U.S. Public Pension Plans Sustain Support for ESG Resolutions

Republican-leaning states’ plans show greatest decline in support for ESG, our study shows.

Political rhetoric about the aims and efficacy of environmental, social, and governance-focused investing has turned heated in the past year. Public pension funds—irretrievably tied to politics by nature of their public funding—continued demonstrating strong support for ESG shareholder resolutions in the 2022 proxy season, according to a Morningstar review of some of the largest U.S. pension funds. The full study can be found here. These resolutions varied from calls for companies like Costco COST and Berkshire Hathaway BRK.A to reduce greenhouse gas emissions to proposals for Alphabet GOOG and The Home Depot HD to conduct and report on racial equity audits.

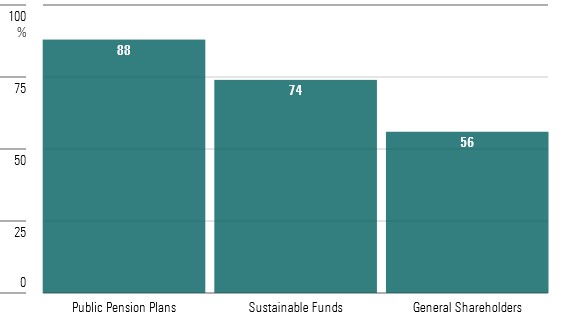

Count on Public Pensions Plans To Vote for ESG

Our analysis of state and local public pension funds from across the United States found that, as a group, their 88% support rate for key ESG resolutions was considerably higher than general shareholders’ 56%. What’s more, as seen in the exhibit below, public pensions supported key ESG resolutions at a higher rate than the 74% for sustainable funds, which use ESG criteria to evaluate investments or assess their societal impact and pursue sustainability-related themes.

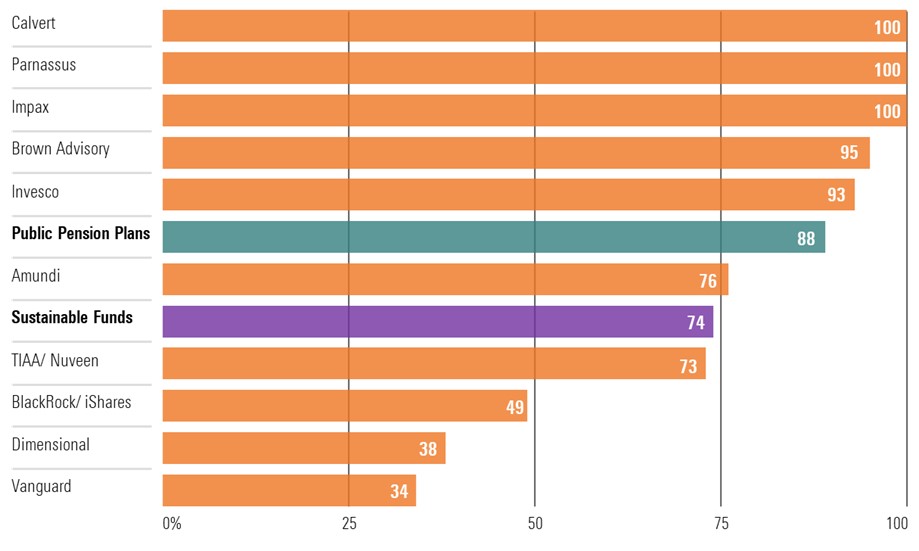

Public Pension Plans Meet Few Key ESG Resolutions They Dislike

While many public pensions have ESG-related sympathies, our review of the U.S. public pension space found no public plans claiming ESG investing as their primary goal. In fact, of the top 10 asset managers by assets under management for U.S. sustainable funds, the key ESG resolution support rates of TIAA/Nuveen, BlackRock/iShares, Dimensional, and Vanguard trail the typical sustainable funds’ and public pensions’. The next exhibit shows how public pension plans’ support for key ESG resolutions was nearly double that of BlackRock’s and Vanguard’s sustainable funds.

Public Pension Plans’ Support Nearly Double That of BlackRock’s and Vanguard’s Sustainable Funds

The data included in this study encompasses votes taken in the 2022 proxy-voting season using the most recently available data for U.S. public pensions. Morningstar defines key resolutions as those that address ESG topics and gain more than 40% support from independent shareholders. This focus on independent shareholders is key: It excludes the influence of insider shareholder votes to better approximate broad market sentiment. Our key resolution methodology also strips out much of the increased volume of resolutions that many institutional shareholders see as too prescriptive. These adjustments remove noise from the data and give us a better view into the issues on which plans are prepared to take a stand.

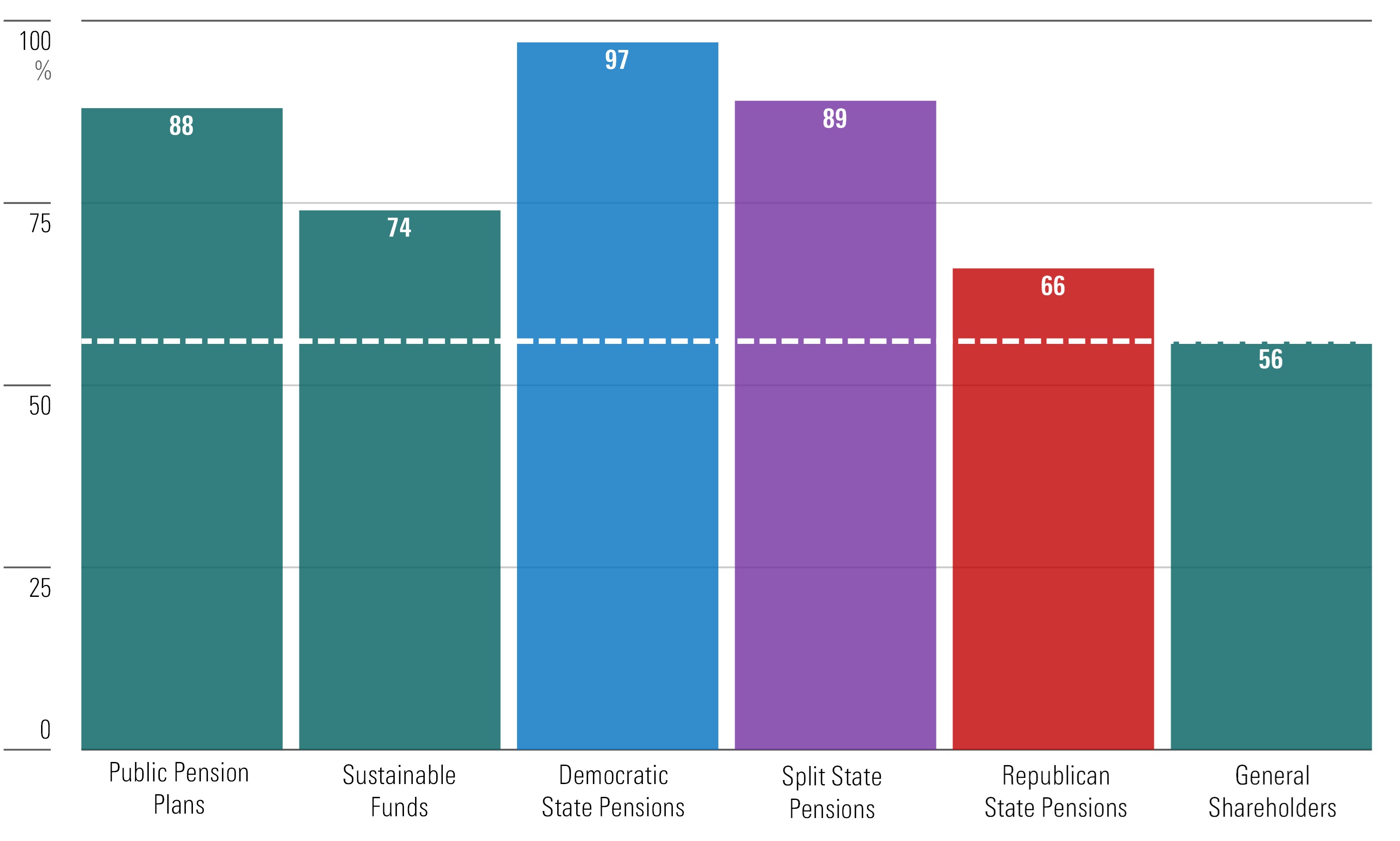

Party Politics Play a Pronounced Role in Public Pension Funds’ Proxy Voting

Support for ESG resolutions crossed party lines, though politics made their mark. The following exhibit shows how voting decisions among individual plans strongly correlated with the partisan lean of a public pension plan’s home state. Democratic-leaning states’ 97% rate of support approached near unanimity. Plans based in more politically divided split states had an 89% support rate that was still ahead of that of sustainable funds. Republican-leaning states’ public pension plans’ key resolution support rate was a much lower 66%, though that was still 10 percentage points greater than general shareholders’ support.

We sorted pension plans based on their home state’s FiveThirtyEight 2022 Partisan Lean Score, designating Democratic-leaning states as those with scores at or above D+10, Republican-leaning states as those at or above R+10, and split states with scores below D+10 or below R+10.

Support for ESG Resolutions Crossed Party Lines, Though Politics Made Their Mark

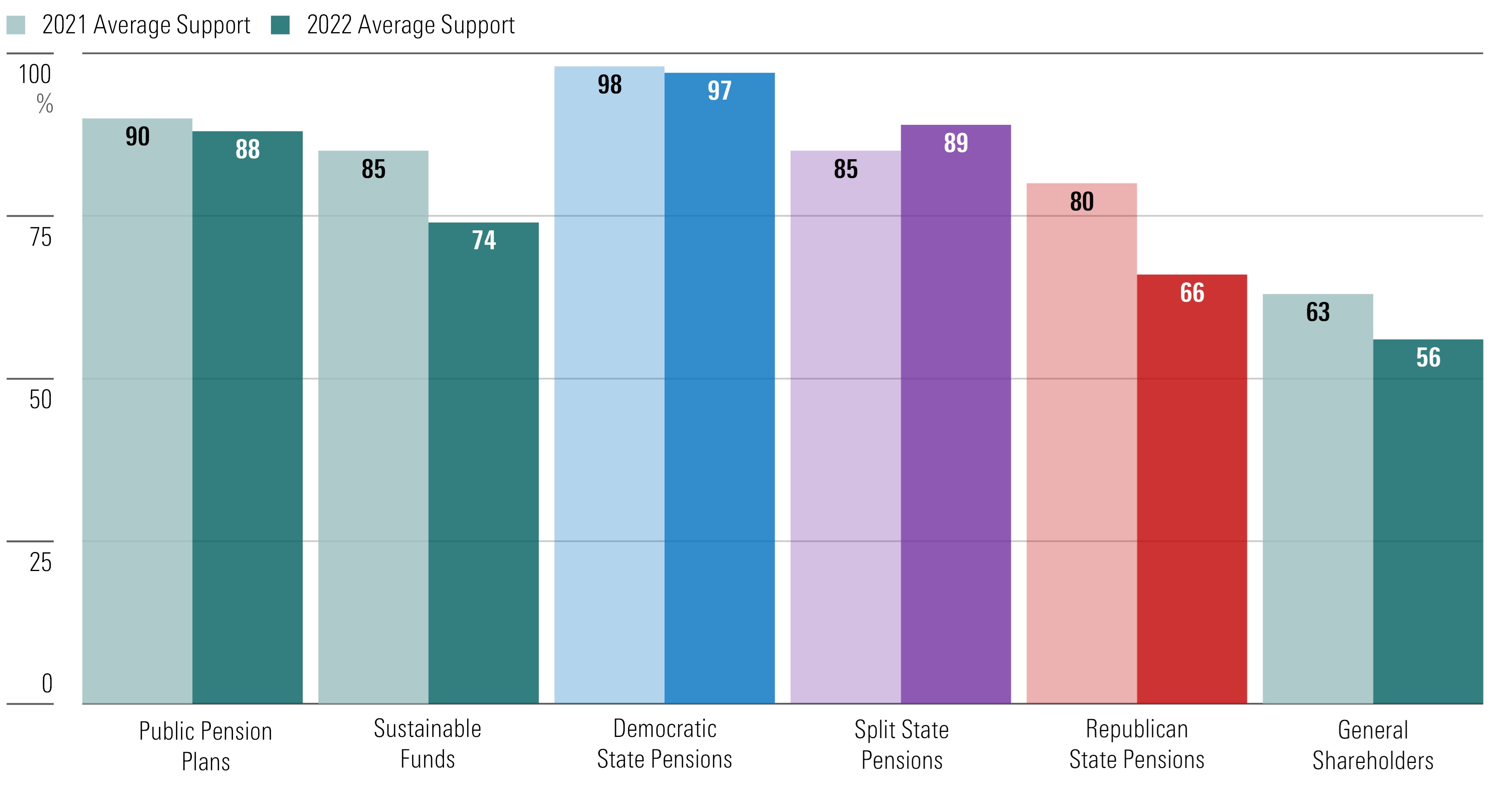

Support for ESG resolutions generally declined from the 2021 to the 2022 proxy season, at least partially reflecting the decrease in support from some of the world’s largest asset managers. BlackRock’s and Vanguard’s support of key ESG resolutions, for example, dropped by double-digit percentage points. Those and other managers have recently emphasized their reluctance to support unduly prescriptive resolutions or those that repeat existing requests.

As shown in the exhibit below, support for ESG resolutions dropped most noticeably in Republican-leaning states; it is Republican voices that have generally been the loudest in questioning the merits of sustainable investing. Those plans showed the largest year-over-year decline in support, dropping almost 15 percentage points from 2021 to 2022.

Support for ESG Resolutions Dropped Most Noticeably in Republican-Leaning States

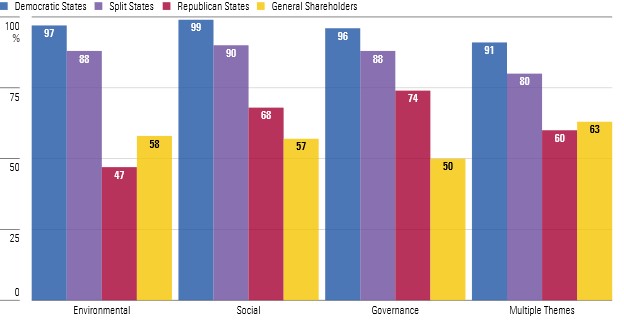

Public pension funds based in Republican-leaning states show uniformly lower levels of support across ESG resolutions compared with pensions based in Democratic-leaning or split states. Republican-leaning plans’ support for environmental-based ballot items is particularly low. While these pensions still supported almost half of environment-related proposals, the 47% support rate was more than 10 percentage points lower than that of general shareholders. On social- and governance-related matters, in contrast, their levels of support were higher than that of general shareholders.

Partisan Proxy-Voting Divides Seen Across the Board, and Especially in Environmental Ballot Items

The differences in voting habits as well as the changes from year to year strongly suggest that the political spotlight on ESG investing has had some chilling effect on public pension funds’ support of ESG resolutions. There remains broader agreement among investment professionals on the merits of sustainable investing. This is borne out by the relatively high level of support for the key ESG resolutions.

Author Janet Yang Rohr is an elected Illinois state representative (D) and works on legislation related to topics addressed in this research.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)