Hints of Sea Change in Big Fund Company ESG Proxy Votes

At midseason for 2021 proxy votes, signs of a jump in support.

Big mutual funds have for years taken heat from some corners for not using their heft to pressure the companies whose stocks they own when it comes to issues like climate change, workplace practices, and pressing social issues.

But midway through the 2021 corporate proxy-voting season, a time when investors cast their ballots on resolutions that could shape company policies, there are signs of a significant shift amid record levels of support for environmental, social, and governance proposals.

The details of how fund companies voted won’t be fully reported until later this year. Yet, evidence of a change in the landscape can be seen in the overall numbers being reported by companies on shareholder proposals that as recently as last year saw scant support from fund companies such as BlackRock, Vanguard, and State Street--often referred to as the "Big Three."

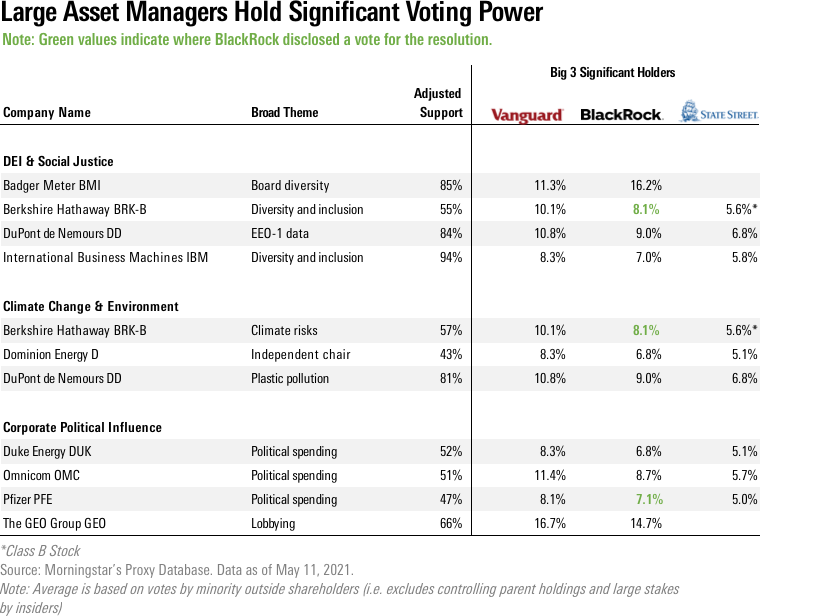

In many cases, the 2021 versions of these proposals are now recording big gains in support and, in some cases, by wide majorities. That suggests that the Big Three fund companies--which combined manage nearly 40% of the money in mutual funds--along with other large money managers may now be supporting the kinds of proposals that they had once opposed.

That’s been the case with recent votes at DuPont DD, Berkshire Hathaway BRK.B, and Pfizer PFE, as well as late-2020 votes at Procter & Gamble PG and Oracle ORCL. In the case of P&G--a vote urging stronger efforts to prevent supply chain deforestation--and Oracle--a vote on racial and gender pay gap reporting--both were supported by BlackRock, Vanguard, and State Street.

ESG Shareholder Resolutions Attract Record Support in 2021

In December 2020, BlackRock announced a new stance on ESG proxy voting--one that would likely deliver a larger number of votes in support of diversity and climate action on the ballot. Vanguard's 2021 proxy-voting guidelines, published early in April, also signal a new openness to voting "For" broad categories of resolutions--climate-related disclosure and workforce diversity disclosure--where guidance had previously taken a "case-by-case" approach.

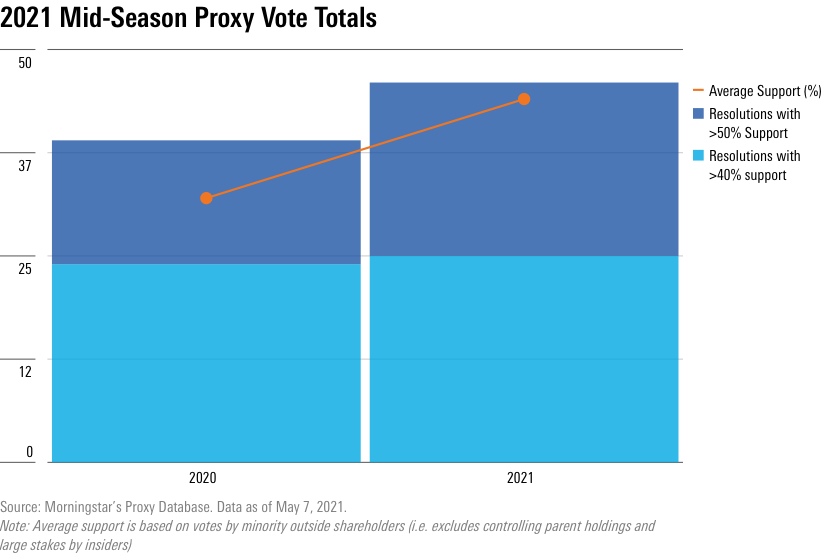

As of May 7, 21 ESG resolutions had earned the support of a majority of shareholders--six more than at the same point last year. Twenty-six of the 54 ESG resolutions voted since January earned more than 40% support from outside, minority shareholders (not counting shares controlled by parent companies or insiders, often founders with large holdings).

From the beginning of January, and with about seven weeks of proxy season to go--average shareholder support for ESG resolutions is up by 12% over the same period last year, at 44%. Underscoring this trend, average support by outside minority shareholders for a category of resolutions covering workplace diversity and inclusion and social justice is at 46% so far, up from 39% in 2020.

In some cases, the combined holdings of the Big Three asset managers total more than 20% of publicly traded shares, as indicated in companies’ significant beneficial ownership disclosures. Strong levels of support are likely driven by more votes in support of ESG resolutions by these large fiduciaries--particularly BlackRock and Vanguard, who have historically supported fewer ESG resolutions than most of their asset manager peers.

Typically, ESG resolutions on corporate proxy ballots receive an "Against" vote recommendation from boards. In the case of recent votes at IBM IBM, General Electric GE, and Bunge BG, boards encouraged shareholders to cast votes "For" ESG ballot initiatives. This are a rarity in proxy voting and a public statement of alignment between boards and proponents, another sign of a potential change in the tide.

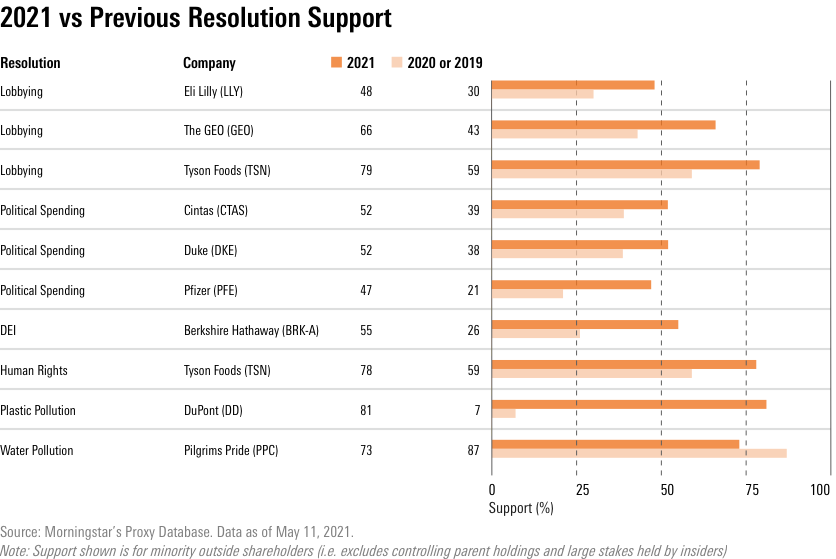

Shareholders Extend Support on Repeat Votes

Drilling down into 2021 resolutions that were on the ballot in one of the previous two years helps highlight the change in voting trends.

One of the most dramatic swings was at DuPont. In 2019, a resolution asking for regular reporting of DuPont’s plastic pellet spills--the second-most important source of marine plastic contamination--received just 7% of the vote.

This year, despite management’s recommendation that investors again vote it down, the same resolution earned 81% support. In addition, a resolution asking DuPont for diversity disclosure won 84% support. With BlackRock, Vanguard, and State Street holding a combined 27% of DuPont stock, it is very likely all three supported both proposals.

Another notable pair of results came at Berkshire Hathaway’s BRK.B May 1 meeting. Fifty-seven percent of shareholders, other than Warren Buffett, agreed that Berkshire Hathaway should explain how its business model will be compatible with a low-carbon economy. Fifty-five percent agreed that Berkshire Hathaway should explain to shareholders how it is managing diversity and inclusion within its 360,000-strong workforce.

Rebuffing opposition from Buffett himself, BlackRock publicly took a "For" stance on both issues and explained why in a special vote bulletin issued immediately after the meeting. BlackRock also opposed the re-election of two Berkshire Hathaway directors because of "concerns over shortfalls in the company's governance practices and climate action planning and disclosure."

At Tyson Foods TSN and Pilgrim’s Pride PPC, both controlled companies, minority shareholders have repeatedly used proxy voting to signal concerns over water pollution, workplace and supply chain human rights conditions, and lobbying activities. Unsafe working conditions in meatpacking plants resulted in some of the earliest workplace coronavirus exposures.

However, under new SEC rules on shareholder resolutions, which were hastily adopted late in 2020, this could be the last we hear from shareholders on these issues--a stake held by the Tyson family gives it 70% of the vote at Tyson Foods and a stake held by JBS (Pilgrim's Pride) gives the parent 80% of the vote--preventing overall support from reaching the critical threshold of 25% for a third-time repeat vote.

Looking Ahead to Upcoming Votes

Proxy season is far from over--it reaches a peak in late May. Key votes still lie ahead at high-profile companies such as Exxon Mobil XOM and Amazon.com AMZN. Fourteen resolutions addressing workplace diversity and inclusion and, more broadly, civil rights and racial equity will be voted on at 11 shareholder meetings from the second week of May up to mid-June.

Each of the three largest asset managers have singled out climate and diversity as priority themes. In December, Vanguard published a stewardship brief setting out workplace diversity expectations. In his letter to CEOs in January, BlackRock's CEO, Larry Fink, stated that "there is no company whose business model won't be profoundly affected by the transition to a net zero economy."

The weeks ahead will offer several opportunities to amplify these messages.

Morningstar Direct and Office clients can find a longer version of this article with a discussion of upcoming votes and details on 2021 votes here.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)