3 ETFs That Buy Low--But Not Too Low

These funds strike a balance between value and quality.

The idea of buying quality companies at a discount to what they are worth is no revelation. Keeping an eye on quality can help investors screen out stocks that might be cheap for very good reasons, and being conscientious about valuations may prevent them from overpaying for quality franchises.

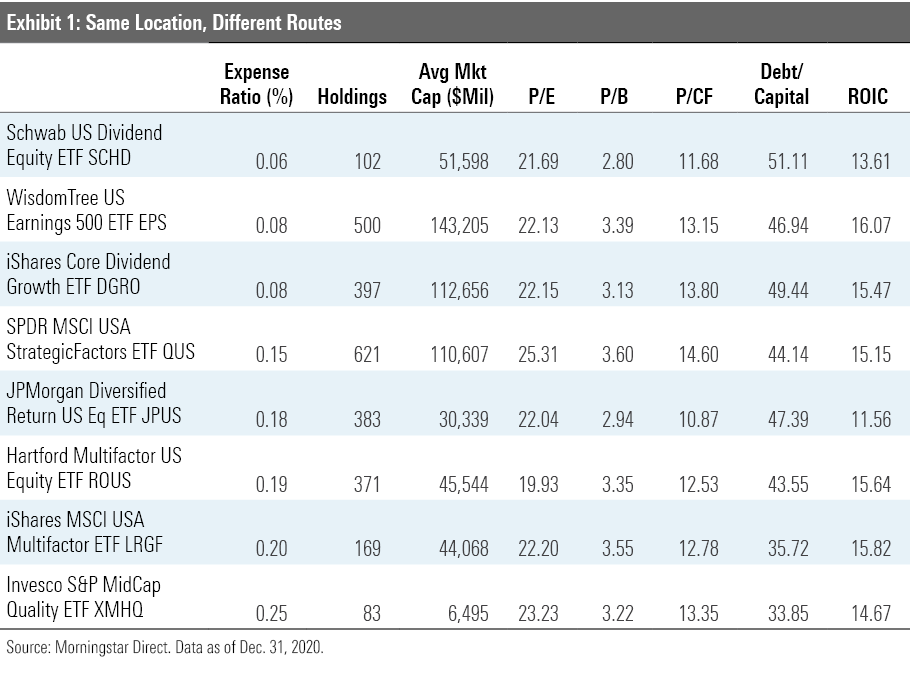

Within the realm of U.S. equity exchange-traded funds, there are eight that appear to balance this dual mandate. These funds, featured in Exhibit 1, rank in the cheaper (as measured by their price/earnings ratios) and more profitable (as measured by their return on assets) halves of the universe of broad U.S. stock ETFs. Additionally, each has accumulated over five years of track record and has an expense ratio less than or equal to 0.25%.

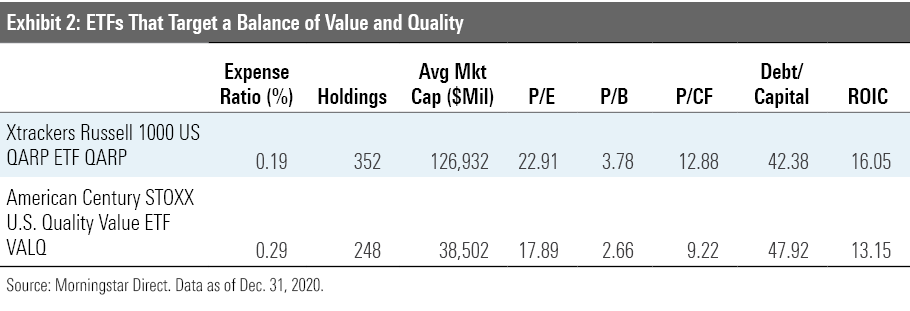

The ETFs in Exhibit 1 take different routes to find their outsize quality and value exposures. However, none of them exclusively and explicitly target quality and value. The ETFs in Exhibit 2 do. American Century STOXX U.S. Quality Value ETF VALQ and Xtrackers Russell 1000 U.S. QARP ETF QARP are designed to wrangle profitable stocks trading at attractive valuations. They seek, as the Xtrackers fund’s ticker acronymizes, “Quality At a Reasonable Price.”

The screen that yielded Exhibit 1 uncovered a pair of particularly interesting strategies. WisdomTree U.S. Earnings 500 ETF EPS is one of the cheapest funds on the list, and a strong tide of recent inflows suggest that investors are starting to note its cost edge and sensible fundamentals-driven approach. Hartford Multifactor U.S. Equity ETF ROUS is an inexpensive, disciplined strategy that has not received the same investor attention as multifactor peers like iShares MSCI USA Multifactor ETF LRGF. Comparing these ETFs with QARP reveals that strategies that back into their quality and value tilts tend to have similar exposure to those that explicitly target the factors. And these “unintentional” quality and value funds may bring something extra to the table.

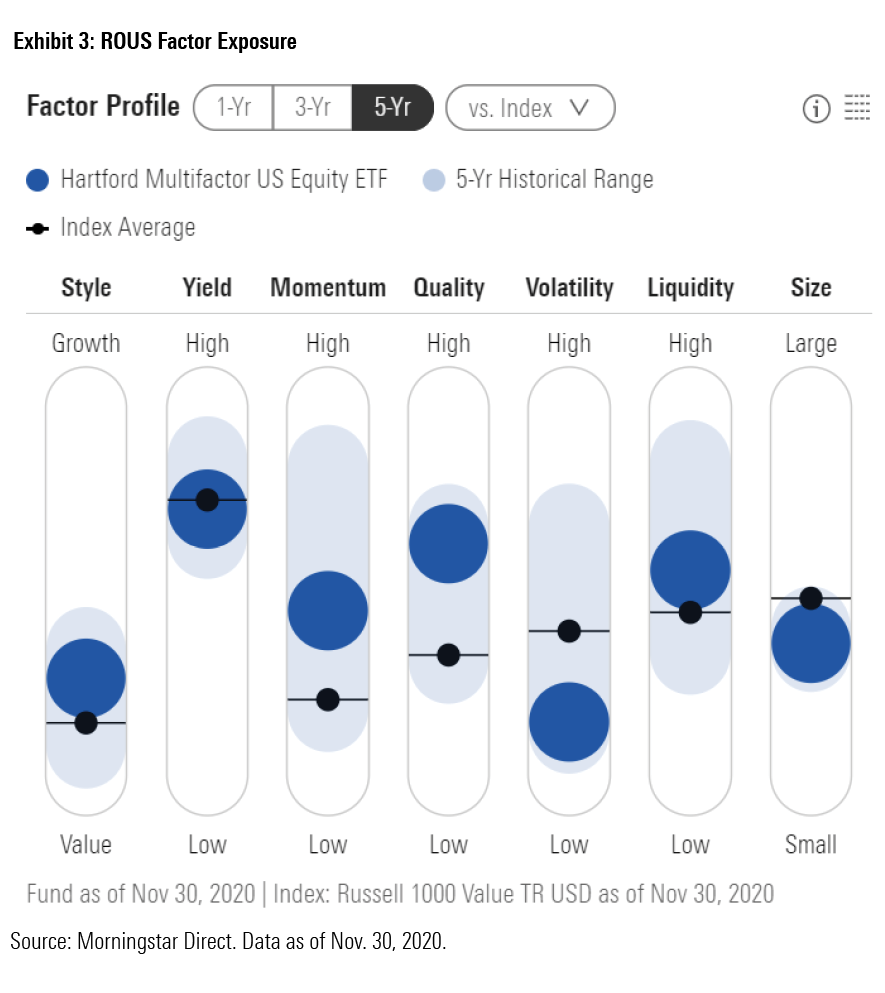

Hartford Multifactor U.S. Equity ETF ROUS Many multifactor funds angle for quality and value exposure, but ROUS captures their effects with particular efficacy. This multifactor ETF draws from the market's 1,000 largest stocks. Each candidate receives a composite factor score that reflects their value (50% of composite score), quality (30%), and momentum (20%) characteristics. An optimizer selects stocks based on their score and weights the portfolio with two objectives in mind: 1) reduce volatility by 15% relative to the Russell 1000 Index and 2) maximize the portfolio's composite factor exposure.

This fund qualifies as a diversified multifactor fund, but its composite score paints a picture of a value strategy with quality and momentum tilts. It targets stocks from across the value-growth spectrum, but cheaper names like Intel INTC and AbbVie ABBV receive the lion’s share of assets. The portfolio trades at valuations that approximate the Russell 1000 Value Index more closely than the broad market. While it has floated toward the middle of the Morningstar Style Box over the past year, value remains the primary driver of this fund’s performance.

Quality plays second fiddle in portfolio construction, but it remains a key element of this fund. Over the trailing 12 months through December 2020, this fund posted stellar return on equity, return on assets, and return on invested capital ratios. This strong profitability points to the efficacy of this fund’s multifactor approach. By favoring stocks with strong combined factor traits rather than building separate sleeves, ROUS prevents the strength of one factor from offsetting another.

This fund offers unique advantages outside of its value and quality exposure. Its low-volatility mandate gives it a defensive posture that should help it during turbulent markets. The novel coronavirus-driven sell-off from Feb. 19 through March 23, 2020, saw this fund top the Russell 1000 Value Index by 2.30 percentage points. The fund itself is also attractively priced. Its 0.19% expense ratio ranks in the large-value Morningstar Category’s cheapest decile. A solid process and competitive fee underpin its Morningstar Analyst Rating of Silver.

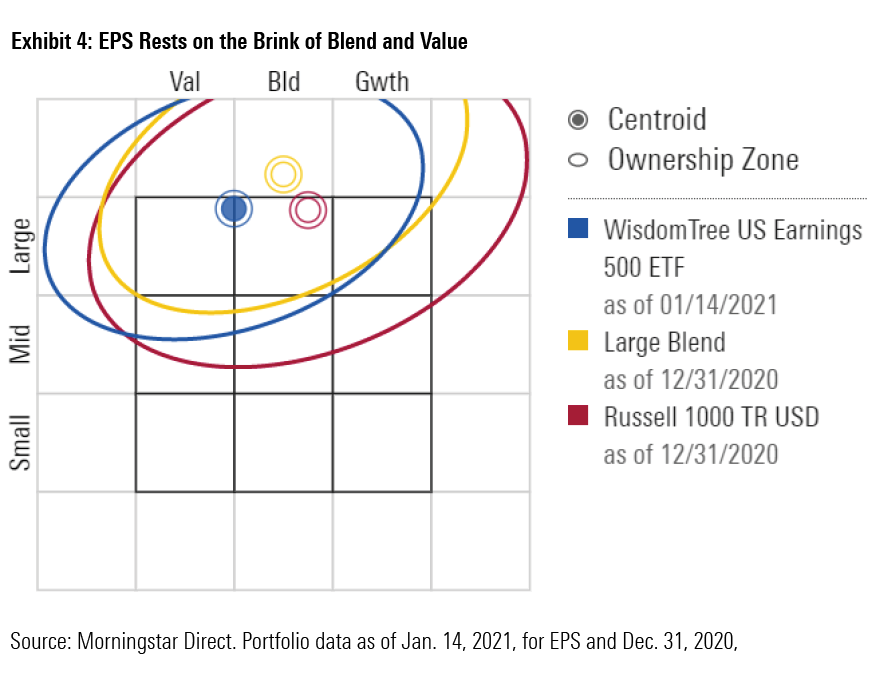

WisdomTree U.S. Earnings 500 ETF EPS Rather than pursue an array of factors, EPS follows the profits. Firms must post positive cumulative earnings over the trailing four quarters at each annual reconstitution to be eligible for entry into this portfolio. The fund sweeps in the largest 500 U.S. stocks that check this box and sums up all of their earnings. Dividing each stock's earnings by the collective earnings of all stocks in the portfolio yields their portfolio weighting. Market fluctuations will push and pull these weightings over the course of the year, but the fund rigidly rebalances each December.

Profitability is central to EPS’ approach, so its pronounced quality tilt comes as no surprise. Industry leaders like Microsoft MSFT and JPMorgan Chase JPM occupy some of the portfolio’s top spots, but the durable competitive advantages run top-to-bottom, as stocks representing nearly 90% of the portfolio have a Morningstar Economic Moat Rating of either narrow or wide.

How the fund channels value is not as direct. While earnings and stock prices tend to be highly correlated, they are not the same. This fund breaks the link between stocks’ market caps and their portfolio weights by emphasizing firms that are underpriced relative to their profits. When this fund rebalances each December, it mechanically overweights firms whose prices have declined relative to their earnings. For example, this fund holds a relatively large position in Biogen BIIB, whose stock price has sunk while its earnings have held relatively steady over the past three years.

Since earnings are closely tied to stock price over the long run, EPS’ value exposure is mild. Its broad diversification makes up for it. Targeting stocks from across the value-growth spectrum spreads risk, and index constraints keep the portfolio’s sector composition close to that of the broad market. Additional holding-level constraints safeguard against portfolio concentration.

That said, the fund still trailed the Russell 1000 Index by 1.04 percentage points annually over the past 10 years, with similar volatility. That’s a strong effort from a fund that could reasonably be placed in the large-value category. If value roars back to life, this fund should stack up better against the broad index, though it will likely lag its deeper-value peers. The fund’s ability to effectively mitigate turnover and its 0.08% expense ratio both mark durable advantages irrespective of the value-growth climate.

Xtrackers Russell 1000 QARP ETF QARP To find the best opportunities for "quality at a reasonable price," QARP surveys the Russell 1000 Index, which represents the largest 90% of the U.S. equity market. The fund selects stocks based on the combined strength of their quality and value characteristics. Stocks' quality scores consider both profitability (return on assets, asset turnover, accruals) and leverage (operating cash flow divided by total debt). Value is defined by a combination of cash flow yield, earnings yield, and sales/price. These scores dictate weighting as well. Each stock's market cap is multiplied once by its value score and twice by its quality score.

As its weighting approach would indicate, this portfolio leans more heavily into “quality” than “reasonable price.” Some of the market’s largest--and most richly valued--companies claim the portfolio’s top spots by virtue of their market-cap weight starting blocks and the fund’s quality emphasis. At the end of December 2020, tech titan Apple AAPL was the portfolio’s largest holding.

This fund leads both EPS and ROUS in profitability metrics, but its holdings trade at steeper valuations. Like EPS, it lands in the large-blend category. QARP’s tempered value orientation illustrates the challenge of optimizing quality and value exposure. Just because this fund’s stated remit is to capture both factors (and the fact that it has a clever ticker) does not make in uniquely equipped to do so. The success of the two factors tend to be negatively correlated, and building a portfolio that seeks both requires accepting some trade-offs.

Steering into quality more than value has yielded excellent performance since this fund’s inception in May 2018. Like EPS, this fund won’t likely see booming returns if value stages a comeback. Should that be the case, this fund does not have quite as complete a profile as the “unintentional” quality and value funds to fall back on. EPS benefits from a razor-thin expense ratio and low turnover. ROUS can lean on its low volatility and momentum exposure. Herein lies the advantage in backing into quality and value exposure: If those factors nosedive, these portfolios often come with other features that may help them float.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)