3 Funds That Feasted on Nvidia

These strategies have benefited from the stock’s meteoric rise in 2023.

Nvidia’s NVDA stock soared in the first half of 2023, climbing 190% as investors’ interest in artificial intelligence spiked. The firm’s graphic processing units, or GPUs, are crucial to developing cutting-edge technology like image and speech recognition and large language-processing models like ChatGPT.

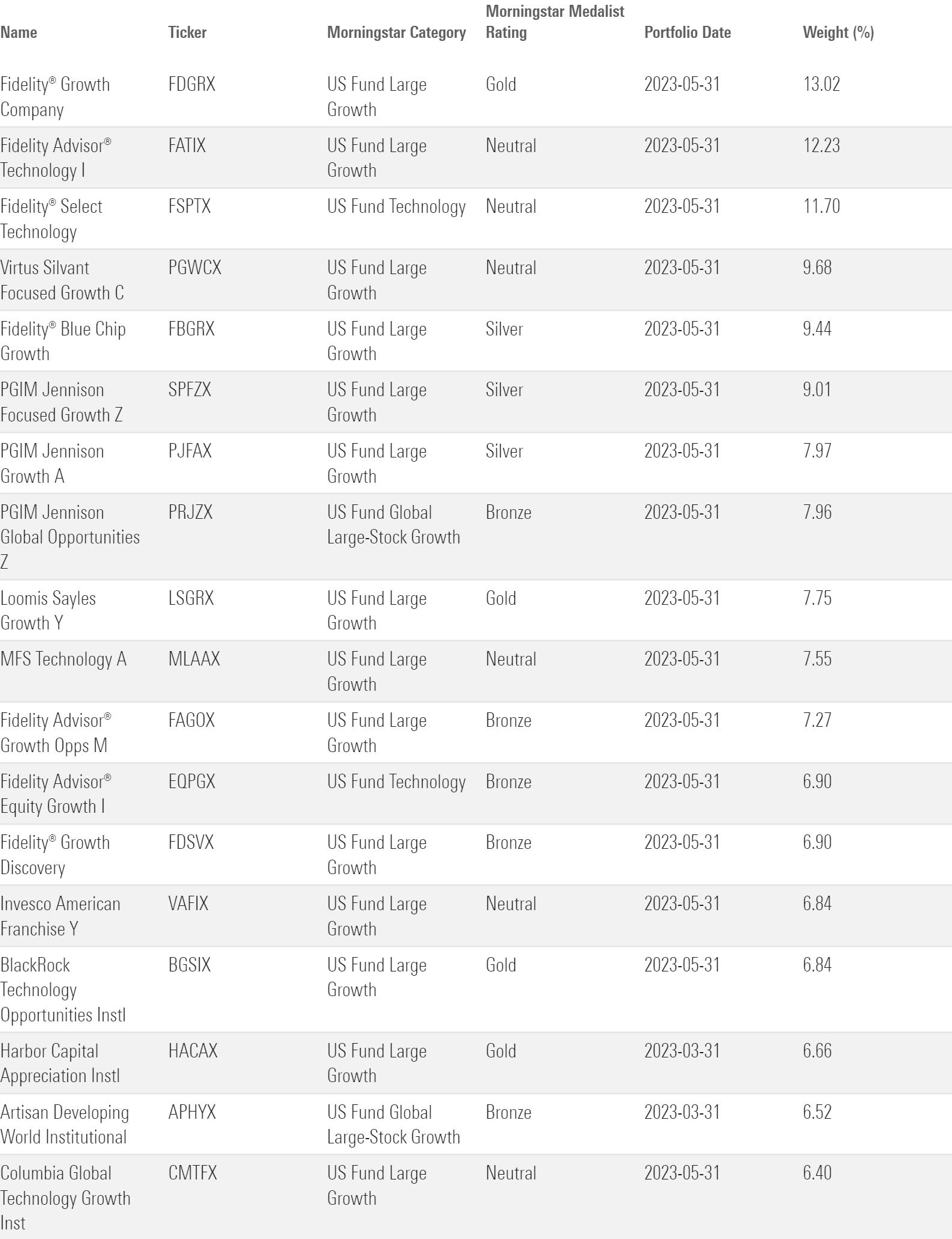

Three highly rated funds had large stakes in Nvidia. Fidelity Growth Company FDGRX, which has a Morningstar Medalist Rating of Gold, had 13% of its assets in the stock as of May 2023, the most recent portfolio. Silver-rated Fidelity Blue Chip Growth FBGRX had 9.4% in Nvidia in May, and similarly, Silver-rated PGIM Jennison Focus Growth SPFZX had 9.0%.

Here are other funds with the largest stakes in Nvidia.

Funds With the Largest Nvidia Positions

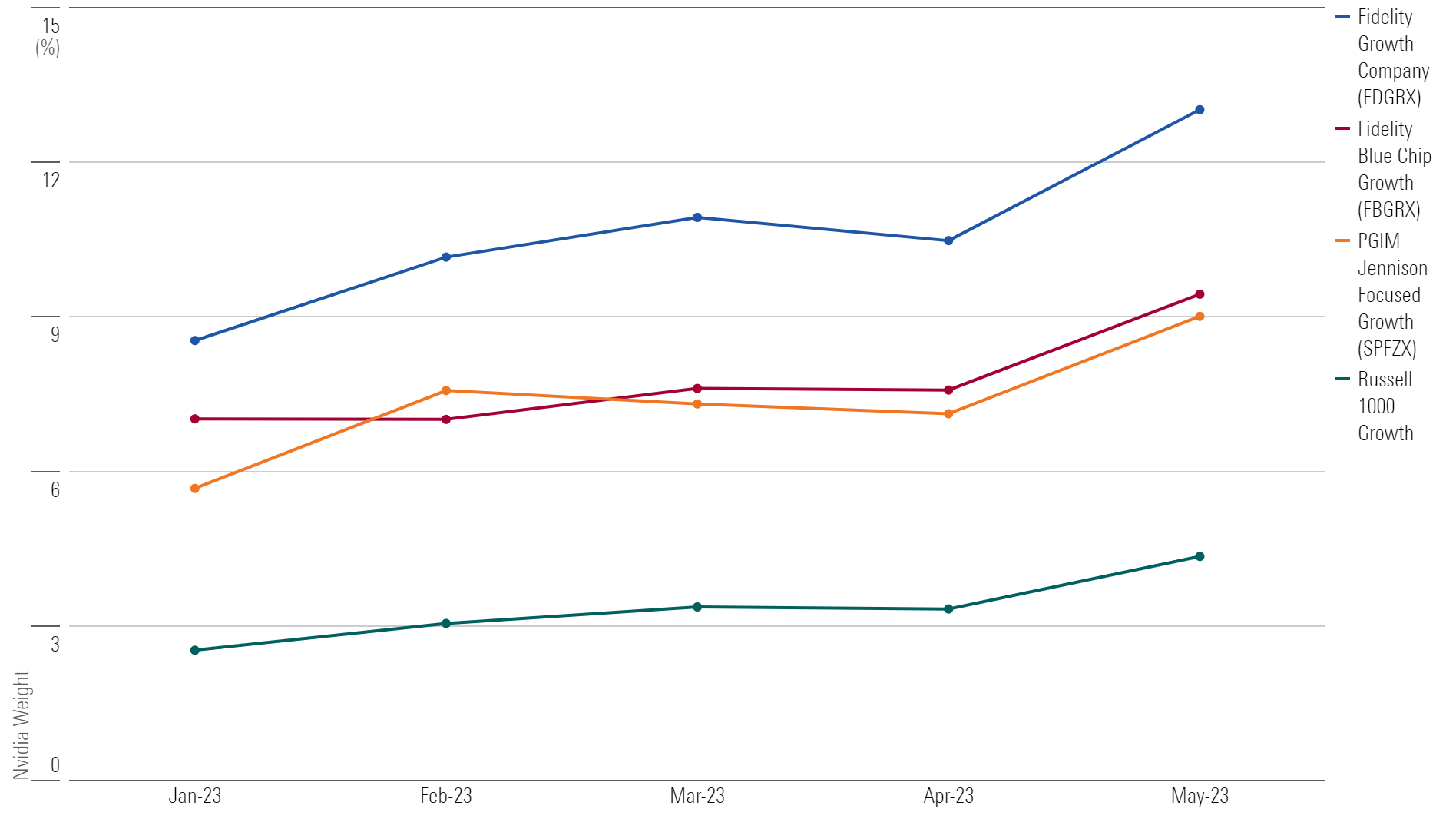

A closer look at Fidelity Growth Company, Fidelity Blue Chip Growth, and PGIM Jennison Focused Growth shows how their Nvidia stakes evolved over 2023 relative to the benchmark. For example, Fidelity Growth Company averaged 10.6% of its assets in the stock for the year to date through May, versus 7.7% and 7.3% for Fidelity Blue Chip Growth and PGIM Jennison Focused Growth, respectively. Meanwhile, the Russell 1000 Growth averaged just 3.3%.

Funds With the Largest Nvidia Positions vs. Russell 1000 Growth

Nvidia’s weight in all three strategies generally increased over the first five months of 2023. Stock price appreciation accounts for much of the increases, so to assess how managers traded their positions, one can look at the stock’s share count percentage change.

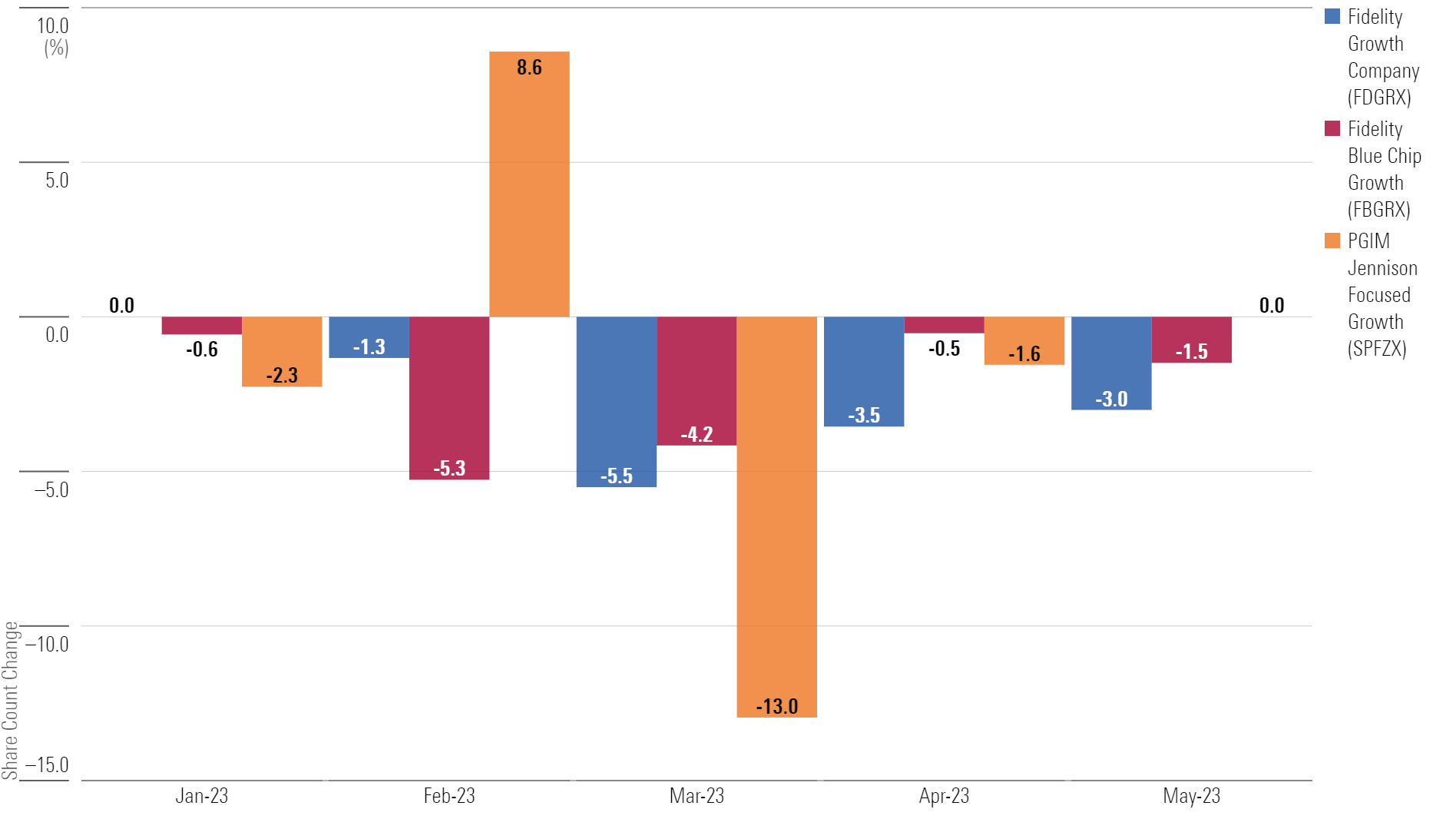

Fidelity Growth Company’s Nvidia share count didn’t change from December 2022 to January 2023, but it steadily decreased over the following four months. Similarly, Fidelity Blue Chip Growth reduced its share count through the first five months of 2023. Meanwhile, PGIM Jennison Focused Growth slightly cut the stock in January, increased its stake by 8% in February, and subsequently decreased its share count by 13%. It remained roughly flat in the following two months.

Nvidia Share Count % Change Across FDGRX, FBGRX, and SPFZX

How Did Funds That Owned Nvidia Perform?

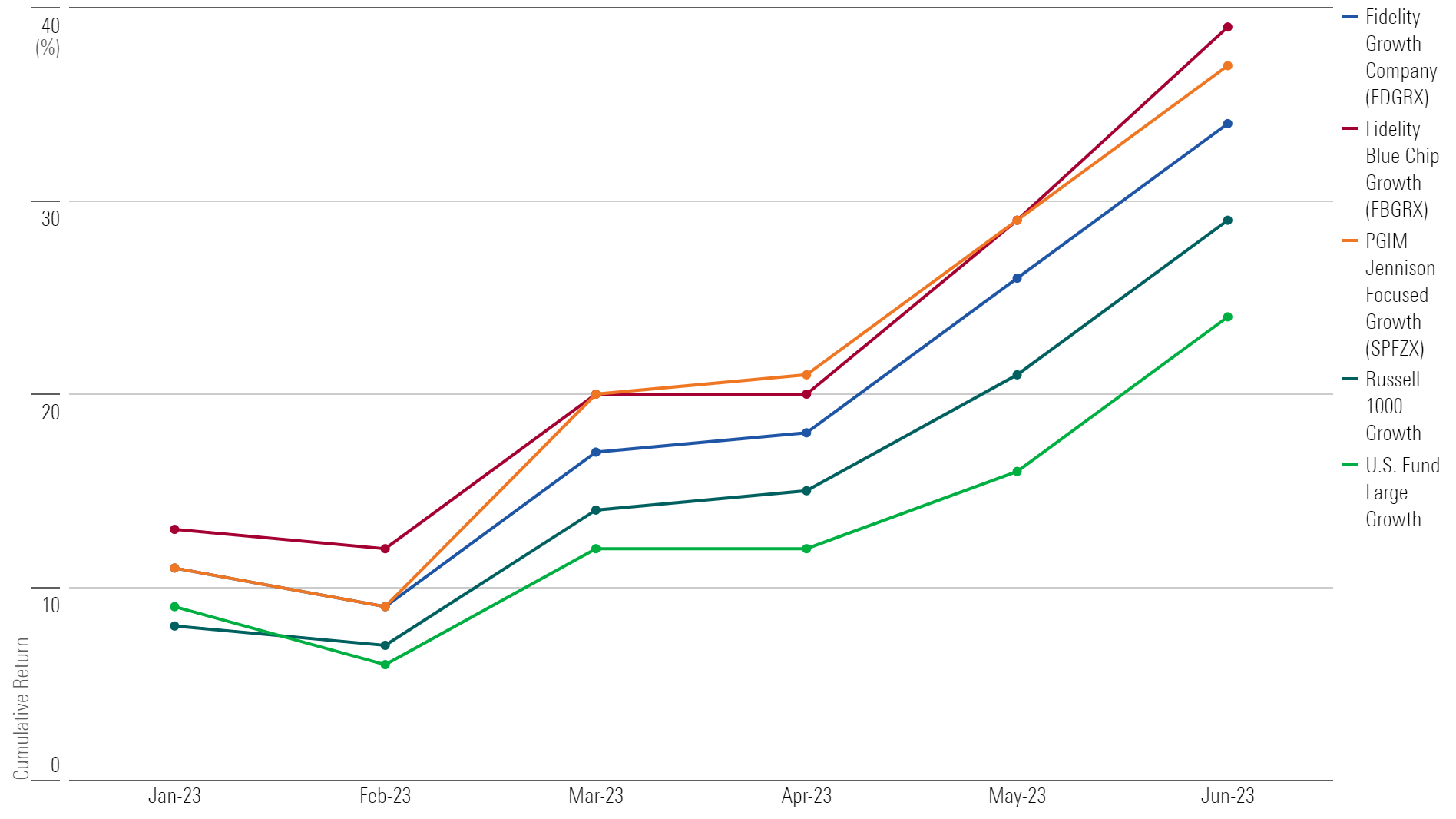

Many large-growth funds that target stocks like Nvidia have done incredibly well for the year to date through June 2023. The typical large-growth Morningstar Category peer gained 24% as many of these strategies bounced back from a punishing 2022. However, the funds that owned Nvidia and weighted them heavily often did even better than the typical fund so far through 2023. For example, Fidelity Blue Chip Growth gained 39%, PGIM Jennison Focused Growth increased 37%, and Fidelity Growth Company grew 34%. All three strategies outperformed the Russell 1000 Growth Morningstar Category Index by 10, 8, and 5 percentage points, respectively.

Large-Growth Funds' Year-to-Date Cumulative Returns vs. Russell 1000 Growth

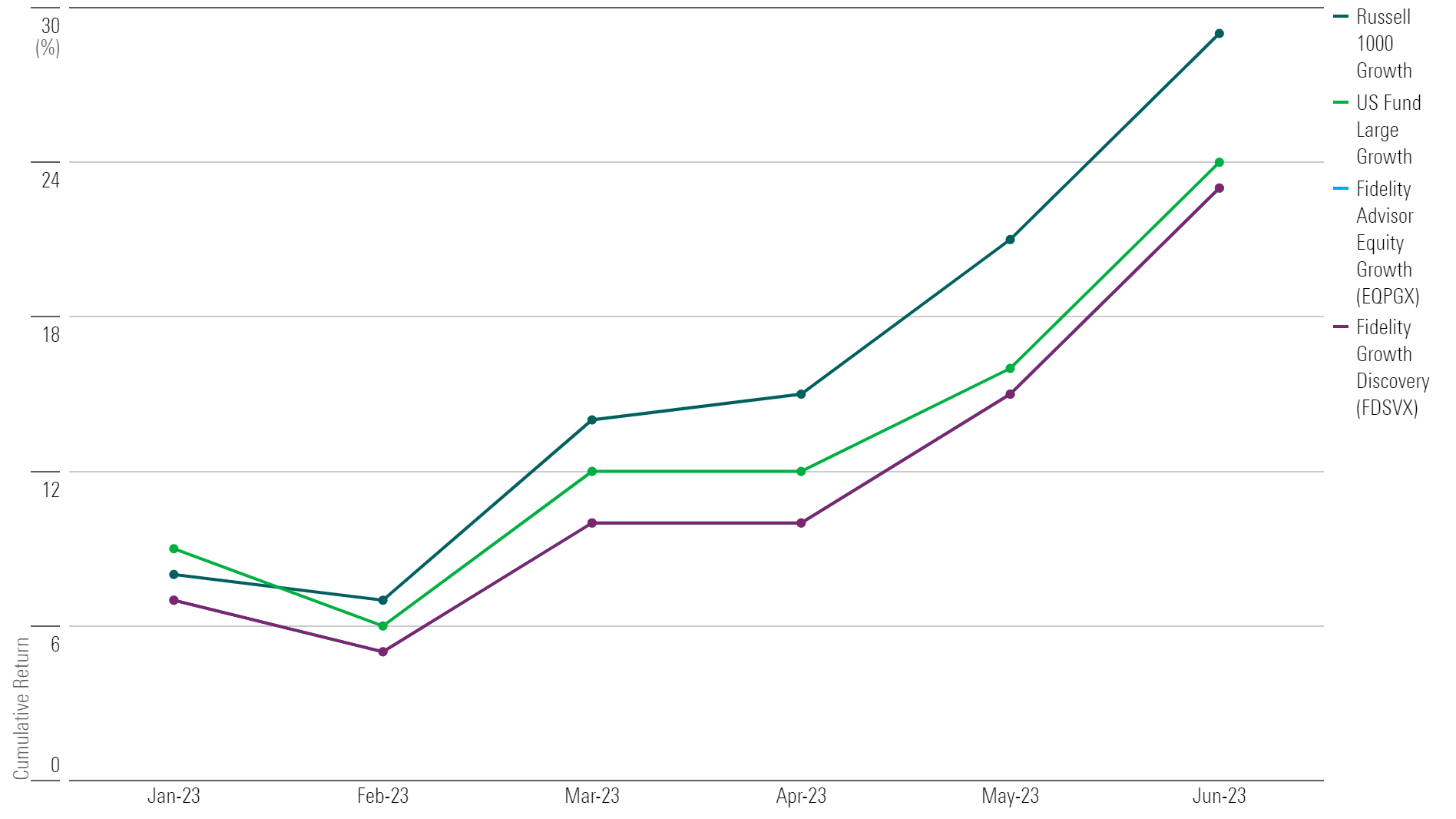

Not all funds that owned large stakes in Nvidia outperformed the benchmark and typical peer. For example, Bronze-rated Fidelity Advisor Equity Growth EQPGX and Bronze-rated Fidelity Growth Discovery FDSVX both had 6.9% positions in Nvidia as of May 2023 and averaged 4.5% and 4.6% weights, respectively, in the stock in the first five months of the year. Despite its strong gains, other missteps caused the funds to underperform, such as overweighting healthcare and energy stocks.

Fidelity Equity Advisor Growth and Fidelity Growth Discovery Year-to-Date Cumulative Returns

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)