus.

Meanwhile, near-term inflation has reached sizzling rates, but we see this as neither a threat to the economic recovery nor a harbinger of elevated long-term inflation. Durable goods (namely vehicles) and energy are driving the bulk of U.S. inflation, but we expect these factors to be resolved as supply catches up with demand. The unwinding of price spikes in these categories will drive large deflationary pressure. We're below consensus on inflation through 2025, as we think consensus is overreacting to near-term developments.

We're Above Consensus on U.S. GDP Growth Through 2025

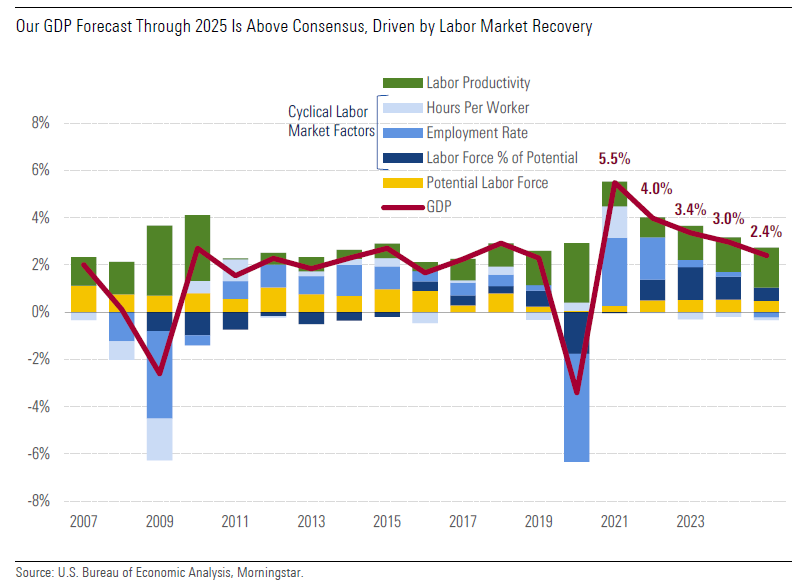

The chart below shows our U.S. real GDP growth forecast, disaggregated into supply-side factors. We focus on the supply side because the demand side of the economy will not be constrained for the near future.

We project 5.5% real GDP growth in 2021 and 4.0% in 2022, which are essentially in line with consensus, according to The Wall Street Journal. However, over 2023-25 we expect nearly 200 basis points more GDP growth than consensus.

Our bullish view on U.S. GDP growth through 2025 compared with consensus is attributable to our views on the long-run supply side of the economy (known as potential GDP):

- We see room for strong gains in labor force participation owing to tight labor markets over the next several years.

- The advent of near-term bottlenecks in supply doesn't affect our view of the U.S. economy's long-term productive capacity, as these issues should be resolved.

The only potentially concerning aspect of the near-term data would be the labor market, where we're seeing a somewhat slow recovery in employment given the record high rate of job openings. However, we don't think the labor market recovery is anywhere near being completed.

That said, our forecast has now incorporated a delayed recovery in GDP, owing to issues such as the semiconductor shortage, which we now expect to take longer than previously thought. Though our U.S. GDP growth forecast for 2021 and 2022 has been reduced as a result, we've increased our forecasts for 2023 to 2025 by a near-offsetting amount.

U.S. GDP Growth Slowed Abruptly in Q3 Because of the Delta Variant and Supply Issues

As mentioned above, U.S. real GDP growth slowed to just 2% (quarter over quarter, annualized) in the third quarter.

The main driver of this weak growth was a 9% fall in goods consumption. One side effect of lower goods consumption was lessened depletion of inventories, so inventories flipped to being a positive contributor to growth in the third quarter. On the other hand, growth in private fixed investment slowed.

We've been expecting a slowdown in consumer goods spending. However, we thought the slowdown would be caused by a rotation of consumer spending into services, with total spending growth remaining strong. Instead, the drop in consumer goods spending in the third quarter looks mainly attributable to supply chain issues. Surging vehicle prices (as well as sheer product unavailability) led to a collapse in vehicle purchases.

Meanwhile, consumer services spending growth decelerated sharply in the third quarter. The flare-up in coronavirus cases sparked by the highly transmissible delta variant caused a slowing in the return to normal. Altogether, this caused real consumer spending to grow just 1.6% (annualized) in the third quarter. This was far slower than we saw in the first half of the year (nearly 12%), as well as the rate we expect over the next two years (3.2%). Consumer services spending is still lagging the prepandemic trend, indicating that the recovery is far from finished.

In the third quarter overall, real personal consumption of services was about 5% below its prepandemic trend. The recovery in the healthcare, recreation, and restaurant and hotel categories decelerated in the third quarter, likely because of the delta variant. It's also possible that labor shortages (which appear particularly strong in the hospitality industries) helped to constrain output.

Interestingly, we also see that the healthcare sector remains a major drag on services spending. However, this is probably artificial, as billings of high-value procedures are crowded out given that system capacity is swamped by coronavirus-related admissions. Also, we saw many people return to doctor visits in early 2021 following mass vaccination; this should lead to increased levels of high-value procedures at a lag. We expect healthcare to be a solid (and probably overlooked) contributor to the recovery in the services sector going forward.

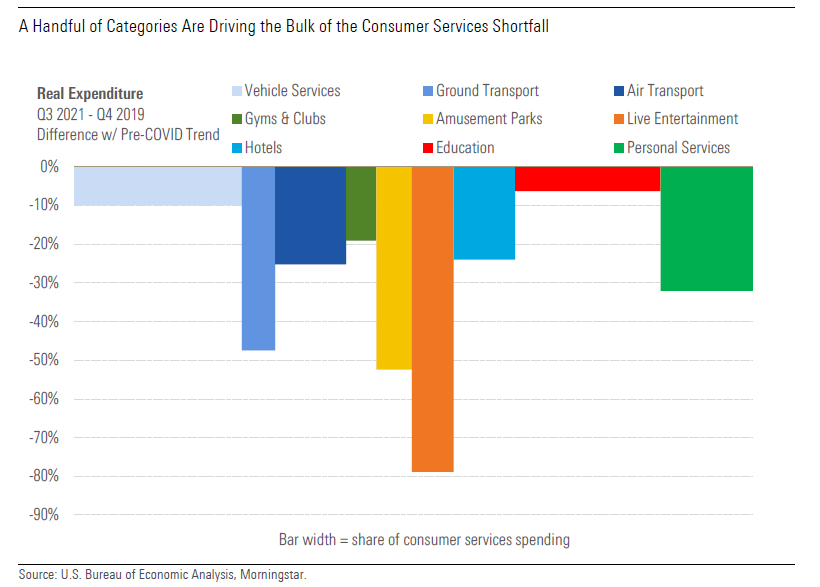

The chart below breaks down the consumer services categories that are driving the bulk of the consumer services spending shortfall. These categories accounted for just 14% of prepandemic consumer services spending but are accounting for about two thirds of the shortfall in consumer services spending.

Still, we think these categories will follow the very strong recovery already seen in restaurant spending, just at a lag. This lag reflects the time needed to plan out trips and events, as well as the time needed for consumers to get comfortable with larger crowds.

Inflation Should Cool Down After a Hot 2021

Meanwhile, we're below consensus on inflation through 2025, as we're expecting an average 2.4% inflation in the Consumer Price Index over 2022 to 2025, compared with about 2.8% for consensus and 3.0% for the bond market. We think consensus is overreacting to near-term inflation pressures and failing to factor in the deflationary impact as these pressures unwind.

Like with the U.S. GDP growth forecast, we have bumped up our inflation forecast for 2021 and 2022, while reducing it in 2023, when we expect the resolution of supply issues to provide strong deflationary pressure, particularly for durable goods.

The sources of today's high inflation are principally factors (mainly the vehicle shortage) that should abate in coming years. And, even if more persistent sources of inflation emerge, we believe the Federal Reserve will step in to keep inflation from getting too high.

These examples of durable goods are also cases where demand has exploded since the start of the pandemic, owing to fiscal stimulus and substitution away from services spending. Strong demand has combined with limited supply to create a perfect storm for price increases.

Energy price inflation has also contributed to excess inflation. The story here is more complicated, but ultimately we expect prices to subside in coming years.

Our inflation forecast assumes that the unwinding of these two categories (durable goods and energy) will provide significant deflationary pressure in coming years. We expect price inflation for durable goods to moderate to 2% for full-year 2022 and then drop to negative 6% in 2023.

To be sure, there are early signs that the semiconductor shortage is alleviating, though broad price declines for vehicles and other durables affected by the semiconductor shortage probably won't occur until late 2022.

For all other categories, we do expect inflation to remain moderately above normal through 2025, averaging about 3% over 2021 to 2025. This reflects the impact of tight labor markets as the Fed pushes for its goal of maximum employment. Also, these categories (mostly services) typically see slightly higher inflation than the overall index.

It's also worth noting that we expect inflation expectations to remain under control. Higher inflation expectations can lead to higher actual inflation. This self-fulfilling prophecy emerges because price and wage setters begin to bake in higher inflation expectations into their decision-making. For now, however, we don't see a surge in inflation expectations.

In our next article, we'll cover how developments in the labor market will impact the economic recovery.

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)