Big Biotech Shares Take a Wild Ride

As the post-pandemic pharma landscape takes shape, Moderna and BioNTech slide, Pfizer rallies.

In recent days, shares of some of the biggest biotechnology and pharmaceutical stocks have seen wide swings, in part as investors reassess the competitive landscape for the post-coronavirus-pandemic world.

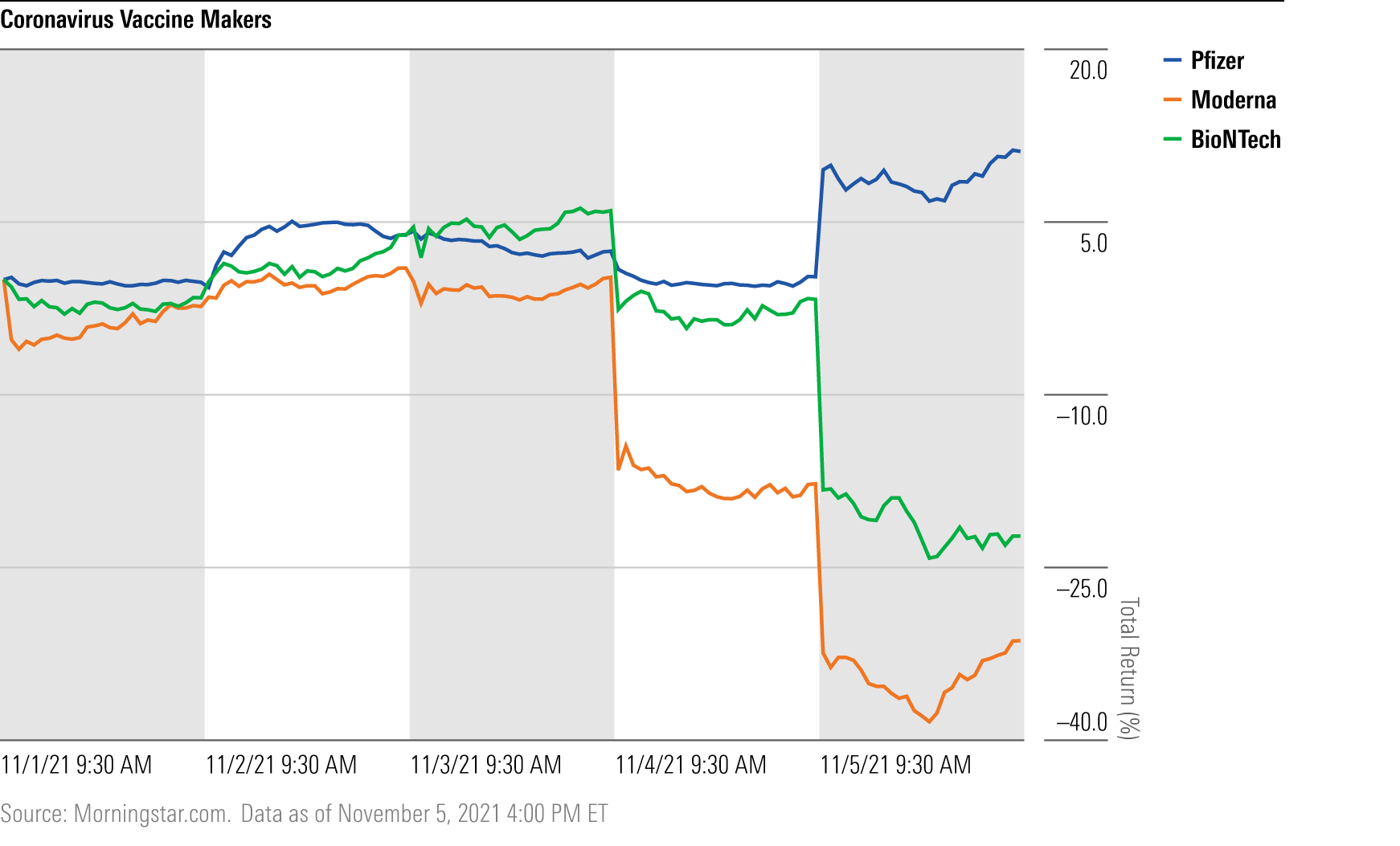

Shares of Moderna MRNA and BioNTech BNTX--both makers of COVID-19 vaccines--plummeted on Nov. 5 after Moderna reported disappointing third-quarter revenue and the company reduced 2021 sales forecasts. That same day, Moderna lost 16.6%. BioNTech--which reports earnings Tuesday morning--lost 20%. In contrast, Pfizer PFE rallied 11% on Nov. 5 after releasing impressive clinical results for an oral COVID-19 treatment.

To Morningstar healthcare strategist Karen Andersen, the earnings results, coupled with the Pfizer treatment, which is designed to prevent severe illness among those already showing COVID-19 symptoms, are signs that the landscape is shifting.

“With Moderna cutting their 2021 sales targets and heightened competition on the rise, it may be time to acknowledge we’re nearing the end of a pandemic-induced demand,” she says. More specifically: “The transition to an endemic market--post-pandemic--is likely happening faster than originally expected, so seasonal boosters in 2022 might only be needed by high-risk individuals."

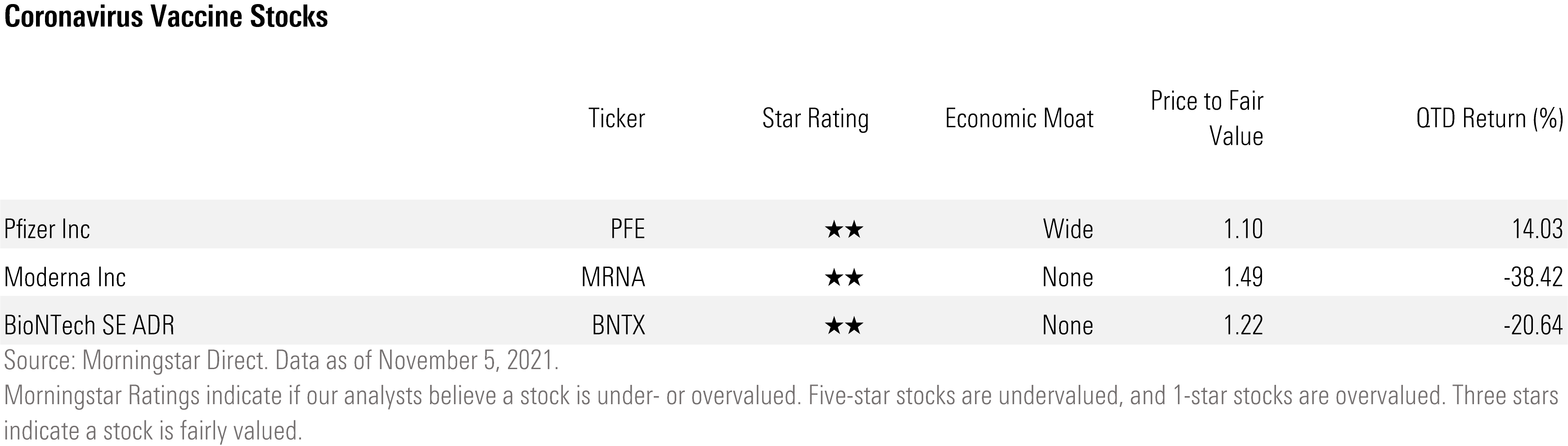

Andersen has long seen both Moderna and BioNTech shares as heavily overvalued. The recent losses bring the two firms closer to what she sees as fairly valued. However, both firms still trade at a premium to her fair value estimates. Moderna is 49% above her fair value estimate, while BioNTech trades 22% above at the time of writing.

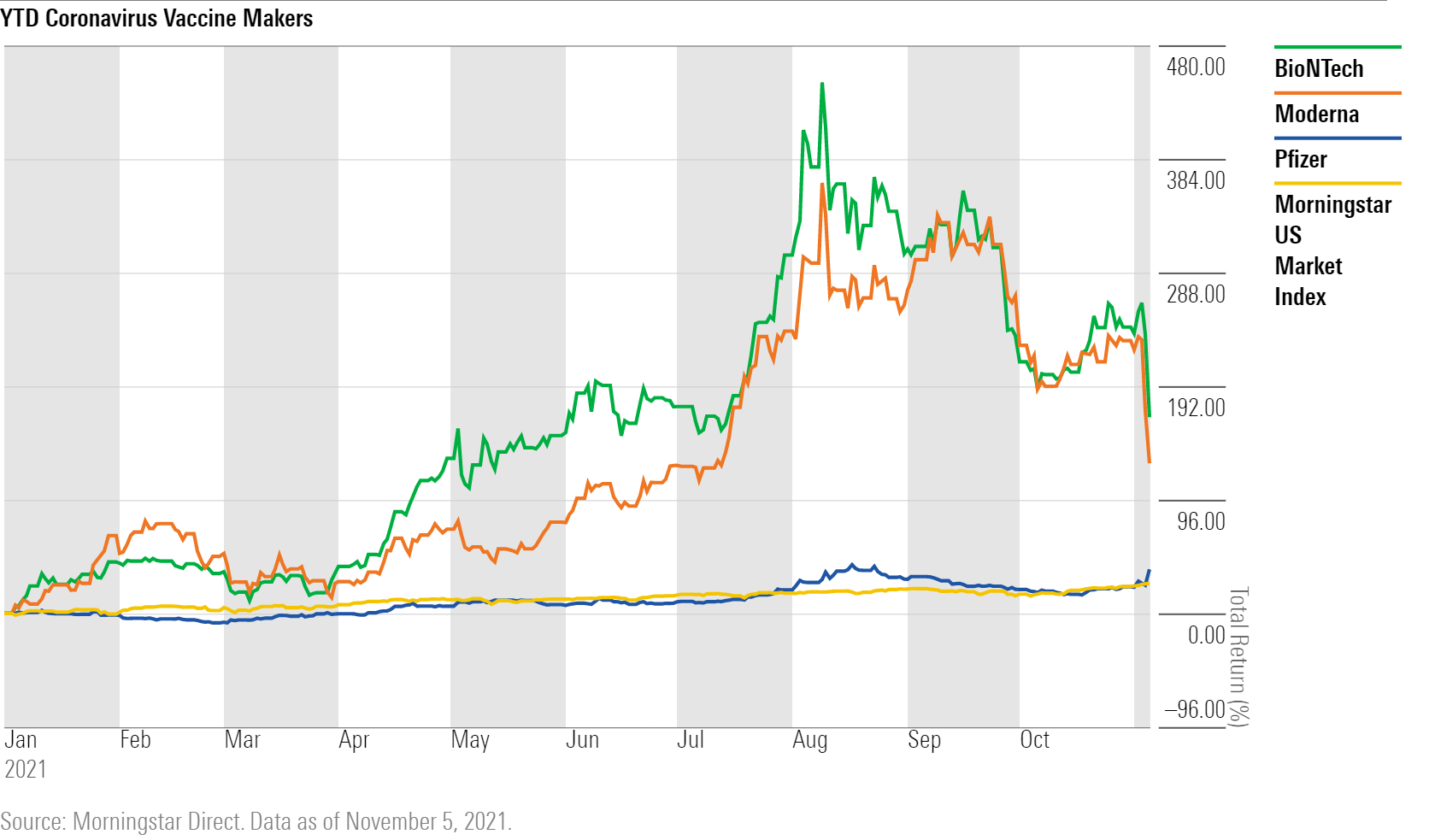

Following strong performance in Moderna and BioNTech shares early in the year, investors had increasingly grown more uncertain about the long-term profitability of the coronavirus vaccine market. Both Moderna and BioNTech's share prices peaked in early August, with Moderna rallying as high as 364% since the beginning of the year and BioNTech up as much as 449%. Shares have tumbled twice since those highs.

Last week's declines followed Moderna’s earning report last Thursday, when the company posted earnings results 14% below FactSet earning consensus estimates, and revenue 18% below estimates.

Moderna also revealed it was facing production and distribution issues that are pushing back its deliveries, prompting management to cut their forecasts for their full-year revenue.

But that’s far from Moderna’s only headwind. Andersen attributes the market’s overzealous appreciation of the vaccine makers earlier this year to bullish bets that the market for coronavirus vaccine would remain strong for the foreseeable future. Andersen disagreed with the market’s sentiment, saying, “the transition to a post-pandemic market is likely happening faster than originally expected, and long-term demand visibility is low." Profitability from booster shot demand would mostly likely be undercut by an endemic market, where dosages would be reserved for high-risk populations.

Compounding issues for coronavirus vaccine revenue streams is that vaccine sales are transitioning toward lesser developed markets around the world with lower prices, according to Andersen. Furthermore, we’re seeing heightened levels of competition from others in the pharmaceutical industry.

Pfizer recently reported strong clinical data regarding COVID-19 treatment Paxlovid, an oral antiviral treatment. “It appears we’ll have two oral antivirals--Merck MRK and Pfizer--available in the near term and having these in our back pocket could make the idea of getting a booster shot in areas with low rates of infection less appealing,” says Andersen.

As for Pfizer, Morningstar’s healthcare sector director Damien Conover says that while the sales benefit of Paxlovid will probably be robust for Pfizer in the near term, we don’t expect a long tail of sales from the drug because of a likely decline in cases as vaccinations continue to increase.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)