Top Fund Managers Largely Avoided the Market’s Biggest Winners

Outside of vaccine-makers, few owned the fastest risers since the start of 2020.

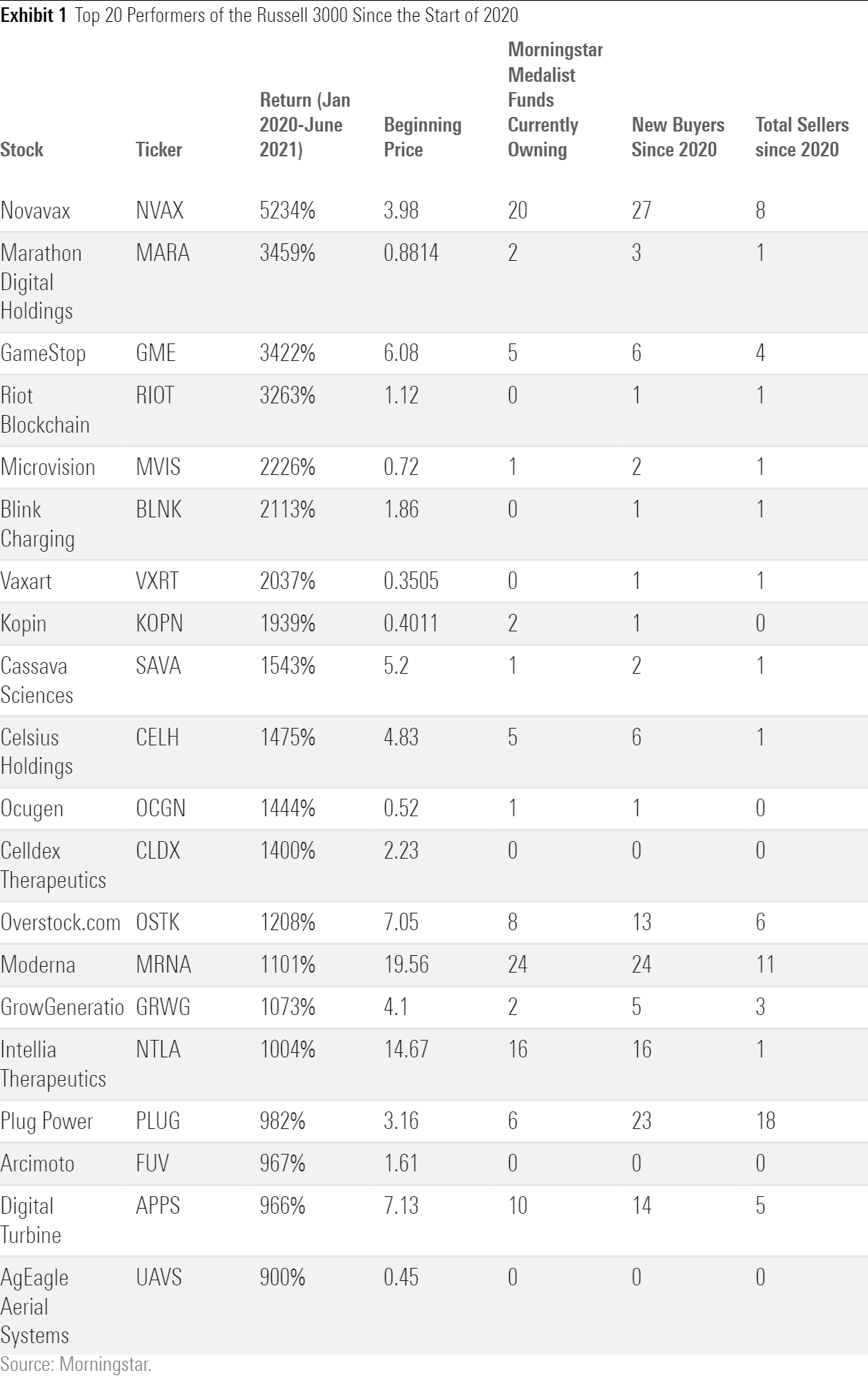

The hottest stocks from the start of 2020 through June 2021 tended to be related to coronavirus vaccines, Reddit.com message boards, or bitcoin. Highly rated managers did not own much in the latter two groups. Bottom-up stock-pickers largely shunned meme and bitcoin stocks because they didn’t like or couldn’t value the businesses, although some quantitative managers whose models use price momentum as an input were more willing to own them. It is not uncommon to see managers eschew the highest performers, as they are often penny stocks teetering on insolvency whose stock gains are largely the product of their tiny starting bases. But this period was different; normally, in any given month, two or three stocks in the Russell 3000 will have gained 1,000%-plus over the trailing 18 months. This period saw 16, the highest since 2010, and at least half cannot be labeled as mere penny stocks. A number of the companies are now meaningful constituents of widely used indexes, which makes ignoring them tougher to do. To track how top-rated fund managers traded the frothiest stocks since the start of 2020, we examined the portfolio changes of every fund with a Morningstar Analyst Rating of Bronze or higher that owned at least one of the Russell 3000’s top 20 performing stocks.

Vaccine Stocks

Since the start of 2020, no stock in the Russell 3000 gained more than Novavax NVAX, a biotechnology firm that developed a COVID-19 vaccine, but has yet to distribute it, as it awaits FDA authorization. Its stock price soared from under $4 per share at the start of 2020 to over $212 by June 2021, a more than 5,000% increase. Only one Morningstar Medalist fund, though, Vanguard Explorer VEXPX, owned the stock before the start of 2020. The fund doubled its stake in the company in 2020’s first quarter, when the stock still traded below $20. As its price began to rise, the fund’s managers pared the position, though they still have 0.08% of assets in the company. Many managers believe the stock still has room to run; 13 Medalists bought it since the start of 2021, when the price had already passed $200 per share, and only eight managers had sold their stakes.

Moderna MRNA was the second COVID-19 vaccine-developer to gain emergency authorization from the FDA, and its vaccine was the first product the company brought to market. A handful of managers first bought the stock during its December 2018 IPO when it debuted at $23 per share, including JPMorgan SMID Cap Equity WOOPX, Fidelity Growth Company FDGRX, Morgan Stanley Institutional Growth MSEQX, Morgan Stanley Institutional Discovery MPEGX, Vanguard US Growth VWUSX, and T. Rowe Price Health Sciences PRHSX. Only the JPMorgan fund no longer owns the stock, as it sold its stake in October 2020. Vanguard International Growth VWIGX currently has a bigger share of its assets in the stock than any Medalist--3.6%. Moderna is still a popular holding despite its over 1,000% increase; 23 Medalists own the stock as of their most recently disclosed portfolio.

Vaxart VXRT is developing a COVID-19 vaccine in pill form. Institutional investors own less than 30% of the company, whose vaccine is still in the testing phase, but retail investors have piled into it. The stock started 2020 at $0.34 per share and reached as high as $15.75 in June 2020 before closing June 2021 at $7.49. Medalist funds barely dipped their toes in it; Vanguard Explorer bought the stock in the second quarter of 2020 before selling it in the first quarter of 2021. No Medalist-rated funds recently owned the stock.

Meme Stocks

Prior to its meteoric rise, just four Medalist funds--including three Vanguard offerings--owned GameStop GME, the granddaddy of meme stocks that took off in January 2021. Fidelity Low Priced Stock’s FLPSX longtime manager, Joel Tillinghast, owned the stock since 2009, and sold it sometime during its January 2021 rise after years of relatively unfruitful ownership. Two Medalists--Principal Large Cap Growth PLGIX and Vanguard Explorer--actually first bought the stock following its price spike. The purchases, however, look more mechanical than fundamental, as it appears quantitative sleeves of each strategy made the purchases. Part of the Principal fund tracks the Russell 2500 Growth Index, in which GameStop is now a top-40 constituent. The Vanguard fund has a quantitatively run sleeve that tilts toward higher-momentum stocks like GameStop.

Microvision MVIS was another favorite of Reddit’s WallStreetBets community that was the launching point for many meme stocks. The company develops lidar sensors for use in driver-assist and autonomous driving systems. Its stock price traded below $1 per share when 2020 began before shooting to more than $23 per share in February 2021 after Reddit users turned their attention on it. This stock also has light institutional ownership. Only two Medalist funds, BlackRock Advantage Small Cap Growth PSGIX and Vanguard Explorer, bought the stock in the second quarter of 2021. BlackRock Advantage Small Cap Growth is a quant fund and Explorer has a quant sleeve, which likely explains their purchases.

Bitcoin Stocks

Two of the top four performing stocks since the start of 2020 were bitcoin-mining stocks, but Medalist managers kept their distance. Before becoming a cryptocurrency miner, Marathon Digital Holdings MARA was a grab-bag of businesses. The Las Vegas-based company dabbled in uranium mining, real estate, and patent investing. It still monetizes its patent assets, but it now mostly pitches itself as a bitcoin miner. Ten years into its existence, the company has yet to turn a profit in a full fiscal year and has survived only by raising new equity capital. Its bitcoin pitch, however, attracted enough investors to propel its shares to a more than 3,400% gain from the start of 2020 through June 2021, the second best in the Russell 3000. Just three Medalist-rated funds own the stock, and each of them relies at least partially on quant models: JPMorgan Small Cap Core Equity IJSSX, BlackRock Advantage Small Cap Growth, and Vanguard Strategic Equity VSEQX all bought it in 2021’s second quarter, after much of the stock’s appreciation had already occurred. Riot Blockchain RIOT, another bitcoin miner, gained more than 3,000%, but only one Medalist fund, quant-run BlackRock Advantage Small Cap Growth, owned it.

Historical Context

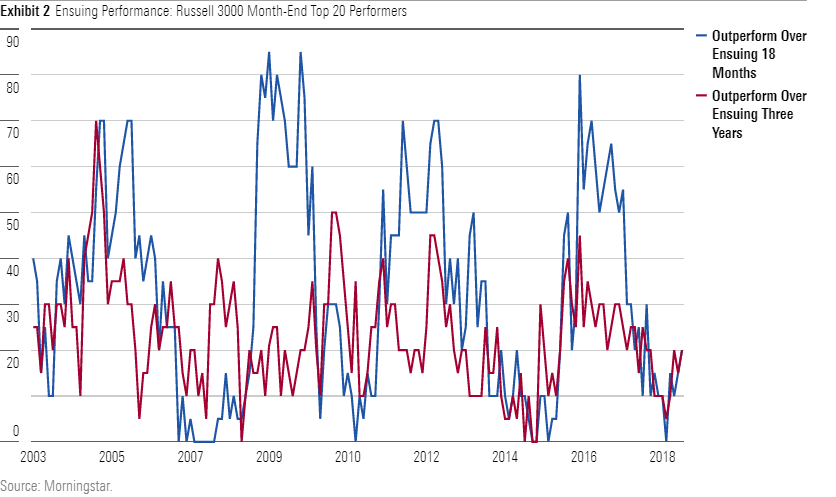

Medalist managers’ general avoidance of the highest-performing stocks is wise from a historical perspective. While some previous high-flying stocks like Netflix NFLX, Enphase Energy ENPH, and NVIDIA NVDA continued to grow into established, proven companies, most did not. Since 2003, just 35% of companies that ranked in the top 20 of the Russell 3000 for trailing 18-month performance in any given month ended up outperforming the broader index over the ensuing 18 months. In fact, more than half lost value, and nearly one fourth declined by 50% or more. Over the ensuing three years, performance was even worse, as only 25% of stocks ended up outperforming the broader index, with more than 60% losing value and over 35% getting halved or worse. While it’s tempting to chase the next high-climber, these stocks more often than not end up tumbling back to earth.

/s3.amazonaws.com/arc-authors/morningstar/b0c51583-b9a2-49eb-9a8f-5f25a8bda4a3.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b0c51583-b9a2-49eb-9a8f-5f25a8bda4a3.jpg)