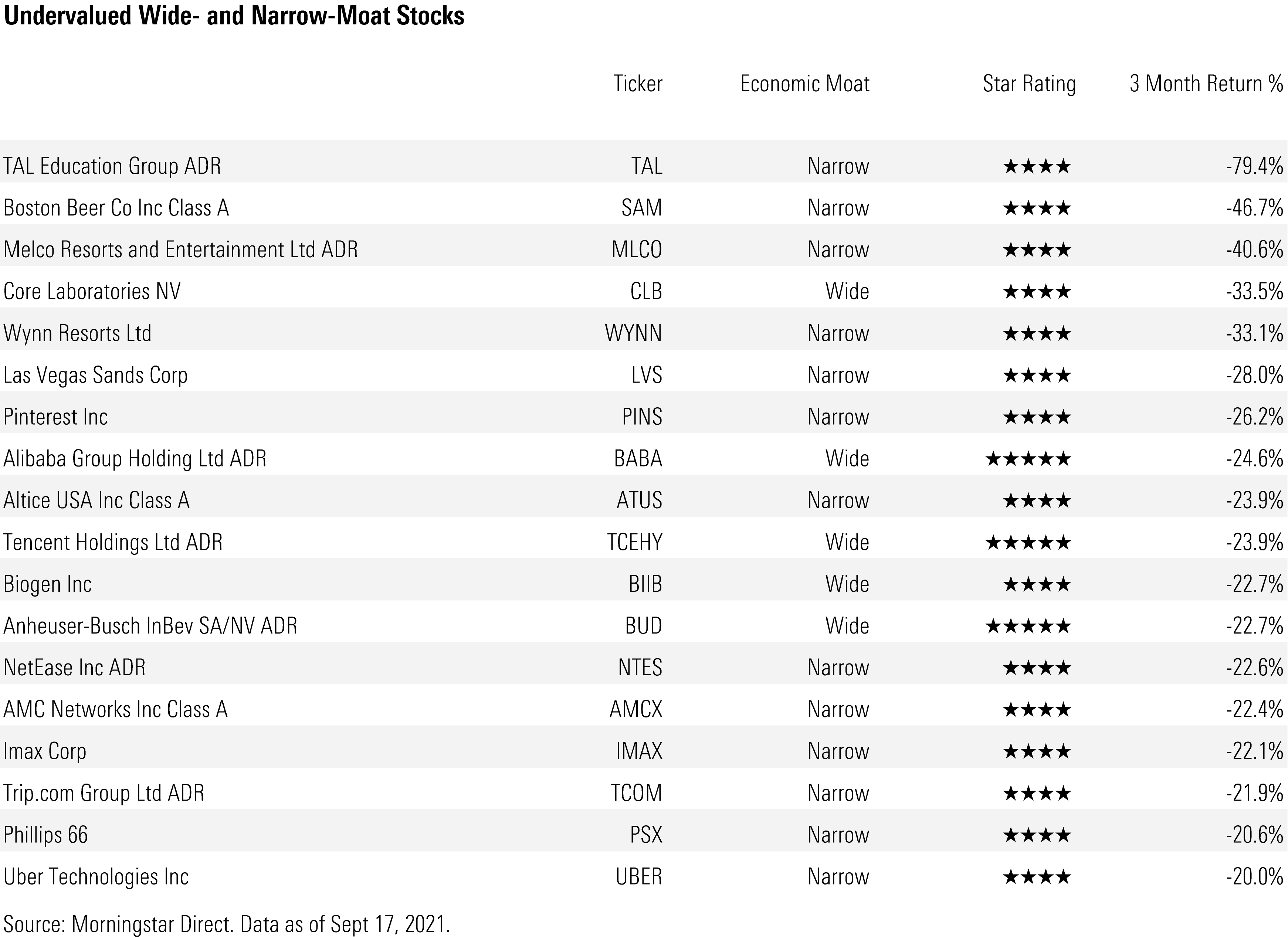

18 Battered and Undervalued Quality Stocks

These wide- and narrow-moat stocks have suffered losses lately and are now trading in 4- and 5-star range.

Stock market volatility has returned in full force in September 2021. In fact, the market hasn't been kind to many high-quality stocks for the past few months. Today, we're screening for stocks with Morningstar Economic Moat Ratings of narrow or wide that have lost more than 20% in the three months ended Sept. 17. Eighteen of them look undervalued to us.

Several China-based stocks populate the list. Waves of regulatory crackdowns from the Chinese government have wiped out billions of market value from companies in the Chinese tech sector, such as Tencent Holdings TCEHY, to companies in the private education sector, such as TAL Education Group TAL. While most investors have been left reeling from China's regulatory changes, we think the crackdown has created opportunity for long-term investors willing to endure some volatility.

The most recent wave of Chinese regulations has targeted the gambling industry in Macao. Three gambling stocks in our coverage universe lost more than 20% during the last three months: Melco Resorts and Entertainment MLCO, Wynn Resorts WYNN, and Las Vegas Sands LVS. While the latter two companies are not based in Macao, a significant portion of their business comes from the territory. Senior equity analyst Jennifer Song sees three areas of concern for investors betting on the Macao gambling industry: "First, the proposed revised gambling law will set up scrutiny of casino operators and increase local ownership, which suggests more direct government supervision on gaming companies' operations. Second, China's crackdown on cross-border currency outflows and money laundering spells likely risk to junkets and the VIP segment. Third, there is little transparency on the renewal of gaming licenses, with little guidance so far on the number of licenses and the concession period as well as restriction on capital allocation."

We've lowered our fair value estimates on these gambling stocks because of these headwinds, yet they still present opportunity for long-term investors.

Here's what our analysts have to say about three of the other undervalued names from the list:

Anheuser-Busch InBev BUD

"Anheuser-Busch InBev, or AB InBev, has been acquisitive, having made transformative deals for Interbrew and Anheuser-Busch, and more recently acquiring Grupo Modelo, Oriental Brewery, and SABMiller. Management's strategy is to buy brands with a promising growth platform, expand distribution, and ruthlessly squeeze costs from the business. The payback period for the SABMiller deal has been much longer than usual, however, despite management executing well on costs. Since the deal, one road bump after another has caused EBITDA growth to slow; from craft beer in the United States to slowing demand in South Africa to the shutdown of the on-trade during the coronavirus, and net debt/EBITDA stood at 5.5 times at the end of 2020. We expect the merger and acquisition playbook to be on hold for a year or two more until AB InBev deleverages its balance sheet.

"Still, previous acquisitions have created a monster with vast global scale as well as regional density. AB InBev has one of the strongest cost advantages in our consumer defensive coverage and is among the most efficient operators. Vast global scale and its monopolylike positions in Latin America and Africa give AB InBev significant fixed cost leverage and procurement pricing power. This plays out in the firm's excess returns on invested capital and best-in-class operating and cash cycles, asset turnover ratios, and working capital management. AB InBev delays payments to trade creditors more than 20% longer than its closest rival Heineken HEINY, and its free cash flow conversion has been consistently higher than peers' in recent years. Driving AB InBev's profitability is its majority stake in Ambev, the Latin American brewer that generates a whopping near-40% EBIT margin in beer in Brazil.

"AB InBev is well-positioned to exploit secular growth in several of its markets. In Latin America and in Asia (almost two thirds of consolidated EBIT combined), the consumer is trading up into premium global brands, and AB InBev holds a strong portfolio with Budweiser, Corona, and Stella Artois. Developed markets, on the other hand, are likely to remain fragmented and competitive."

-- Philip Gorham, director

Core Laboratories CLB

"We have long believed that Core Laboratories is one of the highest-quality oilfield-service companies. For one, with a wide moat rating, Core Lab possesses the strongest moat across our entire oilfield-service coverage. The company's foundational core analysis business in the reservoir description segment, in particular, has been virtually unchallenged over the past three decades. The business passes the Warren Buffett quality test, whereby even an 'idiot' could likely run the business with some profitability.

"Yet, Core Lab has long been managed with the utmost skill, in our view. The 1998 acquisition of Owen Oil Tools and subsequent repositioning of the business to offer high-quality solutions for the fast-growing U.S. shale markets was a stroke of brilliance. The combination of topnotch management plus a strong underlying business has delivered unrivaled levels of returns on capital over the past two decades.

"The downturn in oil and gas activity beginning in late 2014 has continued to depress financial results for most oilfield-services companies, and Core Lab hasn't fully escaped the effects. Also, the coronavirus hit oil markets hard in 2020, although we expect the impact of the pandemic to be mostly temporary. In any case, Core Lab has impressively generated economic profits even at the cycle trough."

--Preston Caldwell, senior equity analyst

Biogen BIIB

"We think Biogen's specialty-market-focused drug portfolio and novel, neurology-focused pipeline create a wide economic moat. Biogen's strategy has its roots in the 2003 merger of Biogen (multiple sclerosis drug Avonex) and Idec (cancer drug Rituxan). While Rituxan is succumbing to biosimilar competition, Biogen is expanding its neurology portfolio beyond MS with blockbuster neuromuscular disease drug Spinraza and future Alzheimer's disease blockbuster Aduhelm.

"Outside of MS, Biogen has strong human genetic validation for its neurology pipeline. Spinal muscular atrophy drug Spinraza (partnered with Ionis) is a $2 billion franchise, although competition from Novartis (gene therapy Zolgensma, approved in May 2019) and Roche (oral drug Evrysdi) are beginning to erode U.S. Spinraza sales. Aduhelm has the largest potential; it was approved in the U.S. in June 2021 as the first disease-modifying Alzheimer's therapy. While there is significant uncertainty surrounding the potential commercial uptake of Aduhelm, we think the market also underestimates Biogen's remaining pipeline, which includes a continuing partnership with Ionis (including tau-targeting Alzheimer's drug BIIB094) and drug candidates to treat conditions including stroke, depression, Parkinson's, pain, and ALS."

--Karen Andersen, strategist

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)