Newsworthy Stocks Aren't Always Great Investments

We examine the value of some popular companies.

Editor's note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

I recently spoke to a former college roommate, and he mentioned that one of our friends just opened a Robinhood account and bought a lot of pharmaceutical stocks. That left me curious. What stocks might a young investor be drawn to these days, and would they be worth investing in?

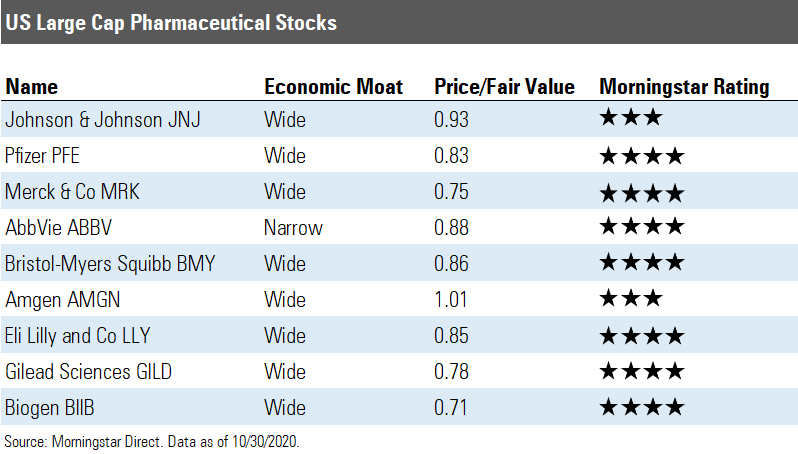

Why Pharmaceutical Stocks? Given the coronavirus' devastation across the world, the race for a vaccine gives heightened attention to drug manufacturers. Before the pandemic, I could name only one or two pharmaceuticals, but now the largest names regularly appear in the news: Johnson & Johnson JNJ, Pfizer PFE, Merck MRK, Amgen AMGN, AbbVie ABBV, and Gilead Sciences GILD.

But asking why pharmaceutical names are in the news and whether they are good investments are two very different questions.

At Morningstar, we consider purchasing a stock as becoming a part-owner of the business. This means you should answer a couple of questions: 1) Is it a good business? and 2) What is it worth?

Morningstar analysts help us answer that question by determining a company's economic moat, or sustained competitive advantages, and a stock's fair value. A company without a moat can be a good business, but it has less protection against competition. And even a company with a moat may not be a good investment if its stock is trading at a price higher than what it's worth, or its fair value.

Let's look at the pharmaceutical stocks that my friend might have bought:

All nine stocks have moats, and eight of them have wide moats (the best Morningstar Economic Moat Rating). Six of them received a 4-star Morningstar Rating as of Oct. 22, 2020, meaning they were undervalued, and none were overvalued (a 1- or 2-star rating).

What About Technology Stocks? Another popular investing trend has been buying stocks that have benefited from the work-from-home and shelter-in-place trends during the pandemic. Facebook FB, Apple AAPL, Amazon AMZN, Netflix NFLX, and Alphabet (the parent company of Google) GOOGL/GOOG, or the FAANG stocks, have seen a lot of attention. Other technology stocks, like cybersecurity, have also seen their stock prices rise.

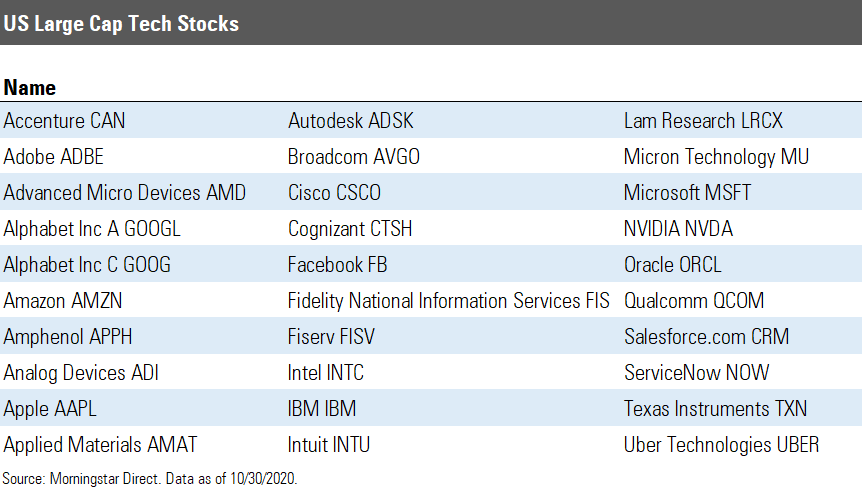

The table below lists the technology stocks that are in the Morningstar US Large Cap Index, which holds the largest 191 U.S. stocks weighted by market capitalization. You'll recognize many, as they also dominate the news.

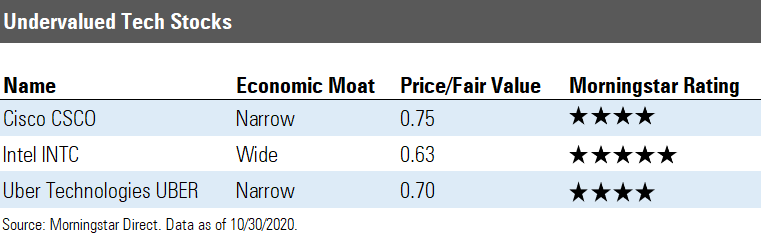

Large pharmaceuticals turned out to be reasonably valued as well as newsworthy. But what about technology companies? Not so much. Only three of the tech stocks in the Morningstar index are trading below their fair value, and you'll notice all the FAANG names are missing.

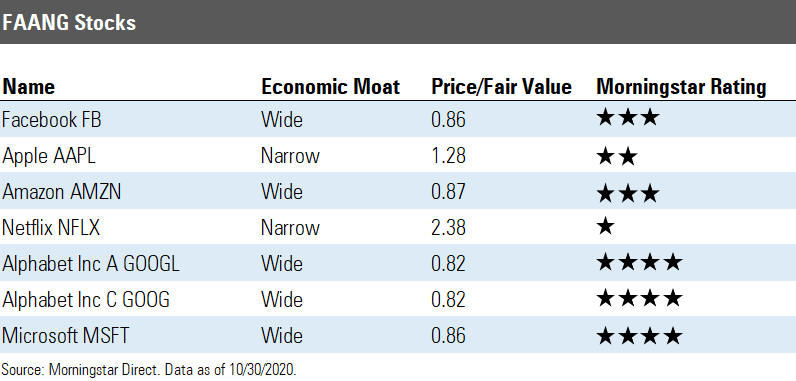

Here's a look at the FAANG stocks, plus Microsoft MSFT--though not technically FAANG, it has benefited from the same trends. Alphabet trades as two different share classes: the A shares, GOOGL, and the C shares, GOOG.

Though FAANG stocks are strong businesses, their current prices are generally at or above fair value estimates. Recently market volatility has made Google and Microsoft more attractive than normal.

Incorporate Value Into Your Stock Selection Investing in stocks successfully means buying low and selling high, so valuation is essential to stock selection.

The valuations of technology stocks illustrate the risk of following investing trends. It's harder to buy stocks that are going to go up if you aren't buying stocks that are undervalued in the first place.

Some investors may think technology's outperformance over the past decade will continue for the foreseeable future. Brian Colello, Morningstar's director of the technology sector, says current prices are too high, and a pullback would be welcome. Tech may continue soaring for a while, but we expect it to fall back eventually.

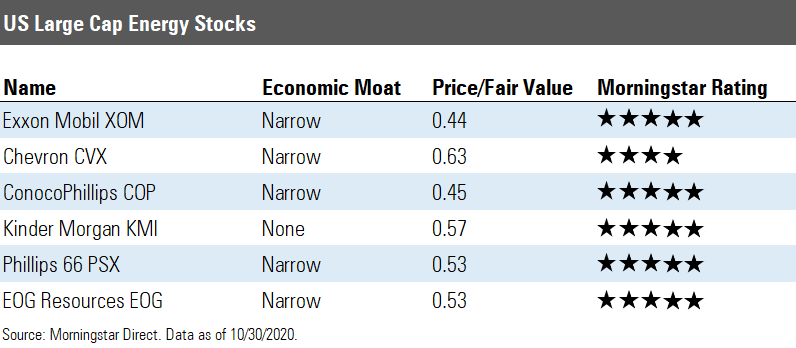

Where to Find Value Morningstar's chief U.S. market strategist Dave Sekera looked at opportunities across the U.S. stock market. He found that almost 70% of the energy stocks we cover are undervalued with 4- or 5-star ratings.

Falling prices for energy stocks implies the demand for energy is falling. Though this might be a current trend, we expect energy demand to catch up by 2022. Here's a look at the largest energy stocks that are trading below their fair value.

While energy stocks may not be overpriced now, the sector comes with its own risks. To minimize the danger of concentrating on certain stocks or sectors, consider one of these diversified exchange-traded funds that provide exposure to undervalued stocks: Vanguard Value ETF VTV or iShares Core S&P U.S. Value ETF IUSV. Both have Morningstar Analyst Ratings of Gold.

/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)