Why We Upgraded T. Rowe Price Dividend Growth to Gold

Also, Dodge & Cox Emerging Markets Stock comes under full coverage and other April ratings highlights.

Increased conviction in T. Rowe Price Dividend Growth’s PRDGX veteran manager and solid supporting cast upgraded its People Pillar to High from Above Average. That boosted the strategy’s Morningstar Medalist Rating to Gold from Silver across all share classes and its exchange-traded fund.

Longtime manager Tom Huber’s absolute track record is strong, but his risk-adjusted results are even more impressive. The 8.2% annualized gain of the strategy’s no-load share class since his March 2000 start through April 2023 beat its S&P 500 prospectus benchmark’s 6.5% and typical large-blend Morningstar Category peer’s 6.4%. The strategy’s annualized Sharpe ratio over Huber’s tenure was nearly 40% higher than the index.

Huber’s experience, deep knowledge and talented supporting cast should help the strategy continue outperforming. He has amassed one of the longest track records in the large-blend category since taking this strategy over in 2000. He started at T. Rowe Price as an analyst covering industries like retail, leisure, and gaming in 1994. Though it saw some changes last year, the analyst team Huber draws from remains large and skilled. In March 2022, T. Rowe Price split into two distinct research entities—T. Rowe Price Investment Management and T. Rowe Price Associates—but Huber’s team, which remains in the latter group, is still capable.

That team follows a sensible approach. Huber looks for dividend-paying stocks with the financial strength to keep paying and increasing their payouts and good prospects for outperforming the S&P 500 with less volatility. Such businesses tend to have deep competitive advantages, ample cash flow, and leaders who are disciplined capital allocators and put shareholders first. Huber’s focus on dividend growth means the overall portfolio’s yield won’t be high by absolute standards, but its payouts may be more reliable.

Huber has distinguished himself in down markets. Businesses that are heathy enough to increase their dividends tend to ride out market turbulence better than financially weaker ones. That has proved true in every bear market Huber has seen as a manager. In 2002, for example, the strategy’s no-load shares dropped 10.2% versus the S&P 500′s 18.1% loss. That was a top-decile category finish, thanks to strong consumer discretionary, financials, and technology stock picks.

New to Coverage

Dodge & Cox Emerging Markets Stock DODEX earned a Medalist Rating of Bronze as it came under full analyst coverage in April 2023. This relatively new offering relies on Dodge & Cox’s signature bottom-up, value investing approach with a twist. Like the firm’s other funds, an investment committee that includes veterans of other strategies approves undervalued stocks for this portfolio. Unlike its siblings, though, most of this fund’s ideas come from a quantitative model focused on valuation, business quality, management effectiveness, and growth. Analysts spot-check the model’s recommendations before informing the investment committee. That’s an efficient way to navigate a large universe, but it doesn’t make the most of the firm’s fundamental research edge. However, the strategy is likely to evolve at the edges and looks decent with its low fee.

Ratings Roundup

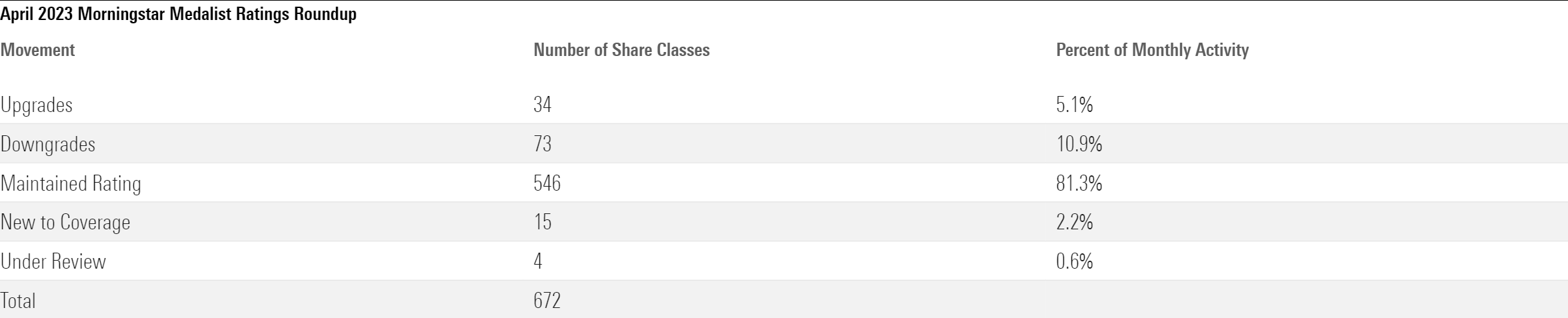

Morningstar analysts updated the Medalist Ratings for 672 fund share classes, exchange-traded funds, separately managed accounts, collective investment trusts, and model portfolios in April 2023. Of these, 546 retained their previous rating, 34 earned upgrades, 73 received downgrades, and 15 were new to coverage, and four were placed under review. Looking through share classes and vehicles to their underlying strategies, Morningstar issued 162 Medalist Ratings throughout April. Of these, five were new to coverage, 11 received upgrades, eight received downgrades, one was placed under review, and the majority (137) retained their previous ratings.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)