Is Apple a Growth Stock, a Value Stock, or Both?

Where the market’s largest stock lands can affect your returns.

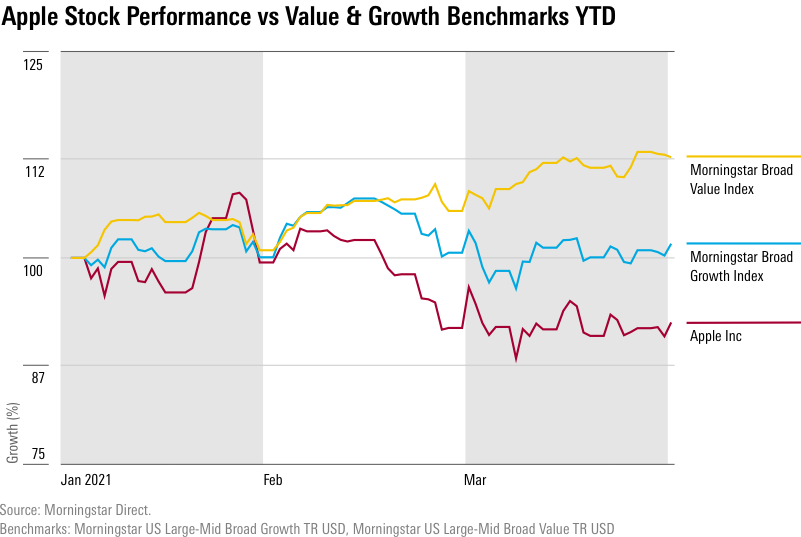

With a market capitalization of roughly $2 trillion, Apple AAPL is too big for most investors to ignore. Even with its up and down performance so far in 2021, as market preference has shifted to more economically sensitive sectors poised to benefit from recovery, Apple remains a major driver of both equity returns and whether the market is seen as cheap or expensive.

Any investor holding a broad equity market index fund owns a generous helping of Apple. It consumes nearly 5% of the Morningstar U.S. Market Index--which counts 1,439 stocks--its share price having appreciated by more than 80% in both 2019 and 2020. For other broad indexes reflecting the higher end of the U.S. equity market, Apple’s weight can reach 6%. Thanks to strong iPhone demand and a sticky customer base, Apple flourished both before and during the pandemic. Investors are slated to get the latest read on Apple’s earnings on Wednesday, April 28.

But when it comes to where Apple lands outside broad equity market indexes, a tricky question arises: Is Apple a growth stock, a value stock, or both?

Most people likely think of Apple as a growth stock, counting it along with many other technology names. For most index providers, that’s where Apple lands. It’s a classification that has led to concentration problems within benchmarks used by active managers and tracked by index funds.

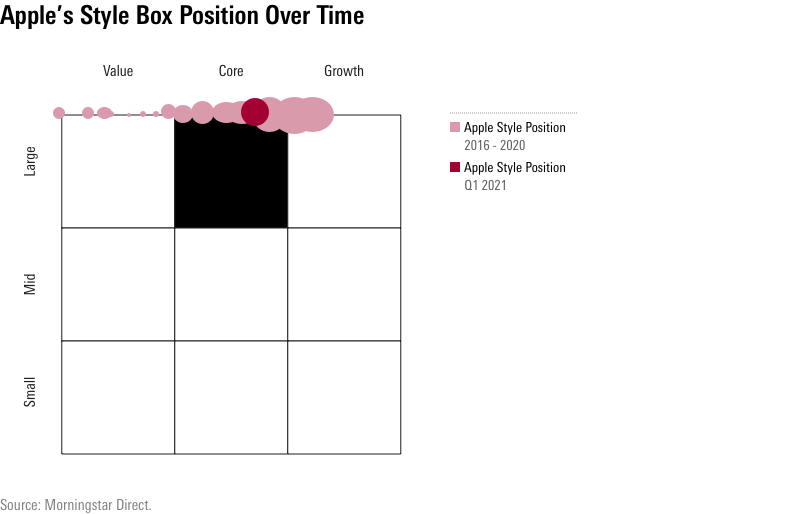

At Morningstar, the process for classifying stocks within the Morningstar Style Box directs Apple into the “large core” segment, meaning that it displays a mix of value and growth characteristics.

What’s Apple’s Style?

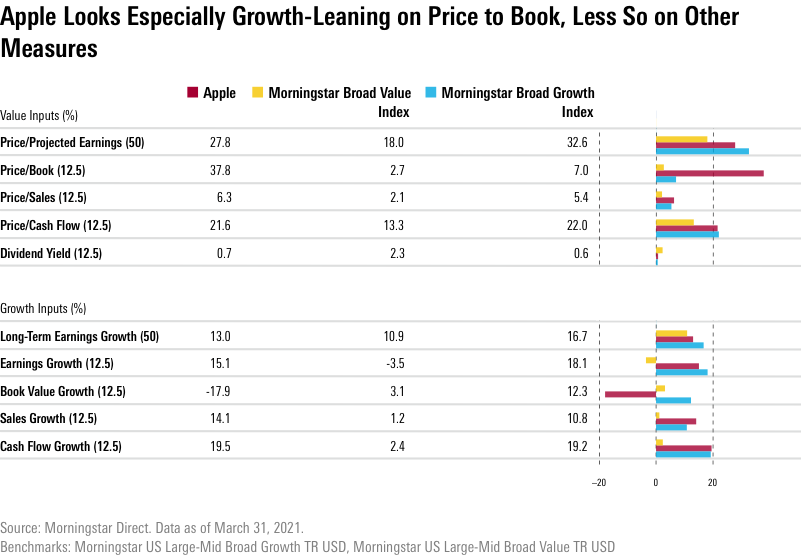

Since 2016, Apple has generally drifted to the middle of the Morningstar style spectrum. The below table shows how Apple compares with Morningstar's broad growth and broad value style indexes on the 10 inputs that determine style-box classification.

Price/book value is one measure that makes Apple look like an extreme growth stock. A measure of share price valuation, price/book has come under criticism for its neglect of intangible assets, such as intellectual property.

Apple derives most of its value from intangibles, including its formidable brand and the iOS operating system that seamlessly integrates hardware and software. Since Apple’s book value is low, its price/book value ratio is high. Morningstar’s 10-factor style model reduces reliance on any one metric. On the two forward-looking inputs, which together drive half the style score, Apple falls in between growth and value.

Apple’s Journey

Apple hasn’t always landed in between growth and value. Like many stocks, it has undergone a style journey.

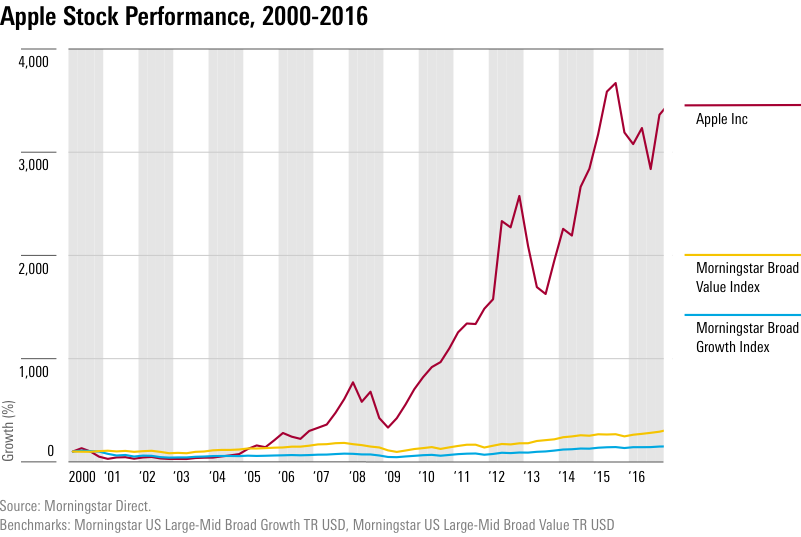

Many investors today may have forgotten--and younger investors may not even know--that during the dot-com frenzy of the late 1990s, with Steve Jobs newly returned as chief executive, Apple Computer, as it was then known, was considered a technology industry has-been. In 2000, Apple’s growth rate and valuation multiples landed it closer to the value side of the style box.

Then came an astounding run of innovation that brought the world the iPod, iTunes, the OS X, the MacBook, the iPhone, the iPad, and the Apple Watch. Apple spent 2004 to 2016 as a high-flying growth stock.

While highly successful, the company’s previous growth trajectory could not be sustained. In 2012, Apple even started paying a dividend--a sign of maturation. In recent years, Apple has drifted into the middle section of the Morningstar Style Box.

Why Does Apple’s Style Assignment Matter?

Exchange-traded funds tracking growth indexes hold more than $300 billion in investor assets, and even more investor capital is in other passive growth investments such as traditional index funds. Investors in some growth index funds might be surprised to learn that more than 11% of portfolio assets end up dedicated to Apple. Of course, the U.S. equity market has become quite concentrated overall in recent years, with a small cohort of tech-related names consuming a huge portion of market value.

Apple’s prominence makes it a key driver of relative returns. For index-tracking funds and ETFs, the more Apple exposure the better in recent years. But in early 2021, Apple’s share price declined, reducing overall returns for many index-tracking funds.

Meanwhile, managers of the more than $2 trillion in active growth funds have a tough decision to make. If they like Apple, they need to dedicate a very chunky portfolio allocation in order to maintain an “overweight” position. If Apple does well, an “underweight” position will disadvantage them. On the value side, funds that owned Apple got a big boost relative to benchmarks with no Apple exposure in recent years. In 2021’s value rally, though, Apple exposure would have held a value fund back.

The Two Sides of Apple

The mixed picture of Apple that Morningstar’s approach paints can also be seen in the diverse views of the company among active fund managers.

Within the large-growth Morningstar Category, prominent strategies such as Fidelity Contrafund FCNTX, T. Rowe Price Blue Chip Growth TBCIX, and Harbor Capital Appreciation HACAX hold large positions in Apple. Meanwhile, some of the biggest funds in the large-value category--American Funds American Mutual AMRMX, Vanguard Windsor VWNDX, and JP Morgan Equity Income OIEIX--also held Apple as of the end of 2021’s first quarter, albeit at lower weights.

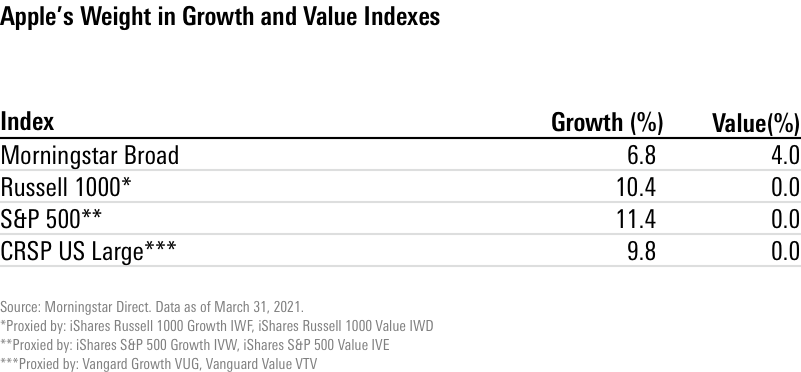

How does Morningstar’s style assignment for Apple drive the stock weight for its broad growth and broad value benchmarks compared with other index providers? As displayed below, Apple is partially allocated to both Morningstar’s broad growth and broad value indexes, albeit at different weights. The broad growth index devotes significantly less share to Apple than competitors, who use a range of methodologies, explained by Morningstar manager research analysts in their ETF analyses. Morningstar is unique in including Apple in its value index.

For investors, the lesson is value--or growth--is in the eye of the beholder. So, when looking at a fund’s portfolio holdings, Apple is a clear example of why methodologies matter.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. ILCV tracks the Morningstar US Large-Mid Cap Broad Value Index. ILCG tracks the the Morningstar US Large-Mid Cap Broad Growth Index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. A list of investable products that track or have tracked a Morningstar index is available on the resources tab at indexes.morningstar.com. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)